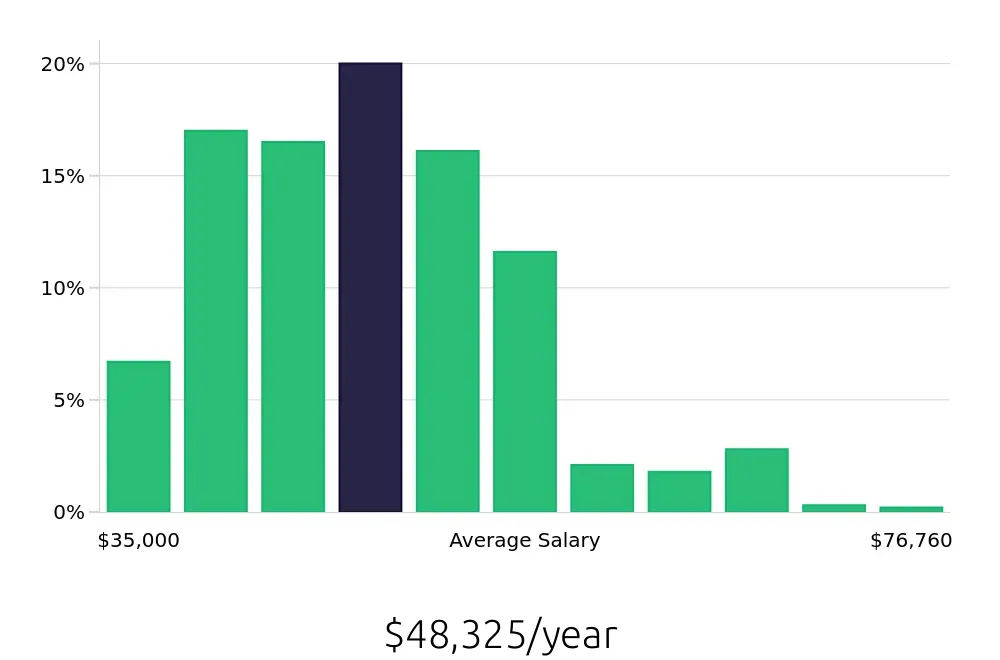

How much does a Relationship Banker make?

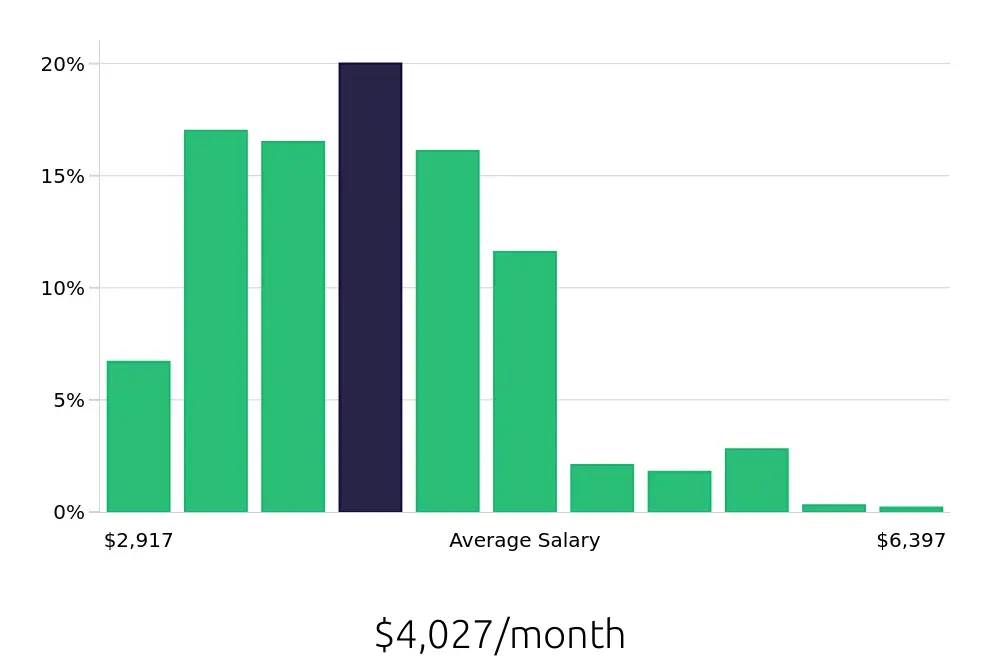

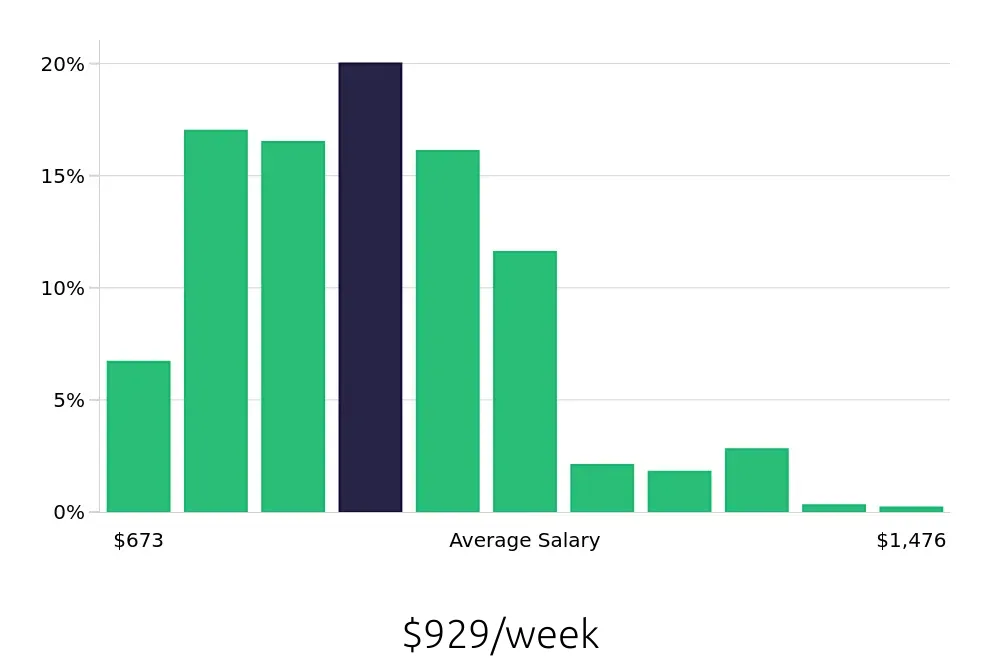

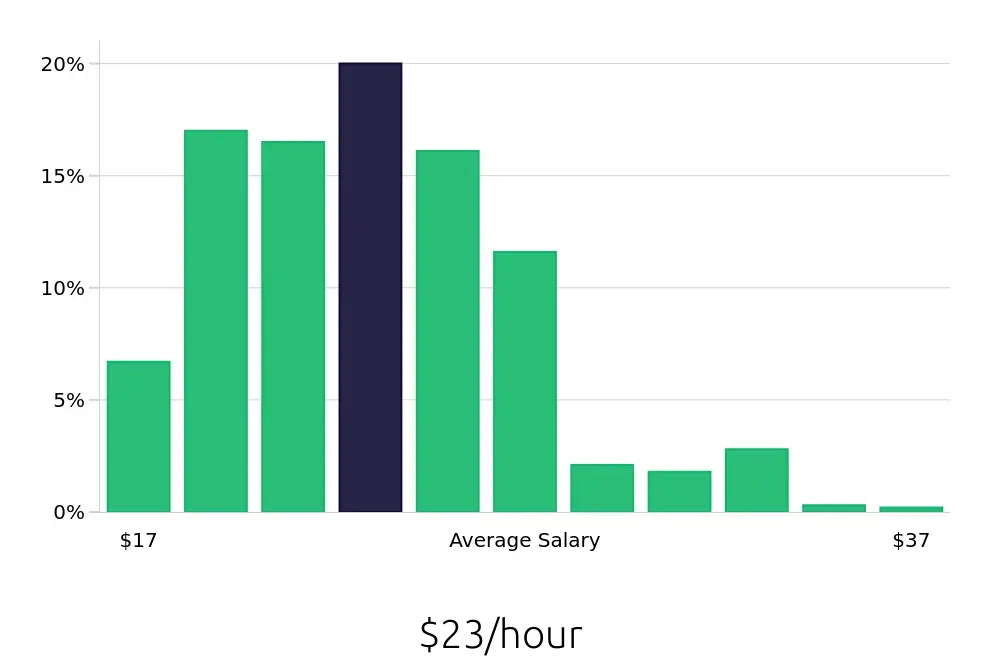

Relationship bankers enjoy a range of earnings based on their experience and location. The average yearly salary for a relationship banker stands at $48,325. This figure reflects a mix of salaries across different experience levels and locations.

The salary can vary significantly. Entry-level relationship bankers might earn around $35,000 annually. As experience grows, so does the salary. Those with more than ten years in the field can earn over $72,000. Factors like location and the specific financial institution can also impact earnings. Bankers in major cities or prestigious banks often see higher salaries.

To sum up, relationship bankers have the potential for a rewarding career with competitive pay. As they gain experience and advance in their careers, their earnings can increase, offering both financial security and growth opportunities.

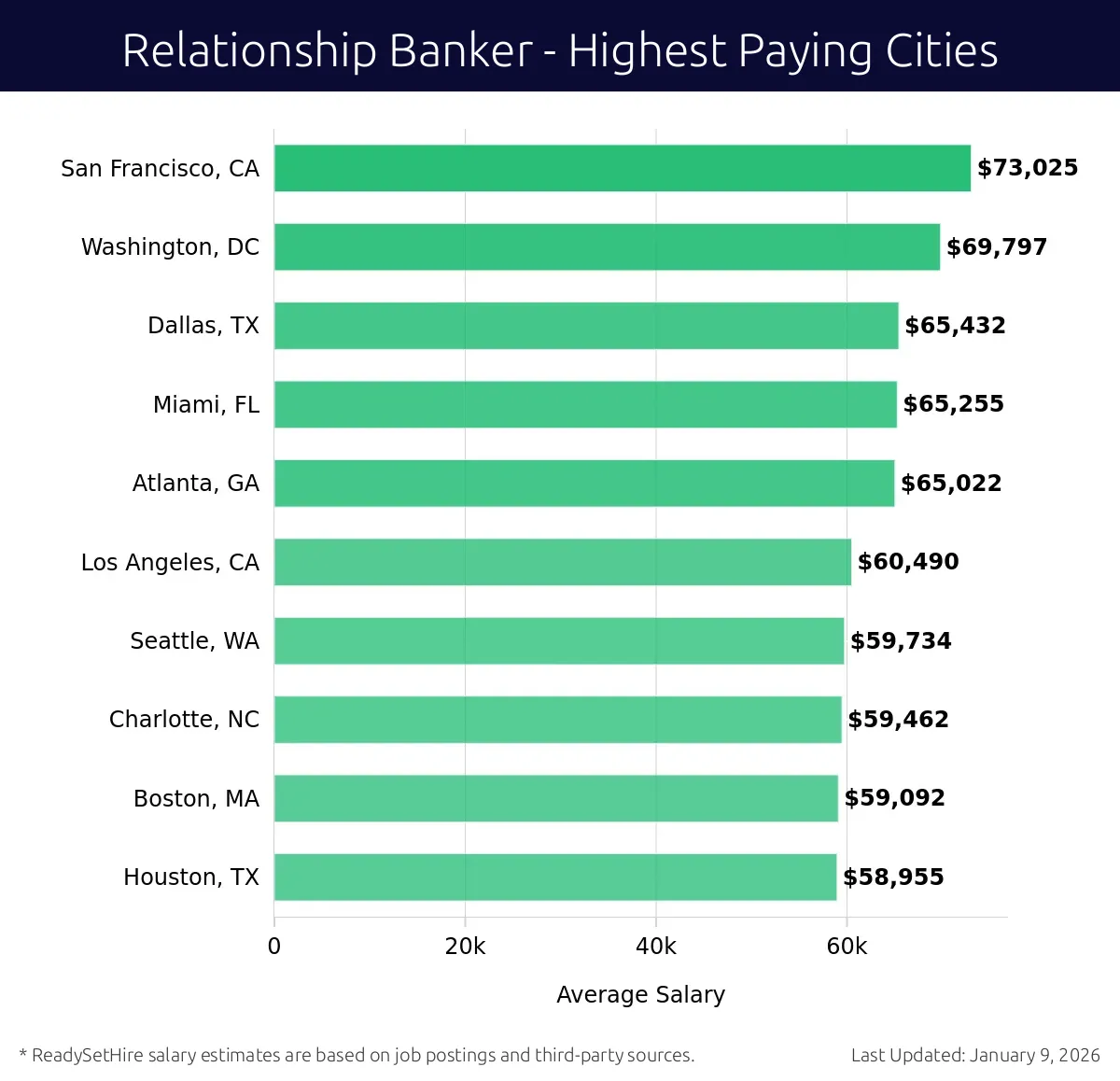

What are the highest paying cities for a Relationship Banker?

-

San Francisco, CA

Average Salary: $73,025

In San Francisco, Relationship Bankers enjoy a dynamic job environment. The city hosts major financial institutions like Wells Fargo and JPMorgan Chase. Here, bankers build strong relationships with clients, providing personalized financial advice.

Find Relationship Banker jobs in San Francisco, CA

-

Washington, DC

Average Salary: $69,797

In Washington, DC, Relationship Bankers work with a diverse clientele. The presence of federal agencies means a stable job market. Capital One and PNC Bank are prominent employers in this field. Bankers here often connect clients with financial solutions tailored to their needs.

Find Relationship Banker jobs in Washington, DC

-

Dallas, TX

Average Salary: $65,432

Dallas offers a thriving job market for Relationship Bankers. With companies like Bank of America and JPMorgan Chase, opportunities abound. Bankers work closely with individuals and businesses, helping them achieve their financial goals.

Find Relationship Banker jobs in Dallas, TX

-

Miami, FL

Average Salary: $65,255

Miami's diverse population provides a rich environment for Relationship Bankers. Banks like Wells Fargo and Capital One offer vibrant opportunities. Bankers here build lasting relationships, often assisting clients with unique financial needs.

Find Relationship Banker jobs in Miami, FL

-

Atlanta, GA

Average Salary: $65,022

Atlanta's growing economy offers excellent prospects for Relationship Bankers. SunTrust Bank and Wells Fargo are key players. Bankers in this city enjoy a mix of urban and suburban clientele, providing a variety of financial services.

Find Relationship Banker jobs in Atlanta, GA

-

Los Angeles, CA

Average Salary: $60,490

Los Angeles provides a dynamic setting for Relationship Bankers. With banks like Chase and Bank of America, bankers engage with a diverse population. They focus on building trust and understanding client needs to offer tailored financial solutions.

Find Relationship Banker jobs in Los Angeles, CA

-

Seattle, WA

Average Salary: $59,734

Seattle offers a tech-savvy environment for Relationship Bankers. Major banks like Wells Fargo and JPMorgan Chase are prominent. Bankers here work with a mix of tech professionals and local businesses, providing specialized financial advice.

Find Relationship Banker jobs in Seattle, WA

-

Charlotte, NC

Average Salary: $59,462

Charlotte is a banking hub, making it an ideal place for Relationship Bankers. Banks such as Wells Fargo and Bank of America thrive here. Bankers connect with clients, helping them navigate their financial journeys.

Find Relationship Banker jobs in Charlotte, NC

-

Boston, MA

Average Salary: $59,092

Boston offers a rich history and a strong financial sector. Relationship Bankers here work with clients at companies like Bank of America and JPMorgan Chase. They focus on understanding client needs to offer personalized financial advice.

Find Relationship Banker jobs in Boston, MA

-

Houston, TX

Average Salary: $58,955

In Houston, Relationship Bankers find a thriving job market. With banks like Chase and Wells Fargo, there are ample opportunities. Bankers here work with a diverse range of clients, providing customized financial solutions.

Find Relationship Banker jobs in Houston, TX

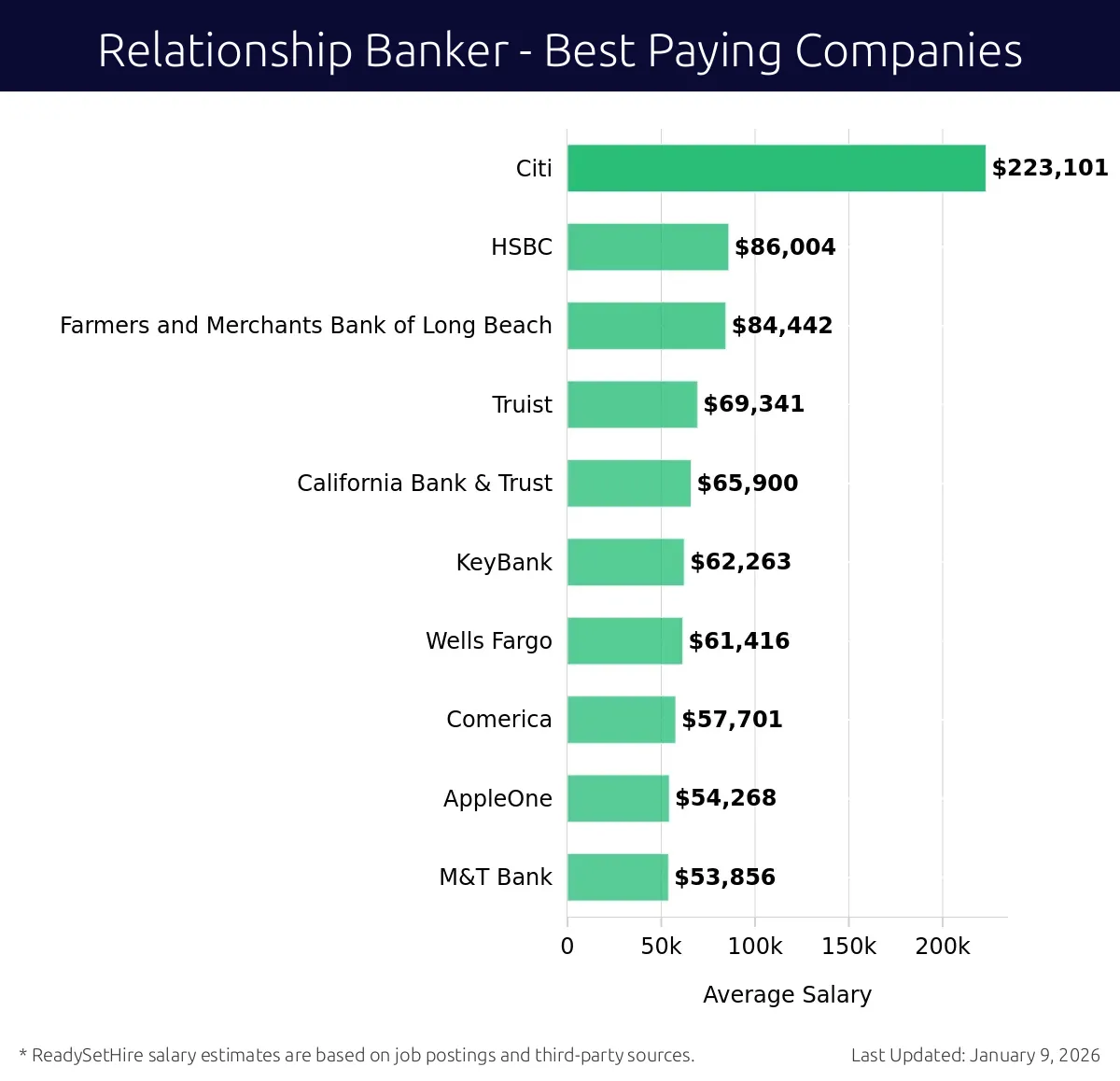

What are the best companies a Relationship Banker can work for?

-

Citi

Average Salary: $223,101

Citi offers Relationship Banker roles in many global locations. At Citi, these professionals help clients manage wealth and investments. They also assist with loans and other banking services.

-

HSBC

Average Salary: $86,004

HSBC provides Relationship Banker positions in various countries. These roles focus on building long-term relationships with clients. They offer services like personal banking, mortgages, and more.

-

Farmers and Merchants Bank of Long Beach

Average Salary: $84,442

This bank has Relationship Banker jobs in California. They work closely with clients to provide personalized banking solutions. The bank operates in Southern California.

-

Truist

Average Salary: $69,341

Truist offers Relationship Banker positions across the Southeast. These roles aim to build strong client relationships. They handle a range of banking services from savings to loans.

-

California Bank & Trust

Average Salary: $65,900

California Bank & Trust provides Relationship Banker jobs in California. These professionals focus on building client trust and offering personalized banking services. They support clients in achieving their financial goals.

-

KeyBank

Average Salary: $62,263

KeyBank has Relationship Banker roles in many states. These jobs focus on serving clients’ banking needs. They offer services from checking accounts to mortgages.

-

Wells Fargo

Average Salary: $61,416

Wells Fargo provides Relationship Banker jobs nationwide. These roles help clients with all their banking needs. They offer services like credit cards, loans, and wealth management.

-

Comerica

Average Salary: $57,701

Comerica has Relationship Banker positions in several states. They work with clients to meet their banking needs. Services include loans, credit cards, and wealth management.

-

AppleOne

Average Salary: $54,268

AppleOne offers Relationship Banker jobs in various locations. They help clients with banking and financial services. The company focuses on building strong client relationships.

-

M&T Bank

Average Salary: $53,856

M&T Bank provides Relationship Banker roles in the Northeast. These positions focus on offering personalized banking services. They help clients with savings, loans, and investment services.

How to earn more as a Relationship Banker?

Increasing earnings as a Relationship Banker involves a mix of skills, strategies, and dedication. This role offers many chances to boost income through various avenues. Understanding these can help Relationship Bankers achieve higher earnings.

Firstly, mastering the art of client relationship management can lead to significant income growth. By building strong, trusting relationships with clients, bankers can encourage referrals and repeat business. This not only increases client retention but also opens up more business opportunities. Secondly, expanding one’s client base through networking and referrals can lead to higher commissions. Active participation in community events and maintaining strong ties with existing clients can result in new business. Thirdly, gaining certifications and continuing education can enhance job performance and lead to higher pay. Specializing in areas such as wealth management or business banking can set a Relationship Banker apart. Fourthly, demonstrating consistent sales performance by meeting and exceeding sales targets can result in bonuses and salary increases. Setting realistic goals and regularly reviewing progress can help achieve these targets. Lastly, staying updated with the latest financial products and services allows bankers to offer better solutions to clients, potentially leading to higher sales and commissions.

In summary, a Relationship Banker can increase their earnings through effective client management, expanding their network, gaining specialized knowledge, achieving sales goals, and staying informed about financial products. These strategies not only enhance job performance but also lead to better financial rewards.

Factors to Increase Earnings as a Relationship Banker:

- Build strong client relationships

- Expand client base through networking

- Gain relevant certifications and education

- Meet and exceed sales targets

- Stay informed about financial products