What does a Mortgage Loan Originator do?

A Mortgage Loan Originator connects potential homebuyers with lenders. This role involves guiding clients through the mortgage application process. Originators assess clients' financial situations and match them with suitable loan options. They explain loan terms, interest rates, and repayment plans clearly. Originators also collect and verify necessary documents from clients. Once the application is complete, they submit it to the lender for approval.

This position demands strong communication skills and attention to detail. Originators must be knowledgeable about various mortgage products. They often work closely with real estate agents and brokers. Their goal is to ensure clients secure the best mortgage terms available. By simplifying a complex process, Mortgage Loan Originators help clients achieve their dream of homeownership.

How to become a Mortgage Loan Originator?

Becoming a Mortgage Loan Originator can open many doors in the financial industry. This role involves helping clients get home loans, which can be very rewarding. Here are the key steps to start this career:

- Earn a High School Diploma or GED. A strong foundation in math and communication skills will help.

- Complete Pre-licensing Education. This training covers the basics of mortgage lending and the laws in your state.

- Pass the National Mortgage Licensing System (NMLS) Exam. This test ensures you understand the mortgage industry's rules and practices.

- Get a Job with a Mortgage Lender. Many lenders offer on-the-job training, which is crucial for gaining experience.

- Obtain a Mortgage Broker or Lender License. This license lets you work in the mortgage industry legally.

Starting as a Mortgage Loan Originator can lead to a stable and fulfilling career. Follow these steps to launch your career in mortgage lending. Gain the skills and knowledge needed to succeed in this growing field.

How long does it take to become a Mortgage Loan Originator?

A career as a Mortgage Loan Originator holds promise and potential. People often wonder how long it takes to enter this field. Generally, the path can be straightforward and fairly quick. Many individuals complete the necessary steps in less than a year. This makes it an attractive option for those seeking to enter the financial sector.

First, a person needs to complete the required education. This often involves a high school diploma or GED. Some states also require a bachelor’s degree. Next, they must complete pre-licensing education. This typically takes about 20 hours. After that, candidates must pass a national exam. Following the exam, they need to apply for a license. This involves submitting fingerprints and background checks. Once licensed, ongoing education is necessary to keep the license active. Most states require 12-24 hours of continuing education every year. This combination of steps ensures a well-rounded entry into the profession.

Mortgage Loan Originator Job Description Sample

We are seeking a highly motivated and experienced Mortgage Loan Originator to join our team. The successful candidate will be responsible for the full-cycle mortgage loan process, from pre-qualification to closing. This role requires a strong understanding of the mortgage industry, excellent communication skills, and a commitment to providing exceptional customer service.

Responsibilities:

- Conduct initial client consultations to assess mortgage needs and goals.

- Evaluate clients' financial situations to determine eligibility for various mortgage products.

- Prepare and submit loan applications to lenders for approval.

- Guide clients through the mortgage process, explaining terms, rates, and fees.

- Negotiate loan terms with lenders on behalf of clients.

Qualifications

- Bachelor’s degree in Finance, Business, or a related field preferred.

- 3+ years of experience as a Mortgage Loan Originator or similar role.

- Strong understanding of mortgage products, lending practices, and regulatory requirements.

- Excellent communication and interpersonal skills.

- Proficient in Microsoft Office Suite and mortgage loan software.

Is becoming a Mortgage Loan Originator a good career path?

A Mortgage Loan Originator helps people get loans to buy homes. They work with lenders to find the best loan for a person's needs. This job can be both rewarding and challenging. It allows someone to help others achieve a big goal, like buying a house. This career offers opportunities to meet new people and build strong relationships.

Those interested in this path should know both the positives and negatives. On the positive side, a Mortgage Loan Originator can earn a good income. Many get paid a base salary plus commissions for each loan they close. This job also offers flexibility. Many loan originators work independently or from home, which can be a big plus for work-life balance. However, the job can also have its challenges. It requires a lot of time and effort to close loans. Meeting quotas can be tough, and rejection is part of the job. Loan originators also need to stay up-to-date with changing mortgage rules and rates.

Here are some pros and cons to consider:

- Pros:

- Potential for high income with base salary and commissions.

- Opportunity to help people achieve homeownership.

- Flexibility in work hours and location.

- Independence in managing your own clients and schedule.

- Cons:

- High pressure to meet sales targets and quotas.

- Need to handle rejection and setbacks.

- Requirement to stay updated with changing mortgage rules and rates.

- May involve long hours and significant effort to close loans.

What is the job outlook for a Mortgage Loan Originator?

Job seekers interested in the financial industry have a promising outlook when considering the role of a Mortgage Loan Originator. The Bureau of Labor Statistics (BLS) reports an average of 27,700 job positions available annually for this role. This number shows that there are ample opportunities for those seeking to enter or advance in this field. Additionally, the BLS projects a job opening percent change of 3.1% from 2022 to 2032, indicating steady growth in this profession.

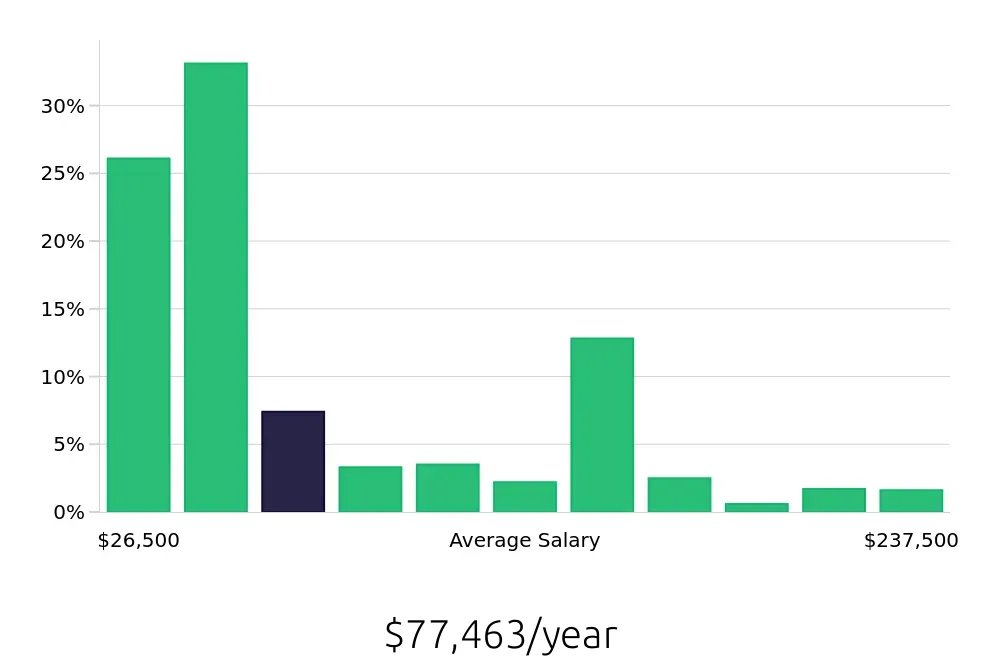

The role of a Mortgage Loan Originator also offers a competitive average national annual compensation. According to BLS data, the average salary stands at $82,000 per year. This figure reflects the value placed on the skills and expertise required for this role, making it an attractive career choice for those in the job market. Furthermore, the average national hourly compensation is $39.43, showcasing the potential for both full-time and part-time workers to earn a substantial income. This compensation aligns with the significant responsibilities of helping clients secure mortgage loans and guiding them through the lending process.

Overall, the job outlook for Mortgage Loan Originators is positive, with consistent demand and growth opportunities. Job seekers in this field can look forward to a stable career path with the potential for financial rewards. The combination of job stability, growth potential, and competitive compensation makes this role a valuable option for professionals entering the workforce or looking to advance their careers.

Currently 489 Mortgage Loan Originator job openings, nationwide.

Continue to Salaries for Mortgage Loan Originator