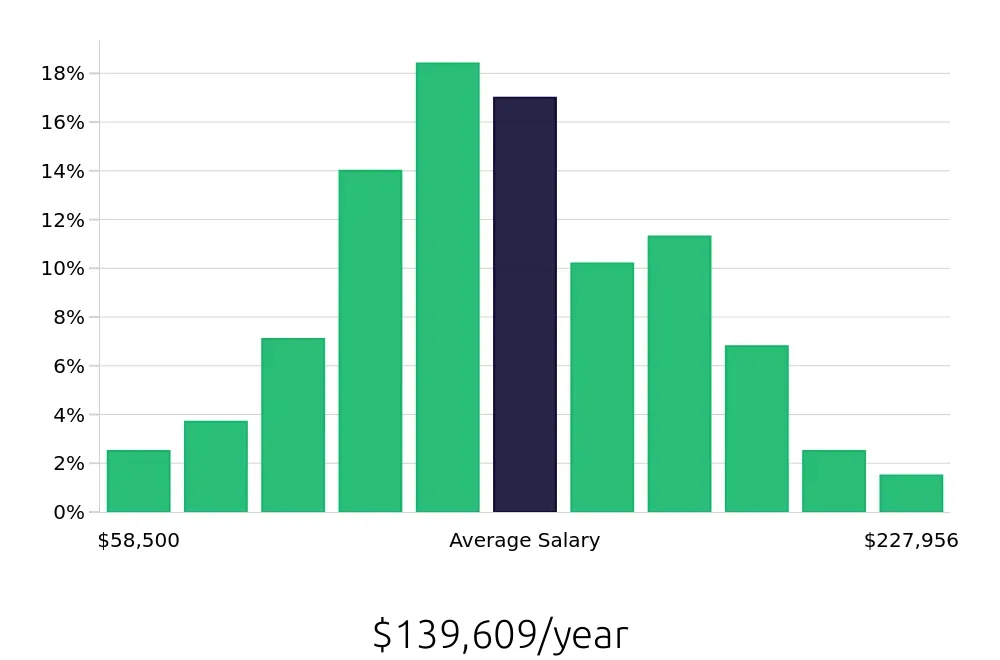

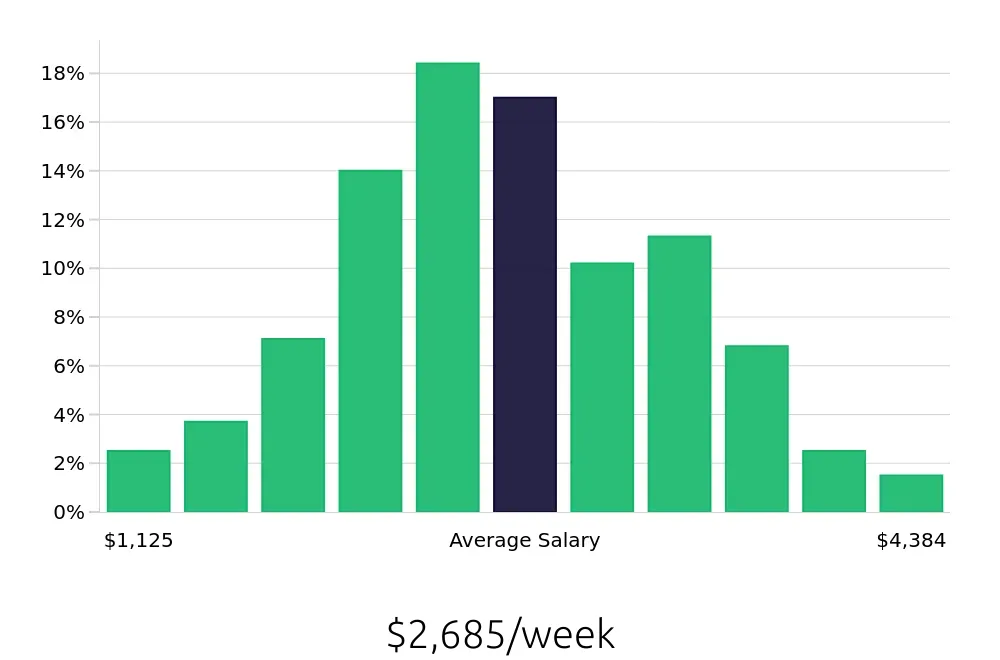

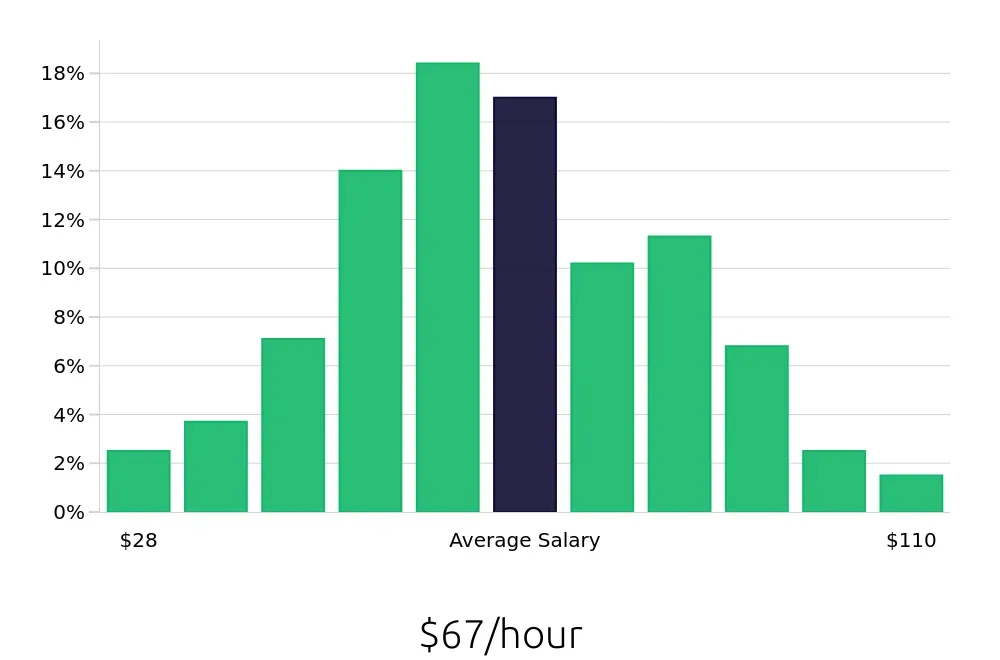

How much does a Risk Management Manager make?

A Risk Management Manager plays a vital role in protecting a company's assets and ensuring its long-term success. This professional's main task is to identify and manage potential risks. They create plans to avoid problems before they occur. On average, a Risk Management Manager earns about $139,609 each year. This salary can vary based on experience, location, and industry.

Risk Management Managers can find employment in various sectors, including finance, healthcare, and manufacturing. Their salary can differ depending on where they work. For instance, those in the finance industry may earn more due to the high stakes involved. Managers in healthcare might earn less, but the job provides an important service. Experience also affects earnings. More experienced managers often earn higher salaries. Those with advanced degrees or certifications may also see higher pay.

What are the highest paying cities for a Risk Management Manager?

-

San Francisco, CA

Average Salary: $170,394

In San Francisco, professionals work with leading tech companies to secure their assets and data. The fast-paced environment demands quick thinking and adaptability. Companies like Salesforce and Google offer exciting opportunities.

Find Risk Management Manager jobs in San Francisco, CA

-

Seattle, WA

Average Salary: $167,102

Seattle offers a unique blend of technology and natural beauty. Here, experts ensure companies like Microsoft and Amazon remain safe. The city’s innovative spirit makes risk management both challenging and rewarding.

Find Risk Management Manager jobs in Seattle, WA

-

Tampa, FL

Average Salary: $159,795

Tampa provides a warm climate and a growing job market. Risk managers here protect businesses from various threats. Companies such as Raymond James and TECO Energy look for skilled professionals to join their teams.

Find Risk Management Manager jobs in Tampa, FL

-

Dallas, TX

Average Salary: $154,501

In Dallas, professionals enjoy a mix of big-city opportunities and Southern hospitality. The area is home to companies like AT&T and ExxonMobil. Risk managers here play a key role in ensuring business continuity.

Find Risk Management Manager jobs in Dallas, TX

-

Cincinnati, OH

Average Salary: $153,416

Cincinnati offers a blend of urban and suburban living. The city is known for its financial sector. Professionals here work with companies like Procter & Gamble and Kroger to manage risks effectively.

Find Risk Management Manager jobs in Cincinnati, OH

-

Washington, DC

Average Salary: $152,185

Washington, DC, is a hub for political and financial activities. Risk managers here protect institutions from various threats. The city’s dynamic environment offers many opportunities to make a difference.

Find Risk Management Manager jobs in Washington, DC

-

Boston, MA

Average Salary: $150,897

Boston offers a rich history and a strong job market. Risk managers here work with companies like Fidelity and General Electric. The city's educational institutions also create many opportunities.

Find Risk Management Manager jobs in Boston, MA

-

Buffalo, NY

Average Salary: $150,753

Buffalo provides a balance of urban amenities and a lower cost of living. The city is known for its manufacturing sector. Risk managers here help companies navigate challenges and protect their interests.

Find Risk Management Manager jobs in Buffalo, NY

-

Atlanta, GA

Average Salary: $147,972

Atlanta is a growing city with a diverse economy. Risk managers here work with companies like Coca-Cola and Delta Airlines. The city offers many opportunities for career growth.

Find Risk Management Manager jobs in Atlanta, GA

-

Detroit, MI

Average Salary: $147,796

Detroit is known for its automotive industry. Risk managers here help companies like General Motors and Ford stay ahead. The city is experiencing a resurgence, offering many new opportunities.

Find Risk Management Manager jobs in Detroit, MI

What are the best companies a Risk Management Manager can work for?

-

Synchrony

Average Salary: $227,857

Synchrony works with customers to offer credit, collections, and other financial services. Their Risk Management Managers help ensure data security and risk control. Locations include the United States and Canada.

-

Intuit

Average Salary: $188,792

Intuit develops financial software for individuals and businesses. Their Risk Management Managers focus on minimizing financial and operational risks. The company operates in the United States, Canada, the United Kingdom, and Australia.

-

PwC

Average Salary: $188,228

PwC offers audit, tax, and consulting services globally. Their Risk Management Managers work on assessing and mitigating risks for clients. They operate in multiple countries worldwide.

-

Baker Tilly

Average Salary: $181,489

Baker Tilly provides accounting and consulting services. Their Risk Management Managers focus on strategic risk assessments. They have offices in the United States, Canada, and internationally.

-

KPMG

Average Salary: $177,443

KPMG offers audit, tax, and advisory services. Their Risk Management Managers ensure compliance and mitigate business risks. KPMG has a global presence with offices in over 150 countries.

-

EY

Average Salary: $171,790

EY provides assurance, tax, transaction, and advisory services. Their Risk Management Managers help clients manage risks effectively. They operate in more than 150 countries.

-

Huntington Bank

Average Salary: $163,615

Huntington Bank offers personal and commercial banking services. Their Risk Management Managers oversee risk assessment and management processes. They serve customers in the United States.

-

Citi

Average Salary: $158,958

Citi provides banking and financial services worldwide. Their Risk Management Managers focus on mitigating financial risks. They have a presence in over 100 countries.

-

Amazon.com

Average Salary: $153,313

Amazon is a global e-commerce and cloud computing company. Their Risk Management Managers ensure compliance and manage operational risks. Amazon operates in many countries, including the United States, Canada, and Europe.

-

Rsm

Average Salary: $151,875

Rsm provides audit, tax, and consulting services. Their Risk Management Managers work to identify and manage financial risks. The company operates in multiple locations in the United States.

How to earn more as a Risk Management Manager?

A Risk Management Manager plays a vital role in ensuring a company’s stability and success. By focusing on strategic decisions, this role carries a significant responsibility. To earn more in this position, certain key factors can make a difference.

First, gaining advanced certifications can boost earning potential. Certifications like the Certified Risk Manager (CRM) or Financial Risk Manager (FRM) stand out on a resume. These credentials show dedication to the field and expertise. Second, accumulating more experience brings higher compensation. Each year spent in the industry adds value. Managers with five or more years of experience often command higher salaries. Third, specializing in a high-demand area can lead to better pay. Risk areas such as cybersecurity, compliance, and financial risk management are currently in high demand. Fourth, relocating to areas with a higher cost of living can lead to salary increases. Managers willing to move for the right opportunity often see significant pay raises. Lastly, networking within the industry can open doors to better-paying positions. Attending conferences, joining professional organizations, and connecting with peers can lead to new job opportunities.

Consider these steps to increase earning potential as a Risk Management Manager. Earning advanced certifications, gaining experience, specializing in high-demand areas, relocating, and networking can all lead to higher salaries. These strategies require dedication and effort but offer rewarding results.

- Advanced Certifications: Earn credentials like CRM or FRM.

- Experience: Gain five or more years in the industry.

- Specialization: Focus on high-demand areas like cybersecurity.

- Relocation: Move to areas with a higher cost of living.

- Networking: Attend conferences and join professional organizations.