What does a Credit Representative do?

A Credit Representative plays a crucial role in a company's financial health. They assess the creditworthiness of potential clients or customers. This involves reviewing applications, analyzing financial documents, and making recommendations. The goal is to determine if a person or business is likely to repay a loan or fulfill financial obligations. This role requires attention to detail and strong analytical skills. It also involves communicating clearly with applicants to gather necessary information.

Daily tasks for a Credit Representative include evaluating credit applications, monitoring financial trends, and maintaining accurate records. They must stay informed about credit laws and regulations to ensure compliance. They work closely with sales and account management teams to support overall business strategies. A Credit Representative helps manage financial risks by making informed decisions about extending credit. Their work directly impacts the company's ability to grow and maintain healthy client relationships.

How to become a Credit Representative?

Becoming a Credit Representative involves a clear process that combines education, experience, and skill development. This role requires attention to detail, strong communication skills, and a solid understanding of credit principles. With the right steps, anyone can embark on a successful career in credit management.

The journey to becoming a Credit Representative starts with obtaining the necessary education and qualifications. A high school diploma or equivalent is the first step. Many employers prefer candidates with a college degree in finance, business, or a related field. Additional certifications in credit management can also be beneficial.

- Earn a relevant degree: Start with a high school diploma. Consider pursuing a bachelor's degree in finance, business administration, or a related field.

- Gain experience: Look for internships or entry-level positions in finance or credit departments. Practical experience is valuable in this field.

- Obtain certifications: Consider getting certifications such as the Certified Credit Executive (CCE) or Certified Credit Professional (CCP) to boost your credentials.

- Develop skills: Focus on developing skills such as analytical thinking, attention to detail, and excellent communication. Use software tools for credit analysis.

- Apply for positions: Start looking for jobs as a Credit Representative. Tailor your resume to highlight relevant skills and experiences.

How long does it take to become a Credit Representative?

Pursuing a career as a Credit Representative can be a rewarding path. On average, it takes about two years to gain the necessary skills and qualifications. Many start with a high school diploma or equivalent. This initial step sets the foundation for further education or training.

After high school, options include community college courses or a bachelor's degree in finance or business. Some choose to complete specialized training programs in credit management. Certification from recognized bodies can also enhance job prospects. Many professionals gain valuable experience through internships or entry-level positions in related fields. This hands-on experience often leads to a full-time role as a Credit Representative.

Skills such as attention to detail, strong analytical abilities, and excellent communication are crucial. These can be developed through formal education, on-the-job training, and continuous professional development. With dedication and the right path, individuals can achieve their career goals in credit representation.

Credit Representative Job Description Sample

The Credit Representative is responsible for assessing credit applications, managing client relationships, and ensuring compliance with company policies and regulations. This role requires a combination of analytical skills, customer service orientation, and adherence to compliance standards.

Responsibilities:

- Evaluate credit applications and determine credit limits based on financial data and credit history.

- Maintain accurate and up-to-date client records and credit files.

- Communicate with clients regarding credit decisions, policies, and procedures.

- Collaborate with sales and other departments to ensure smooth credit processes.

- Identify potential risks and recommend appropriate credit solutions.

Qualifications

- Bachelor's degree in Finance, Business, or a related field.

- Minimum of 2 years of experience in credit analysis or a similar role.

- Strong analytical skills and attention to detail.

- Excellent communication and interpersonal skills.

- Knowledge of credit policies, procedures, and regulatory requirements.

Is becoming a Credit Representative a good career path?

A Credit Representative plays a pivotal role in financial services, assessing and managing the credit risk of clients. This job requires a blend of analytical skills and interpersonal abilities to evaluate credit applications and ensure financial stability. Credit Representatives often work in banks, credit unions, and financial services firms, focusing on client interactions and risk assessment.

Working in this role has its unique set of benefits and challenges. Consider these pros and cons before pursuing a career as a Credit Representative. The decision should align with personal career goals and preferences.

- Pros:

- Stable Employment: Financial institutions often require Credit Representatives, providing job stability.

- Client Interaction: This role involves regular interaction with clients, offering the chance to build relationships.

- Skill Development: Credit Representatives gain valuable skills in analysis, negotiation, and risk assessment.

- Cons:

- High Responsibility: The job carries significant responsibility, as decisions can impact clients' financial health.

- Stressful Environment: Deadlines and client pressures can create a high-stress work environment.

- Limited Advancement: Career growth opportunities might be limited compared to other roles in the financial sector.

What is the job outlook for a Credit Representative?

Looking to become a Credit Representative? The job outlook can be positive for those entering this field. The Bureau of Labor Statistics (BLS) reports an average of 4,600 job positions open each year. This steady flow of opportunities makes it easier for job seekers to find positions.

Despite the slight projected decline of -4.3% in job openings from 2022 to 2032, this occupation remains stable. Job seekers should not be discouraged. A solid foundation in credit analysis and customer service can lead to a rewarding career. Those who thrive in a detail-oriented role will find ample opportunities.

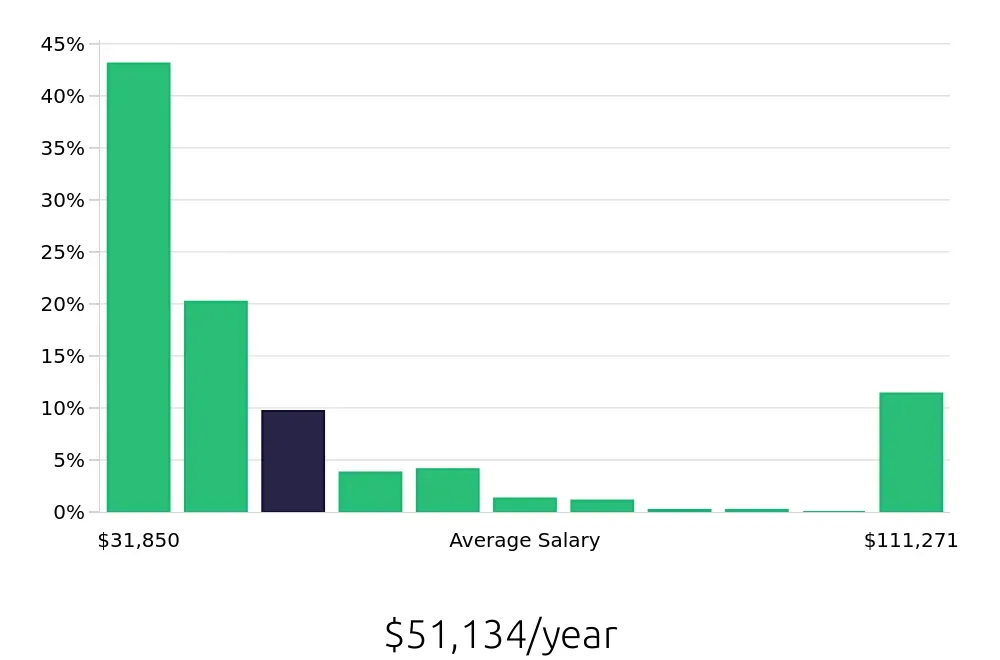

Earnings for Credit Representatives are competitive. The BLS reports an average national annual compensation of $94,750. This figure reflects the value placed on these professionals. With experience, this figure can grow even higher. Hourly compensation averages $45.56, making this a lucrative career choice.

Currently 95 Credit Representative job openings, nationwide.

Continue to Salaries for Credit Representative