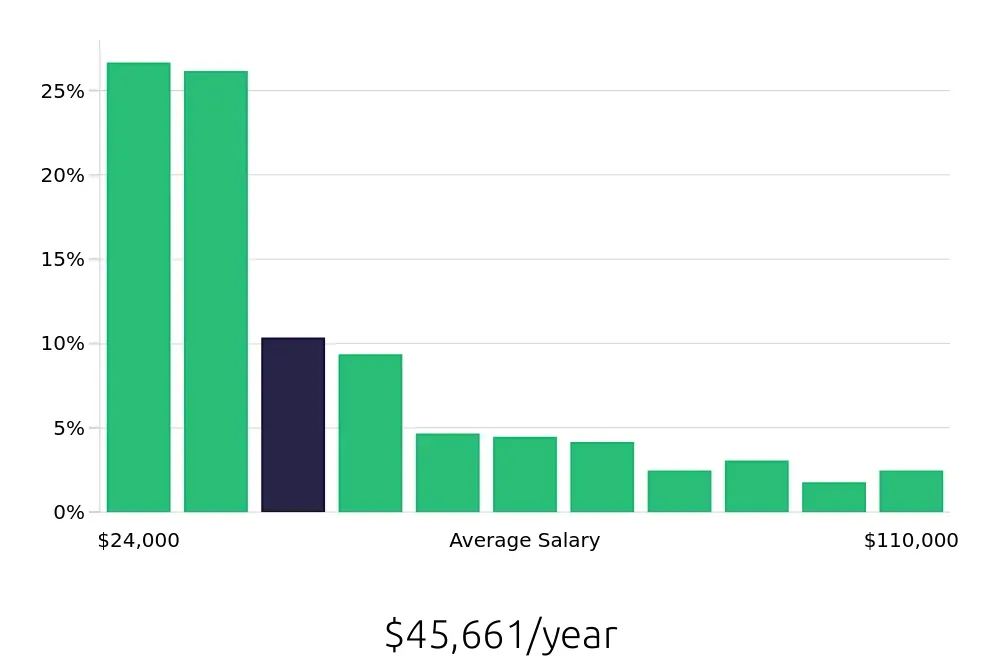

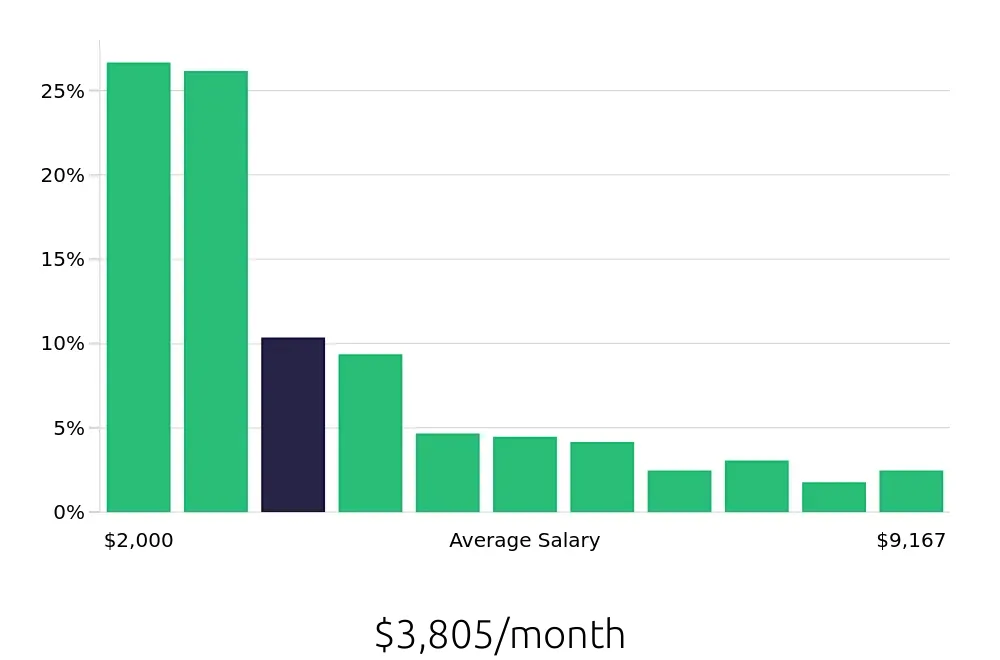

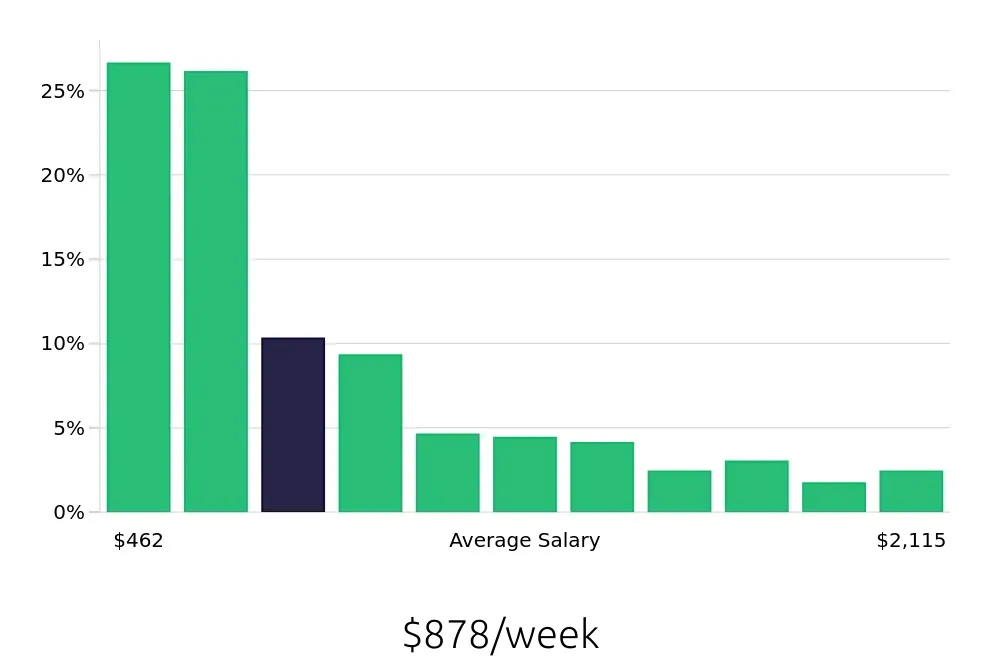

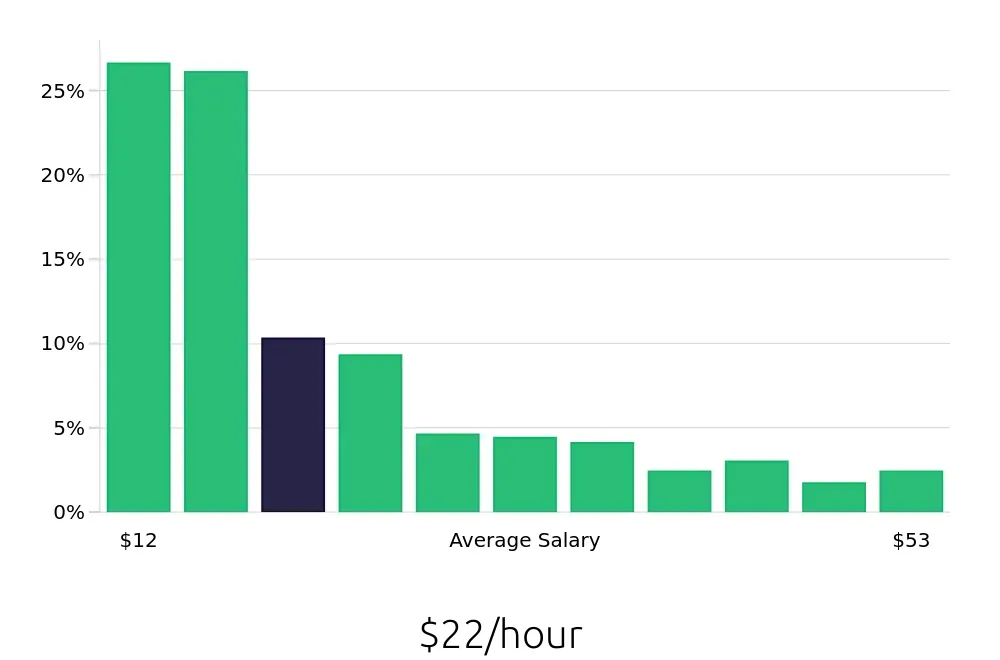

How much does a Tax Preparer make?

A Tax Preparer helps people figure out their taxes and fill out the right forms. This job can pay well, depending on experience and location. On average, a Tax Preparer makes about $45,661 per year. Some Tax Preparers make more or less, depending on how much they work and where they live.

Some Tax Preparers work for big companies or accounting firms. These jobs often pay higher salaries. For example, the top 10% of Tax Preparers earn more than $110,000 each year. Others may work for smaller firms or for themselves. Their pay can vary, but still offers good earning potential.

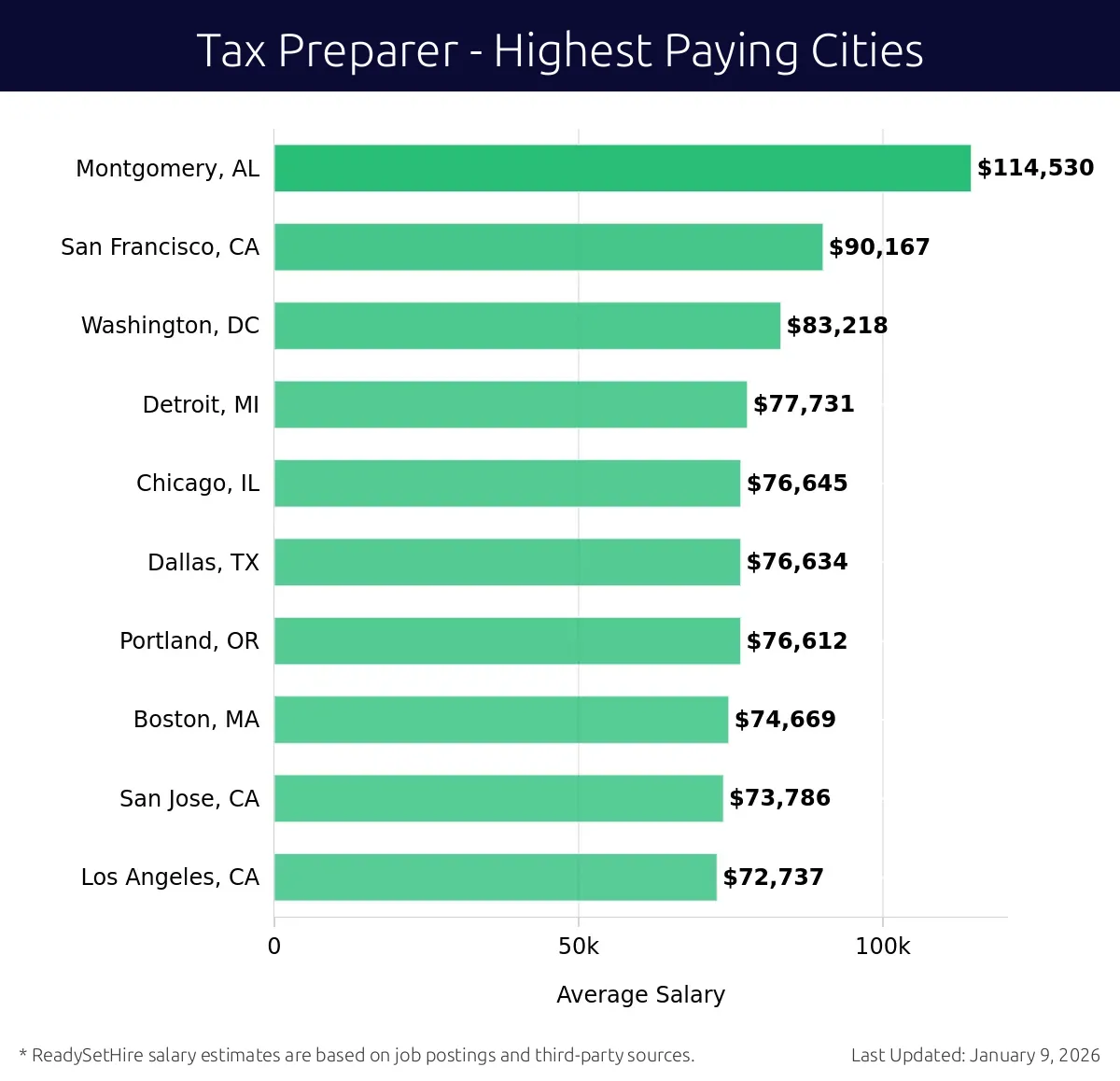

What are the highest paying cities for a Tax Preparer?

-

Montgomery, AL

Average Salary: $114,530

In Montgomery, tax professionals enjoy a stable job market with plenty of opportunities. The presence of diverse businesses provides a rich variety of tax scenarios to handle. Working with local firms, you gain hands-on experience with varied tax laws and regulations.

Find Tax Preparer jobs in Montgomery, AL

-

San Francisco, CA

Average Salary: $90,167

San Francisco offers a vibrant job environment with numerous financial institutions and tech companies. Professionals here benefit from a diverse range of tax preparation needs. Opportunities with major firms like Intuit and H&R Block provide excellent experience.

Find Tax Preparer jobs in San Francisco, CA

-

Washington, DC

Average Salary: $83,218

Washington, DC, is a hub for tax professionals with its concentration of government agencies. Working here means dealing with complex tax laws and getting exposure to federal tax regulations. Companies such as PricewaterhouseCoopers and EY offer great career growth opportunities.

Find Tax Preparer jobs in Washington, DC

-

Detroit, MI

Average Salary: $77,731

Detroit presents a unique market for tax experts with its blend of traditional industries and emerging sectors. The city’s diverse economy offers varied challenges and learning opportunities. Firms like KPMG and Deloitte provide excellent platforms for professional development.

Find Tax Preparer jobs in Detroit, MI

-

Chicago, IL

Average Salary: $76,645

Chicago’s dynamic job market offers tax specialists many opportunities. The city’s strong financial sector creates a demand for expert tax preparation services. Working with firms such as Grant Thornton and RSM USA, you can build a robust career in tax preparation.

Find Tax Preparer jobs in Chicago, IL

-

Dallas, TX

Average Salary: $76,634

Dallas boasts a thriving job market for tax professionals. The city’s diverse industries provide a wealth of tax preparation experiences. Companies like PwC and EY offer solid platforms for career advancement and professional growth.

Find Tax Preparer jobs in Dallas, TX

-

Portland, OR

Average Salary: $76,612

Portland offers a growing job market with a mix of small businesses and larger corporations. The city’s progressive atmosphere provides unique tax challenges. Working with local firms, you gain practical experience and build a strong professional network.

Find Tax Preparer jobs in Portland, OR

-

Boston, MA

Average Salary: $74,669

Boston’s rich history of finance and education creates a strong demand for tax experts. Professionals here benefit from working with prestigious firms like EY and KPMG. The diverse job market offers varied and rich tax preparation experiences.

Find Tax Preparer jobs in Boston, MA

-

San Jose, CA

Average Salary: $73,786

San Jose’s tech-driven economy offers exciting opportunities for tax preparers. The city’s growing industries provide unique tax challenges. Working with tech giants and major firms, you gain valuable experience in handling complex tax scenarios.

Find Tax Preparer jobs in San Jose, CA

-

Los Angeles, CA

Average Salary: $72,737

Los Angeles presents a bustling job market with its entertainment and diverse industries. The city’s dynamic job scene offers many opportunities for tax professionals. Companies like Deloitte and PwC provide excellent career growth prospects.

Find Tax Preparer jobs in Los Angeles, CA

What are the best companies a Tax Preparer can work for?

-

Rödl & Partner

Average Salary: $120,000

Rödl & Partner offers rewarding roles for Tax Preparers, focusing on individual and corporate tax preparation. The company operates in many locations, including New York, Miami, and San Francisco.

-

Deloitte

Average Salary: $89,169

At Deloitte, Tax Preparers work on complex tax returns and ensure compliance. Deloitte has offices across the country, including Chicago, Denver, and Los Angeles.

-

JDA TSG

Average Salary: $83,976

JDA TSG provides comprehensive tax preparation services. They serve clients in key areas such as New York City, Boston, and Philadelphia.

-

J & J Staffing Resources

Average Salary: $78,611

J & J Staffing Resources offers flexible tax preparation positions. They have offices in major cities, including Atlanta, Detroit, and Houston.

-

Ryan, LLC

Average Salary: $77,934

Ryan, LLC provides Tax Preparer jobs with strong client support. They have multiple locations, including Charlotte, Minneapolis, and Portland.

-

Guardian Tax

Average Salary: $67,599

Guardian Tax offers Tax Preparer positions with a focus on customer service. They operate in areas such as Los Angeles, Phoenix, and San Antonio.

-

Robert Half

Average Salary: $67,232

Robert Half offers diverse Tax Preparer roles, providing flexibility and growth. They have offices in major cities, including Boston, Seattle, and Washington, D.C.

-

AppleOne

Average Salary: $61,784

AppleOne provides Tax Preparer jobs with a wide range of experience levels. Their offices are located in areas like Chicago, Dallas, and San Diego.

-

1-800Accountant

Average Salary: $60,318

1-800Accountant offers Tax Preparer positions with a focus on efficiency and accuracy. They serve clients in key cities, including Denver, Miami, and San Francisco.

-

The Bonadio Group

Average Salary: $60,000

The Bonadio Group provides Tax Preparer jobs with opportunities for advancement. They are located in cities such as Buffalo, Rochester, and Syracuse.

How to earn more as a Tax Preparer?

A career as a tax preparer can be rewarding, both financially and professionally. To earn more in this field, consider focusing on these key areas. A tax preparer who masters these factors can increase their income and reputation.

First, gaining relevant certifications can boost earning potential. Certifications such as the Enrolled Agent (EA) or Certified Public Accountant (CPA) are highly valued in the industry. These credentials demonstrate expertise and can command higher fees from clients. Specialization in certain areas, such as small business tax preparation or estate planning, can also lead to higher income. Experience in these niches allows a tax preparer to cater to specific client needs, thereby increasing their value.

Second, building a strong reputation through excellent client service can lead to more business. Word-of-mouth referrals and positive reviews can attract new clients and encourage existing ones to return. Third, leveraging technology can enhance efficiency and productivity. Using advanced tax software and online tools can save time and reduce errors, allowing for more clients to be handled in less time. Fourth, expanding service offerings can also increase income. Offering additional services such as bookkeeping, financial planning, or payroll processing can create new revenue streams. Finally, networking and marketing efforts can lead to more clients. Joining professional organizations, attending industry events, and utilizing social media can increase visibility and attract new business.

An investment in these areas can lead to significant increases in income for tax preparers. By focusing on certifications, specialization, client service, technology, and marketing, tax preparers can position themselves for financial success.

- Certifications: Obtain relevant credentials like EA or CPA.

- Specialization: Focus on specific areas such as small business tax preparation.

- Client Service: Build a strong reputation through excellent service.

- Technology: Use advanced software and tools to increase efficiency.

- Expanded Services: Offer additional services like bookkeeping or financial planning.