What does a Risk Management Manager do?

A Risk Management Manager plays a crucial role in identifying, analyzing, and mitigating risks within an organization. This professional works across departments to assess potential threats that could impact the company's operations, finances, and reputation. The goal is to implement strategies that prevent or minimize these risks, ensuring the company can operate smoothly and securely.

In their daily duties, a Risk Management Manager conducts risk assessments, develops risk management plans, and ensures compliance with industry regulations. They collaborate with various stakeholders to understand business needs and potential vulnerabilities. This role requires strong analytical skills, attention to detail, and the ability to communicate effectively. Risk Management Managers must stay updated on industry trends and legal changes to provide the best protection for the organization.

How to become a Risk Management Manager?

Becoming a Risk Management Manager involves a series of steps. This career path requires a combination of education, experience, and specialized skills. Follow this process to reach your goal.

First, complete a relevant degree, such as business administration or finance. This education provides the foundation needed for understanding business operations and financial risks. Next, gain experience in a related field. Working in finance, accounting, or business analysis can help you learn about different types of risks. Look for roles that focus on identifying and mitigating risks. After gaining experience, consider obtaining a certification. The Certified Risk Manager (CRM) credential can enhance your resume and demonstrate your expertise. Finally, seek out a position in risk management. Look for openings in your desired industry, and apply your skills and certifications to secure the role.

To summarize, follow these steps to become a Risk Management Manager:

- Complete a relevant degree.

- Gain experience in a related field.

- Obtain a certification.

- Seek out a position in risk management.

By following these steps, you can build a successful career as a Risk Management Manager.

How long does it take to become a Risk Management Manager?

Many professionals aim to reach the role of a Risk Management Manager. This position requires a mix of education, skills, and experience. Typically, it takes a few years to gather the necessary qualifications. A bachelor’s degree in business, finance, or a related field usually serves as a solid foundation. This degree often takes about four years to complete.

After earning a degree, gaining relevant work experience is essential. Many individuals start in entry-level positions related to risk management, finance, or insurance. With dedication, they can move up to mid-level roles within a few years. Most Risk Management Managers have between five to ten years of experience in the field. This experience helps them understand risk assessment, mitigation strategies, and compliance. Certifications, like the Professional Risk Manager (PRM) or Financial Risk Manager (FRM), can also help speed up the process. These certifications require study and exams but add significant value to a resume. With the right education and experience, a professional can expect to become a Risk Management Manager in about five to ten years.

Risk Management Manager Job Description Sample

The Risk Management Manager will be responsible for identifying, assessing, and mitigating risks across the organization. This role involves developing and implementing risk management strategies and ensuring compliance with relevant regulations and internal policies.

Responsibilities:

- Develop and implement risk management policies, procedures, and controls.

- Conduct regular risk assessments and identify potential risks that could impact the organization.

- Analyze data to identify trends and patterns that may indicate potential risks.

- Collaborate with various departments to ensure risk management practices are integrated into their operations.

- Prepare risk management reports for senior management and the board of directors.

Qualifications

- Bachelor’s degree in Business Administration, Finance, Risk Management, or a related field.

- Proven experience in a risk management role, preferably within a similar industry.

- Professional certifications such as CRISC, FRM, or ARM are highly desirable.

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

Is becoming a Risk Management Manager a good career path?

A Risk Management Manager plays a crucial role in organizations by identifying and mitigating potential risks. This career often requires a blend of analytical skills and strategic thinking. These professionals analyze data to predict risks and develop plans to address them. They work in various sectors, including finance, healthcare, and insurance. Risk Management Managers collaborate with other departments to ensure comprehensive risk assessment and management.

Working as a Risk Management Manager offers both benefits and challenges. Understanding these can help individuals decide if this career is right for them. Here are some pros and cons to consider:

- Pros:

- Job stability: High demand in almost every industry.

- Competitive salary: Attractive compensation packages.

- Variety of work: Diverse tasks from risk assessment to policy development.

- Impact: Significant influence on organizational success and safety.

- Cons:

- High stress: Managing risks can be pressure-filled.

- Detail-oriented: Requires careful analysis and attention to detail.

- Continuous learning: Need to stay updated with industry trends.

- Complexity: Involves understanding and managing various types of risks.

What is the job outlook for a Risk Management Manager?

Job seekers interested in a role as a Risk Management Manager will find a positive job outlook ahead. According to the Bureau of Labor Statistics (BLS), there are approximately 61,300 job positions available annually. This number reflects a growing need for skilled professionals who can identify and mitigate potential risks within organizations. With the right qualifications and experience, candidates can look forward to numerous opportunities in this field.

The job outlook for Risk Management Managers is promising, with an expected growth rate of 8.2% from 2022 to 2032. This growth suggests that more organizations are recognizing the importance of risk management and are seeking qualified candidates to lead these efforts. This trend provides a favorable environment for those looking to advance in their careers or transition into this field. Aspiring Risk Management Managers should consider the consistent demand for skilled professionals as they plan their career paths.

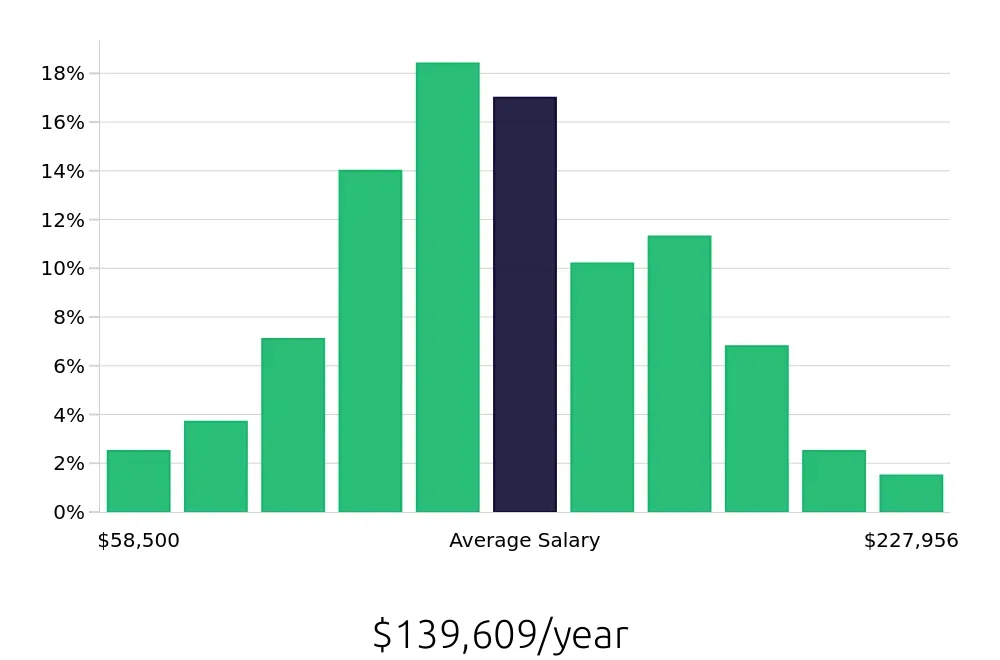

Professionals in this role can expect an average national annual compensation of $123,330, according to BLS data. This compensation reflects the critical nature of the work and the expertise required. The average hourly rate stands at $59.29, highlighting the value organizations place on experienced Risk Management Managers. For job seekers, these figures indicate both a competitive salary and the potential for career growth and stability.

Currently 195 Risk Management Manager job openings, nationwide.

Continue to Salaries for Risk Management Manager