What does a Insurance Analyst do?

An Insurance Analyst examines and interprets data to help insurance companies make smart decisions. They look at numbers and trends to understand risk levels. Analysts gather information from policies, claims, and market data. They use this data to create reports and make recommendations. This helps companies decide how much to charge for insurance and what types of policies to offer.

Insurance Analysts work closely with underwriters and claims adjusters. They ensure that the company’s policies align with their risk assessment. Analysts also communicate with other departments to help manage company resources. They play a key role in keeping the company competitive. They must stay up-to-date with industry trends and changes in regulations. Analysts use their skills to help the company grow and succeed. By providing valuable insights, they help the company make better business decisions.

How to become a Insurance Analyst?

Becoming an Insurance Analyst can lead to a rewarding career. This role involves studying data to assess risk and suggest insurance policies. An Insurance Analyst works in the insurance industry, helping companies make informed decisions. This career path requires specific skills and education.

Here are the steps to become an Insurance Analyst:

- Earn a Degree: Start with a bachelor’s degree in finance, economics, business, or a related field. This provides the foundation needed for the job.

- Gain Relevant Experience: Look for internships or entry-level positions in the insurance industry. This helps build practical skills and industry knowledge.

- Learn Data Analysis Tools: Become familiar with data analysis tools and software. Programs like Excel, SQL, and data visualization tools are often used.

- Obtain Certifications: Consider getting professional certifications. The Certified Insurance Analyst (CIA) or the Chartered Property Casualty Underwriter (CPCU) are valuable.

- Network and Apply: Join industry groups and attend job fairs. Networking can lead to job opportunities. Apply for positions that match your skills and experience.

By following these steps, someone can successfully start a career as an Insurance Analyst. The journey requires education, experience, and ongoing learning. With the right preparation, you can thrive in this important role.

How long does it take to become a Insurance Analyst?

Becoming an Insurance Analyst involves a blend of education, training, and experience. Many analysts start by earning a bachelor's degree in a related field like finance, economics, or business. This typically takes about four years. Graduates can then enter the workforce, gaining experience that will be crucial for career advancement.

To further specialize, some analysts choose to complete additional certifications or training. These can include courses in risk management or insurance principles. These programs may take anywhere from a few months to a couple of years. Some employers offer training programs to new hires as part of their onboarding process. Experienced analysts can enhance their skills through continued education and professional development opportunities. This journey ensures they stay updated with industry trends and regulatory changes.

Insurance Analyst Job Description Sample

An Insurance Analyst is responsible for analyzing insurance data, assessing risks, and developing strategies to optimize insurance policies and procedures. This role involves collaborating with various departments to ensure that the company's insurance needs are met effectively and efficiently.

Responsibilities:

- Conduct thorough analysis of insurance data to identify trends, patterns, and areas for improvement.

- Assess and evaluate insurance risks for various business operations and recommend strategies to mitigate those risks.

- Collaborate with underwriting, claims, and finance teams to develop and implement cost-effective insurance solutions.

- Prepare detailed reports and presentations on insurance analysis findings and recommendations.

- Monitor and evaluate the performance of existing insurance policies, making recommendations for improvements.

Qualifications

- Bachelor’s degree in Finance, Business Administration, Risk Management, or a related field.

- Minimum of 3 years of experience in insurance analysis or a related role.

- Strong analytical skills with the ability to interpret complex data and provide actionable insights.

- Proficient in Microsoft Office Suite, particularly Excel, and insurance management software.

- Excellent communication and interpersonal skills with the ability to work collaboratively across departments.

Is becoming a Insurance Analyst a good career path?

An Insurance Analyst examines insurance policies, claims, and financial data. They work to ensure companies remain profitable while serving their customers. This role often requires a blend of analytical skills and a good understanding of insurance products. Analysts gather data, prepare reports, and provide insights to management. This can lead to roles in underwriting, risk management, or financial analysis.

Working as an Insurance Analyst offers several benefits. One key advantage is job stability. Insurance is a fundamental service, so demand remains steady. Analysts often work in a structured environment with clear career progression. They can specialize in areas like health, property, or life insurance. Working in this field can lead to roles with higher responsibility and better pay. Analysts also gain valuable experience in data analysis, which is useful in many industries. However, there are challenges to consider. The job can be detail-oriented and stressful, especially during busy periods. Analysts must stay updated with changing regulations and market trends, which requires continuous learning. The role may involve long hours, particularly when preparing reports or analyzing large datasets.

To summarize, consider these pros and cons:

- Pros:

- Job stability in a growing industry.

- Clear career progression and opportunities for specialization.

- Skills gained in data analysis are transferable.

- Cons:

- Detail-oriented work can be stressful.

- Need to keep up with changing regulations.

- Potential for long working hours.

What is the job outlook for a Insurance Analyst?

The job outlook for Insurance Analysts is a critical consideration for job seekers in the industry. According to the Bureau of Labor Statistics (BLS), there are, on average, about 22,100 job positions available each year. This consistent availability provides a steady flow of opportunities for professionals entering or switching to this career path. With a reliable number of positions opening each year, job seekers can feel encouraged to pursue roles in this field.

The BLS also reports a job openings percent change from 2022 to 2032 of -3.2, indicating a slight decrease in job openings over the next decade. However, this change does not necessarily mean a decline in the demand for Insurance Analysts. Instead, it suggests a shift in how companies may prioritize their hiring needs. Job seekers should remain optimistic, as there will still be ample opportunities in this industry. Staying informed about industry trends and continuously updating skills will help professionals remain competitive.

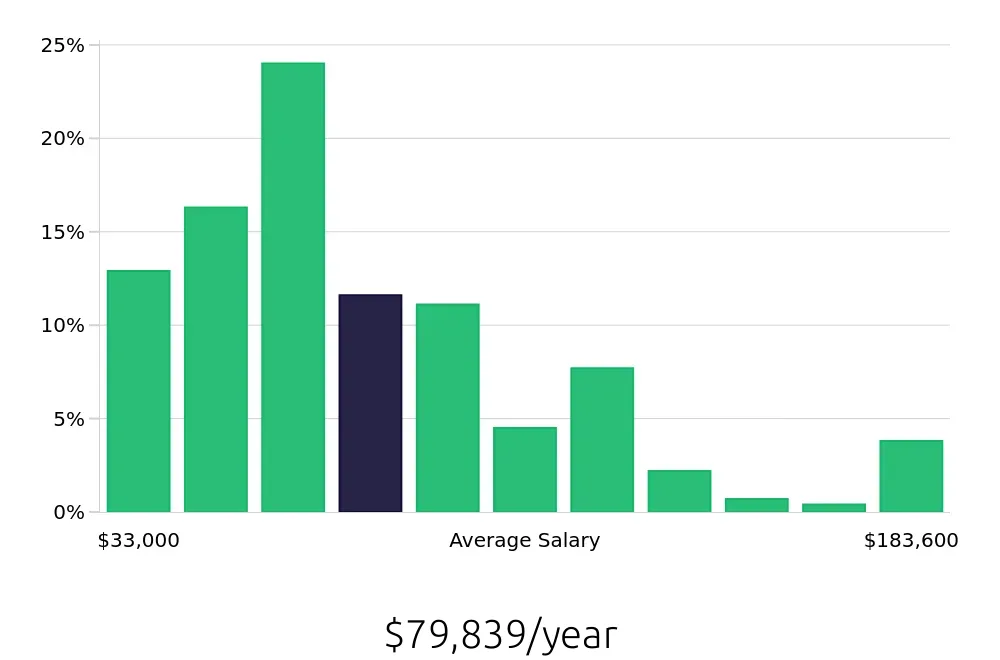

Earnings in the Insurance Analyst field are competitive, with an average national annual compensation of $49,530 and an average national hourly compensation of $23.81, according to the BLS. These figures highlight the financial rewards associated with this career. With the right education and experience, job seekers can expect to secure a stable and potentially lucrative role in the insurance industry. Understanding the salary potential is an important factor for those considering a career as an Insurance Analyst.

Currently 38 Insurance Analyst job openings, nationwide.

Continue to Salaries for Insurance Analyst