What does a Loan Servicing Specialist do?

A Loan Servicing Specialist plays a crucial role in managing and maintaining customer relationships for mortgage and loan accounts. This position ensures that borrowers understand their loan terms and payments. The specialist handles inquiries, provides account updates, and assists with payment processing. They work closely with customers to resolve any issues that may arise, ensuring a smooth and positive experience.

The Loan Servicing Specialist also maintains accurate records of all transactions and communications. They use specialized software to track payments and update account information. This role requires strong communication skills and attention to detail. The specialist must be knowledgeable about loan products and regulations to provide accurate and helpful information. By offering excellent customer service, the Loan Servicing Specialist helps to build trust and maintain long-term relationships with clients.

How to become a Loan Servicing Specialist?

Becoming a Loan Servicing Specialist is a rewarding career choice. This role involves managing mortgage payments and ensuring borrowers meet their obligations. It requires attention to detail and strong communication skills. Follow these steps to start your journey in this field.

First, gain a solid understanding of the mortgage industry. This includes learning about loan terms, interest rates, and payment structures. Knowledge of these areas is crucial for handling customer inquiries and resolving issues. Next, obtain relevant education. Many employers prefer candidates with a high school diploma or equivalent. Some may require a college degree in finance, accounting, or a related field. Consider taking courses in these areas to enhance your qualifications.

- Earn a degree or certification in finance or a related field.

- Gain experience in customer service or financial roles.

- Learn about mortgage laws and regulations.

- Apply for entry-level positions in loan servicing.

- Seek opportunities for professional development and advancement.

Experience in customer service or financial roles can be very beneficial. It helps develop the skills needed to interact with clients and handle financial transactions. Understanding mortgage laws and regulations is also important. This knowledge ensures compliance with legal standards and protects both the company and the borrower. Apply for entry-level positions in loan servicing to gain practical experience. Look for roles that offer training and mentorship. This will help you grow in your career.

Seek opportunities for professional development and advancement. Attend workshops, seminars, and training sessions. Consider earning certifications such as the Certified Loan Servicing Specialist (CLSS) credential. This can enhance your resume and open up more job opportunities. With dedication and the right qualifications, you can succeed as a Loan Servicing Specialist.

How long does it take to become a Loan Servicing Specialist?

The journey to becoming a Loan Servicing Specialist involves several steps. First, a person needs a high school diploma or equivalent. This is the basic requirement. Next, they should complete a training program or take courses in finance or business. These programs can last from a few weeks to a year. They teach important skills like loan management and customer service.

After training, gaining experience is key. Many start as loan servicing assistants. This role helps them learn the job from the ground up. With time and skill, they can move up to a full Loan Servicing Specialist position. This often takes about one to two years. Some may find jobs faster if they have prior experience in finance or customer service. The path may vary, but dedication and learning can lead to a successful career.

Loan Servicing Specialist Job Description Sample

A Loan Servicing Specialist is responsible for managing the day-to-day operations of a loan portfolio, ensuring compliance with regulatory requirements, and providing excellent customer service to borrowers. This role involves processing loan payments, handling customer inquiries, and maintaining accurate records of loan activities.

Responsibilities:

- Process loan payments and ensure accurate recording of transactions.

- Handle customer inquiries and resolve issues related to loan accounts.

- Maintain up-to-date records of loan activities and ensure compliance with regulatory requirements.

- Prepare and distribute loan statements to borrowers.

- Coordinate with other departments to ensure smooth loan servicing operations.

Qualifications

- Bachelor’s degree in Finance, Business Administration, or a related field.

- Minimum of 2-3 years of experience in loan servicing or a related field.

- Strong understanding of mortgage and loan servicing processes.

- Excellent communication and customer service skills.

- Proficient in Microsoft Office Suite and loan servicing software.

Is becoming a Loan Servicing Specialist a good career path?

A Loan Servicing Specialist plays a key role in the financial industry. This role involves managing mortgage loans and ensuring borrowers meet their payment obligations. Specialists handle tasks such as processing payments, maintaining records, and communicating with borrowers. This position requires strong attention to detail and excellent customer service skills. The job offers a stable career path with opportunities for growth in the financial sector.

Working as a Loan Servicing Specialist has its own set of advantages and challenges. Here are some pros and cons to consider:

- Pros:

- Job stability: The demand for loan servicing specialists remains steady.

- Clear career progression: Opportunities for advancement to management roles.

- Skill development: Gain skills in customer service, financial management, and compliance.

- Cons:

- High responsibility: Managing others' financial obligations can be stressful.

- Repetitive tasks: The job may involve repetitive tasks, which can be monotonous.

- Regulatory changes: Must stay updated with changing laws and regulations.

What is the job outlook for a Loan Servicing Specialist?

The job outlook for Loan Servicing Specialists looks promising for job seekers. The Bureau of Labor Statistics (BLS) reports an average of 27,700 job positions available each year. This steady demand indicates a stable career path for those entering the field. With a projected job openings percent change of 3.1% from 2022 to 2032, the industry shows a positive trend. This growth suggests that Loan Servicing Specialists will continue to be in demand.

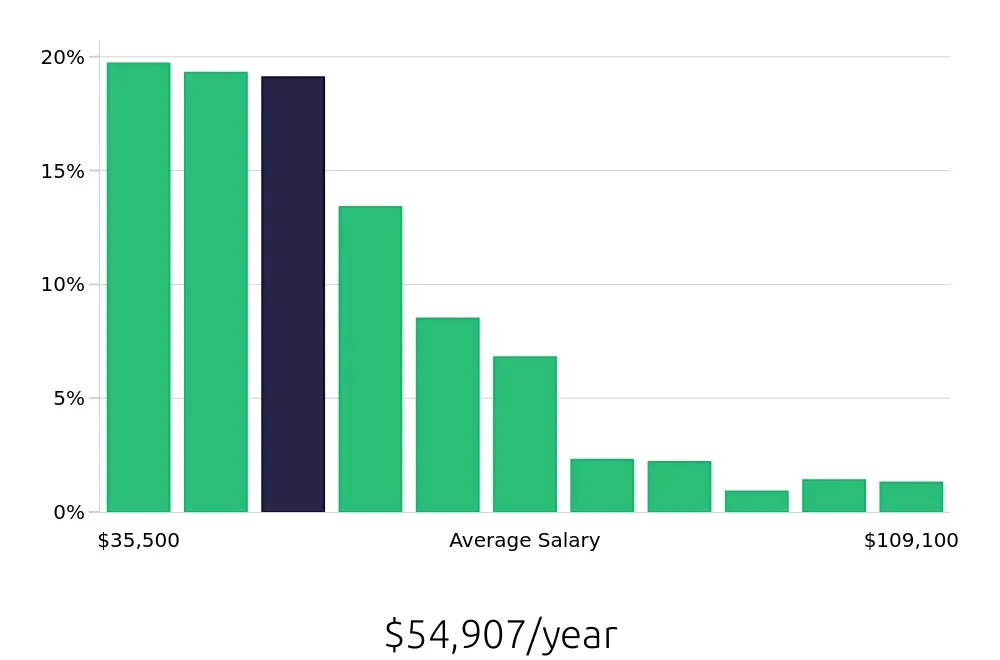

Loan Servicing Specialists can expect a competitive salary as well. The BLS reports an average national annual compensation of $82,000. This figure reflects the value placed on the skills and responsibilities of these professionals. Additionally, the average national hourly compensation stands at $39.43, offering a clear picture of the earning potential in this role. These figures make the position attractive to those seeking a rewarding career.

For job seekers, the combination of steady job availability and a strong salary makes Loan Servicing a viable career choice. The industry's growth and compensation levels provide a solid foundation for long-term career stability. With these factors in mind, entering the field of Loan Servicing can be a smart move for those looking to secure a stable and well-compensated job.

Currently 138 Loan Servicing Specialist job openings, nationwide.

Continue to Salaries for Loan Servicing Specialist