How much does a Portfolio Manager make?

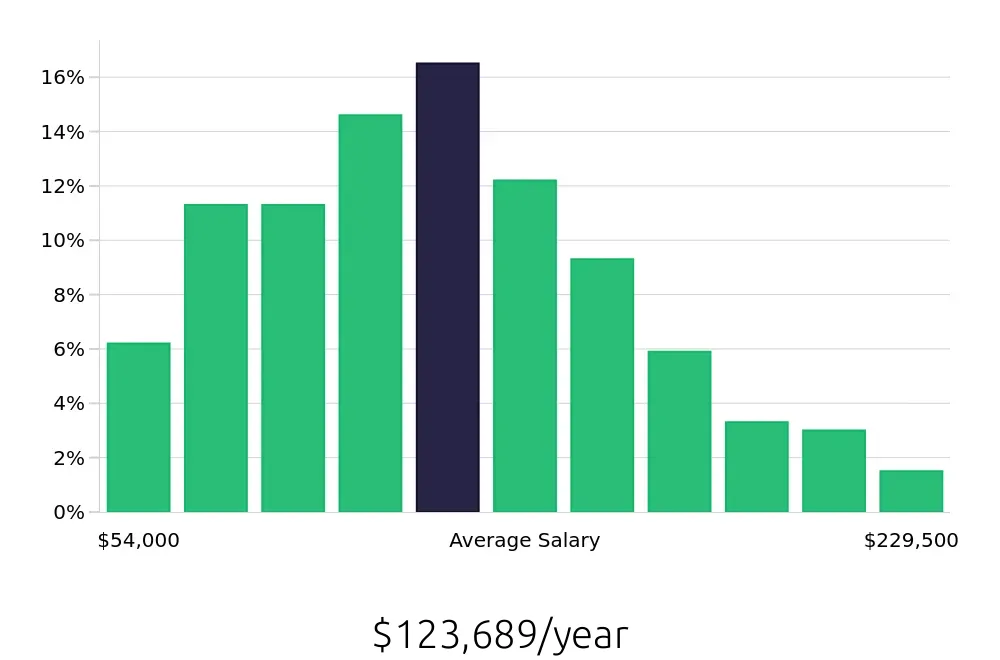

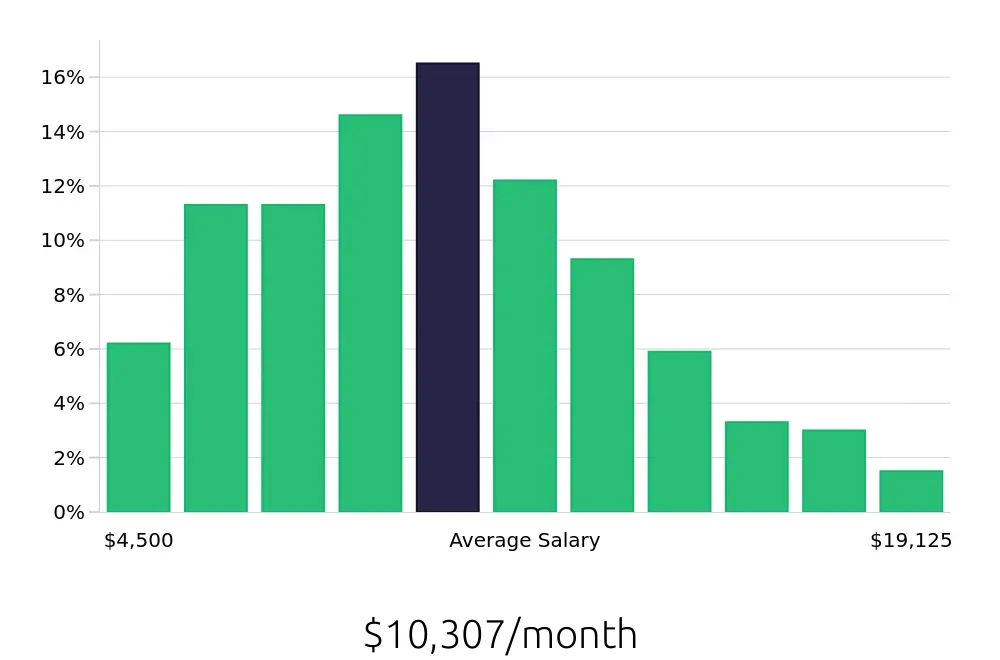

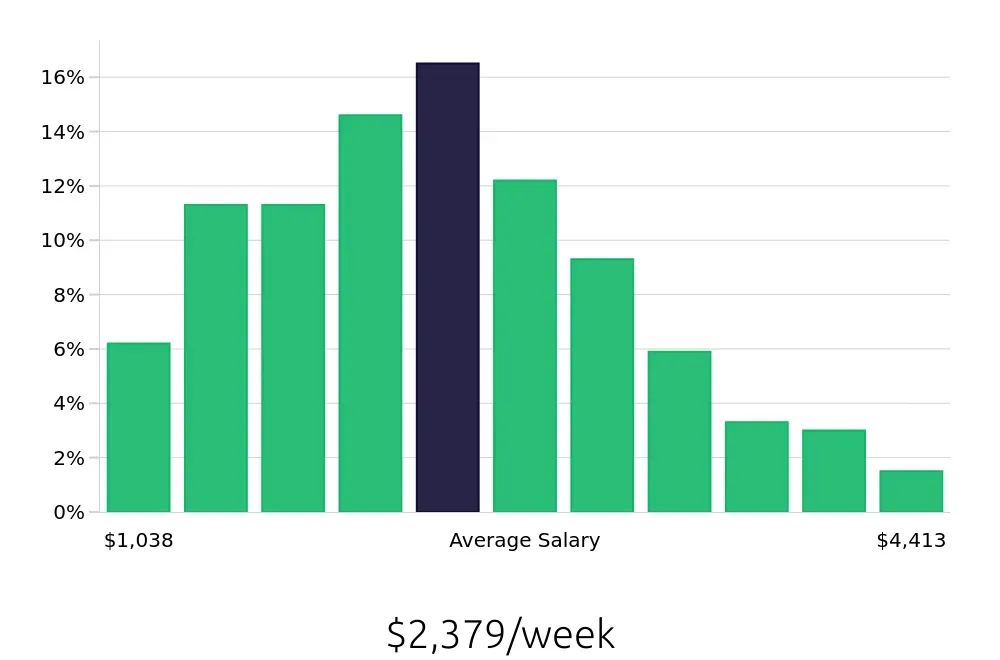

Portfolio Managers earn a good living by overseeing investments. The salary can vary based on experience and the industry. Most Portfolio Managers make between $69,955 and $181,636 per year. The average yearly salary for these professionals is about $123,689.

Here are more details about the salary range:

- About 10% of Portfolio Managers earn less than $69,955.

- Around 11% make between $69,955 and $85,909.

- About 14% earn between $85,909 and $101,864.

- Close to 16% make between $101,864 and $117,818.

- More than 12% earn between $117,818 and $133,773.

- About 9% make between $133,773 and $149,727.

- Around 6% earn between $149,727 and $165,682.

- Close to 6% make between $165,682 and $181,636.

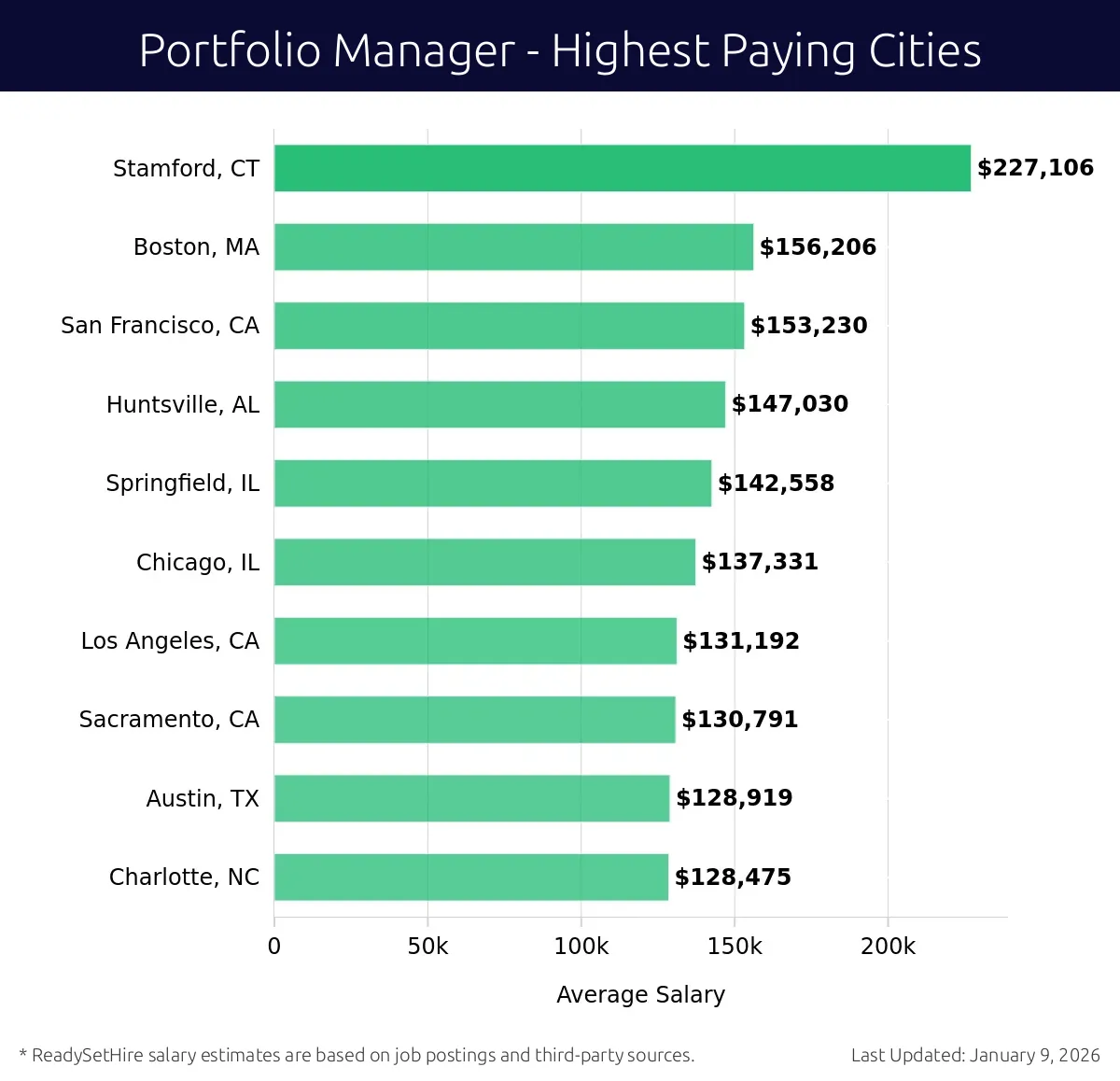

What are the highest paying cities for a Portfolio Manager?

-

Stamford, CT

Average Salary: $227,106

In Stamford, financial firms seek adept professionals for managing investment portfolios. The city offers a dynamic environment with many financial institutions, making it ideal for seasoned managers.

Find Portfolio Manager jobs in Stamford, CT

-

Boston, MA

Average Salary: $156,206

Boston boasts a thriving financial industry with numerous investment firms. Here, professionals manage portfolios for a variety of clients, enjoying a vibrant economic landscape.

Find Portfolio Manager jobs in Boston, MA

-

San Francisco, CA

Average Salary: $153,230

San Francisco's tech and finance sectors blend to create unique opportunities. Professionals here manage innovative portfolios, working for both traditional banks and cutting-edge fintech companies.

Find Portfolio Manager jobs in San Francisco, CA

-

Huntsville, AL

Average Salary: $147,030

Huntsville combines a growing tech scene with a strong financial industry. Managers here find a supportive environment for handling diverse investment portfolios.

Find Portfolio Manager jobs in Huntsville, AL

-

Springfield, IL

Average Salary: $142,558

Springfield offers a more relaxed pace with solid financial institutions. Professionals manage portfolios with a focus on stability and growth, benefiting from a lower cost of living.

Find Portfolio Manager jobs in Springfield, IL

-

Chicago, IL

Average Salary: $137,331

Chicago is a financial hub with numerous investment opportunities. Managers here work for major firms, overseeing large and complex portfolios in a bustling market.

Find Portfolio Manager jobs in Chicago, IL

-

Los Angeles, CA

Average Salary: $131,192

Los Angeles provides a dynamic and diverse market for portfolio management. Managers here work for both large corporations and emerging firms, navigating a vibrant economic landscape.

Find Portfolio Manager jobs in Los Angeles, CA

-

Sacramento, CA

Average Salary: $130,791

Sacramento offers a balanced approach to finance, with opportunities in both government and private sectors. Managers here manage portfolios with a focus on local economic trends.

Find Portfolio Manager jobs in Sacramento, CA

-

Austin, TX

Average Salary: $128,919

Austin's tech-driven economy offers exciting opportunities for portfolio managers. The city's growth and innovation make it a great place for managing cutting-edge portfolios.

Find Portfolio Manager jobs in Austin, TX

-

Charlotte, NC

Average Salary: $128,475

Charlotte is known for its strong financial sector, with many banking and investment firms. Managers here enjoy a supportive environment for managing diverse and dynamic portfolios.

Find Portfolio Manager jobs in Charlotte, NC

What are the best companies a Portfolio Manager can work for?

-

Apple

Average Salary: $249,038

Apple offers exciting opportunities for Portfolio Managers. They work across various locations, including Cupertino, California, and other global sites. Apple provides a dynamic environment with opportunities to manage high-value investments.

-

3M

Average Salary: $218,560

At 3M, Portfolio Managers play a key role in managing company investments. They operate from locations such as St. Paul, Minnesota, and other sites worldwide. 3M values innovation and provides a collaborative work environment.

-

Synchrony

Average Salary: $216,250

Synchrony offers strong career growth for Portfolio Managers. They work in locations like Stamford, Connecticut, and other areas across the country. Synchrony provides a supportive atmosphere to develop your investment skills.

-

Leidos

Average Salary: $191,836

Leidos is a leading company for Portfolio Managers. They operate from locations such as Reston, Virginia, and other sites nationwide. Leidos offers a stable and rewarding environment for managing large portfolios.

-

Wells Fargo

Average Salary: $182,382

Wells Fargo provides excellent opportunities for Portfolio Managers. They work in locations like San Francisco, California, and other areas. Wells Fargo values experience and offers a dynamic work environment.

-

Liberty Mutual Insurance

Average Salary: $169,000

Liberty Mutual Insurance offers diverse roles for Portfolio Managers. They operate from Boston, Massachusetts, and other locations. The company provides a supportive environment to manage and grow your investment portfolio.

-

Bank of America

Average Salary: $164,286

Bank of America offers numerous opportunities for Portfolio Managers. They work in Charlotte, North Carolina, and other sites. The company provides a comprehensive environment for investment management.

-

Webster Bank

Average Salary: $154,118

Webster Bank provides rewarding roles for Portfolio Managers. They work in locations like Waterbury, Connecticut, and other areas. The company offers a supportive environment to develop your financial skills.

-

Comerica

Average Salary: $144,611

Comerica offers solid opportunities for Portfolio Managers. They work in Detroit, Michigan, and other locations. The company provides a collaborative environment to manage investment portfolios effectively.

-

Cushman & Wakefield

Average Salary: $141,026

Cushman & Wakefield provides interesting roles for Portfolio Managers. They operate from locations such as New York, New York, and other sites. The company offers a dynamic work environment to manage investment portfolios.

How to earn more as a Portfolio Manager?

Portfolio managers play a vital role in helping investors achieve their financial goals. To earn more in this role, one must combine skills, knowledge, and strategic planning. Successful portfolio managers often find ways to boost their income through various avenues. By focusing on these areas, individuals can enhance their earning potential significantly.

To earn more as a portfolio manager, consider these key factors:

- Expand Your Expertise: Gain deeper knowledge in specific market sectors or investment strategies. Specialization can lead to higher earning opportunities.

- Grow Your Network: Build relationships with clients, colleagues, and industry professionals. A strong network can lead to more job opportunities and referrals.

- Enhance Communication Skills: Clearly explaining investment strategies and performance to clients can lead to better client retention and trust.

- Stay Updated with Market Trends: Keep up with the latest market news and trends. Being informed can help in making better investment decisions.

- Seek Advanced Certifications: Obtaining certifications like CFA (Chartered Financial Analyst) can increase credibility and earning potential.