What does a Risk Specialist do?

A Risk Specialist plays a crucial role in ensuring the security and stability of an organization. They identify potential risks that could affect the company's operations, finances, and reputation. This involves analyzing data, assessing the likelihood of risks, and developing strategies to manage these risks effectively. The Risk Specialist works closely with different departments to understand their specific needs and tailor risk management plans accordingly.

Daily tasks for a Risk Specialist include conducting risk assessments, preparing detailed reports, and implementing risk mitigation plans. They must stay updated on the latest risk management trends and regulatory requirements. Good communication skills are essential as they need to explain complex risk concepts to non-specialists. Collaboration with senior management and other stakeholders helps ensure that risk management practices align with the organization's overall strategy. By proactively identifying and addressing risks, the Risk Specialist helps protect the organization from potential threats and supports its long-term success.

How to become a Risk Specialist?

Becoming a Risk Specialist can lead to a rewarding career in risk management. This profession involves assessing and mitigating risks for companies. It requires a blend of analytical skills, attention to detail, and knowledge of industry-specific risks. Here is a clear path to becoming a Risk Specialist.

First, focus on education. A bachelor’s degree in finance, business, economics, or a related field is often required. Some employers may prefer a master’s degree or relevant certifications. Second, gain experience through internships or entry-level jobs in risk management. Third, develop key skills such as data analysis, critical thinking, and communication. Fourth, seek out professional certifications to boost qualifications. Fifth, network with industry professionals to learn about job opportunities and best practices.

To succeed, follow these steps:

- Get a relevant degree.

- Gain practical experience.

- Develop essential skills.

- Earn professional certifications.

- Network within the industry.

By following these steps, job seekers can prepare themselves for a career as a Risk Specialist.

How long does it take to become a Risk Specialist?

The path to becoming a Risk Specialist involves several steps. Many start with a bachelor's degree in business, finance, or a related field. This education takes about four years. Some choose to pursue a master's degree, adding another two years.

After completing formal education, gaining experience is key. Risk Specialists often start in entry-level positions, such as financial analysts or insurance underwriters. This hands-on experience helps to build the necessary skills. Gaining relevant certifications, like the Professional Risk Manager (PRM) or the Certified Risk Management Professional (CRMP), can also boost career prospects. With the right combination of education and experience, one can become a Risk Specialist in about five to seven years.

Risk Specialist Job Description Sample

A Risk Specialist is responsible for identifying, analyzing, and mitigating potential risks that could impact the organization's operations, financial health, and reputation. This role involves developing and implementing risk management strategies, conducting risk assessments, and collaborating with various departments to ensure compliance with regulatory requirements and internal policies.

Responsibilities:

- Conduct comprehensive risk assessments to identify potential threats and vulnerabilities.

- Develop and implement risk management plans and strategies to mitigate identified risks.

- Collaborate with various departments to ensure risk management policies and procedures are effectively integrated into daily operations.

- Prepare detailed risk management reports and presentations for senior management.

- Stay updated on industry trends, regulatory changes, and best practices in risk management.

Qualifications

- Bachelor's degree in Risk Management, Finance, Business Administration, or a related field.

- Professional certifications such as FRM (Financial Risk Manager), PRM (Professional Risk Manager), or CRISC (Certified in Risk and Information Systems Control) are highly desirable.

- Minimum of 5 years of experience in risk management or a related field.

- Strong understanding of risk management principles, techniques, and methodologies.

- Excellent analytical and problem-solving skills.

Is becoming a Risk Specialist a good career path?

A Risk Specialist focuses on identifying, analyzing, and mitigating risks in a business. This role requires strong analytical skills and attention to detail. Companies often seek Risk Specialists to help them avoid potential hazards that could affect their operations or finances. This career path offers many opportunities for growth and specialization in areas such as insurance, finance, and consulting.

Working as a Risk Specialist involves evaluating risks related to investments, operations, and compliance. Specialists create risk management plans and suggest ways to reduce potential losses. This job often includes working closely with other departments to ensure all risks are addressed. Those in this role may also conduct training sessions to educate staff on risk management practices.

Being a Risk Specialist has several benefits and challenges. Consider these pros and cons:

- Pros:

- Stability: Many industries need Risk Specialists, offering job stability.

- Salary: This role often pays well, with potential for bonuses and promotions.

- Growth: Opportunities for advancement and specialization are available.

- Cons:

- Stress: High responsibility can lead to stress, especially during crises.

- Complexity: Understanding and analyzing risks requires significant expertise.

- Regulatory changes: Keeping up with new laws and regulations can be challenging.

What is the job outlook for a Risk Specialist?

The career outlook for Risk Specialists is promising, with an average of 61,300 job positions available each year according to the Bureau of Labor Statistics (BLS). This steady demand makes it a reliable career path for job seekers. The field also shows a positive job openings percent change, expected to grow by 8.2% from 2022 to 2032. This growth reflects the increasing need for professionals who can identify and mitigate risks in various industries.

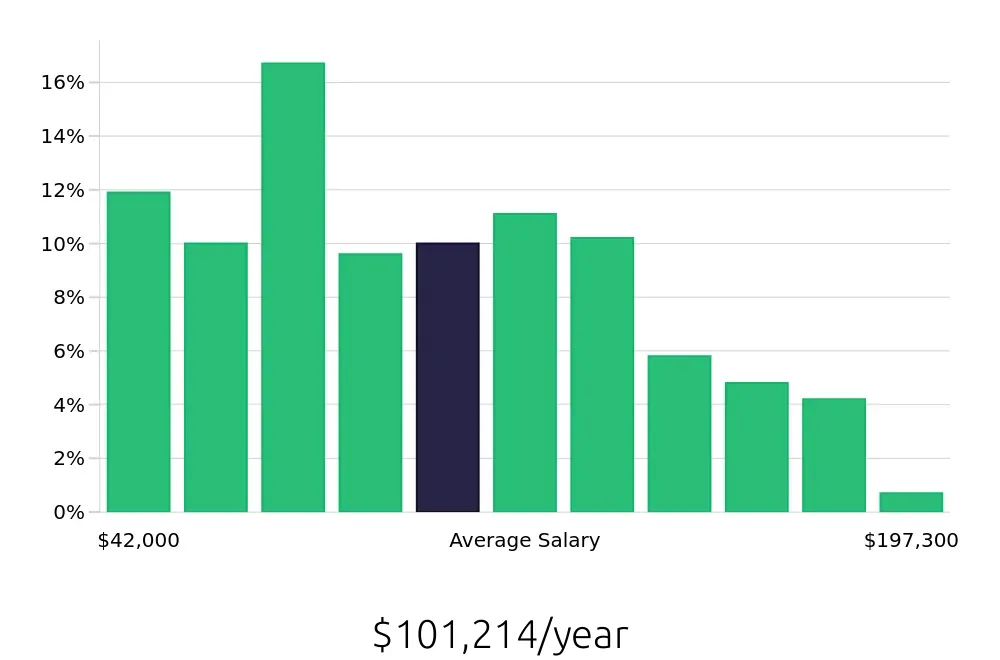

Risk Specialists earn a competitive salary, with an average national annual compensation of $123,330 as reported by the BLS. This figure highlights the financial rewards of entering this field. Hourly compensation averages $59.29, making it a lucrative career choice for those with the right skills and qualifications. The higher pay is a reflection of the critical role Risk Specialists play in ensuring the stability and success of their organizations.

Job seekers aiming for this role can expect a stable and growing job market. The combination of steady job positions, positive growth projections, and attractive compensation makes Risk Specialist a favorable career choice. Those who pursue this path can look forward to a rewarding career with ample opportunities for advancement.

Currently 122 Risk Specialist job openings, nationwide.

Continue to Salaries for Risk Specialist