What does a Portfolio Manager do?

A Portfolio Manager plays a key role in overseeing a collection of investments. This person develops, manages, and monitors portfolios to meet clients' financial goals. They analyze market trends and make informed decisions about buying and selling assets. The goal is to maximize returns while minimizing risks.

The Portfolio Manager works closely with clients to understand their financial needs and objectives. They create personalized investment strategies and keep clients informed about their portfolio's performance. This job requires strong analytical skills and a deep understanding of financial markets. Good communication skills are also essential, as the Portfolio Manager often needs to explain complex financial concepts in simple terms.

How to become a Portfolio Manager?

Starting a career as a Portfolio Manager involves a clear path of education, experience, and skill development. By following these steps, one can successfully navigate the journey to becoming a skilled Portfolio Manager.

First, gaining a solid educational foundation is essential. A degree in finance, economics, or a related field provides the necessary knowledge. Coursework should include financial markets, investment strategies, and risk management. Internships or part-time jobs in finance can provide practical experience during college.

- Earn a relevant degree.

- Gain practical experience through internships or entry-level jobs.

- Obtain necessary certifications.

- Build a strong professional network.

- Stay updated with industry trends.

Next, gaining practical experience is vital. Internships or entry-level positions in investment firms, banks, or asset management companies allow one to apply academic knowledge in real-world settings. This hands-on experience builds a strong foundation in investment management.

Obtaining certifications can enhance credibility and job prospects. Certifications such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) demonstrate expertise and dedication. These credentials can provide a competitive edge in the job market.

Building a professional network is another critical step. Networking with industry professionals can lead to job opportunities and provide valuable insights into the field. Attending industry conferences, joining professional organizations, and connecting with mentors can aid in career advancement.

Staying updated with industry trends is crucial. The financial industry is ever-changing, with new investment strategies and technologies emerging regularly. Continuous learning through workshops, seminars, and online courses ensures one remains knowledgeable and competitive.

How long does it take to become a Portfolio Manager?

The journey to becoming a Portfolio Manager involves a mix of education, experience, and certification. Most professionals in this field start with a bachelor's degree in finance, economics, or a related field. This usually takes about four years to complete. Completing a degree provides a solid foundation in financial theory and investment strategies.

After earning a degree, gaining practical experience is crucial. Aspiring Portfolio Managers often work in financial roles like financial analyst or investment banking. This hands-on experience helps build the skills needed for managing portfolios. Many professionals gain this experience through internships or entry-level jobs during their studies. This step can take one to three years, depending on career opportunities and personal goals. Certifications, such as the Chartered Financial Analyst (CFA), can also enhance job prospects. Passing the CFA exams requires significant study time, often several months to a year per exam. Aspiring managers usually take all three levels over a period of two to four years.

Portfolio Manager Job Description Sample

We are seeking a dynamic and experienced Portfolio Manager to join our team. The ideal candidate will have a strong track record in managing investment portfolios, analyzing market trends, and providing strategic advice to clients. This role offers an exciting opportunity to work in a fast-paced environment and contribute to the growth and success of our firm.

Responsibilities:

- Develop and implement investment strategies for clients based on their financial goals and risk tolerance.

- Conduct in-depth market analysis and research to identify investment opportunities.

- Monitor and review the performance of managed portfolios and make adjustments as needed.

- Collaborate with clients to understand their financial objectives and provide personalized investment advice.

- Prepare and present investment reports and recommendations to clients and stakeholders.

Qualifications

- Bachelor's degree in Finance, Economics, Business Administration, or a related field.

- Certifications such as CFA, CFP, or CPA are highly desirable.

- Proven experience as a Portfolio Manager or in a similar role within the financial industry.

- Strong knowledge of investment strategies, financial markets, and asset classes.

- Excellent analytical and problem-solving skills.

Is becoming a Portfolio Manager a good career path?

A Portfolio Manager guides investments for individuals or organizations. They analyze market trends, make decisions about buying and selling securities, and aim to grow their clients' wealth. This role requires a mix of financial knowledge, analytical skills, and the ability to make strategic decisions under pressure.

Working as a Portfolio Manager has many benefits. It offers the chance to work with diverse clients and manage significant amounts of money. It can also be a path to financial independence and high earning potential. However, the job comes with its challenges. The role requires long hours and high levels of stress, especially during market downturns. Portfolio Managers must also stay updated on market trends and regulatory changes, which can be demanding.

Consider these pros and cons before pursuing a career as a Portfolio Manager:

- Pros:

- Potential for high earnings

- Opportunity to work with various clients

- Skill development in financial analysis and strategy

- Cons:

- High-stress environment

- Long and irregular working hours

- Need for continuous learning and adaptation

What is the job outlook for a Portfolio Manager?

Becoming a Portfolio Manager offers a promising job outlook for aspiring professionals. The Bureau of Labor Statistics (BLS) reveals that there are approximately 9,900 job positions available annually, presenting ample opportunities for growth and career advancement. With a projected increase of 6.1% in job openings from 2022 to 2032, individuals entering this field can anticipate a steady demand for their expertise and skills.

The financial sector remains a robust and dynamic industry, and Portfolio Managers play a crucial role in managing and optimizing investment portfolios for clients. This role requires a deep understanding of financial markets, risk management, and strategic decision-making. Given the evolving economic landscape and the increasing need for financial expertise, the job outlook for Portfolio Managers appears favorable for those with the right qualifications and experience. The BLS reports an average national annual compensation of $89,650, highlighting the potential for a rewarding career in this field.

For those seeking a career in finance, the role of a Portfolio Manager offers not only a stable job outlook but also competitive compensation. The BLS data shows an average national hourly compensation of $43.1, underscoring the financial viability of this profession. As the demand for skilled financial professionals continues to rise, job seekers can take advantage of the numerous opportunities available in this field. With the right combination of education, experience, and dedication, aspiring Portfolio Managers can position themselves for a successful and fulfilling career in finance.

Currently 552 Portfolio Manager job openings, nationwide.

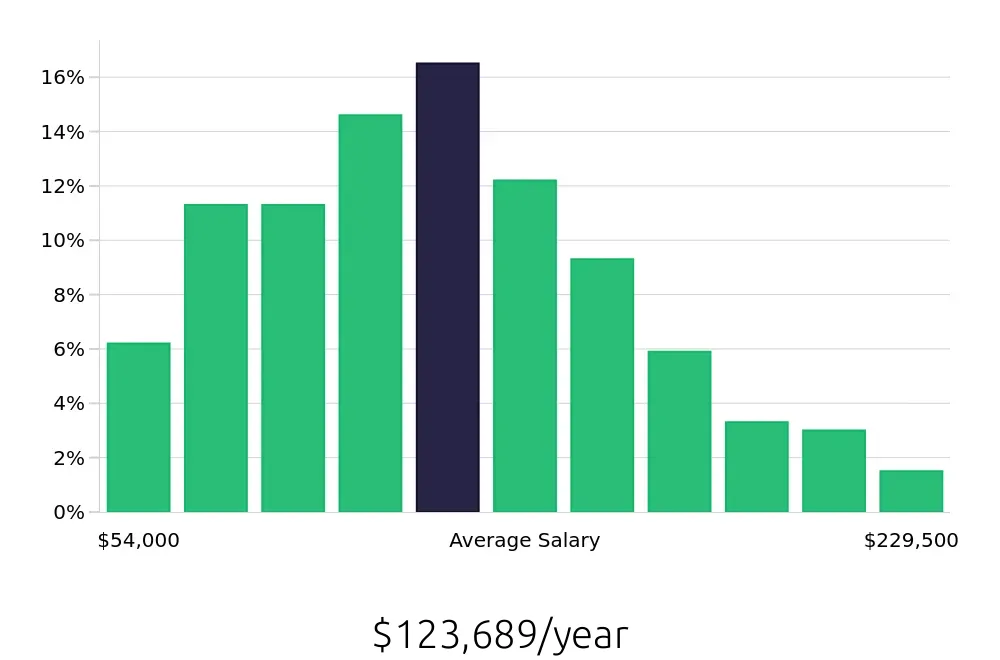

Continue to Salaries for Portfolio Manager