What does a Payroll Clerk do?

A Payroll Clerk manages and processes employee pay. They ensure that all employees receive their paychecks on time and correctly. This role involves calculating wages, deductions, and bonuses. The Clerk handles all payroll-related tasks from start to finish. They must pay attention to detail to avoid errors in calculations.

Responsibilities of a Payroll Clerk include entering employee hours, distributing paychecks, and maintaining payroll records. They work closely with the finance department to ensure accurate payroll processing. The Clerk may also assist with payroll-related inquiries from employees. Accuracy and efficiency are key in this role. They must comply with all local, state, and federal payroll laws. This position requires strong organizational and communication skills.

How to become a Payroll Clerk?

Becoming a Payroll Clerk is an achievable goal for those with the right preparation. This career requires attention to detail, an understanding of financial principles, and proficiency with technology. Following a few key steps can pave the way to securing this role.

First, obtaining the necessary education is crucial. Most employers prefer candidates with at least a high school diploma. Some may require a college degree in accounting or a related field. Acquiring these credentials lays the foundation for understanding financial processes.

- Education: Complete high school or earn a college degree in a related field.

- Skills Development: Learn to use payroll software and develop strong math skills.

- Experience: Gain relevant experience through internships or entry-level jobs.

- Certification: Consider earning a certification, such as the Certified Payroll Professional (CPP).

- Job Search: Apply for Payroll Clerk positions and prepare for interviews.

Second, developing specific skills is important. Payroll Clerks must be adept at using payroll software and possess strong mathematical skills. Familiarity with tax laws and regulations is also necessary. Gaining experience in related roles, such as administrative assistant or accounting clerk, can be beneficial. This experience helps in understanding workplace dynamics and applying skills in real-world settings.

Finally, obtaining certifications and starting the job search round out the process. While not always required, certifications like the Certified Payroll Professional (CPP) can enhance a candidate’s resume. Applying for Payroll Clerk positions and preparing thoroughly for interviews will increase chances of success.

How long does it take to become a Payroll Clerk?

Working as a Payroll Clerk involves handling employee payments, benefits, and tax calculations. It's a crucial role in many businesses. Most Payroll Clerks have a high school diploma or equivalent. Some may complete a short training program or take college courses in business or accounting. This education usually takes between one and two years.

After gaining the necessary education, the next step is gaining experience. Many Payroll Clerks start with entry-level jobs. They may work under the supervision of a more experienced payroll professional. This hands-on experience helps them learn the job in detail. With experience and possibly some additional training, someone can become a full Payroll Clerk. Often, this takes around one to three years. This time can vary based on the individual’s pace and opportunities available.

Payroll Clerk Job Description Sample

The Payroll Clerk is responsible for managing the organization's payroll process, ensuring accurate and timely processing of employee payments. This role involves data entry, reconciliation of payroll records, and compliance with federal and state payroll regulations.

Responsibilities:

- Process employee payroll by accurately calculating wages, deductions, and benefits.

- Maintain and update employee records, ensuring confidentiality and accuracy.

- Reconcile payroll records with bank statements and financial reports.

- Generate and distribute payroll checks, direct deposits, and related documents.

- Ensure compliance with federal, state, and local payroll laws and regulations.

Qualifications

- High school diploma or equivalent required; associate’s degree or higher in finance, accounting, or related field preferred.

- Proven experience as a Payroll Clerk or in a similar role.

- Strong knowledge of payroll procedures and practices.

- Proficiency in Microsoft Office Suite, particularly Excel.

- Excellent attention to detail and accuracy in data entry.

Is becoming a Payroll Clerk a good career path?

A Payroll Clerk plays a key role in managing employee pay and benefits. This job often involves calculating wages, distributing paychecks, and ensuring all tax filings are accurate. Payroll Clerks work closely with HR and accounting departments, making them a vital part of any organization. This position offers stability and the chance to learn about financial operations.

When considering a career as a Payroll Clerk, there are both positive and negative aspects to keep in mind. Below are some pros and cons to help you decide if this path is right for you.

- Pros:

- Payroll Clerks work in a structured environment with clear tasks and goals.

- Most Payroll Clerks have regular hours, which can lead to a good work-life balance.

- This job offers opportunities for professional growth and specialization.

- It provides the chance to work in various industries, not just one specific sector.

- Cons:

- Payroll work can be repetitive, focusing on similar tasks day after day.

- Seasonal spikes in workload can lead to high-pressure periods.

- The job may require dealing with sensitive employee information, which can be challenging.

- There is often limited room for advancement compared to other careers.

What is the job outlook for a Payroll Clerk?

Becoming a Payroll Clerk offers a promising career path, with an average of 12,500 job positions opening each year, according to the Bureau of Labor Statistics (BLS). This steady flow of opportunities makes it a reliable field for job seekers looking to enter the workforce. The demand for skilled professionals in payroll continues to be strong, ensuring a steady stream of roles available.

Despite a projected decrease of 16.4% in job openings from 2022 to 2032, the field still maintains a stable outlook. This projection means that while the number of positions may decline, the need for qualified payroll clerks remains essential. This stability is good news for those entering or considering a career in payroll management.

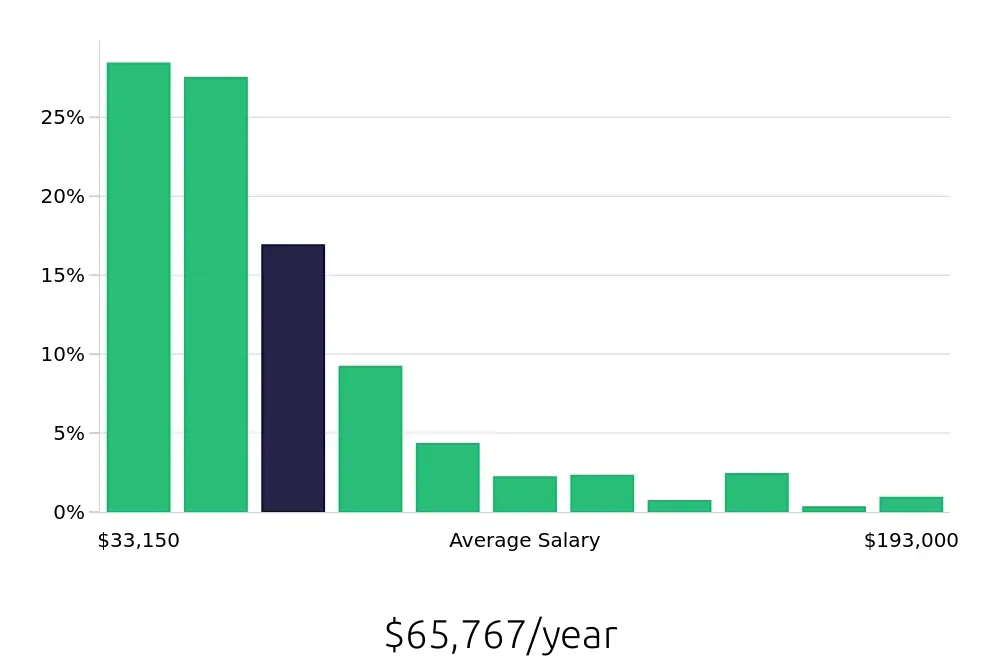

Payroll Clerks can expect a competitive salary to match their responsibilities. The average national annual compensation stands at $54,690, with an hourly rate of $26.29, as reported by the BLS. This remuneration reflects the value of the skills and knowledge required to manage payroll efficiently and accurately. A career in payroll offers not only stability but also the potential for financial rewards.

Currently 549 Payroll Clerk job openings, nationwide.

Continue to Salaries for Payroll Clerk