What does a Investment Banker do?

An Investment Banker works in the financial services industry. They help companies, governments, and other entities raise capital. This can involve selling stocks, bonds, or other financial instruments. Investment Bankers also advise on mergers and acquisitions. They analyze financial data and market trends to guide clients.

Investment Bankers work closely with clients to understand their financial needs. They create strategies to meet these needs. This includes preparing financial documents and making presentations. They also negotiate deals with potential investors. Their goal is to secure the best possible terms for their clients. This requires strong analytical skills and the ability to build relationships. Investment Bankers must stay updated on market conditions and financial regulations.

How to become a Investment Banker?

Becoming an investment banker involves a clear path and dedication. This career offers the chance to work with large companies and high net-worth individuals. Below are five essential steps to help achieve this goal.

First, obtain a bachelor's degree in a relevant field. Common choices include finance, economics, or business administration. This education provides the foundation needed for understanding the financial world. Second, gain experience through internships or entry-level positions in finance. These roles help develop practical skills and build a professional network. Third, consider pursuing a master's degree, such as an MBA, to enhance qualifications. Fourth, acquire necessary certifications, like the Series 7 and Series 63 exams, to meet regulatory requirements. Finally, seek full-time positions with investment banks or related firms. Networking and perseverance play key roles in landing a job.

Each step requires effort and commitment. Starting with a solid education leads to gaining experience and skills. Certifications and advanced degrees make a candidate more attractive to employers. With determination and hard work, the path to becoming an investment banker can be successfully navigated.

How long does it take to become a Investment Banker?

The journey to becoming an investment banker often includes several key steps. This career path demands a mix of education, experience, and specialized skills. A bachelor's degree, usually in finance, business, or economics, serves as a solid foundation. Many candidates also pursue a Master of Business Administration (MBA) to strengthen their credentials. On average, this educational journey takes about four to six years.

After completing formal education, gaining experience becomes crucial. Most aspiring investment bankers start in entry-level positions. These roles may include analyst or associate roles within investment firms. Experience in these positions can take about two to five years. Successful candidates often demonstrate strong analytical skills, attention to detail, and the ability to manage high-pressure environments. Gaining this experience helps to build a strong resume and network in the industry.

Investment Banker Job Description Sample

An Investment Banker is responsible for facilitating transactions and providing financial advice to businesses, governments, and high-net-worth individuals. They help clients with mergers and acquisitions, capital raising, risk management, and other financial services.

Responsibilities:

- Assist clients with mergers, acquisitions, and divestitures.

- Conduct financial analysis and market research to support investment decisions.

- Develop and present financial models and projections to clients.

- Manage client relationships and maintain effective communication.

- Collaborate with internal and external teams to execute transactions.

Qualifications

- Bachelor's degree in Finance, Business, Economics, or related field.

- Proven experience in investment banking or a related field.

- Strong analytical and quantitative skills.

- Excellent communication and interpersonal skills.

- Ability to work under pressure and meet tight deadlines.

Is becoming a Investment Banker a good career path?

An Investment Banker plays a key role in the financial world. They help companies raise capital and manage their finances. This role involves working on mergers, acquisitions, and public offerings. Investment Bankers advise clients on financial decisions, using their expertise to create valuable strategies. This path demands strong analytical skills and attention to detail.

Choosing this career path offers several benefits. Investment Bankers often earn high salaries. They also enjoy the chance to work with major companies and influential clients. Networking opportunities are abundant, opening doors to future career options. However, the job can be demanding. Investment Bankers face long hours and high stress, especially during critical projects. The competitive nature of the industry means constant learning and adaptation are necessary. Balancing work and personal life can be challenging.

Here are some pros and cons to consider:

- Pros:

- High earning potential

- Opportunities to work with top companies

- Strong networking possibilities

- Variety of career growth options

- Cons:

- Long and irregular working hours

- High stress levels during critical periods

- Intense competition for top positions

- Continuous need to update skills

What is the job outlook for a Investment Banker?

Investment bankers help companies raise money and make smart financial decisions. This career can be very rewarding. The job outlook for investment bankers is promising. The Bureau of Labor Statistics (BLS) shows there are about 61,300 job openings each year. This number is expected to grow by 8.2% from 2022 to 2032. This growth means more opportunities for those entering the field.

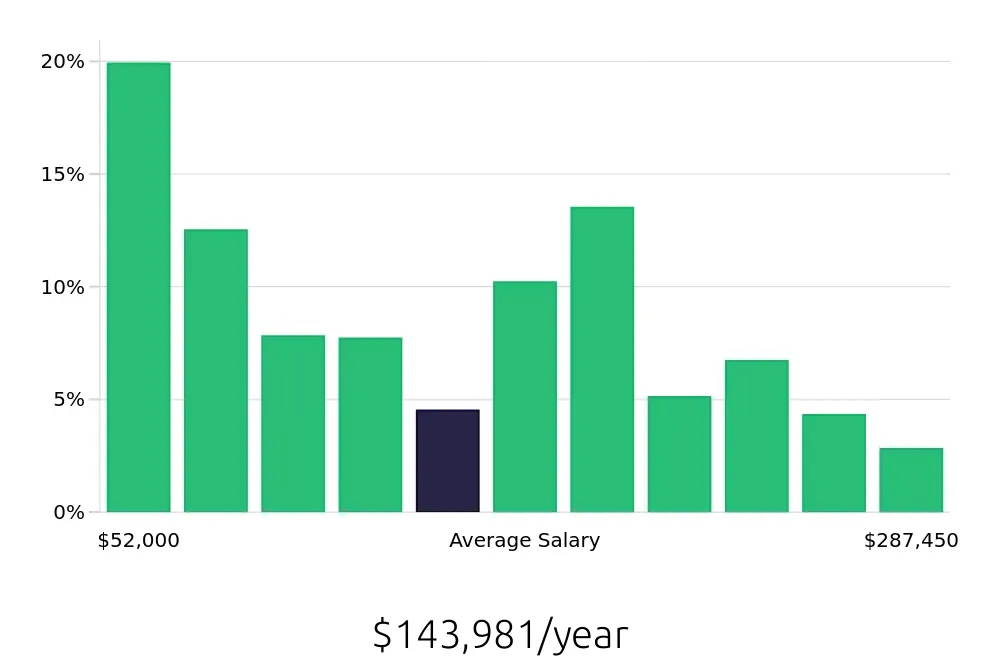

Investment bankers earn a solid income. The average annual salary is $123,330. This pay can be even higher with experience and expertise. Investment bankers also earn an average of $59.29 per hour. This hourly rate highlights the value these professionals bring to their employers. For job seekers, these numbers show a career with good earning potential.

The field of investment banking offers stability and growth. With a strong job outlook and good pay, it is a great career choice. Aspiring investment bankers can look forward to a future with many opportunities. They can expect to work in a field that is both challenging and financially rewarding.

Currently 260 Investment Banker job openings, nationwide.

Continue to Salaries for Investment Banker