What does a Relationship Banker do?

A Relationship Banker acts as a personal financial advisor to their clients. They help people manage their finances by providing advice on savings, loans, investments, and other banking services. Relationship Bankers build strong connections with their clients to understand their financial needs and goals. They work hard to offer tailored solutions to help clients achieve their financial objectives.

These professionals spend time listening to clients, explaining banking products, and guiding them through financial decisions. They educate clients on how to make the most of their money. Relationship Bankers also ensure that clients feel valued and supported. They handle transactions, answer questions, and provide ongoing financial guidance. Their goal is to help clients build a secure financial future.

How to become a Relationship Banker?

Becoming a Relationship Banker involves a clear process that combines education, experience, and the right skills. This career path offers a rewarding opportunity to help individuals and businesses manage their finances effectively. Follow these steps to embark on a successful journey as a Relationship Banker.

Firstly, obtaining a bachelor’s degree in finance, business, or a related field provides a solid foundation. Many institutions offer courses that cover essential banking knowledge and customer service skills. This educational background is crucial for understanding financial products and services.

- Earn a bachelor’s degree.

- Gain relevant experience.

- Develop strong communication skills.

- Obtain necessary certifications.

- Network within the industry.

Gaining experience in the banking sector is the next step. Working in roles such as a bank teller, loan officer, or customer service representative provides valuable insights into the banking environment. This experience helps in understanding the day-to-day operations of a bank.

Strong communication skills are essential for a Relationship Banker. The ability to effectively interact with clients, understand their needs, and provide tailored financial advice is key. Additionally, developing a friendly and professional demeanor helps in building long-term relationships with clients.

Certifications such as the Certified Relationship Banker (CRB) can enhance qualifications. These credentials demonstrate a commitment to professional development and a deeper understanding of banking practices. Obtaining these certifications can make a candidate more competitive in the job market.

Networking plays a crucial role in this field. Attending industry events, joining professional organizations, and connecting with current Relationship Bankers can open doors to job opportunities. Building a strong professional network provides support and can lead to valuable referrals.

How long does it take to become a Relationship Banker?

A Relationship Banker needs education and experience. This journey starts with a high school diploma. After that, a bachelor's degree in business or finance can help. Most colleges offer these degrees. Some people choose to go straight to work and gain experience first.

Once in the field, gaining experience is key. Many start with entry-level jobs in banking. These jobs teach the basics of banking. With time and good work, someone can move up to become a Relationship Banker. This usually takes a few years. Many people spend about 2 to 5 years in different roles before becoming a Relationship Banker.

Relationship Banker Job Description Sample

The Relationship Banker plays a pivotal role in cultivating and maintaining strong relationships with clients to promote the bank's financial products and services. This role requires a blend of customer service skills, sales abilities, and financial expertise to meet the needs of individuals and businesses.

Responsibilities:

- Develop and maintain strong relationships with clients to understand their financial needs and objectives.

- Promote and sell bank products and services such as loans, mortgages, credit cards, and investment services.

- Conduct regular meetings with clients to review their financial situation and recommend appropriate products.

- Prepare and present financial plans and strategies to clients, ensuring they align with their goals.

- Stay updated on financial products, services, and industry trends to provide knowledgeable advice.

Qualifications

- Bachelor's degree in Finance, Business Administration, or a related field.

- Proven experience as a Relationship Banker, Financial Advisor, or similar role.

- Strong understanding of financial products and services, including loans, investments, and credit.

- Excellent communication and interpersonal skills to build and maintain client relationships.

- Strong sales skills and the ability to meet financial targets.

Is becoming a Relationship Banker a good career path?

The role of a Relationship Banker provides a unique blend of financial expertise and customer service. This career path offers individuals the opportunity to build lasting connections with clients. Bankers serve as trusted advisors, guiding clients through their financial journeys. They can assist with savings, investments, loans, and more.

Being a Relationship Banker comes with many benefits. First, this career offers stability and the potential for long-term employment. The role also allows for personal interaction and relationship building. Many find it rewarding to help clients achieve their financial goals. However, this career also has some challenges. It requires a strong understanding of financial products and regulations. Relationship Bankers often face pressure to meet sales targets and maintain customer satisfaction.

Consider these pros and cons before pursuing a career in banking:

- Pros:

- Stability and long-term job security

- Opportunities for personal and professional growth

- The ability to build meaningful relationships

- Competitive salary and benefits

- Cons:

- Need for continuous education and training

- High-pressure sales environment

- Long hours, especially during peak business times

- The need to comply with strict regulations

What is the job outlook for a Relationship Banker?

The job outlook for Relationship Bankers is promising for job seekers looking for stability and growth. According to the Bureau of Labor Statistics (BLS), there are an average of 40,100 job positions for Relationship Bankers each year. This role is essential in the financial industry, connecting with clients to provide personalized banking services. The BLS projects a job openings percent change of 7.4% from 2022 to 2032, highlighting growth potential in this field.

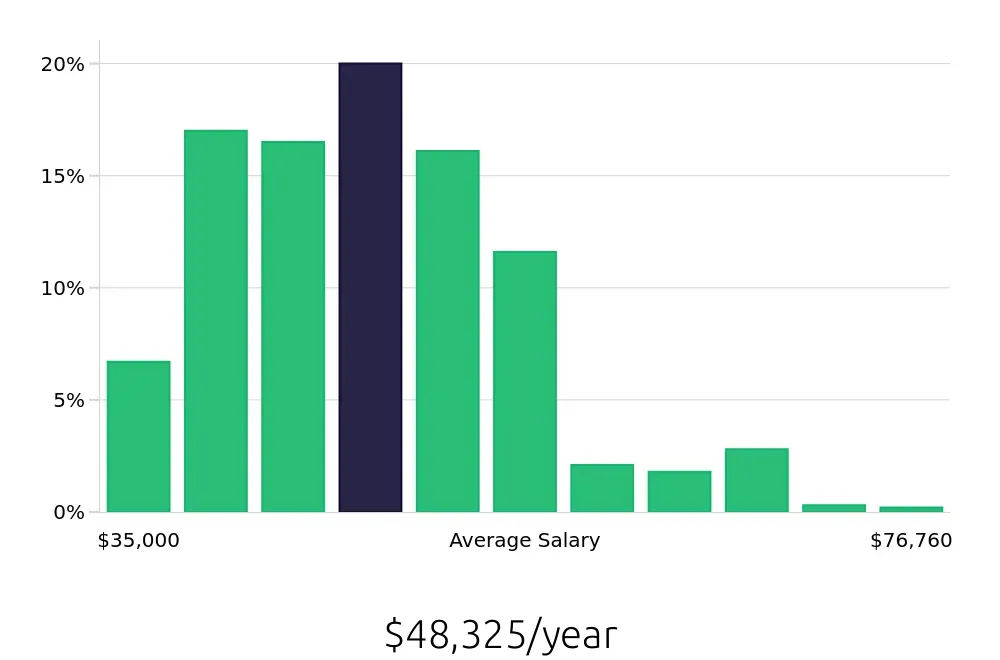

Relationship Bankers can look forward to competitive compensation. The BLS reports an average national annual salary of $109,710. This figure reflects the value placed on skilled professionals who build and maintain strong client relationships. Hourly compensation averages $52.75, with opportunities for higher earnings through bonuses and commissions. These figures show a stable and rewarding career path for those entering this profession.

Prospective Relationship Bankers should consider the market demand and financial rewards. The BLS data emphasizes a healthy job market with consistent openings and positive salary trends. Aspiring bankers can anticipate a role that combines personal interaction with financial success, making it an attractive career choice for many job seekers.

Currently 2,238 Relationship Banker job openings, nationwide.

Continue to Salaries for Relationship Banker