How much does a Loan Specialist make?

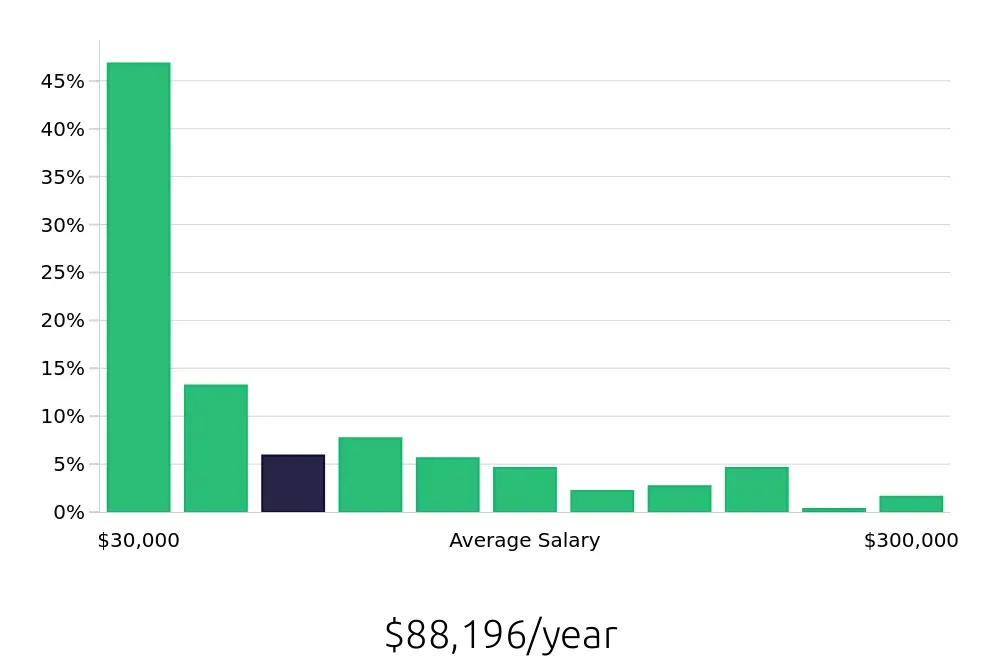

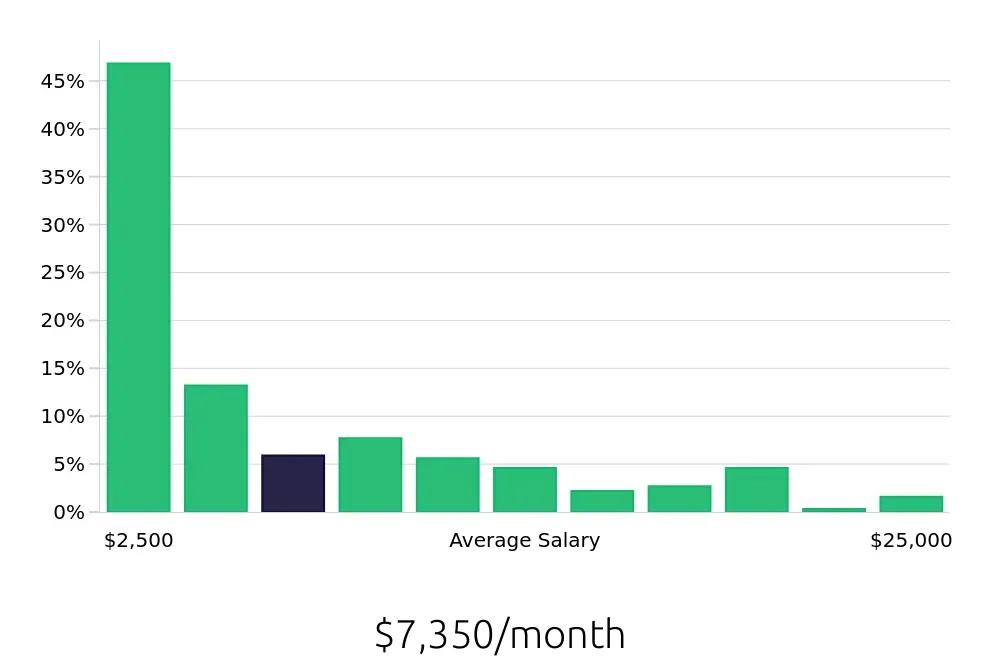

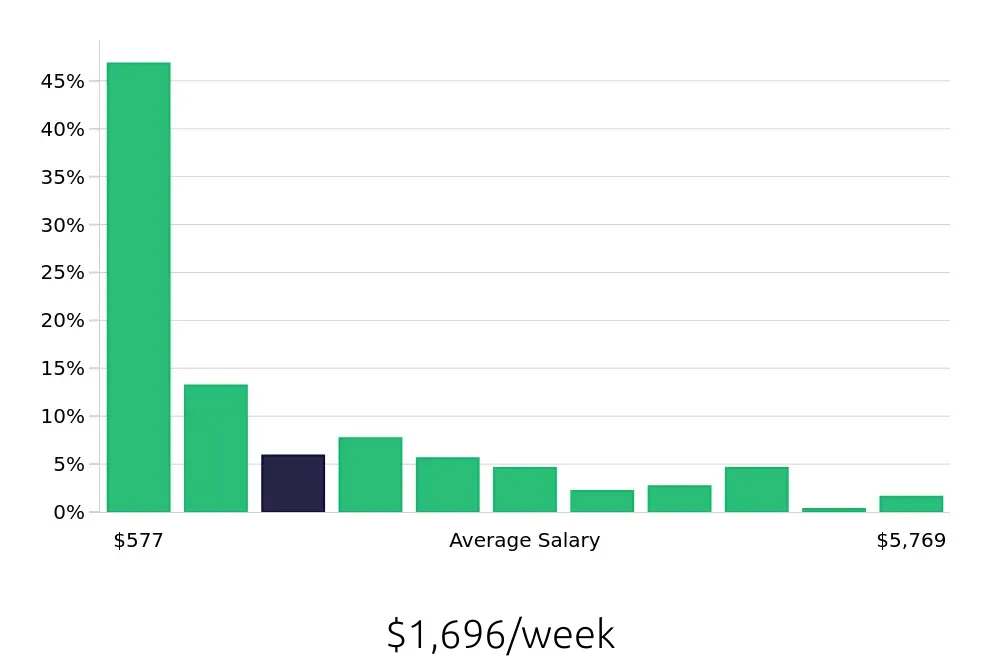

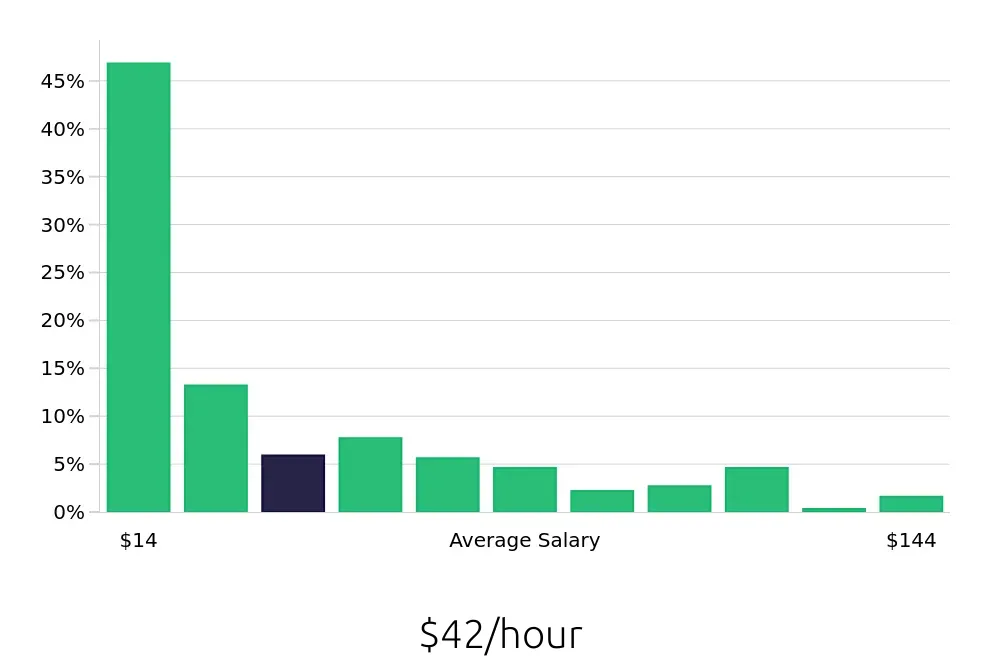

Loan Specialists help people apply for loans and manage the process. They work with banks, credit unions, and other lending companies. The average yearly salary for a Loan Specialist is $88,196. This can vary depending on experience, location, and the specific company.

Here are some details about the salary distribution for Loan Specialists:

- Most Loan Specialists make between $30,000 and $201,818 each year.

- About 46.84% of Loan Specialists earn between $30,000 and $54,545.

- Another 13.17% earn between $54,545 and $79,091.

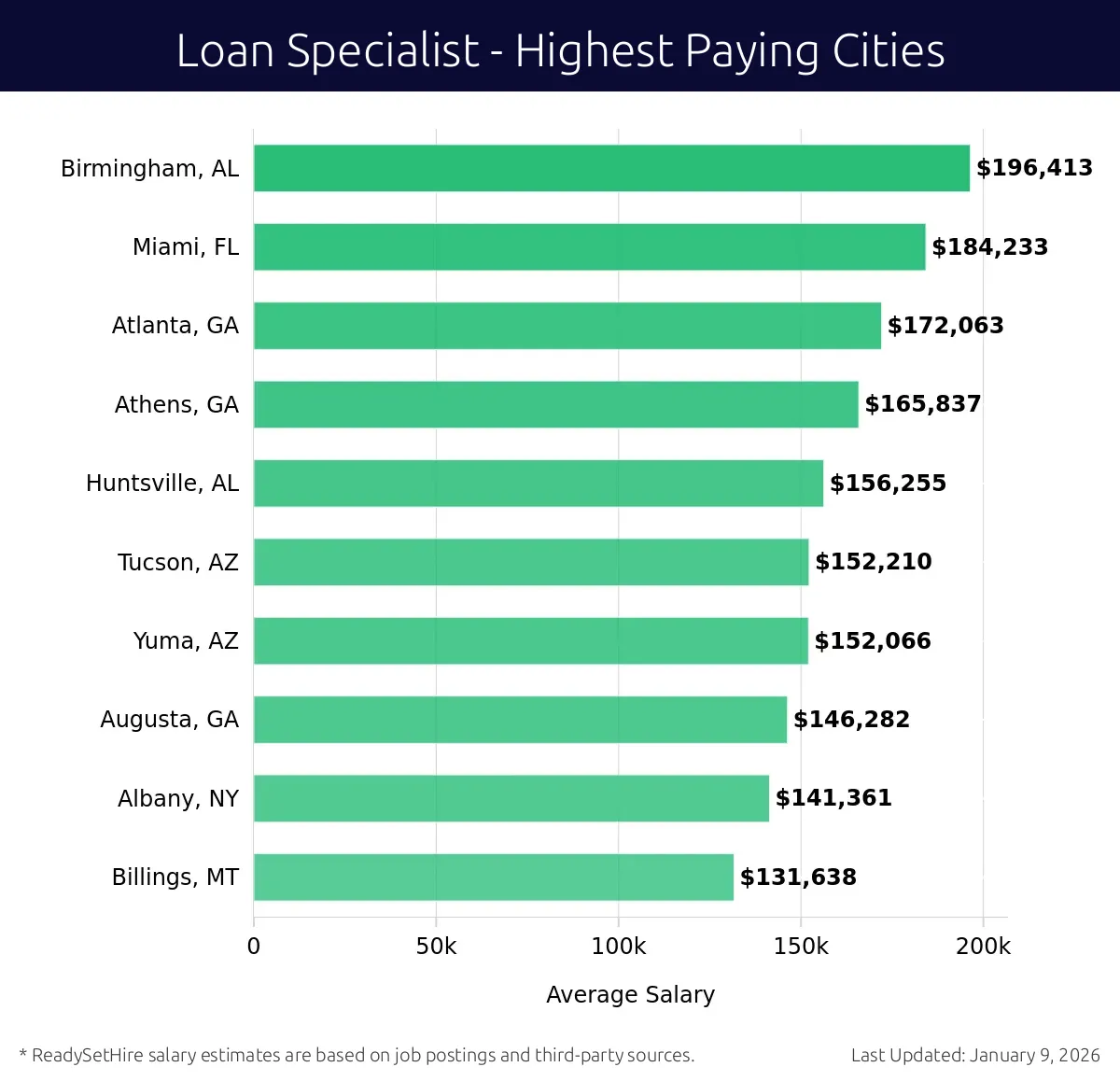

What are the highest paying cities for a Loan Specialist?

-

Birmingham, AL

Average Salary: $196,413

Birmingham offers a growing economy with many financial services companies. You can find many opportunities to grow in the loan industry. Companies like BBVA and Regions Financial Corporation have a strong presence.

Find Loan Specialist jobs in Birmingham, AL

-

Miami, FL

Average Salary: $184,233

Miami's diverse economy provides excellent opportunities for loan professionals. The city's financial sector is thriving. Banks like Bank of America and JPMorgan Chase offer many positions.

Find Loan Specialist jobs in Miami, FL

-

Atlanta, GA

Average Salary: $172,063

Atlanta is a hub for banking and finance. It attracts many loan specialists. Companies like SunTrust Bank and Wells Fargo provide many job opportunities in the city.

Find Loan Specialist jobs in Atlanta, GA

-

Athens, GA

Average Salary: $165,837

Athens offers a small-town feel with a growing job market. It has many companies hiring for loan positions. Local banks and credit unions offer good opportunities for growth.

Find Loan Specialist jobs in Athens, GA

-

Huntsville, AL

Average Salary: $156,255

Huntsville has a strong technology and aerospace sector. It also offers good opportunities for loan specialists. Companies like Hudson's and Credit Unions provide good career prospects.

Find Loan Specialist jobs in Huntsville, AL

-

Tucson, AZ

Average Salary: $152,210

Tucson has a strong job market in the financial sector. Many companies hire for loan positions. Local banks and financial institutions offer good career growth.

Find Loan Specialist jobs in Tucson, AZ

-

Yuma, AZ

Average Salary: $152,066

Yuma offers a quieter job market but still has good opportunities for loan specialists. Local banks and credit unions provide steady job opportunities. Companies like Arizona Bank and Trust are prominent.

Find Loan Specialist jobs in Yuma, AZ

-

Augusta, GA

Average Salary: $146,282

Augusta has a growing economy with many financial services companies. You can find many opportunities in the loan industry. Companies like Synovus and Synchronoss Technologies offer good career opportunities.

Find Loan Specialist jobs in Augusta, GA

-

Albany, NY

Average Salary: $141,361

Albany offers a diverse job market with many financial institutions. You can find good opportunities for loan professionals. Banks like KeyBank and local credit unions offer many positions.

Find Loan Specialist jobs in Albany, NY

-

Billings, MT

Average Salary: $131,638

Billings has a strong job market in finance. Many companies hire for loan positions. Local banks and financial institutions offer good career opportunities in the city.

Find Loan Specialist jobs in Billings, MT

What are the best companies a Loan Specialist can work for?

-

Serv Corp

Average Salary: $280,000

Serv Corp offers top-tier compensation for Loan Specialists. They operate in various locations across the United States. At Serv Corp, Loan Specialists manage large volumes of mortgage loans. They work closely with clients to ensure smooth loan processing.

-

Loanleaders of America

Average Salary: $270,379

Loanleaders of America provides competitive salaries to Loan Specialists. This company has offices nationwide. Loan Specialists here focus on helping clients secure home loans efficiently. The company values expertise and customer service.

-

United Mortgage Lending

Average Salary: $269,286

United Mortgage Lending pays its Loan Specialists well. They operate in several major cities. Here, Loan Specialists work on various types of loans, including commercial and residential. The company supports continuous learning and growth.

-

E Mortgage Capital

Average Salary: $255,736

E Mortgage Capital offers attractive salaries to Loan Specialists. They serve clients in key markets. Loan Specialists here handle mortgage applications and ensure smooth loan closings. The company fosters a collaborative work environment.

-

Paramount Residential Mortgage Group

Average Salary: $240,985

Paramount Residential Mortgage Group provides good compensation for Loan Specialists. They have locations across several states. Loan Specialists work on residential mortgage loans, offering personalized service. The company values teamwork and efficiency.

-

Citizens Financial

Average Salary: $199,182

Citizens Financial offers a solid salary for Loan Specialists. They operate in multiple regions. Here, Loan Specialists manage mortgage loans and assist clients throughout the process. The company promotes a supportive and dynamic work atmosphere.

-

Wells Fargo

Average Salary: $177,368

Wells Fargo provides a competitive salary to Loan Specialists. They have branches nationwide. Loan Specialists here deal with various mortgage-related tasks. The company emphasizes professional development and client satisfaction.

-

eMortgage Funding

Average Salary: $162,500

eMortgage Funding offers a good salary to Loan Specialists. They operate in major metropolitan areas. Loan Specialists handle loan applications and ensure timely approvals. The company values innovation and customer focus.

-

Mission Loans LLC

Average Salary: $154,355

Mission Loans LLC provides a fair salary for Loan Specialists. They serve clients in select regions. Loan Specialists here assist with mortgage processing and customer service. The company encourages a family-oriented work environment.

-

Coldwell Banker

Average Salary: $144,551

Coldwell Banker offers a decent salary for Loan Specialists. They have locations in various parts of the country. Loan Specialists work on mortgage loans and help clients through the process. The company fosters a culture of excellence and collaboration.

How to earn more as a Loan Specialist?

A Loan Specialist can earn more by gaining experience and advancing in their career. As specialists work in the field, they learn the ins and outs of loan processing and customer service. This experience makes them more valuable to employers and can lead to higher pay.

Seeking out additional certifications can also increase a Loan Specialist's earning potential. These certifications show a commitment to the profession and can open up more job opportunities. Some useful certifications include the Certified Residential Mortgage Specialist (CRMS) and the Loan Officer National Association (LONA) certifications.

Working for a company that offers bonuses and incentives can lead to higher earnings. Loan Specialists who meet certain targets or achieve specific goals often receive bonuses. These can include signing up a certain number of clients or closing loans within a certain timeframe.

- Experience and Career Advancement: Gain experience in loan processing to become more valuable to employers.

- Certifications: Pursue certifications like CRMS and LONA to demonstrate commitment and open up more opportunities.

- Bonuses and Incentives: Work for companies that offer bonuses for achieving specific goals.

- Networking: Connect with other professionals in the industry to learn about new opportunities and trends.

- Specializing in High-Demand Areas: Focus on areas like commercial lending or mortgage lending to increase earning potential.