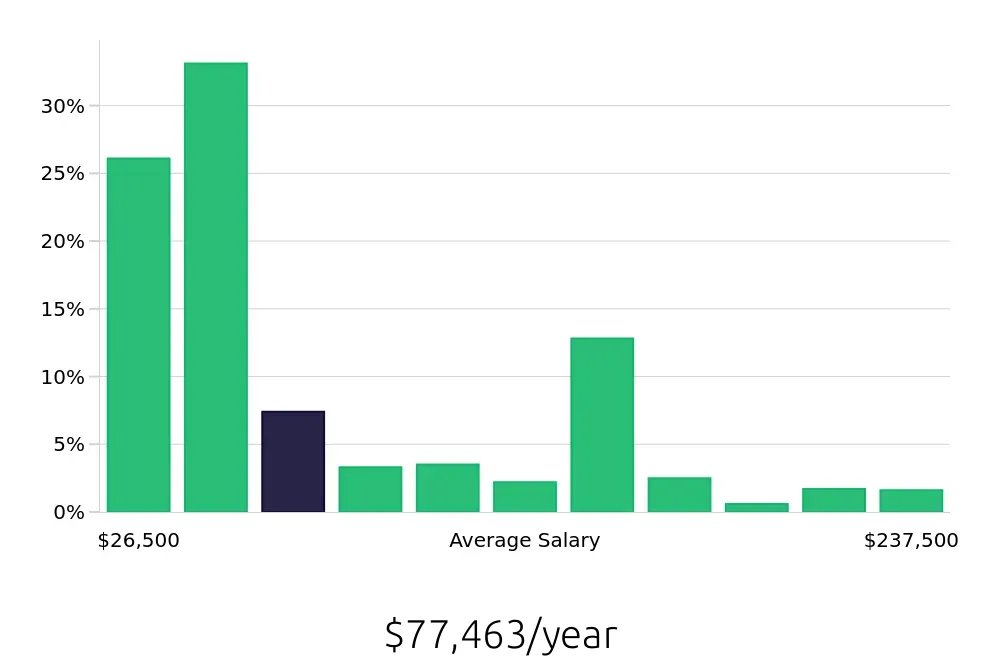

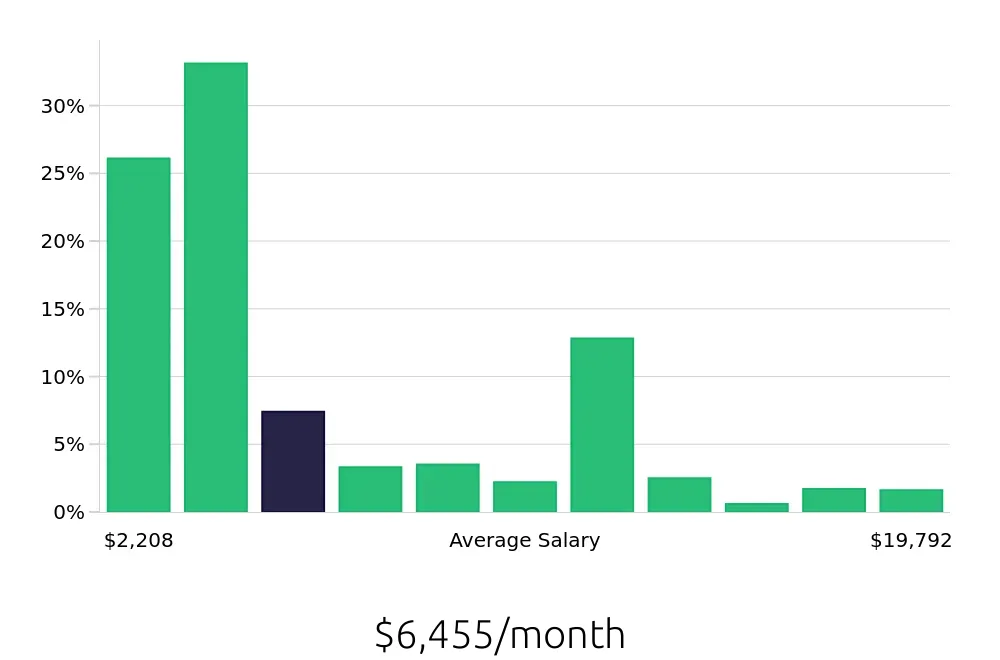

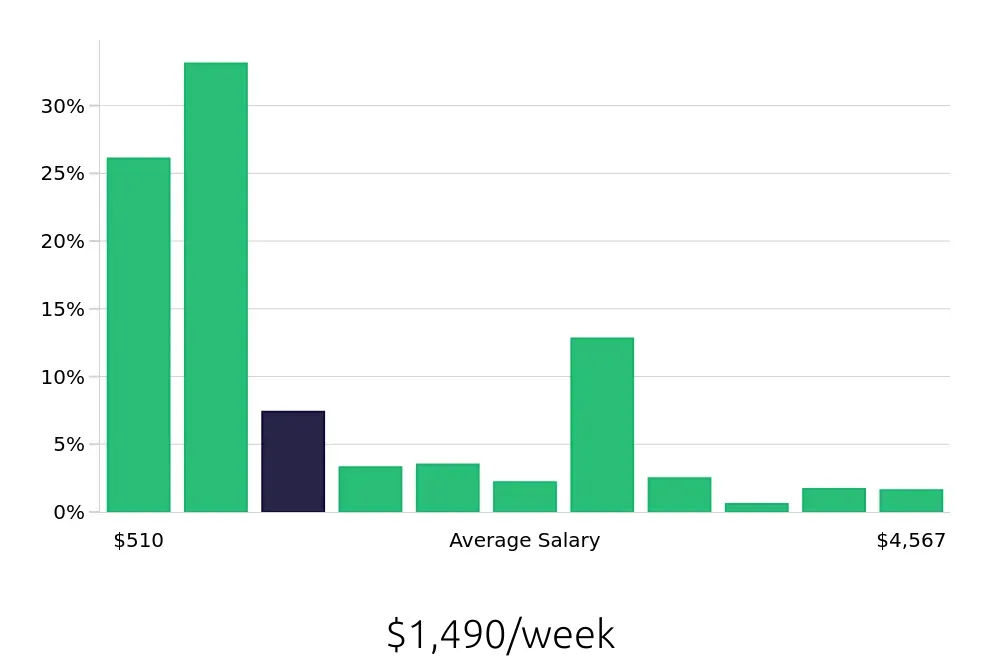

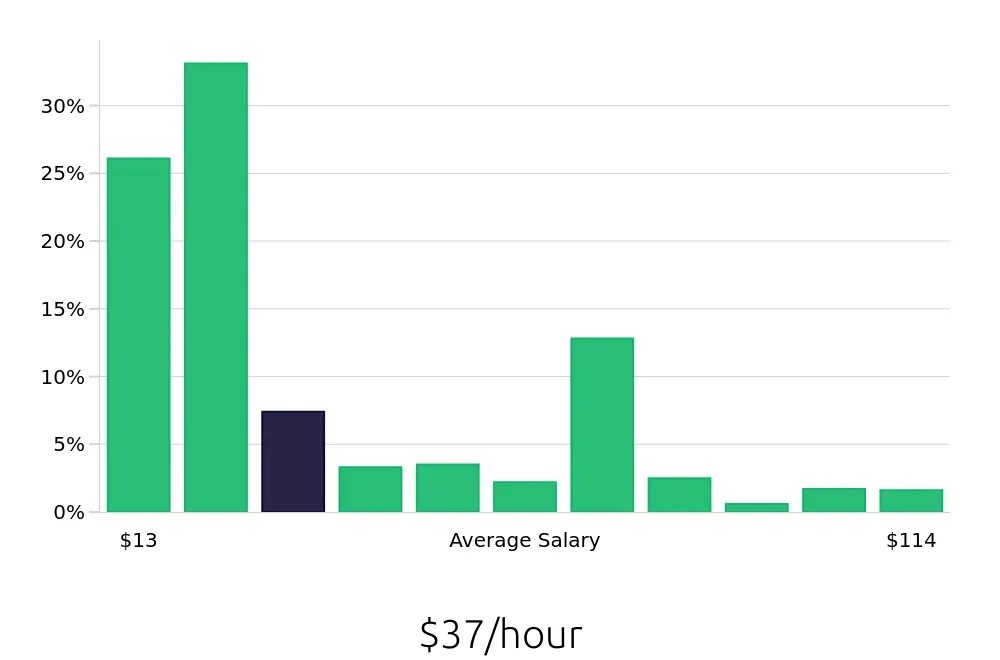

How much does a Mortgage Loan Originator make?

A Mortgage Loan Originator earns a solid salary that can grow with experience. The average yearly salary for this role stands at $77,463. Starting off, someone in this field might expect to earn around $26,500. As experience increases, salaries rise significantly. Experienced originators can earn upwards of $218,318 per year.

Factors like location, company size, and the number of loans processed can affect earnings. Those in larger cities or with top-tier firms often see higher salaries. Additionally, originators who close more loans can earn bonuses and commissions, adding to their total income. Job seekers aiming for this role can expect growth and financial rewards as they build their careers.

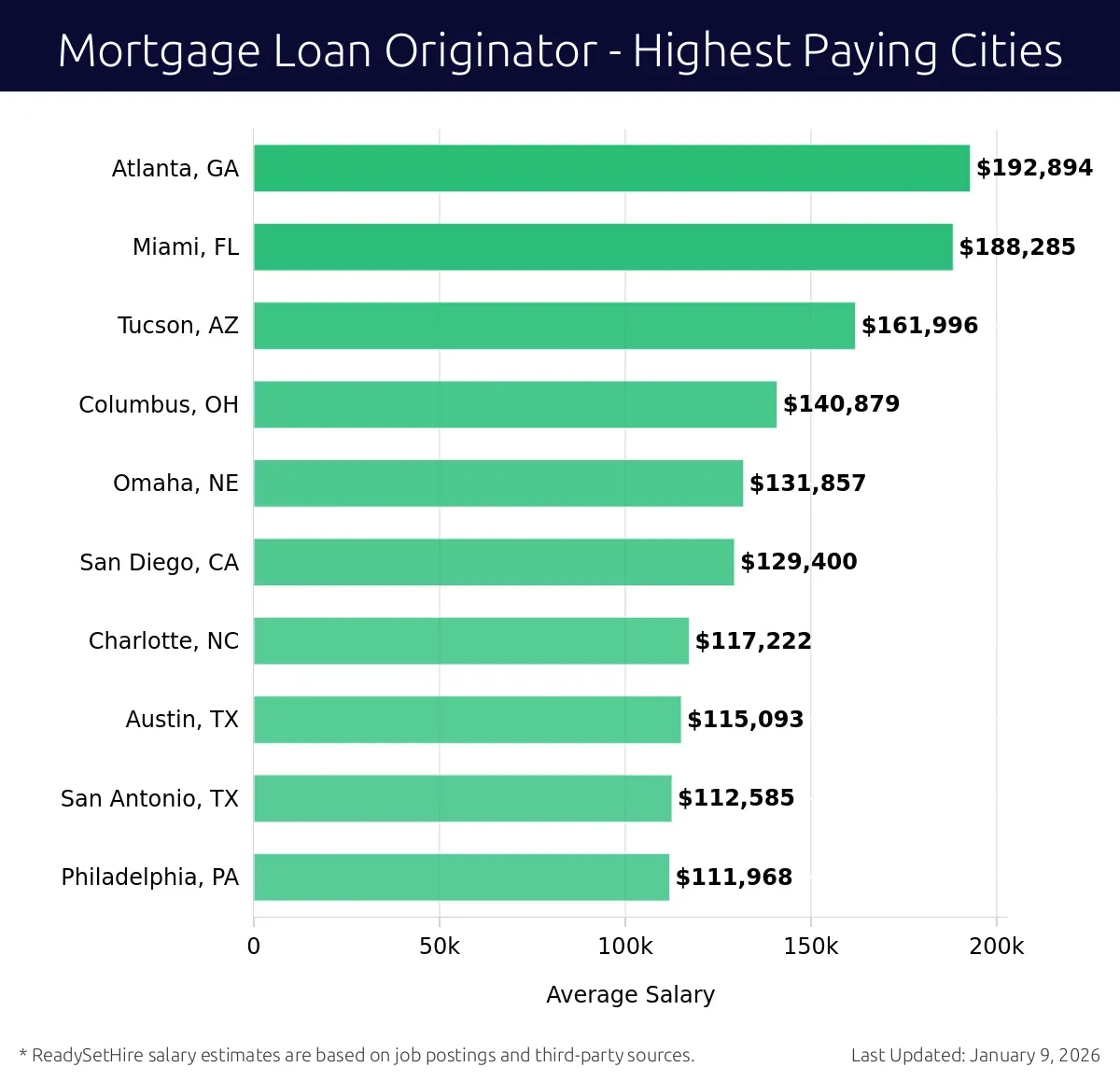

What are the highest paying cities for a Mortgage Loan Originator?

-

Atlanta, GA

Average Salary: $192,894

Atlanta offers a vibrant market for those looking to assist clients with home loans. With prominent firms like SunTrust and Chase, opportunities abound. The city's growing economy makes it a great place for loan professionals.

Find Mortgage Loan Originator jobs in Atlanta, GA

-

Miami, FL

Average Salary: $188,285

In Miami, housing demand drives a lively market for mortgage specialists. Working with companies like Bank of America and Wells Fargo can lead to rewarding experiences. The city's diverse population adds to the dynamic nature of the job.

Find Mortgage Loan Originator jobs in Miami, FL

-

Tucson, AZ

Average Salary: $161,996

Tucson provides a stable environment for mortgage professionals. With companies like U.S. Bank and Chase offering roles, it's a place where one can thrive. The city's steady growth supports a healthy job market for loan originators.

Find Mortgage Loan Originator jobs in Tucson, AZ

-

Columbus, OH

Average Salary: $140,879

Columbus has a solid market for housing loans. Working with local banks such as Huntington and Fifth Third can be fulfilling. The city's growing business sector offers good prospects for loan originators.

Find Mortgage Loan Originator jobs in Columbus, OH

-

Omaha, NE

Average Salary: $131,857

Omaha offers a friendly market for those in the mortgage industry. With local lenders like Bank of the West and TD Bank, there are many paths to success. The city's strong economy makes it a great place for loan professionals.

Find Mortgage Loan Originator jobs in Omaha, NE

-

San Diego, CA

Average Salary: $129,400

San Diego provides a dynamic environment for mortgage professionals. With institutions like Chase and Wells Fargo, the city offers many opportunities. Its coastal location adds a unique flair to the job experience.

Find Mortgage Loan Originator jobs in San Diego, CA

-

Charlotte, NC

Average Salary: $117,222

Charlotte has a robust market for housing loans. Working with banks like Bank of America and Wells Fargo can be very rewarding. The city's financial hub status creates a thriving job market for loan originators.

Find Mortgage Loan Originator jobs in Charlotte, NC

-

Austin, TX

Average Salary: $115,093

Austin offers a vibrant market for mortgage professionals. With companies like Chase and U.S. Bank, the city is full of opportunities. Its fast-paced growth makes it an exciting place to work in the mortgage industry.

Find Mortgage Loan Originator jobs in Austin, TX

-

San Antonio, TX

Average Salary: $112,585

San Antonio provides a solid market for those in the mortgage field. Working with local lenders like Chase and Wells Fargo can lead to rewarding experiences. The city's growing population supports a healthy job market for loan originators.

Find Mortgage Loan Originator jobs in San Antonio, TX

-

Philadelphia, PA

Average Salary: $111,968

Philadelphia offers a historic market for housing loans. With banks like Chase and Wells Fargo, there are many opportunities. The city's rich culture adds to the unique experience of working as a loan originator.

Find Mortgage Loan Originator jobs in Philadelphia, PA

What are the best companies a Mortgage Loan Originator can work for?

-

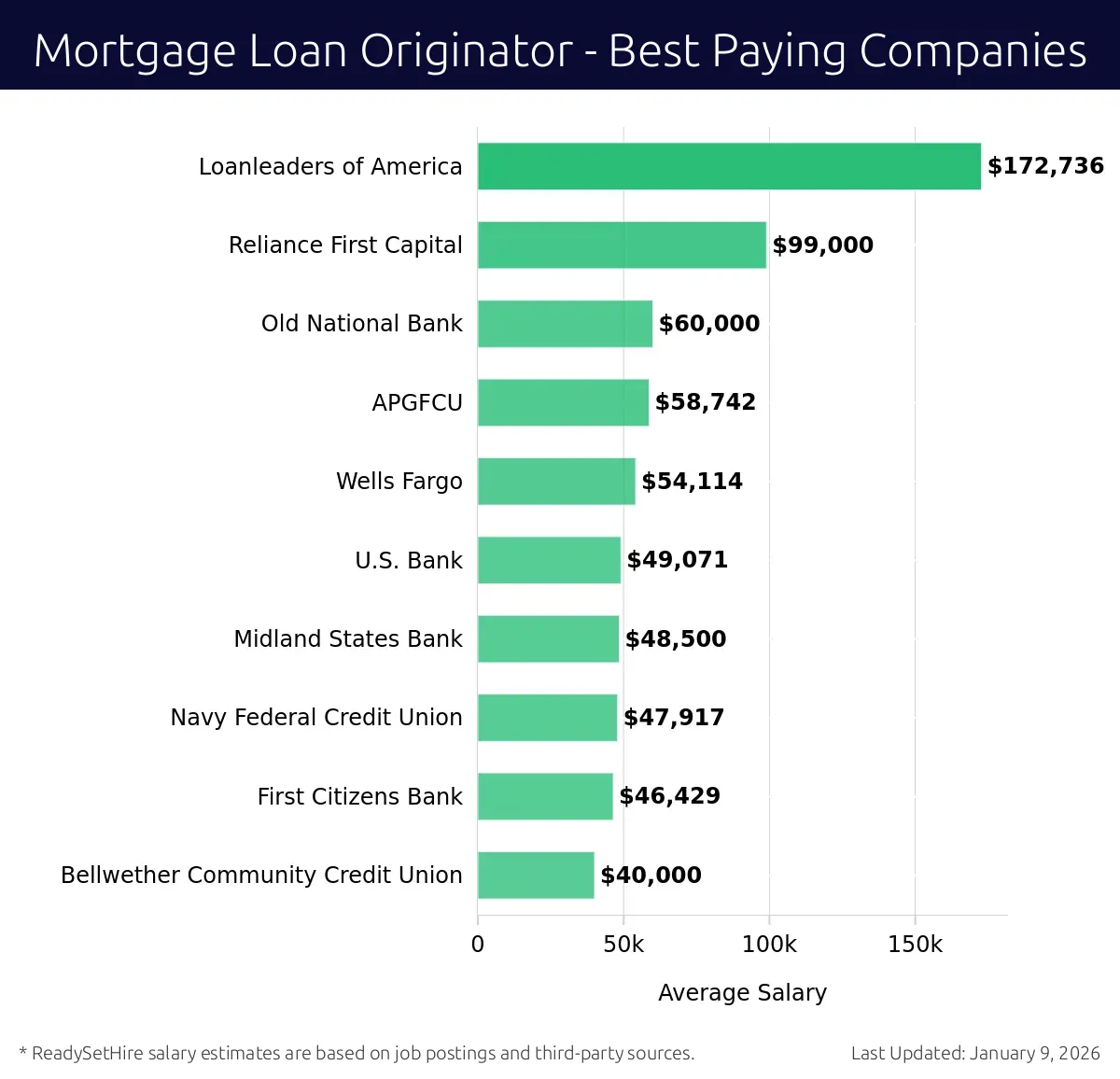

Loan Leaders of America

Average Salary: $172,736

Loan Leaders of America offers competitive salaries for Mortgage Loan Originator jobs. The company operates nationwide, providing mortgage solutions to clients in various locations. Employees benefit from a supportive work environment and the chance to grow in the industry.

-

Reliance First Capital

Average Salary: $99,000

Reliance First Capital provides attractive compensation for Mortgage Loan Originator positions. They serve clients in multiple locations across the United States. This company offers a stable work environment and opportunities for career advancement.

-

Old National Bank

Average Salary: $60,000

Old National Bank offers a solid salary for Mortgage Loan Originator jobs. They serve clients in several locations in the Midwest. This company provides a solid foundation for those entering the mortgage industry.

-

APGFCU

Average Salary: $58,742

APGFCU provides a decent salary for Mortgage Loan Originators. They serve members in specific areas in Pennsylvania. Employees enjoy a friendly work environment and the chance to connect with the community.

-

Wells Fargo

Average Salary: $54,114

Wells Fargo offers competitive pay for Mortgage Loan Originators. They operate in multiple locations across the country. This company provides extensive resources and training for career growth.

-

U.S. Bank

Average Salary: $49,071

U.S. Bank offers a good salary for Mortgage Loan Originator jobs. They serve clients in various regions across the United States. Employees benefit from a supportive team and opportunities to develop their skills.

-

Midland States Bank

Average Salary: $48,500

Midland States Bank provides a solid salary for Mortgage Loan Originators. They operate in specific areas in the Midwest. This company offers a friendly work environment and opportunities for professional growth.

-

Navy Federal Credit Union

Average Salary: $47,917

Navy Federal Credit Union offers a competitive salary for Mortgage Loan Originator positions. They serve members in various locations across the United States. This company provides a supportive environment and benefits for federal employees.

-

First Citizens Bank

Average Salary: $46,429

First Citizens Bank offers a good salary for Mortgage Loan Originators. They operate in specific areas in the southeastern United States. Employees enjoy a positive work culture and opportunities for advancement.

-

Bellwether Community Credit Union

Average Salary: $40,000

Bellwether Community Credit Union offers a decent salary for Mortgage Loan Originator jobs. They serve members in specific areas in Kansas and Missouri. This company provides a community-focused work environment.

How to earn more as a Mortgage Loan Originator?

Becoming a successful Mortgage Loan Originator can lead to a rewarding career with the potential for significant earnings. To maximize income, it’s important to focus on key areas that can lead to higher commissions and better client relationships. This includes building strong relationships with clients, as happy clients often lead to more referrals and repeat business. Additionally, improving one’s knowledge of the mortgage industry can provide a competitive edge. Staying up-to-date with the latest trends and regulations will make the origination process smoother and more efficient, thereby increasing productivity and earnings.

Another factor is the ability to negotiate effectively. This means being able to understand and articulate the benefits of different loan options to clients. Effective negotiation can lead to higher loan amounts and more substantial commissions. Utilizing technology and digital tools can also streamline the loan origination process, reducing time spent on paperwork and allowing for more client interactions. Lastly, a proactive approach to business development can yield significant results. Attending networking events, participating in online forums, and maintaining an active presence on social media can help in gaining new clients and expanding the client base.

Here are some key factors to consider in order to earn more as a Mortgage Loan Originator:

- Build strong client relationships

- Stay updated with industry trends and regulations

- Improve negotiation skills

- Utilize technology and digital tools

- Engage in proactive business development