What does a Payroll Manager do?

A Payroll Manager plays a key role in ensuring that employees receive their compensation on time and accurately. This professional oversees the entire payroll process, from calculating wages to distributing paychecks and managing payroll taxes. The Payroll Manager works closely with the HR department to maintain up-to-date employee records and ensure compliance with labor laws.

The job involves coordinating with various stakeholders, including employees, department heads, and financial teams. The Payroll Manager must handle payroll data with high accuracy and confidentiality. They also update payroll systems and implement new payroll policies when necessary. A strong attention to detail and excellent organizational skills are crucial for this role. The Payroll Manager ensures that all payroll-related activities align with company policies and legal requirements.

How to become a Payroll Manager?

Becoming a Payroll Manager requires a clear path of steps that blend education, experience, and skill development. This role involves ensuring that employees are paid accurately and on time. It requires attention to detail and a solid understanding of accounting and payroll systems. With the right approach, anyone can move toward this rewarding career.

Follow these steps to start a successful career as a Payroll Manager. Each step builds upon the last, providing the foundation needed for this important role.

- Get an education: Start with a high school diploma or GED. Most employers prefer candidates with at least an associate's degree in business, finance, or a related field. Some may require a bachelor's degree.

- Gain relevant experience: Work in accounting, finance, or payroll. Look for jobs that involve handling employee payrolls. Experience in these areas will prepare you for the duties of a Payroll Manager.

- Develop necessary skills: Learn the skills needed for the job. This includes understanding payroll software, tax laws, and financial regulations. Good communication and problem-solving skills are also important.

- Consider certifications: Earn certifications that boost your credentials. The American Payroll Association (APA) offers the Certified Payroll Professional (CPP) credential. This certification shows your expertise in payroll management.

- Seek out job opportunities: Apply for Payroll Manager positions. Tailor your resume and cover letter to highlight your education, experience, and skills. Networking with professionals in the field can also lead to job openings.

How long does it take to become a Payroll Manager?

Getting into a payroll management role involves a journey through education and experience. Most payroll managers hold a bachelor's degree in accounting, finance, or a related field. This education usually takes four years to complete. After earning a degree, gaining practical experience becomes crucial. Many payroll managers start in entry-level positions like payroll clerk or accountant. This helps them learn the basics of payroll management. Gaining experience can take an additional two to three years.

The timeline to becoming a payroll manager may vary based on personal career goals and work experience. Some individuals may find positions with less educational background, focusing on their on-the-job training. Others may pursue certifications to boost their qualifications and career opportunities. Common certifications include the Certified Payroll Professional (CPP) and the Certified Payroll Specialist (CPS). These credentials can speed up the process to becoming a payroll manager.

Payroll Manager Job Description Sample

The Payroll Manager is responsible for overseeing and managing the payroll functions within the organization. This role ensures accurate and timely processing of employee payments, maintains compliance with all applicable laws and regulations, and provides support to HR and finance teams.

Responsibilities:

- Oversee the preparation and processing of payroll for all employees.

- Ensure accuracy and timeliness of payroll processing, including direct deposits, deductions, and statutory contributions.

- Maintain and update payroll records and systems, ensuring compliance with internal controls and regulatory requirements.

- Coordinate and manage the payroll calendar, including end-of-month closing activities.

- Handle payroll-related inquiries and resolve employee issues in a timely and professional manner.

Qualifications

- Bachelor’s degree in Finance, Accounting, or a related field.

- Proven experience (5+ years) in payroll management, preferably in a corporate environment.

- Strong knowledge of payroll systems, processes, and best practices.

- Familiarity with relevant labor laws and regulations.

- Excellent attention to detail and accuracy in data entry and reporting.

Is becoming a Payroll Manager a good career path?

Working as a Payroll Manager involves overseeing the payment of employees. This role ensures that all staff receive their wages on time and accurately. Payroll Managers often handle both regular and bonus pay. They must also make sure that all payroll taxes get paid.

This job can offer many rewards. It provides stability and a chance to work in various industries. Being a Payroll Manager often comes with a good salary and benefits. It also allows for the growth of strong organizational skills and attention to detail. However, this career path has its challenges. Managing payroll can be stressful, especially around paydays. Long hours and tight deadlines are common. Also, the job requires up-to-date knowledge of tax laws and regulations.

Here are some pros to consider:

- Good salary and benefits

- Job stability and growth opportunities

- Development of strong organizational skills

Here are some cons to consider:

- High stress around paydays

- Long working hours

- Need to stay updated with tax laws and regulations

What is the job outlook for a Payroll Manager?

Considering a career as a Payroll Manager? This role offers a positive job outlook for those entering the field. According to the Bureau of Labor Statistics (BLS), there are about 1,100 open positions each year. Additionally, job openings are expected to grow by 2.2% from 2022 to 2032. This growth rate means more opportunities for job seekers in the coming years.

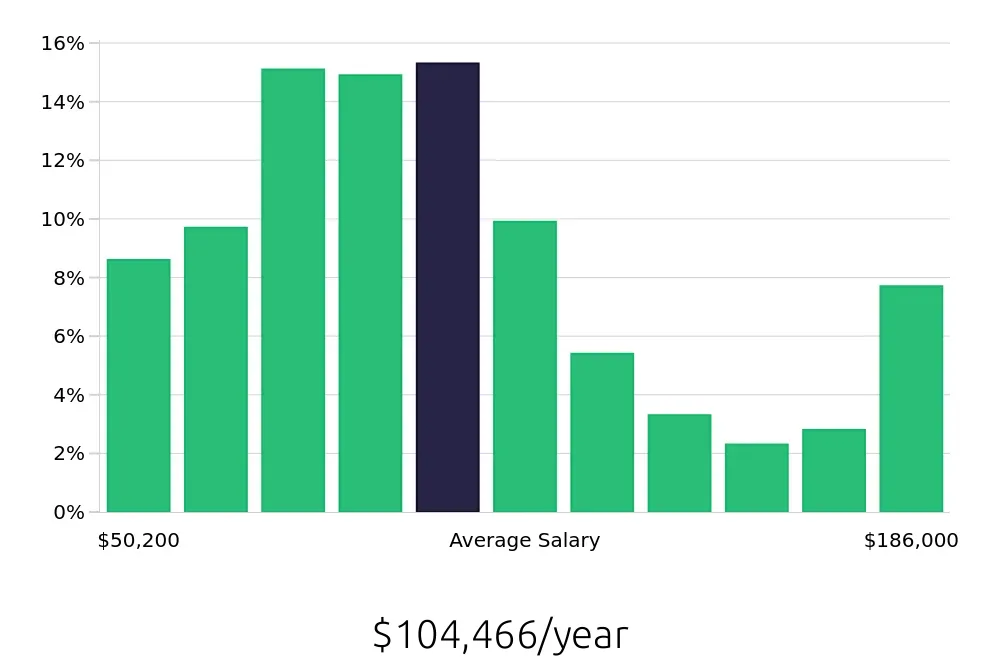

Payroll Managers enjoy a strong average annual compensation as well. The national average annual salary for this role is $150,940. This figure highlights the financial benefits that can come with the position. It also reflects the value employers place on skilled Payroll Managers. The BLS also reports that the average hourly wage is $72.57. This compensation speaks to the expertise and responsibility involved in managing payroll operations.

In summary, the job outlook for Payroll Managers looks bright. With a steady number of positions available each year and expected growth in job openings, it is a good time to consider this career path. The competitive salary further adds to the appeal, making this a lucrative option for professionals in the field.

Currently 223 Payroll Manager job openings, nationwide.

Continue to Salaries for Payroll Manager