What does a Loan Specialist do?

A Loan Specialist plays a key role in the financial services industry. This professional works with clients to understand their financial needs and helps them find the best loan options. They assess applications, review documents, and verify information to ensure accuracy. Loan Specialists communicate with clients throughout the process, explaining terms and conditions clearly. They also maintain records and ensure compliance with regulatory requirements. This role requires strong communication skills, attention to detail, and a good understanding of financial products.

In their day-to-day tasks, Loan Specialists evaluate loan applications and determine eligibility. They guide clients through the documentation process, ensuring all necessary information is complete and accurate. These specialists often work closely with other departments to finalize loan approvals. They may also follow up with clients after loan approval to address any questions or concerns. Loan Specialists must stay updated on industry trends and regulations to provide the best service. Their goal is to help clients secure the loans they need to achieve their financial goals.

How to become a Loan Specialist?

Becoming a Loan Specialist can lead to a rewarding career in finance. This role involves helping clients apply for loans and guiding them through the approval process. A Loan Specialist must be knowledgeable, detail-oriented, and able to communicate effectively. The following steps provide a clear path to entering this profession.

Follow these steps to start your journey as a Loan Specialist. Understanding the process will help you prepare and succeed in this competitive field.

- Earn a High School Diploma or GED: This is the first step towards any career. It provides the foundational knowledge necessary for further education or training.

- Obtain Relevant Education: While not always required, some roles may prefer or require additional education. Consider a bachelor’s degree in business, finance, or a related field. This can provide the skills and knowledge needed for the job.

- Gain Experience: Seek entry-level positions in banking or finance. Working in these roles helps understand the industry and gain practical experience.

- Develop Key Skills: Build skills in communication, attention to detail, and customer service. These skills are crucial for helping clients understand loan options and requirements.

- Apply for Loan Specialist Positions: Once prepared, start applying for Loan Specialist jobs. Tailor your resume and cover letter to highlight your relevant skills and experience.

How long does it take to become a Loan Specialist?

The path to becoming a Loan Specialist can vary based on education and experience. Most often, a high school diploma or GED serves as the baseline requirement. However, some employers might seek candidates with some college coursework or an associate degree in finance, business, or a related field.

After meeting the basic educational requirement, the next step involves gaining relevant experience. Many professionals start with entry-level positions in banking or finance. Some opt to complete internships or on-the-job training programs. Gaining practical experience helps individuals understand the intricacies of loan processing, customer service, and financial regulations. This experience can take anywhere from one to three years. Additionally, obtaining certifications, such as the Certified Loan Officer (CLO) designation, can improve job prospects and career advancement opportunities.

Loan Specialist Job Description Sample

The Loan Specialist is responsible for assessing loan applications, managing the loan approval process, and ensuring compliance with company policies and regulations. This role requires strong analytical skills, attention to detail, and excellent customer service.

Responsibilities:

- Evaluate loan applications for accuracy and completeness.

- Conduct credit checks and assess the financial stability of applicants.

- Review and analyze financial documents to determine the eligibility of loan applicants.

- Communicate with applicants to gather additional information or clarification as needed.

- Prepare loan approval documents and ensure all necessary signatures are obtained.

Qualifications

- Bachelor's degree in Finance, Business, or a related field.

- Minimum of 2 years of experience in loan processing or a similar role.

- Strong understanding of lending principles and practices.

- Excellent analytical and problem-solving skills.

- Proficient in using loan processing software and Microsoft Office Suite.

Is becoming a Loan Specialist a good career path?

A career as a Loan Specialist involves helping people get loans. These specialists work with banks or financial institutions. They guide customers through the loan process. They check loan applications and decide if the customer can get a loan. This job needs good communication skills. It also requires attention to detail.

Working as a Loan Specialist has its pros and cons. On the positive side, this job offers job stability. Many people need loans, which means steady work. Loan Specialists can earn good pay, especially with experience. This job provides the chance to help people with their financial needs. However, it has its challenges. Loan Specialists face pressure to meet targets. They also need to handle difficult situations with customers.

Here are some pros and cons to consider:

- Pros:

- Job stability

- Good pay

- Help people with financial needs

- Cons:

- Pressure to meet targets

- Dealing with difficult situations

What is the job outlook for a Loan Specialist?

The job outlook for Loan Specialists looks promising, with an average of 27,700 positions opening each year. This steady demand reflects the ongoing need for professionals who can navigate the complexities of loan origination and servicing. With a projected growth rate of 3.1% from 2022 to 2032, according to the Bureau of Labor Statistics (BLS), job seekers can anticipate a stable job market. This growth signifies a consistent demand for qualified Loan Specialists, making it a reliable career choice.

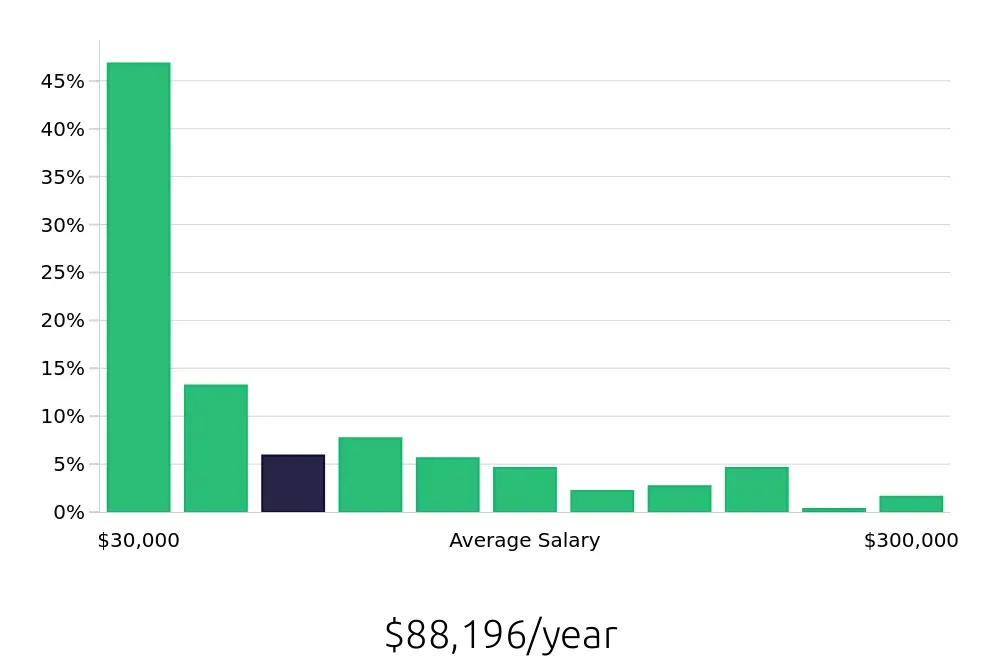

Loan Specialists enjoy a competitive compensation package. On average, they earn an annual salary of $82,000, as reported by the BLS. This figure indicates a solid earning potential for those who enter this field. Additionally, the average hourly wage stands at $39.43, providing a clear picture of the financial benefits associated with this career. These numbers highlight the value placed on Loan Specialists in the financial industry, making this a financially rewarding profession.

Those entering the field of loan specialization will find ample opportunities for growth and advancement. The combination of steady job growth, competitive salaries, and the opportunity to work in a dynamic industry makes this career path attractive. The stability and financial incentives make it an ideal choice for job seekers looking for a rewarding professional journey.

Currently 1,049 Loan Specialist job openings, nationwide.

Continue to Salaries for Loan Specialist