What does a Tax Preparer do?

A Tax Preparer helps individuals and businesses with their taxes. They gather important information and documents. They then use this information to fill out tax forms correctly. This role ensures that people pay the right amount of taxes. It also helps them avoid any penalties.

Responsibilities of a Tax Preparer include reviewing financial records, calculating tax liabilities, and ensuring compliance with tax laws. They often use specialized software to help with these tasks. Tax Preparers must stay up-to-date with tax regulations. This knowledge is crucial to provide accurate advice. They work with clients to explain tax laws and help them understand their tax obligations. This support can make the tax season less stressful and more manageable.

How to become a Tax Preparer?

Becoming a tax preparer can be a rewarding career choice. This role involves helping individuals and businesses file their taxes accurately and efficiently. If you are interested in pursuing this career, follow these key steps to get started.

First, gaining a strong understanding of tax laws and regulations is essential. This knowledge forms the foundation of the job. Individuals should familiarize themselves with federal, state, and local tax codes. Many resources are available, including online courses and textbooks. Additionally, attending workshops or seminars can provide valuable insights.

- Earn Relevant Education: While a college degree is not always required, obtaining a degree in accounting or a related field can be beneficial. Many community colleges offer certificate programs specifically designed for tax preparation.

- Gain Practical Experience: Look for internships or entry-level positions at accounting firms or tax preparation services. This hands-on experience is crucial for understanding how to handle different tax situations.

- Obtain Certification: Consider getting certified through recognized organizations such as the American Institute of CPAs (AICPA) or the National Association of Tax Professionals (NATP). Certification can enhance credibility and job prospects.

- Master Tax Software: Familiarity with tax preparation software is essential. Programs like TurboTax and H&R Block are commonly used. Practicing with these tools can improve efficiency and accuracy.

- Network and Build a Client Base: Connect with local businesses and community organizations to market services. Building a solid client base through referrals and word-of-mouth can lead to a successful career as a tax preparer.

How long does it take to become a Tax Preparer?

Interested in becoming a tax preparer? This role can be quite rewarding and offers a clear timeline. Generally, the process takes a few months to a year, depending on your path. First, some tax preparers gain experience through internships or entry-level jobs in accounting. This can take about three to six months. Others may choose to take courses or get certified.

Many opt for professional certifications from bodies like the American Institute of Certified Public Accountants (AICPA) or the National Association of Tax Professionals (NATP). These certifications can take a few months to complete and often involve passing an exam. If someone has a background in accounting or business, they might find the transition easier. They can complete any necessary training in three to six months. This may include formal education or on-the-job training. Each step brings you closer to being fully prepared to work as a tax preparer.

Tax Preparer Job Description Sample

We are seeking a detail-oriented and experienced Tax Preparer to join our team. The ideal candidate will have a strong background in tax preparation and be adept at handling various tax-related tasks efficiently.

Responsibilities:

- Prepare and file tax returns for individuals and businesses.

- Review financial documents and ensure all relevant information is accurately reported.

- Stay updated on current tax laws and regulations to ensure compliance.

- Provide clients with advice on tax planning and strategies.

- Communicate with clients to gather necessary information and answer any questions.

Qualifications

- Proven experience as a Tax Preparer or similar role.

- Proficient in tax preparation software (e.g., TurboTax, Lacerte, ProSeries).

- Strong knowledge of federal and state tax laws and regulations.

- Ability to analyze financial documents and identify relevant deductions and credits.

- Excellent attention to detail and organizational skills.

Is becoming a Tax Preparer a good career path?

A career as a Tax Preparer can offer many rewards. This role involves helping individuals and businesses file their tax returns accurately. Tax Preparers analyze financial information to ensure compliance with tax laws and maximize tax benefits. Many find this work fulfilling because it combines attention to detail with the opportunity to assist others.

Working as a Tax Preparer has both advantages and challenges. Here are some pros and cons to consider:

- Pros:

- Flexible work hours, including the option to work part-time.

- Opportunity to specialize in different areas, such as individual or business taxes.

- Potential for high earnings, especially with experience and certification.

- Helping clients understand their tax situation and save money.

- Cons:

- Seasonal work during tax filing periods can lead to busy times.

- Need to stay updated on changing tax laws and regulations.

- Potential for high-stress situations during tax season.

- Requires strong attention to detail and strong organizational skills.

What is the job outlook for a Tax Preparer?

The job outlook for Tax Preparers presents a stable and encouraging landscape for job seekers. The Bureau of Labor Statistics (BLS) reports an average of 16,500 job positions available each year. This consistent number ensures that new entrants to the field have ample opportunities to find employment. Furthermore, the BLS forecasts a modest 1.2% change in job openings from 2022 to 2032, indicating a steady demand for tax preparation services.

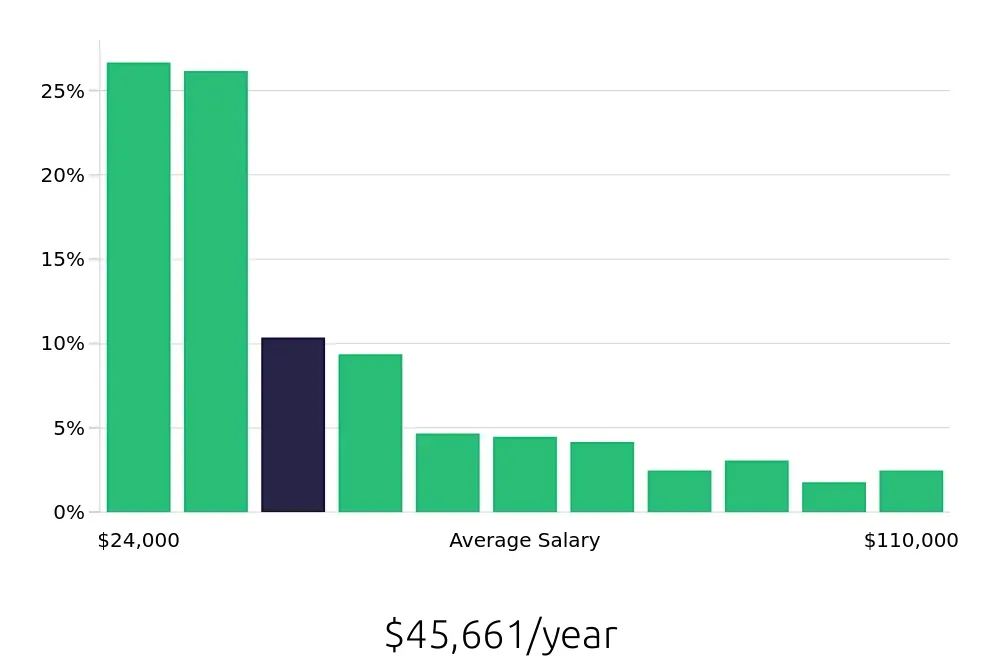

Apart from the steady job availability, Tax Preparers can expect a competitive compensation package. The average national annual salary stands at $60,900, according to the BLS. This figure reflects the value and expertise needed in the profession. Additionally, the hourly compensation averages $29.28, which is another testament to the rewarding nature of this career path. These figures highlight the financial benefits that come with a career in tax preparation.

In conclusion, a career as a Tax Preparer offers a reliable job outlook, consistent opportunities, and attractive compensation. Job seekers looking to enter this field can be confident in its stability and potential for professional growth. With the BLS data showing steady job positions and competitive salaries, now is a good time to pursue a career in tax preparation.

Currently 1,141 Tax Preparer job openings, nationwide.

Continue to Salaries for Tax Preparer