What does a Fraud Analyst do?

A Fraud Analyst plays a crucial role in identifying and preventing fraudulent activities within an organization. This professional reviews transactions, investigates suspicious patterns, and recommends measures to minimize risks. They analyze data to detect any irregularities that could indicate fraud. Using specialized software, they track suspicious transactions and report findings to management. This role requires a keen eye for detail and strong analytical skills to ensure the integrity of financial and operational processes.

In addition to detection, a Fraud Analyst also contributes to the prevention of fraud by developing and implementing fraud prevention strategies. They work closely with other departments to ensure that all systems and processes are secure. This may involve conducting training sessions for staff on recognizing and reporting fraud. They stay updated on the latest fraud trends and technologies to effectively combat new types of fraud. A Fraud Analyst must have excellent communication skills to clearly report their findings and collaborate with team members. Their work helps protect the organization from financial losses and maintains its reputation.

How to become a Fraud Analyst?

Becoming a Fraud Analyst involves understanding financial transactions and identifying fraudulent activities. This role is critical in protecting organizations from financial losses. Below is a clear path to pursuing a career in fraud analysis.

First, obtaining a relevant education is essential. Many Fraud Analysts hold a degree in accounting, finance, or a related field. This education provides a solid foundation in financial concepts. Earning a degree can be the first step to a career in fraud analysis.

- Get Educated: Earn a degree in accounting, finance, or a related field.

- Gain Experience: Work in finance, accounting, or a related area. Experience helps develop necessary skills.

- Get Certified: Consider obtaining relevant certifications, such as Certified Fraud Examiner (CFE).

- Enhance Skills: Develop skills in data analysis and understanding financial regulations. These skills are crucial for identifying fraud.

- Apply for Jobs: Look for job openings as a Fraud Analyst. Use job boards, company websites, and networking to find opportunities.

How long does it take to become a Fraud Analyst?

A career as a Fraud Analyst offers stability and growth potential in a field that is always in demand. The journey to becoming a Fraud Analyst involves several steps. First, individuals often start with a bachelor's degree in a related field such as finance, accounting, or criminal justice. This education can take about four years to complete. Many programs include courses that cover important skills like data analysis, risk management, and understanding financial regulations.

After completing a degree, gaining experience is key. Some new graduates find entry-level positions to build their skills and knowledge. Others may take certification courses to enhance their credentials. These courses can include Certified Fraud Examiner (CFE) and Certified Internal Auditor (CIA) programs. These certifications require studying and passing exams, which can take anywhere from a few months to over a year to complete. With the right education and experience, someone can become a fully qualified Fraud Analyst in about four to six years.

Fraud Analyst Job Description Sample

The Fraud Analyst will play a crucial role in identifying, analyzing, and mitigating fraudulent activities within the organization. This role involves detailed investigation of suspicious transactions, monitoring of financial data, and developing strategies to prevent fraud. The Fraud Analyst will work closely with internal departments and external agencies to ensure the organization's assets are protected from fraudulent activities.

Responsibilities:

- Conduct thorough investigations of suspicious transactions and reports of potential fraud.

- Analyze financial data and transaction patterns to identify fraudulent activities.

- Develop and implement fraud prevention strategies and policies.

- Collaborate with internal departments, such as IT, Compliance, and Legal, to address and resolve fraud cases.

- Prepare detailed reports and documentation of fraud findings and investigations.

Qualifications

- Bachelor's degree in Finance, Accounting, Business Administration, or related field.

- Certification in fraud examination (e.g., CFE, CFCE) is highly desirable.

- Proven experience in fraud analysis or a similar role within the financial industry.

- Strong analytical and critical thinking skills with attention to detail.

- Proficiency in using fraud detection software and tools.

Is becoming a Fraud Analyst a good career path?

A Fraud Analyst works to detect and prevent fraud in various industries. This role involves analyzing financial transactions and identifying suspicious activities. Companies rely on Fraud Analysts to protect their assets and maintain financial integrity. This job often requires strong analytical skills and attention to detail. A Fraud Analyst may work for banks, insurance companies, or corporations.

Fraud Analysis offers some benefits and challenges. Working in this field can be rewarding and impactful. It provides opportunities to make a significant difference by stopping fraudulent activities. Job stability is often high, as companies always need experts to safeguard their finances. However, it can be stressful due to the nature of the work. Fraud Analysts must stay vigilant and work under pressure. The job can be repetitive, focusing on data analysis and pattern recognition. Despite these challenges, the role is crucial for maintaining financial security.

Consider the pros and cons before pursuing a career in Fraud Analysis. Here are some key points:

- Pros:

- Job stability: High demand for fraud prevention skills.

- Impactful work: Helps protect businesses and individuals from fraud.

- Skill development: Enhances analytical and investigative skills.

- Cons:

- Stressful: Must handle pressure and sensitive information.

- Repetitive: Often involves data analysis and pattern recognition.

- Potential for burnout: The job can be mentally taxing.

What is the job outlook for a Fraud Analyst?

Fraud analysts play a crucial role in today's business environment, making this a promising career path. The field offers stability and growth, with an average of 9,900 job positions available each year. Job seekers can expect a steady demand for their skills, ensuring numerous opportunities in the job market.

The outlook for fraud analysts is positive. The Bureau of Labor Statistics (BLS) predicts a 6.1% increase in job openings from 2022 to 2032. This growth reflects the growing need for professionals who can detect and prevent fraudulent activities. Aspiring fraud analysts can look forward to a market that values their expertise and offers potential for career advancement.

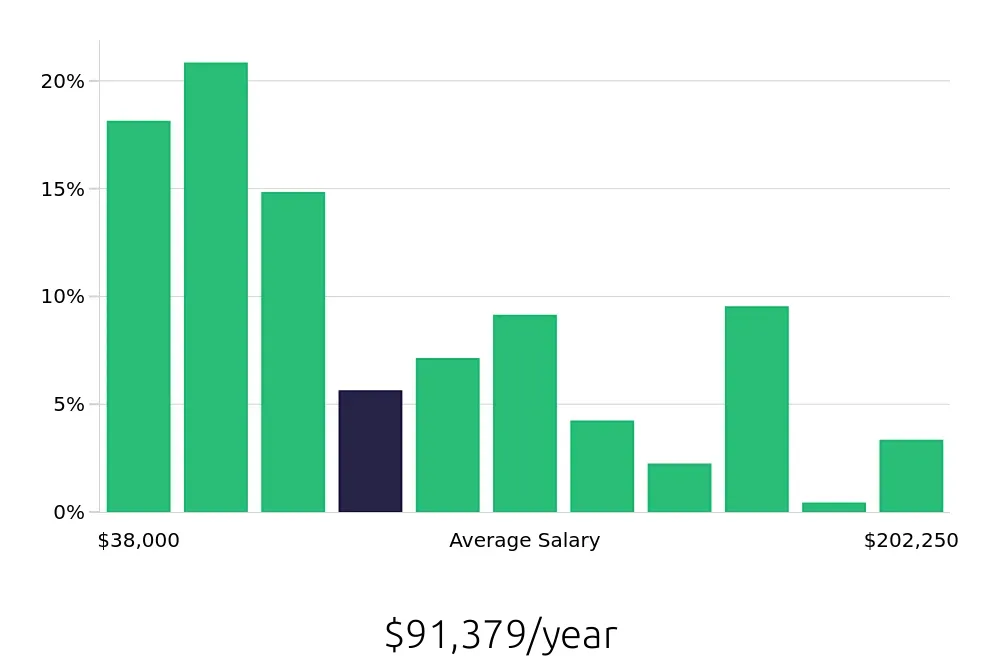

In addition to a stable job outlook, fraud analysts enjoy competitive compensation. The average national annual salary stands at $89,650, with an hourly rate of $43.1. This attractive pay package makes fraud analysis a rewarding choice for job seekers who are passionate about ensuring financial integrity and security. With a combination of job stability, growth opportunities, and competitive pay, fraud analysis is an excellent career choice for those seeking long-term professional success.

Currently 89 Fraud Analyst job openings, nationwide.

Continue to Salaries for Fraud Analyst