How much does a Loan Servicing Specialist make?

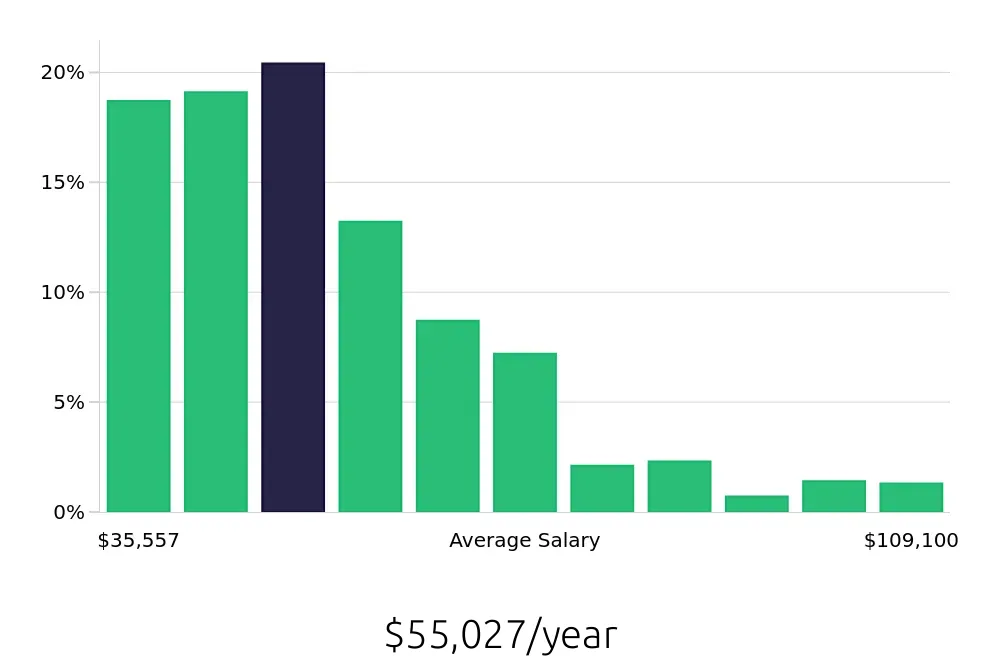

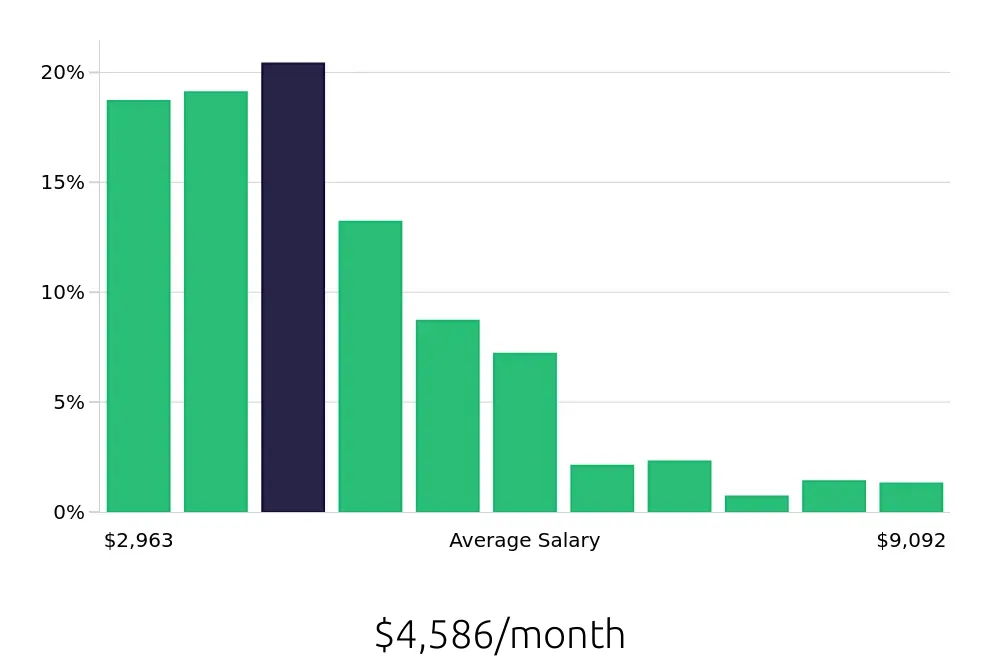

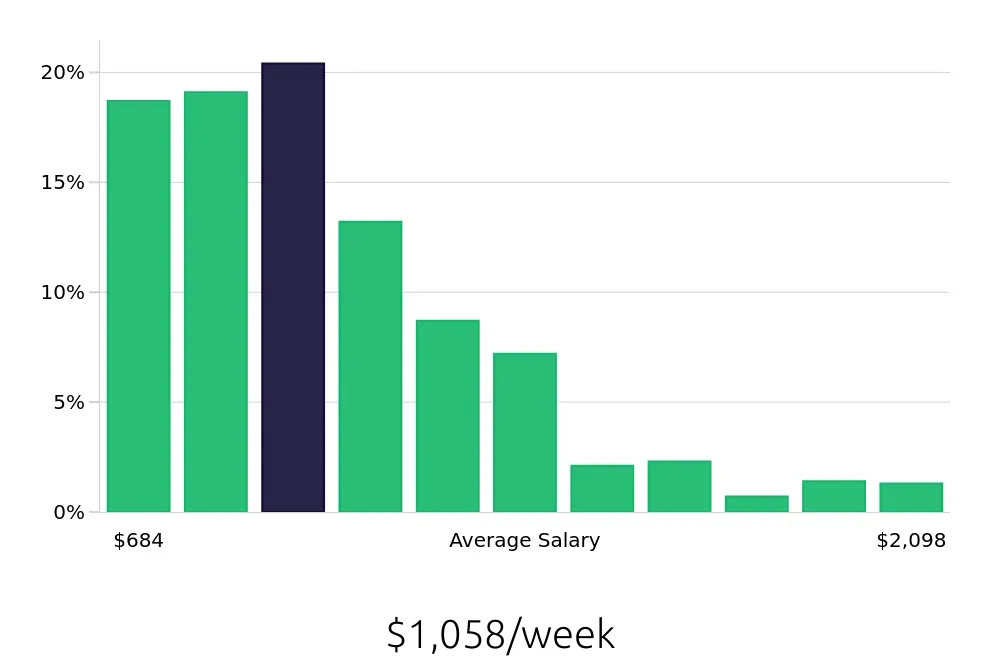

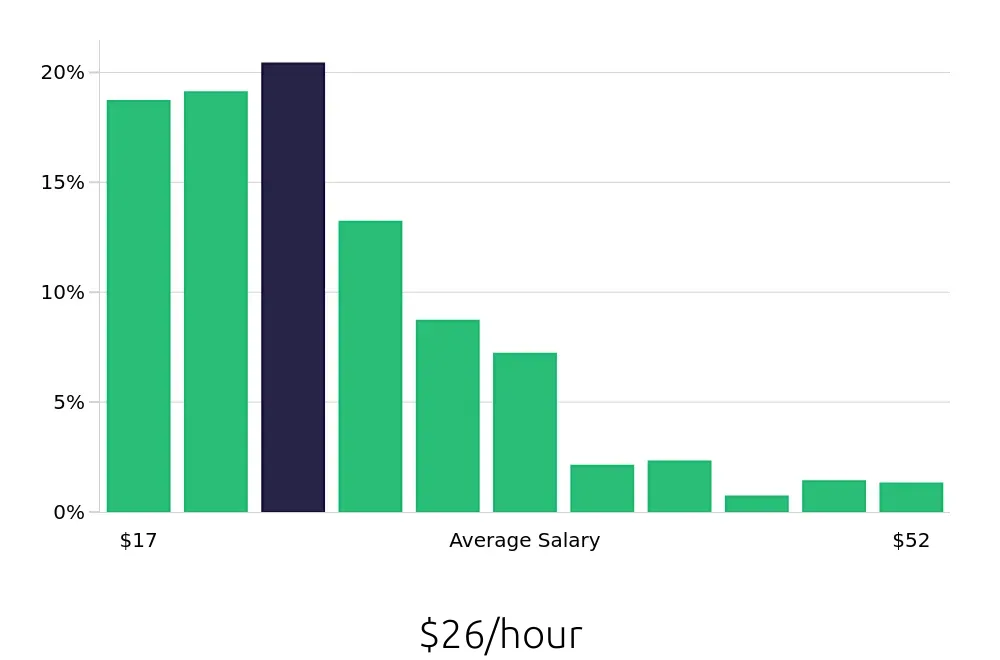

Loan servicing specialists handle many tasks for mortgage companies. They keep records, send out bills, and answer customer questions. Many people choose this job because it offers a steady paycheck. The average yearly salary for a loan servicing specialist is $55,027. This means that, on average, a specialist earns nearly $27 per hour.

Most loan servicing specialists fall somewhere in the middle of the salary range. The lowest-paid specialists earn about $35,557, while the highest-paid earn around $109,100. Most earn between $42,242 and $82,357. If you work hard and gain experience, you can move up the pay scale. You might also get extra pay for working overtime or on weekends.

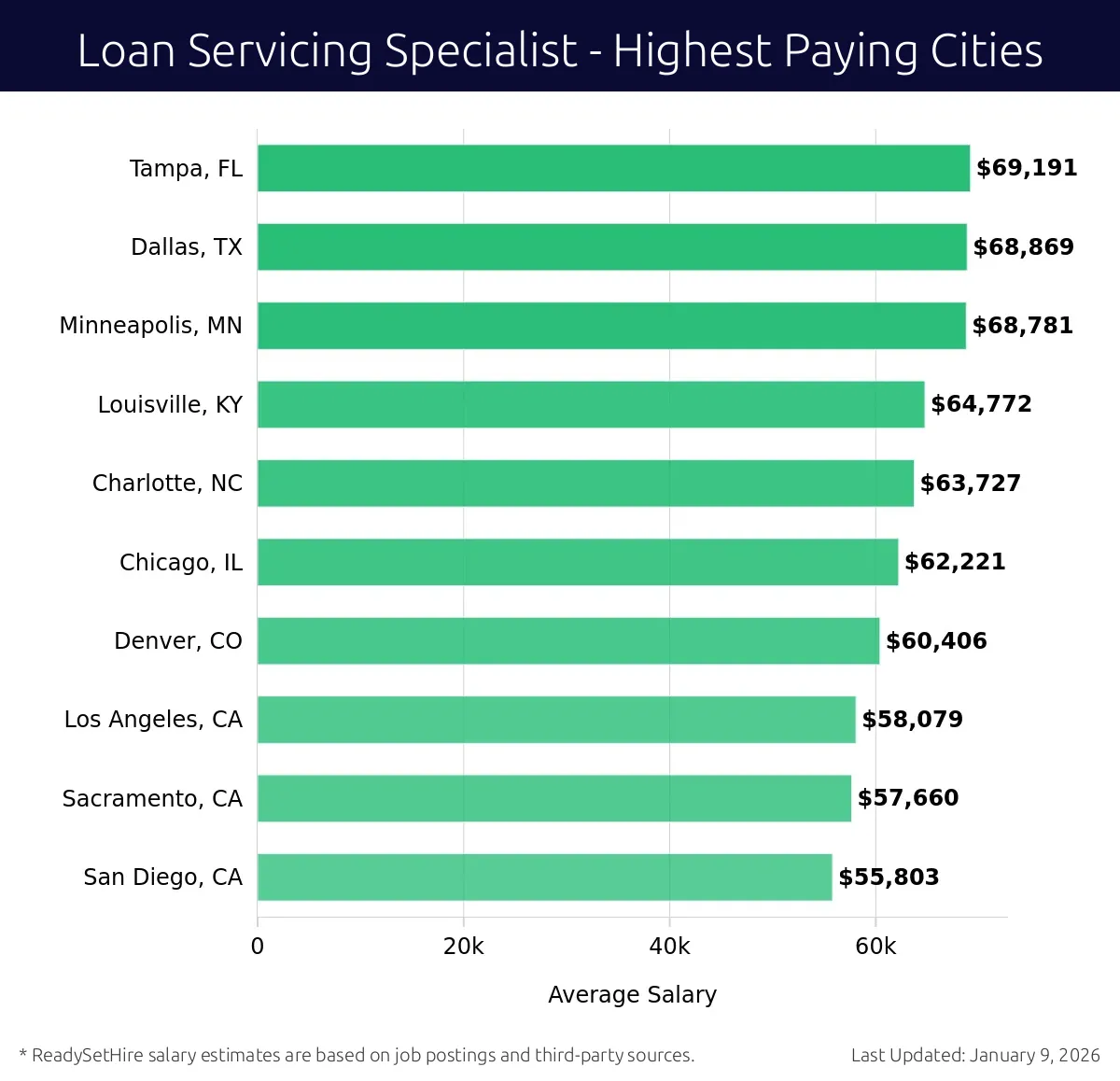

What are the highest paying cities for a Loan Servicing Specialist?

-

Tampa, FL

Average Salary: $69,191

In Tampa, professionals manage mortgage payments and ensure compliance with regulations. Wells Fargo and SunTrust Bank offer promising opportunities.

Find Loan Servicing Specialist jobs in Tampa, FL

-

Dallas, TX

Average Salary: $68,869

Dallas provides a dynamic environment for those handling loan servicing. Key players like Chase and Bank of America create a competitive landscape.

Find Loan Servicing Specialist jobs in Dallas, TX

-

Minneapolis, MN

Average Salary: $68,781

Minneapolis is a hub for loan servicing with U.S. Bank and Wells Fargo leading the way. Employees here value work-life balance.

Find Loan Servicing Specialist jobs in Minneapolis, MN

-

Louisville, KY

Average Salary: $64,772

Louisville offers a mix of traditional and modern roles in loan servicing. Key players like JPMorgan Chase and Fifth Third Bank are prominent here.

Find Loan Servicing Specialist jobs in Louisville, KY

-

Charlotte, NC

Average Salary: $63,727

Charlotte is home to many financial institutions that manage loans. With companies like Bank of America, job seekers find many opportunities.

Find Loan Servicing Specialist jobs in Charlotte, NC

-

Chicago, IL

Average Salary: $62,221

Chicago offers diverse roles with major banks like JPMorgan Chase. The city's financial sector is a great place to build a career in loan servicing.

Find Loan Servicing Specialist jobs in Chicago, IL

-

Denver, CO

Average Salary: $60,406

Denver provides a growing market for loan servicing. Wells Fargo and U.S. Bank are some of the companies hiring here.

Find Loan Servicing Specialist jobs in Denver, CO

-

Los Angeles, CA

Average Salary: $58,079

Los Angeles has many opportunities in loan servicing with companies like Chase and Bank of America. The city offers a dynamic and fast-paced work environment.

Find Loan Servicing Specialist jobs in Los Angeles, CA

-

Sacramento, CA

Average Salary: $57,660

Sacramento offers a balanced approach to loan servicing. The presence of Wells Fargo and Bank of America provides solid career opportunities.

Find Loan Servicing Specialist jobs in Sacramento, CA

-

San Diego, CA

Average Salary: $55,803

San Diego provides a coastal lifestyle with job opportunities in loan servicing. Companies like Chase and U.S. Bank are actively hiring.

Find Loan Servicing Specialist jobs in San Diego, CA

What are the best companies a Loan Servicing Specialist can work for?

-

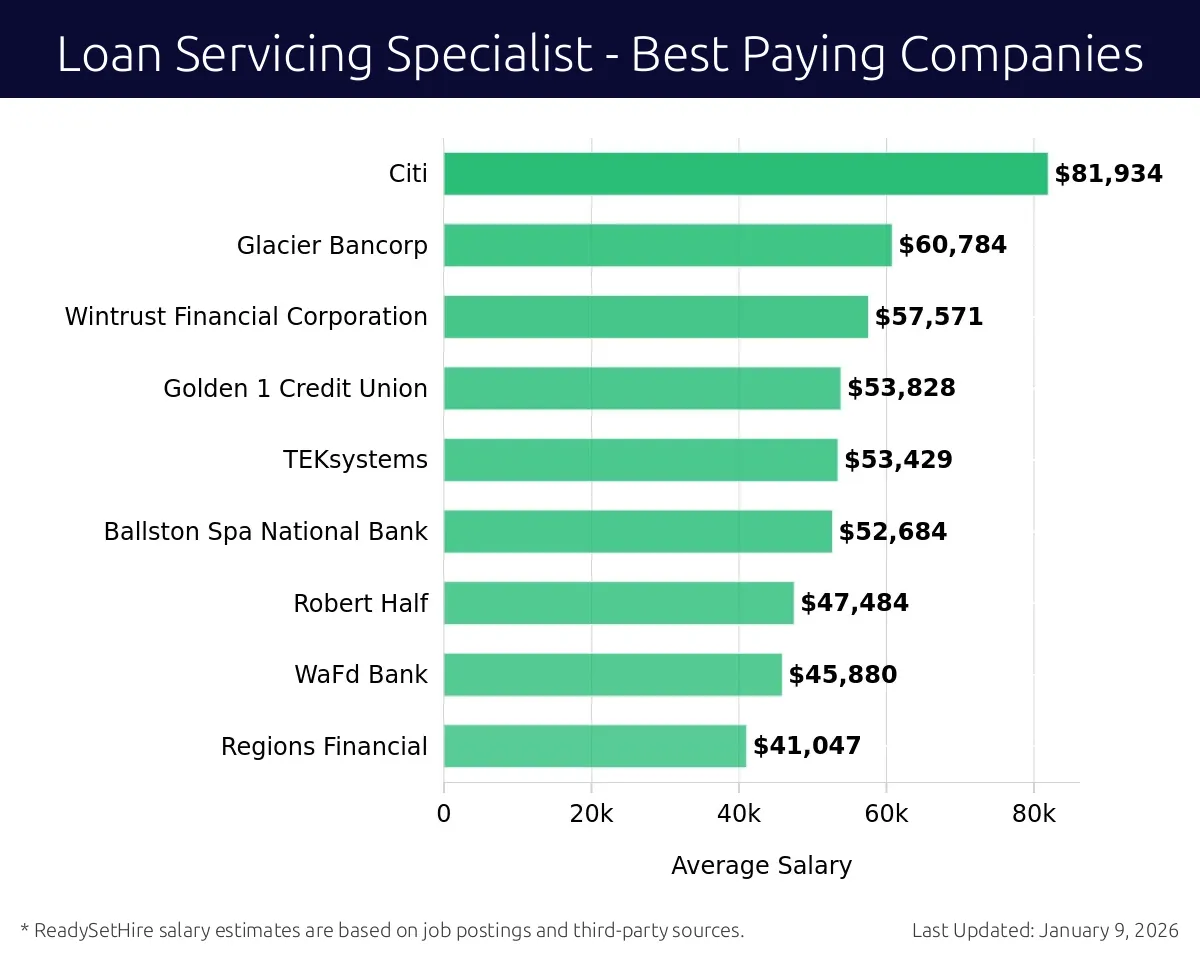

Citi

Average Salary: $81,934

Citi offers competitive salaries for Loan Servicing Specialists. They manage customer accounts and ensure the smooth operation of loan services. Citi operates globally, with locations in major financial centers such as New York, London, and Singapore.

-

Glacier Bancorp

Average Salary: $60,784

At Glacier Bancorp, Loan Servicing Specialists are key in handling loan payments and customer inquiries. They focus on maintaining good relationships with clients. The company operates mainly in the Pacific Northwest with locations in Washington, Oregon, and California.

-

Wintrust Financial Corporation

Average Salary: $57,571

Wintrust Financial Corporation seeks Loan Servicing Specialists to manage loans and assist clients. They offer a stable environment with strong support. Wintrust operates primarily in Illinois, Florida, and New Jersey.

-

Golden 1 Credit Union

Average Salary: $53,828

Golden 1 Credit Union provides a solid salary for Loan Servicing Specialists. They work on handling loans and ensuring customer satisfaction. The credit union operates mainly in California.

-

TEKsystems

Average Salary: $53,429

TEKsystems offers a good salary for Loan Servicing Specialists. They focus on providing excellent service to clients and managing loan processes. TEKsystems operates nationwide.

-

Ballston Spa National Bank

Average Salary: $52,684

Ballston Spa National Bank values its Loan Servicing Specialists. They ensure smooth operations and customer satisfaction. The bank operates in the northeastern United States.

-

Robert Half

Average Salary: $47,484

Robert Half offers a solid salary for Loan Servicing Specialists. They manage loan services and assist clients. Robert Half operates across multiple locations in the United States.

-

WaFd Bank

Average Salary: $45,880

WaFd Bank provides a good salary for Loan Servicing Specialists. They focus on customer service and loan management. The bank operates in Washington and Florida.

-

Regions Financial

Average Salary: $41,047

Regions Financial offers a competitive salary for Loan Servicing Specialists. They ensure efficient loan services and client satisfaction. Regions Financial operates in the southeastern United States.

How to earn more as a Loan Servicing Specialist?

A Loan Servicing Specialist can find many ways to increase earnings in this field. Each step taken toward professional development and skill enhancement can lead to higher compensation. With the right strategies, it becomes possible to advance both knowledge and salary.

Experience remains a key factor for higher earnings. As a specialist gains more years in the industry, they often command higher salaries. Mastery of loan servicing software and an understanding of mortgage regulations also play important roles. Here are some steps to follow:

- Certifications: Earning certifications can set a specialist apart from others. Look for courses in mortgage servicing, loan modifications, or other relevant areas.

- Advanced Education: Pursuing a degree in finance, business, or a related field can open more job opportunities and higher salaries.

- Specialization: Focusing on a niche within loan servicing, such as foreclosure or customer service, can lead to higher pay.

- Additional Skills: Learning new software or improving communication skills can help a specialist become more valuable to employers.

- Networking: Building connections with other professionals in the industry can lead to job openings and salary increases.