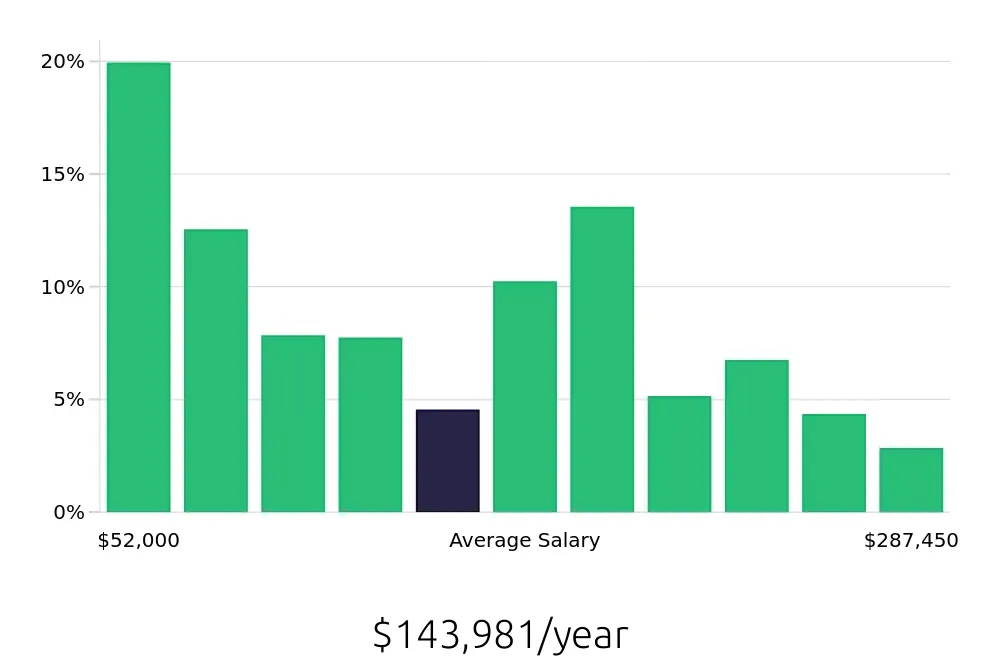

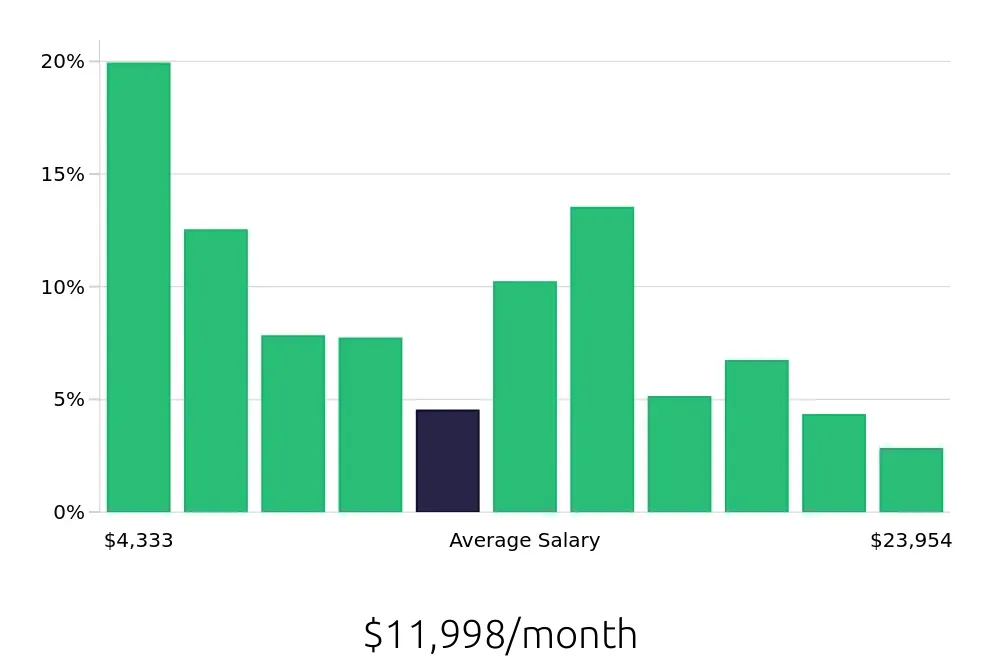

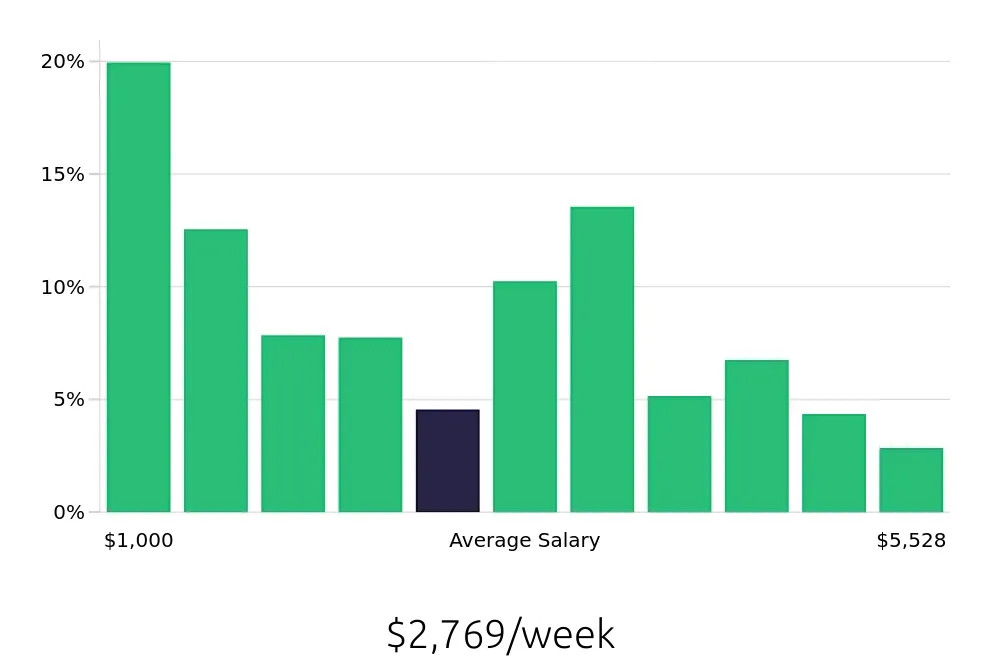

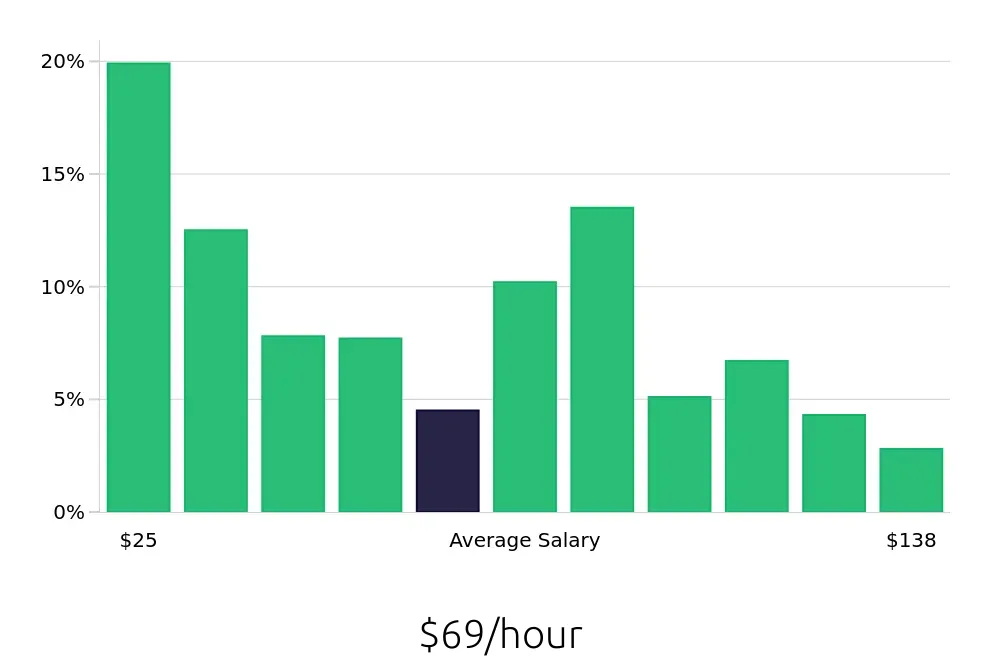

How much does a Investment Banker make?

Investment bankers work hard, and their salaries reflect their efforts. The average yearly salary for an investment banker is around $143,981. This means that someone in this field can expect to earn a good income. The data shows that salaries range from about $52,000 for those just starting out to over $287,000 for those with the most experience.

Investment bankers often earn more as they gain experience and take on more responsibility. For example, those in the top 10% of earners make over $266,000 a year. This shows that hard work and dedication can lead to significant rewards. It is also worth noting that salaries can vary based on the company and the specific role within the investment banking sector.

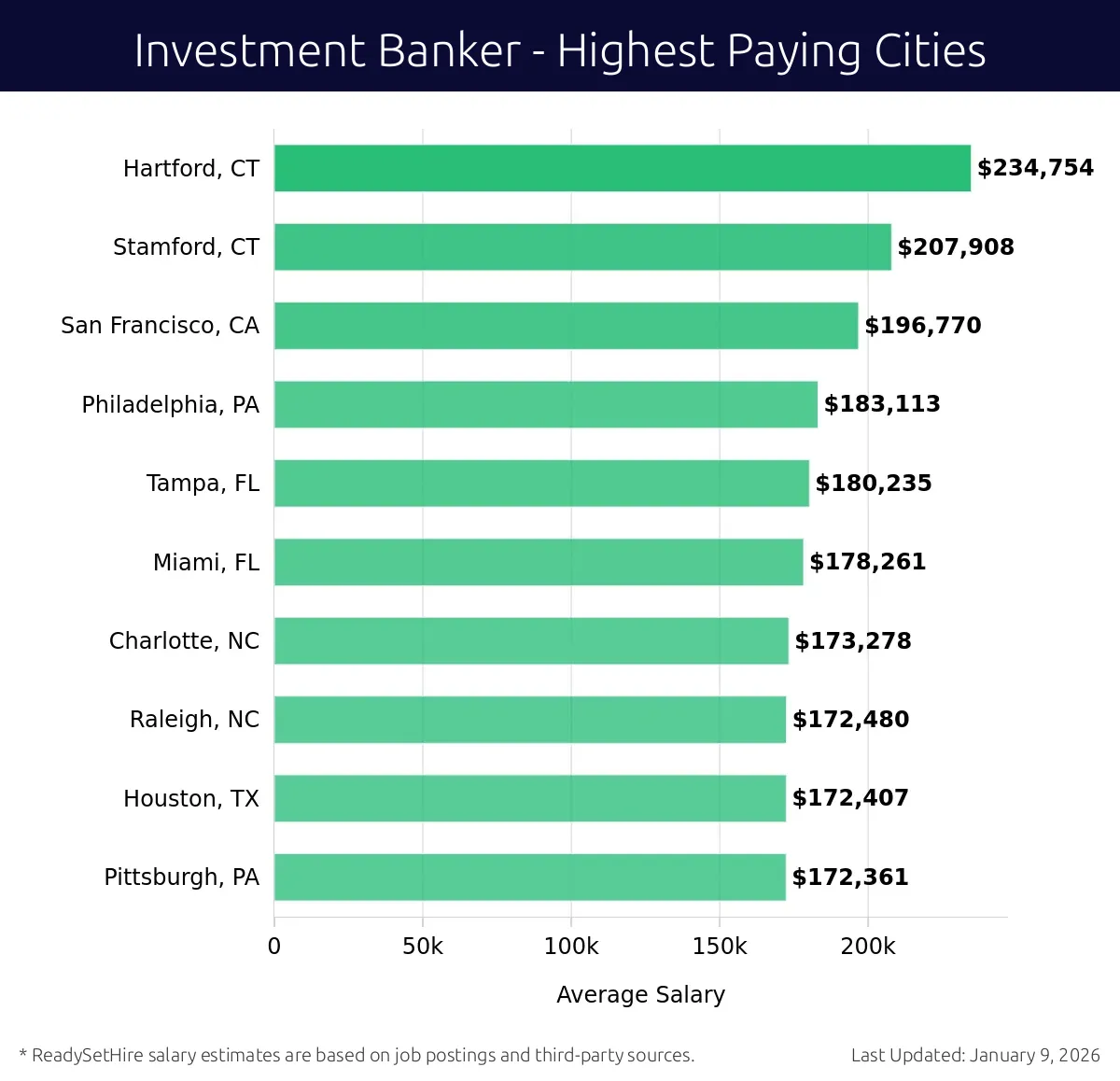

What are the highest paying cities for a Investment Banker?

-

Hartford, CT

Average Salary: $234,754

In Hartford, top financial firms provide excellent opportunities. Investment banking roles here focus on mergers and acquisitions. Major companies like The Hartford Financial Services offer dynamic environments.

Find Investment Banker jobs in Hartford, CT

-

Stamford, CT

Average Salary: $207,908

Stamford has a strong financial sector. Investment bankers enjoy a mix of corporate and entrepreneurial opportunities. Companies like Evercore and CBRE Group offer varied experiences.

Find Investment Banker jobs in Stamford, CT

-

San Francisco, CA

Average Salary: $196,770

San Francisco's tech boom creates a vibrant market. Investment banking roles here often involve tech IPOs. Firms like Goldman Sachs and J.P. Morgan provide growth opportunities.

Find Investment Banker jobs in San Francisco, CA

-

Philadelphia, PA

Average Salary: $183,113

Philadelphia offers a mix of traditional finance and innovation. Investment bankers here work on a range of deals. Companies like Nomura and TD Ameritrade are prominent.

Find Investment Banker jobs in Philadelphia, PA

-

Tampa, FL

Average Salary: $180,235

Tampa's growing economy offers exciting prospects. Investment bankers here engage in diverse projects. Firms like Raymond James and Wells Fargo provide solid platforms.

Find Investment Banker jobs in Tampa, FL

-

Miami, FL

Average Salary: $178,261

Miami's dynamic market attracts investment bankers. The focus is on finance and real estate. Companies like Goldman Sachs and Morgan Stanley offer vibrant work settings.

Find Investment Banker jobs in Miami, FL

-

Charlotte, NC

Average Salary: $173,278

Charlotte has a strong banking presence. Investment banking roles here involve significant financial activities. Bank of America and Wells Fargo are major players.

Find Investment Banker jobs in Charlotte, NC

-

Raleigh, NC

Average Salary: $172,480

Raleigh's growing tech scene provides unique opportunities. Investment bankers here work on innovative projects. Firms like Truist and Synovus offer promising roles.

Find Investment Banker jobs in Raleigh, NC

-

Houston, TX

Average Salary: $172,407

Houston's energy sector creates diverse opportunities. Investment bankers here often work on energy deals. Companies like JPMorgan Chase and Goldman Sachs are active.

Find Investment Banker jobs in Houston, TX

-

Pittsburgh, PA

Average Salary: $172,361

Pittsburgh offers a blend of industry and finance. Investment banking roles here focus on tech and manufacturing. Companies like PNC and BNY Mellon provide solid careers.

Find Investment Banker jobs in Pittsburgh, PA

What are the best companies a Investment Banker can work for?

-

UBS

Average Salary: $273,958

UBS is a leading global financial services firm. Investment Bankers at UBS work in cities like New York, London, and Hong Kong. They assist with mergers, acquisitions, and raising capital.

-

Bank of America

Average Salary: $259,318

Bank of America is one of the largest financial institutions in the world. Investment Bankers here focus on a range of services, including underwriting and market-making, in locations like Charlotte and New York.

-

Barclays

Average Salary: $230,451

Barclays operates globally, with Investment Bankers playing key roles in London, New York, and other financial hubs. They provide financial advisory services to corporations and governments.

-

PwC

Average Salary: $229,152

PwC offers professional services in assurance, tax, and consulting. Investment Bankers at PwC help clients with complex financial transactions and strategic advice in cities like Sydney and Toronto.

-

Citi

Average Salary: $221,636

Citi is a global bank with a strong presence in international markets. Investment Bankers at Citi work in New York, London, and Hong Kong, providing services like M&A and capital raising.

-

Scotiabank

Average Salary: $215,562

Scotiabank operates in over 50 countries. Investment Bankers here focus on corporate finance, working with clients in Latin America, the Caribbean, and North America.

-

Truist

Average Salary: $210,185

Truist is a leading financial institution in the United States. Investment Bankers work in major cities like Atlanta and New York, offering services such as M&A and debt and equity capital markets.

-

Deloitte

Average Salary: $203,900

Deloitte provides audit, tax, consulting, and financial advisory services. Investment Bankers at Deloitte help clients with complex financial matters in cities like London, New York, and San Francisco.

-

Lazard

Average Salary: $185,000

Lazard is a global investment bank and asset management firm. Investment Bankers at Lazard work in New York, London, and other global financial centers, specializing in M&A and capital markets.

-

Morgan Stanley

Average Salary: $184,038

Morgan Stanley is a global leader in financial services. Investment Bankers here work in locations like New York, London, and Tokyo, providing advisory services on M&A, capital raising, and more.

How to earn more as a Investment Banker?

In the world of finance, investment bankers have the potential to earn significant income. Those who excel in this field often do so by focusing on several key strategies. Each strategy provides a pathway to higher earnings and greater job satisfaction.

First, gaining specialized skills can lead to higher pay. Investment bankers who master skills like financial modeling, mergers and acquisitions, and equity research stand out. Second, working at a top-tier investment bank can result in larger bonuses and higher salaries. Banks such as Goldman Sachs and JPMorgan Chase often offer competitive compensation packages. Third, building a strong network within the industry can open doors to high-paying opportunities. Networking with colleagues, clients, and industry leaders can lead to job offers and new projects. Fourth, taking on leadership roles can increase earnings. Managers and directors in investment banking often earn more than their junior counterparts. Lastly, obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) designation, can enhance credibility and earnings potential.

Consider these strategies to increase earning potential as an investment banker:

- Gain specialized skills in financial modeling, mergers and acquisitions, and equity research.

- Work at top-tier investment banks to access competitive compensation packages.

- Build a strong network within the industry to discover high-paying opportunities.

- Take on leadership roles for higher earnings.

- Obtain relevant certifications like the CFA designation to enhance credibility.