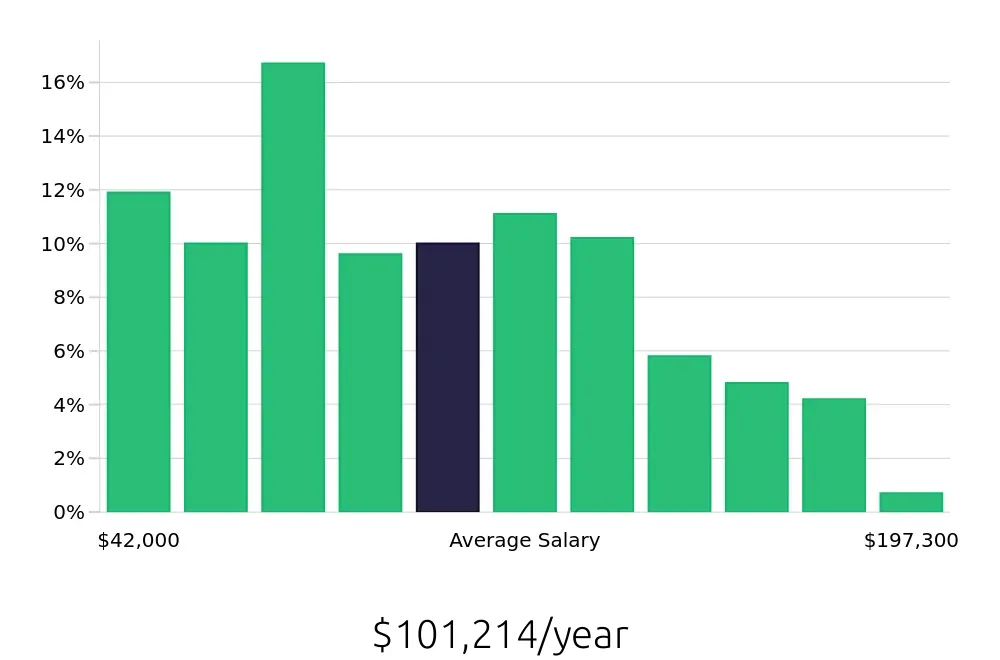

How much does a Risk Specialist make?

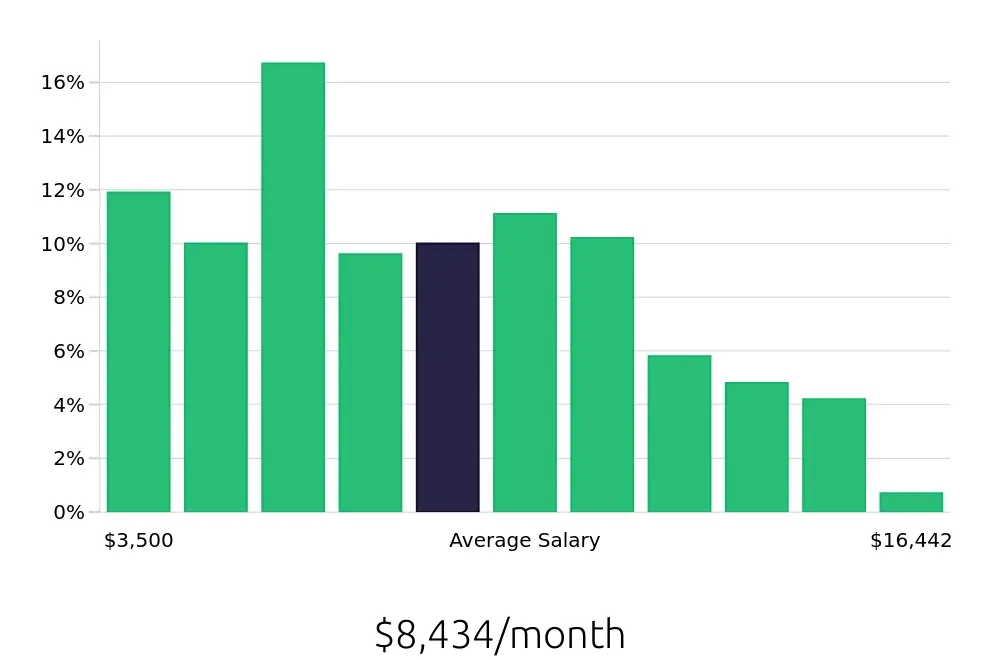

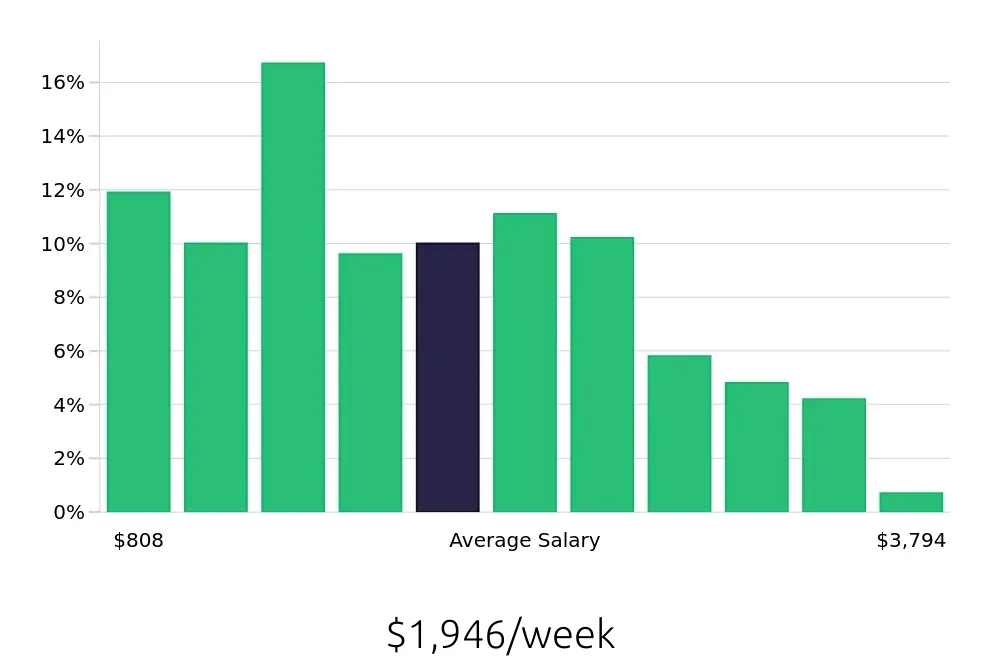

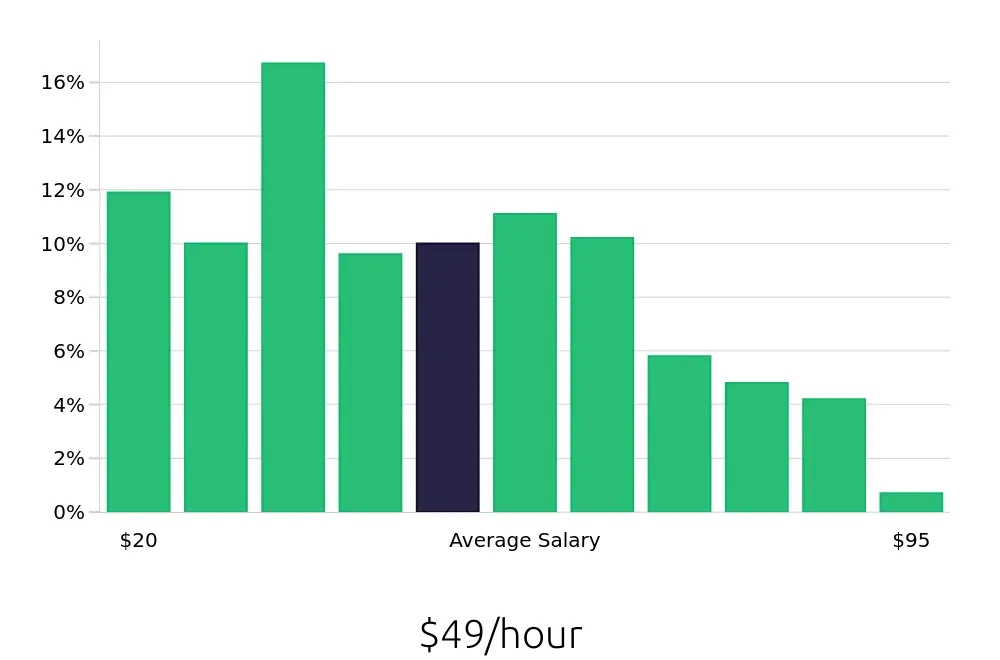

A Risk Specialist plays a key role in protecting businesses from potential losses. The average yearly salary for this position stands at approximately $101,214. This income can vary based on several factors, including the specialist's experience, location, and the specific industry they work in.

Here are some specific salary points for Risk Specialists:

- About 11.88% of specialists earn $42,000 or less.

- Around 10.01% earn between $42,000 and $56,118.

- Approximately 16.71% earn between $56,118 and $70,236.

- About 9.58% earn between $70,236 and $84,355.

- Around 10.01% earn between $84,355 and $98,473.

- Approximately 11.11% earn between $98,473 and $112,591.

- About 10.18% earn between $112,591 and $126,709.

- Around 5.85% earn between $126,709 and $140,827.

- About 4.75% earn between $140,827 and $154,945.

- About 4.24% earn between $154,945 and $169,064.

- About 0.68% earn $169,064 or more.

These figures show a range of salaries, indicating that with experience and skills, a Risk Specialist can earn a good living.

What are the highest paying cities for a Risk Specialist?

-

Washington, DC

Average Salary: $135,629

In Washington, DC, risk management roles offer access to key policy discussions. Major financial institutions and government agencies provide diverse opportunities.

Find Risk Specialist jobs in Washington, DC

-

Charlotte, NC

Average Salary: $128,242

Charlotte, NC, serves as a banking hub, making it ideal for risk experts. Companies like Bank of America and Wells Fargo offer dynamic work environments.

Find Risk Specialist jobs in Charlotte, NC

-

Boston, MA

Average Salary: $124,630

Boston, MA, attracts top talent to its finance and tech sectors. Risk professionals can work with leading firms in both industries.

Find Risk Specialist jobs in Boston, MA

-

Chicago, IL

Average Salary: $120,913

Chicago, IL, boasts a thriving financial sector. Risk specialists find many opportunities in banking, insurance, and trading firms.

Find Risk Specialist jobs in Chicago, IL

-

San Francisco, CA

Average Salary: $117,219

San Francisco, CA, is a tech haven, offering risk jobs in innovative companies. Tech startups and established firms provide exciting career paths.

Find Risk Specialist jobs in San Francisco, CA

-

Seattle, WA

Average Salary: $117,052

Seattle, WA, is known for its tech giants. Risk managers here work with companies like Microsoft and Amazon, in a fast-paced environment.

Find Risk Specialist jobs in Seattle, WA

-

Philadelphia, PA

Average Salary: $111,759

Philadelphia, PA, combines a rich history with modern finance. Risk experts can find opportunities in local banks and financial institutions.

Find Risk Specialist jobs in Philadelphia, PA

-

Dallas, TX

Average Salary: $108,127

Dallas, TX, is a growing business center. Risk specialists here work with energy firms and banks, in a vibrant job market.

Find Risk Specialist jobs in Dallas, TX

-

St. Louis, MO

Average Salary: $108,091

St. Louis, MO, offers a mix of finance and insurance roles. Local firms provide stable opportunities for risk professionals.

Find Risk Specialist jobs in St. Louis, MO

-

Minneapolis, MN

Average Salary: $107,224

Minneapolis, MN, has a strong financial sector. Risk roles here often involve working with insurance companies and banks.

Find Risk Specialist jobs in Minneapolis, MN

What are the best companies a Risk Specialist can work for?

-

KPMG

Average Salary: $169,500

KPMG offers Risk Specialist jobs with a strong focus on financial services and consulting. KPMG operates globally, including major offices in New York, London, and Sydney. They help businesses manage risks and improve financial performance.

-

Wells Fargo

Average Salary: $162,200

Wells Fargo has Risk Specialist roles with a focus on managing risks across banking and financial services. They have locations nationwide, including headquarters in San Francisco and major branches in New York and Chicago.

-

Amazon.com

Average Salary: $117,472

At Amazon, Risk Specialists analyze and mitigate risks in the fast-paced e-commerce environment. They operate out of headquarters in Seattle and many other global locations, including London and Tokyo.

-

TD Bank

Average Salary: $114,584

TD Bank offers Risk Specialist jobs with a focus on financial risk management. They have numerous branches across the U.S. and also operate in Canada, including major offices in Toronto and New York.

-

Deloitte

Average Salary: $112,216

Deloitte provides Risk Specialist roles with opportunities in consulting and financial advisory services. They have a global presence, with offices in major cities like New York, London, and Sydney.

-

Huntington Bank

Average Salary: $101,516

Huntington Bank offers Risk Specialist jobs focused on mitigating risks in the banking sector. They operate mainly in the Midwest, with headquarters in Columbus, Ohio, and branches across several states.

-

USI Insurance Services

Average Salary: $90,776

USI Insurance Services has Risk Specialist roles that focus on insurance risk management. They are headquartered in Irving, Texas, with additional offices across the United States.

-

KSI

Average Salary: $87,500

KSI offers Risk Specialist jobs with a focus on providing risk management services to clients. They operate from their headquarters in Baltimore, Maryland, and have a presence in several other locations.

-

U.S. Bank

Average Salary: $71,978

U.S. Bank has Risk Specialist roles that concentrate on mitigating risks in financial services. They operate from their headquarters in Minneapolis, Minnesota, and have branches across the U.S.

How to earn more as a Risk Specialist?

To increase earnings as a Risk Specialist, one should focus on several key areas. First, gaining specialized certifications can make a candidate more competitive and attractive to employers. Certifications such as the Financial Risk Manager (FRM) or the Chartered Enterprise Risk Analyst (CERA) can open doors to higher-paying positions. Continuous education and keeping up with industry standards will keep skills sharp and relevant.

Second, building a strong professional network can lead to better job opportunities and salary increases. Attending industry conferences, joining professional organizations, and connecting with colleagues on platforms like LinkedIn can create valuable connections. These relationships can provide insider information on job openings and salary trends, which can be crucial for negotiating higher pay. Additionally, gaining experience in different industries can make a Risk Specialist more versatile and marketable.

Consider these factors to earn more:

- Specialized certifications

- Strong professional network

- Experience in different industries

- Effective negotiation skills

- Continuous professional development