How much does a Insurance Analyst make?

Insurance analysts work in an important field that helps people and businesses manage risks. They look at data and provide insights that companies use to set premiums and policies. The work can be challenging but also rewarding.

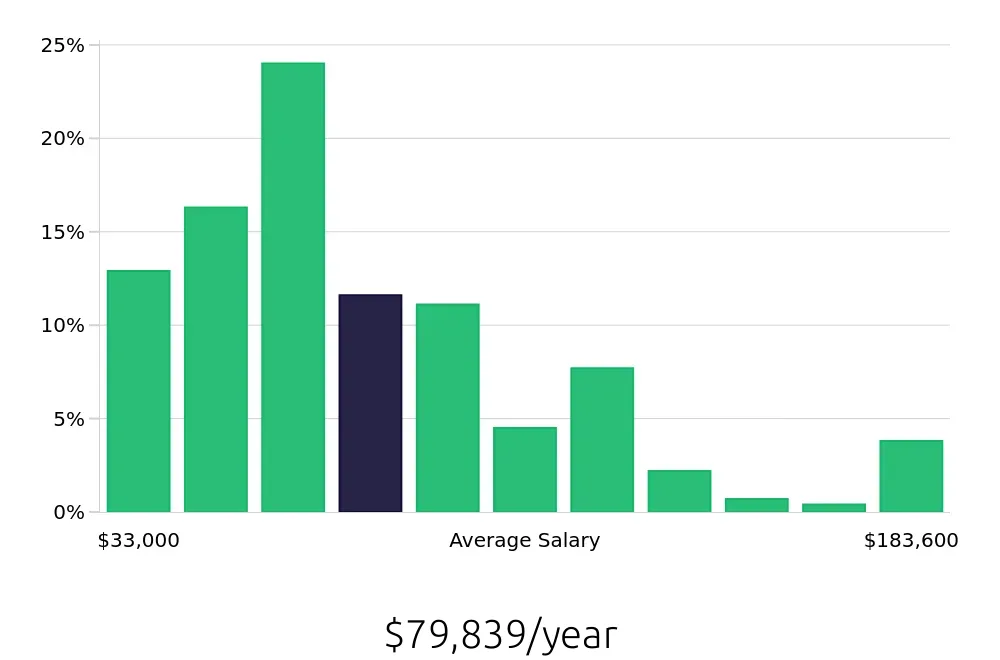

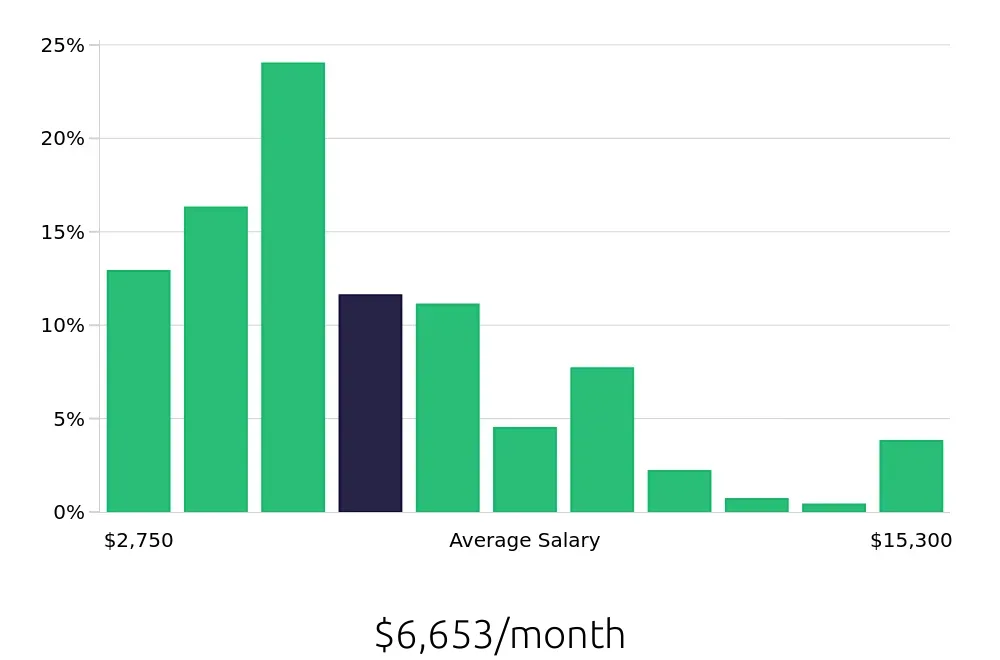

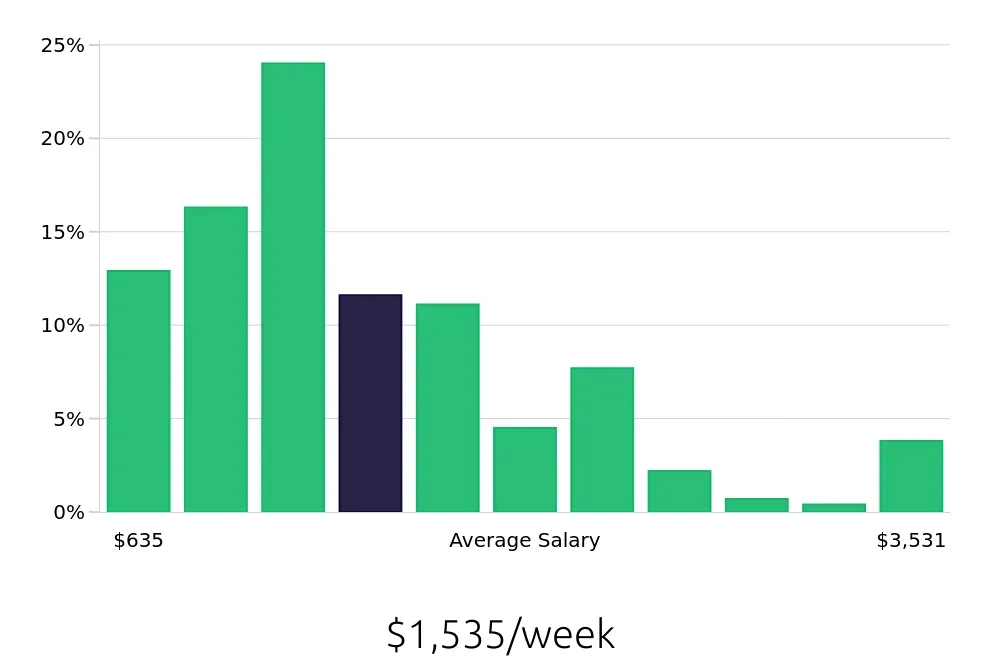

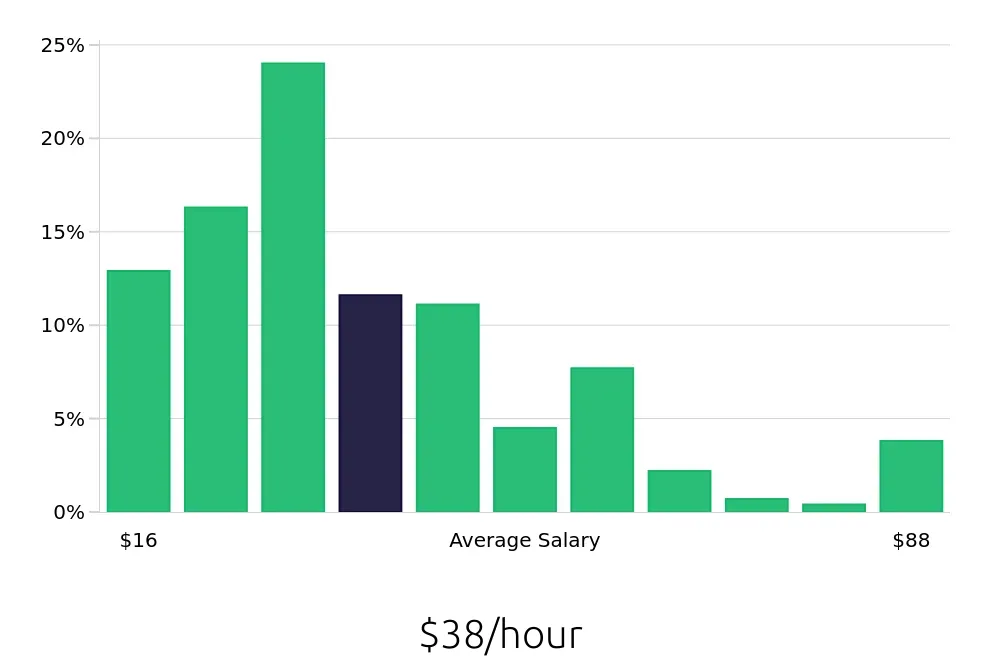

Insurance analysts typically earn a good salary. The average yearly salary for someone in this role is around $79,839. However, salaries can vary based on experience, location, and the size of the company. Here are some figures to give you an idea of the range:

- The lowest-paid 10% of analysts earn less than $33,000 per year.

- The highest-paid 10% earn more than $183,600 annually.

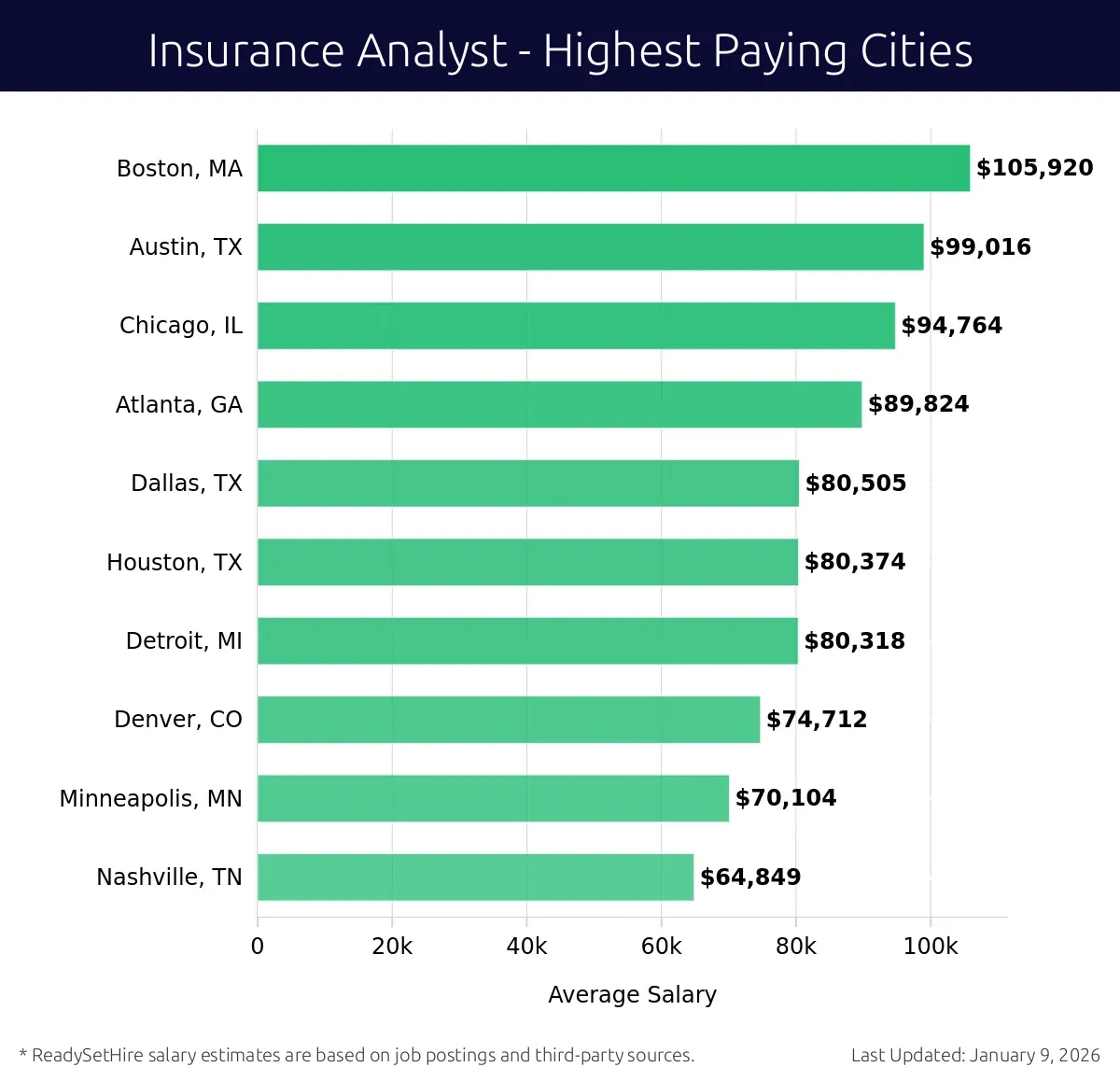

What are the highest paying cities for a Insurance Analyst?

-

Boston, MA

Average Salary: $105,920

In Boston, insurance professionals enjoy a robust job market. Many work for major companies like Liberty Mutual and State Street Corporation. They analyze data to help make important business decisions.

Find Insurance Analyst jobs in Boston, MA

-

Austin, TX

Average Salary: $99,016

Austin offers a thriving tech scene that includes insurance. Companies like USAA and Dell offer many opportunities. Analysts here use technology to improve insurance services and customer experiences.

Find Insurance Analyst jobs in Austin, TX

-

Chicago, IL

Average Salary: $94,764

Chicago boasts a strong insurance industry with giants like Allstate and Allstate. Analysts play a key role in risk management and customer support. They ensure policies meet customer needs and company goals.

Find Insurance Analyst jobs in Chicago, IL

-

Atlanta, GA

Average Salary: $89,824

Atlanta is home to several big insurance companies, including Aflac and SunTrust. Analysts work on policy evaluation and customer claims. They help keep the company running smoothly and efficiently.

Find Insurance Analyst jobs in Atlanta, GA

-

Dallas, TX

Average Salary: $80,505

Dallas has a dynamic insurance market. Companies like Farmers Insurance and Geico provide many opportunities. Analysts focus on customer needs and market trends to improve services.

Find Insurance Analyst jobs in Dallas, TX

-

Houston, TX

Average Salary: $80,374

Houston's insurance sector is growing. Key employers include Travelers and Liberty Mutual. Analysts here look at data to help shape strategies and improve customer interactions.

Find Insurance Analyst jobs in Houston, TX

-

Detroit, MI

Average Salary: $80,318

Detroit's insurance industry is led by companies like Blue Cross Blue Shield of Michigan. Analysts work on risk assessment and policy development. They help ensure the company meets all customer needs.

Find Insurance Analyst jobs in Detroit, MI

-

Denver, CO

Average Salary: $74,712

Denver has a healthy insurance market. Companies like U.S. Bank and Denver-based insurance firms need skilled analysts. They focus on customer satisfaction and efficient operations.

Find Insurance Analyst jobs in Denver, CO

-

Minneapolis, MN

Average Salary: $70,104

Minneapolis has a strong insurance presence. UnitedHealth Group and Thrivent are major employers. Analysts here work on data analysis to improve customer services and company efficiency.

Find Insurance Analyst jobs in Minneapolis, MN

-

Nashville, TN

Average Salary: $64,849

Nashville's insurance industry includes companies like State Farm and Allstate. Analysts in Nashville focus on customer needs and data analysis. They ensure policies meet customer needs and company standards.

Find Insurance Analyst jobs in Nashville, TN

What are the best companies a Insurance Analyst can work for?

-

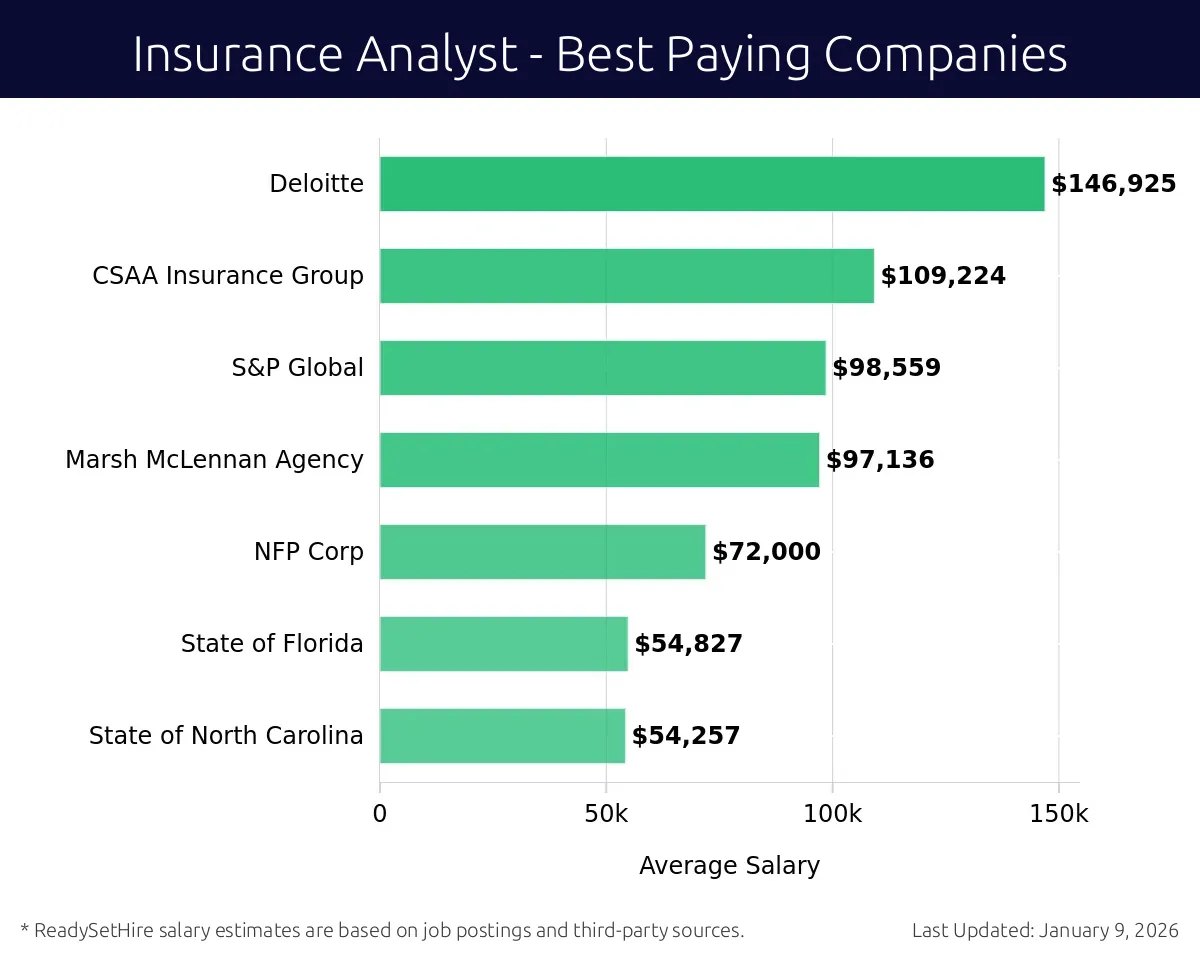

Deloitte

Average Salary: $146,925

Deloitte offers Insurance Analyst jobs with competitive pay. They work in various locations, including New York, San Francisco, and Chicago. Analysts at Deloitte analyze insurance data, help clients make informed decisions, and ensure risk management is top-notch.

-

CSAA Insurance Group

Average Salary: $109,224

CSAA Insurance Group provides rewarding Insurance Analyst positions. This company operates in Texas, California, and several other states. Analysts here focus on risk assessment, policy analysis, and financial reporting to support insurance services.

-

S&P Global

Average Salary: $98,559

S&P Global offers Insurance Analyst jobs with a good salary. They are present in major cities like New York, London, and Singapore. Here, analysts work on market data, trends, and reports to help clients navigate the insurance landscape.

-

Marsh McLennan Agency

Average Salary: $97,136

Marsh McLennan Agency provides Insurance Analyst roles with a solid salary. They operate in cities such as New York, Los Angeles, and Toronto. Analysts at this company evaluate insurance needs, suggest policies, and assist clients in securing the right coverage.

-

NFP Corp

Average Salary: $72,000

NFP Corp offers Insurance Analyst jobs with a reasonable salary. They have offices in many states, including Colorado and Texas. Here, analysts work on risk management, policy development, and client support to ensure comprehensive insurance coverage.

-

State of Florida

Average Salary: $54,827

The State of Florida provides Insurance Analyst positions with a respectable salary. They operate across the state, offering analysts the chance to work on regulatory compliance, policy analysis, and supporting state-run insurance programs.

-

State of North Carolina

Average Salary: $54,257

The State of North Carolina offers Insurance Analyst jobs with a fair salary. They have offices throughout the state. Here, analysts focus on managing public insurance programs, policy analysis, and ensuring compliance with state regulations.

How to earn more as a Insurance Analyst?

Increasing earnings as an Insurance Analyst requires a mix of skill enhancement, strategic networking, and career development. This role demands attention to detail, analytical skills, and a thorough understanding of insurance policies and practices. By focusing on these key areas, analysts can open pathways to higher pay and better career opportunities.

First, gaining specialized certifications can lead to higher earnings. Certifications such as the Associate in Insurance Services (AIS) or Chartered Property Casualty Underwriter (CPCU) can make an analyst more valuable. These credentials showcase expertise and commitment to the field. Second, developing strong analytical skills can set an analyst apart. Mastery of data analysis tools and a deep understanding of insurance trends can provide the edge needed in a competitive job market. Third, networking with industry professionals can uncover hidden job opportunities and lead to salary negotiations. Building a strong professional network can also offer insights into market trends and salary benchmarks.

Additionally, pursuing advanced degrees or relevant coursework can significantly boost earning potential. Degrees in finance, economics, or insurance can provide a deeper understanding of the industry and lead to higher-paying positions. Finally, seeking promotions or lateral moves to companies with higher compensation structures can also increase earnings. Staying informed about industry salary standards and negotiating skills can help in securing better compensation packages.

To summarize, here are five factors that can help an Insurance Analyst earn more:

- Obtain specialized certifications

- Develop strong analytical skills

- Network with industry professionals

- Pursue advanced degrees or coursework

- Seek promotions or better-paying positions