How much does a Fraud Analyst make?

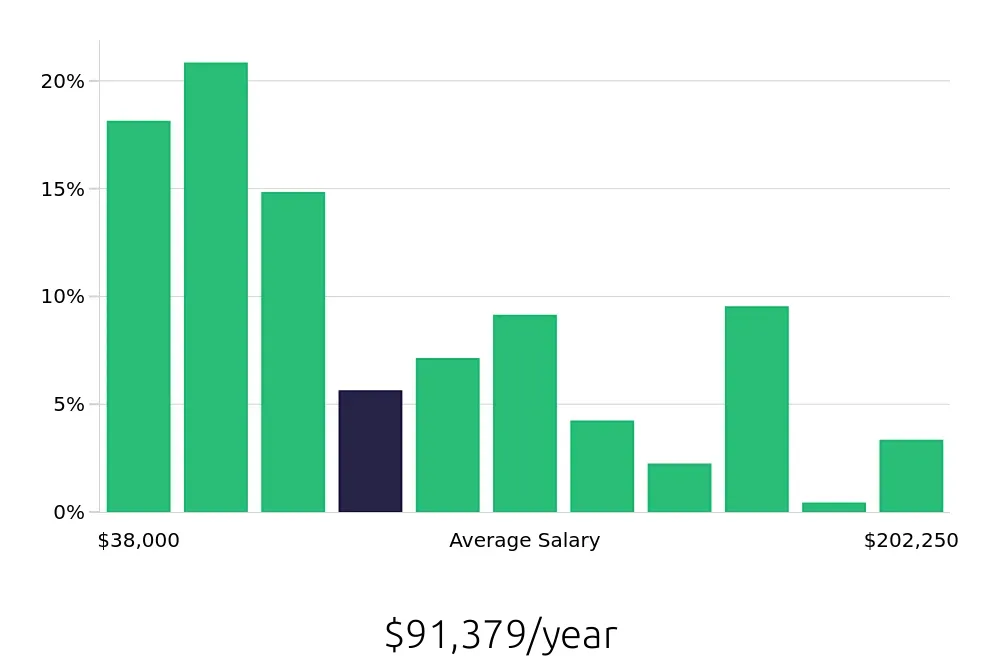

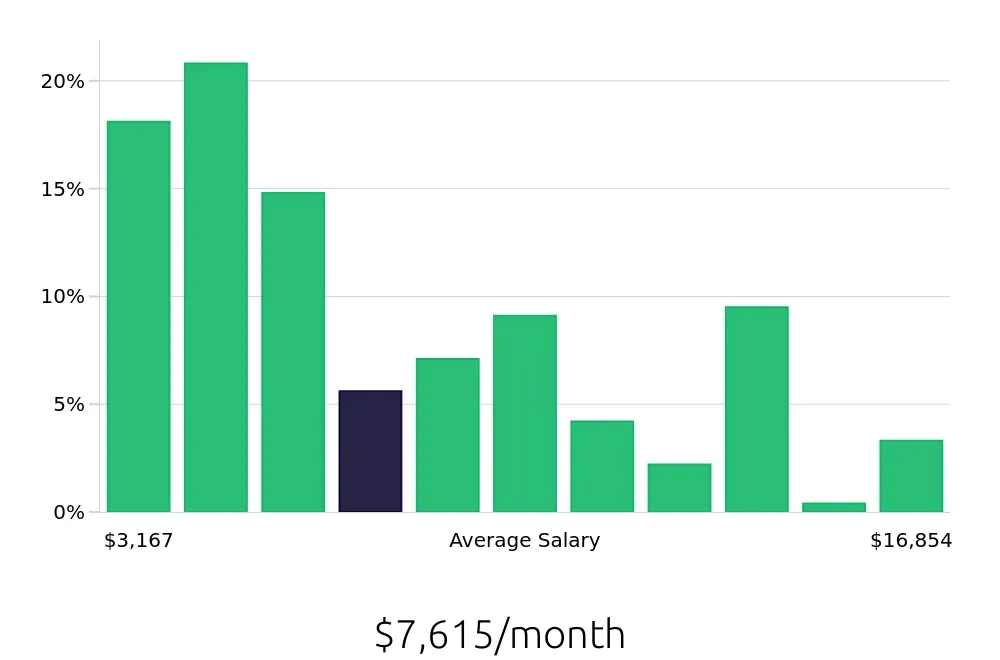

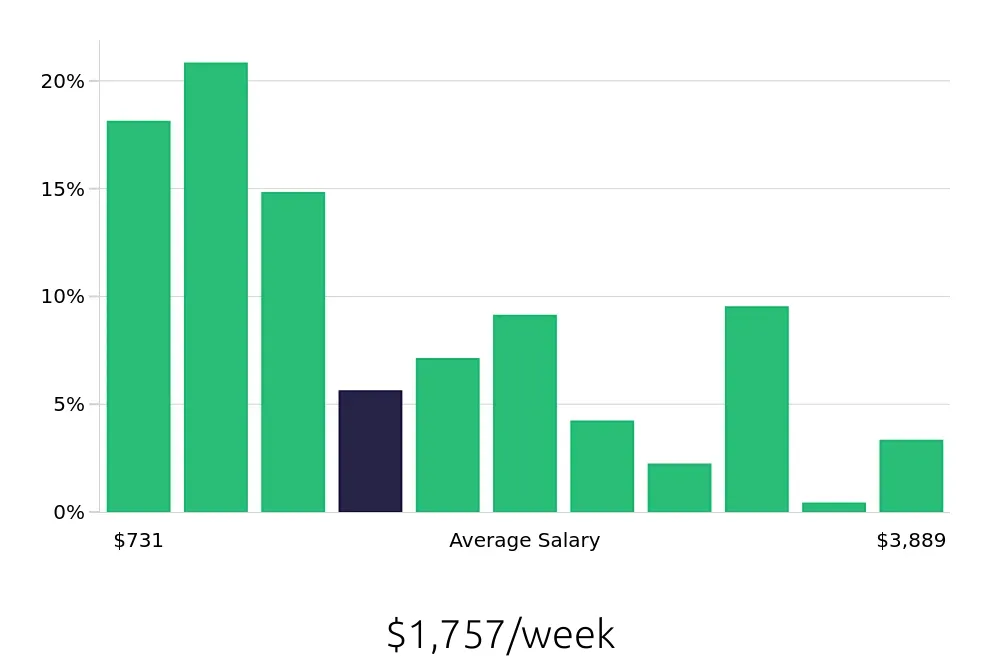

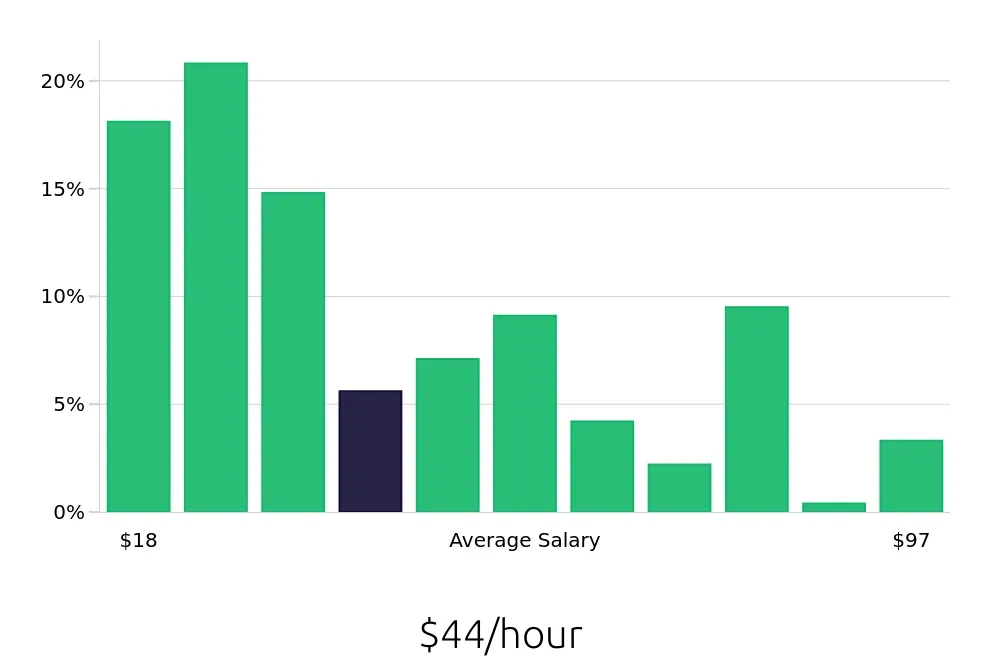

A Fraud Analyst works to identify and prevent fraud in businesses and organizations. They play an important role in keeping companies safe from financial losses and illegal activities. The salary for a Fraud Analyst can vary based on experience, location, and the size of the company. On average, a Fraud Analyst earns about $91,379 a year.

The salary range for Fraud Analysts can be quite wide. The lowest 10% earn around $38,000, while the top 10% can make over $200,000. Most Fraud Analysts fall somewhere in the middle, earning between $52,932 and $142,523 a year. Many factors can affect these numbers, including education, certifications, and the specific industry in which they work.

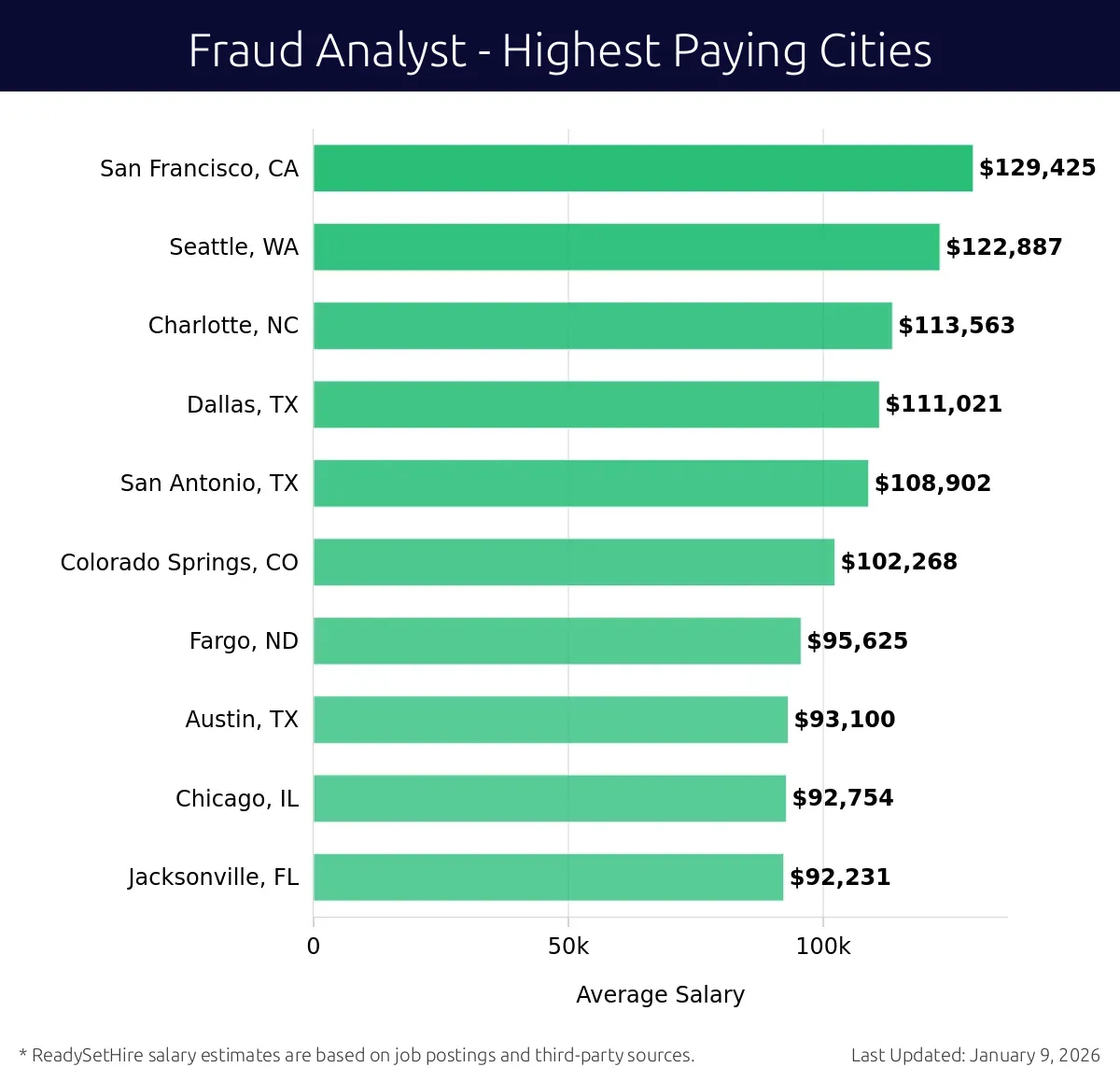

What are the highest paying cities for a Fraud Analyst?

-

San Francisco, CA

Average Salary: $129,425

In San Francisco, working in fraud analysis often involves collaborating with tech companies known for their innovative approaches. Major firms like PayPal and Square value sharp analytical skills. Employees gain expertise in detecting fraudulent transactions quickly.

Find Fraud Analyst jobs in San Francisco, CA

-

Seattle, WA

Average Salary: $122,887

Seattle offers a vibrant work environment for fraud analysts, with companies like Amazon and Microsoft leading the charge. Professionals in this city enjoy a tech-focused culture, where they play a crucial role in safeguarding digital transactions.

Find Fraud Analyst jobs in Seattle, WA

-

Charlotte, NC

Average Salary: $113,563

Charlotte provides a strong financial sector, making it ideal for fraud analysts. Banks like Bank of America and Wells Fargo rely on these experts to maintain security. Workers benefit from a stable job market and strong professional networks.

Find Fraud Analyst jobs in Charlotte, NC

-

Dallas, TX

Average Salary: $111,021

Dallas is home to a growing number of tech startups, offering diverse opportunities for fraud analysts. Companies such as AT&T and JPMorgan Chase look for skilled professionals to protect their assets and customer data.

Find Fraud Analyst jobs in Dallas, TX

-

San Antonio, TX

Average Salary: $108,902

San Antonio combines a strong job market with a lower cost of living. Analysts here find roles in financial institutions like Frost Bank and Security Service Federal Credit Union. The city values data security highly.

Find Fraud Analyst jobs in San Antonio, TX

-

Colorado Springs, CO

Average Salary: $102,268

Colorado Springs offers a blend of tech and government work for fraud analysts. With companies like United States Air Force and Northrop Grumman, analysts here focus on safeguarding sensitive information.

Find Fraud Analyst jobs in Colorado Springs, CO

-

Fargo, ND

Average Salary: $95,625

Fargo provides a more relaxed atmosphere with a focus on financial security. Banks like Wells Fargo and Thrivent Financial rely on these experts. The cost of living is low, making it an attractive option for many.

Find Fraud Analyst jobs in Fargo, ND

-

Austin, TX

Average Salary: $93,100

Austin boasts a dynamic tech scene, perfect for fraud analysts. Companies like Dell Technologies and Apple value their skills. The city’s growth attracts professionals who enjoy a vibrant lifestyle.

Find Fraud Analyst jobs in Austin, TX

-

Chicago, IL

Average Salary: $92,754

Chicago offers a mix of finance and technology roles for fraud analysts. Companies such as JPMorgan Chase and Allstate provide opportunities. The city’s diverse job market allows for career growth and stability.

Find Fraud Analyst jobs in Chicago, IL

-

Jacksonville, FL

Average Salary: $92,231

Jacksonville presents a stable job market with a strong financial sector. Analysts here work for firms like Fidelity National Financial and Bank of America. The city’s lower cost of living is an added benefit.

Find Fraud Analyst jobs in Jacksonville, FL

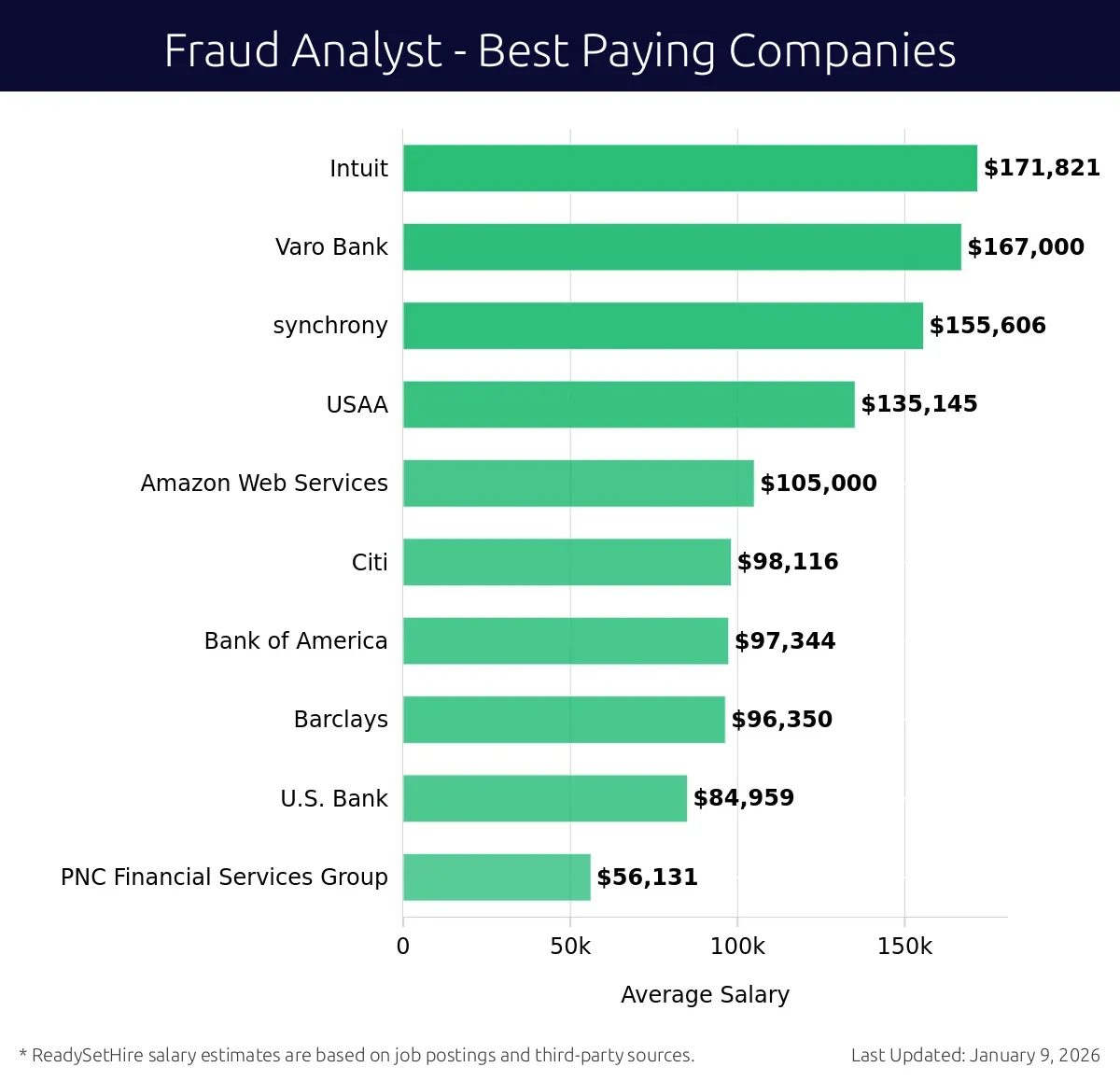

What are the best companies a Fraud Analyst can work for?

-

Intuit

Average Salary: $171,821

Intuit is a top company for Fraud Analysts. They focus on financial software and services. Intuit offers opportunities in various locations, including Mountain View, California; Tempe, Arizona; and Denver, Colorado. Their roles are pivotal in ensuring the security of financial transactions.

-

Varo Bank

Average Salary: $167,000

Varo Bank provides excellent compensation for Fraud Analysts. They are an online bank offering a range of financial services. Their positions are located in Minneapolis, Minnesota, and other parts of the country. Fraud Analysts at Varo Bank play a key role in maintaining the integrity of financial transactions.

-

Synchrony

Average Salary: $155,606

Synchrony pays well for Fraud Analysts. They provide financial services specializing in retail banking. Opportunities exist in Stamford, Connecticut, and various other locations. Here, Fraud Analysts work to detect and prevent fraudulent activities, ensuring customer trust.

-

USAA

Average Salary: $135,145

USAA offers a competitive salary for Fraud Analysts. They focus on financial services for military members and their families. Positions are available in San Antonio, Texas, and other areas. Fraud Analysts at USAA help safeguard the financial security of service members.

-

Amazon Web Services

Average Salary: $105,000

Amazon Web Services provides attractive salaries for Fraud Analysts. They offer cloud computing services globally. Opportunities are in Seattle, Washington, and other key locations. Fraud Analysts at AWS work to protect the platform from fraudulent activities.

-

Citi

Average Salary: $98,116

Citi offers good compensation for Fraud Analysts. They are a global financial services company with a presence in many countries. Positions are in New York, New York, and other locations. Fraud Analysts at Citi focus on detecting and preventing fraudulent transactions.

-

Bank of America

Average Salary: $97,344

Bank of America provides competitive pay for Fraud Analysts. They offer a wide range of financial services. Opportunities are in Charlotte, North Carolina, and other locations. Fraud Analysts help protect the bank’s customers from fraud.

-

Barclays

Average Salary: $96,350

Barclays offers a solid salary for Fraud Analysts. They are a leading financial services company with global operations. Positions are available in London, UK, and other locations. Fraud Analysts work to ensure the security of financial transactions.

-

U.S. Bank

Average Salary: $84,959

U.S. Bank provides good compensation for Fraud Analysts. They offer various banking services nationwide. Opportunities are in Minneapolis, Minnesota, and other areas. Fraud Analysts at U.S. Bank play a crucial role in protecting customers from fraud.

-

PNC Financial Services Group

Average Salary: $56,131

PNC Financial Services Group offers a fair salary for Fraud Analysts. They provide a range of financial services. Positions are in Pittsburgh, Pennsylvania, and other locations. Fraud Analysts help maintain the integrity of financial transactions for customers.

How to earn more as a Fraud Analyst?

Becoming a Fraud Analyst can lead to a rewarding career, but earning more involves more than just having the right skills. It requires dedication and strategic planning. Focus on these key factors to increase earning potential and advance in the field.

First, gaining relevant certifications can significantly boost earning potential. Certifications such as Certified Fraud Examiner (CFE) or Certified in Financial Forensics (CFF) can show employers that an analyst has specialized knowledge and skills. These credentials often lead to higher-paying positions. Second, building a strong network within the industry can open up more job opportunities. Networking with peers and attending industry conferences can help an analyst stay updated on the latest trends and technologies in fraud detection. Third, gaining experience with advanced fraud detection tools and software can make an analyst more valuable. Proficiency in tools like ACL, SAS, or Tableau can set an analyst apart from others.

In addition, continuing education is vital. Staying current with the latest in fraud prevention techniques and regulations can help an analyst perform their job better. Many employers value continuous learning and may reward analysts who pursue further education with higher salaries. Lastly, developing a strong understanding of data analytics and statistics can enhance an analyst's effectiveness. Being able to analyze and interpret data accurately is crucial for identifying fraudulent activities.

To summarize, increasing earning potential as a Fraud Analyst involves obtaining relevant certifications, building a strong network, gaining proficiency in advanced tools, continuing education, and enhancing data analysis skills. Each of these factors plays a role in making an analyst more attractive to employers and securing higher compensation.

- Obtain relevant certifications

- Build a strong industry network

- Gain proficiency in advanced tools

- Continue education and training

- Enhance data analytics and statistics skills