What does a Underwriter do?

An underwriter evaluates risks for an insurance or finance company. They decide if a person or business should get a policy or loan. They look at the risks and costs. They study information about the person or business. This may include their health, finances, and history. They use this data to make a decision. They decide if the company should accept the risk. They also determine the terms and conditions, like the premium or interest rate. An underwriter plays a key role in managing the company’s risk.

An underwriter works closely with other teams. They talk with sales and customer service. They make sure all parties agree on the decision. They also review policies and loans after they are issued. They check if everything follows company rules. They may also recommend changes to improve processes. This role requires strong analytical skills. It also needs good communication skills. An underwriter must be detail-oriented and able to make sound decisions.

How to become a Underwriter?

Becoming an underwriter can be a rewarding career path. It involves assessing the risks of insurance applicants and making decisions about coverage. Here’s a step-by-step guide for those interested in this role.

First, start with a solid educational foundation. Most underwriters hold at least a bachelor's degree. Common majors include finance, business, economics, or insurance. This academic background provides the necessary knowledge of financial principles and risk management.

- Earn a relevant degree.

- Gain experience in a related field.

- Obtain necessary certifications.

- Apply for entry-level positions.

- Advance through the ranks.

Next, gain experience. Work in areas like finance, insurance, or customer service. This will help understand the practical aspects of risk assessment. Look for internships or entry-level jobs to build a resume.

Obtaining certifications can improve job prospects. Professional certifications like the Certified Insurance Counselor (CIC) or the Associate in Risk Management (ARM) can make candidates more attractive to employers. These credentials demonstrate a commitment to the profession and a deeper understanding of industry standards.

Apply for entry-level positions. Start with roles like underwriting assistant or claims analyst. These positions offer hands-on experience and a pathway to more advanced roles. Networking with industry professionals can also lead to job opportunities.

Finally, advance through the ranks. With experience and additional certifications, seek promotions to senior underwriter or team leader roles. Continuous learning and staying updated on industry trends will help in this career progression.

How long does it take to become a Underwriter?

Pursuing a career as an underwriter involves a mix of education, experience, and training. Most entry-level positions require at least a bachelor’s degree. Common majors include business, finance, economics, or insurance. Relevant courses often include statistics, accounting, and risk management.

After completing a degree, gaining some practical experience becomes important. Many underwriters start in assistant roles. They learn about risk assessment, policy analysis, and underwriting procedures. This can take about two to three years. Some may also choose to earn a professional certification, such as the Associate in Risk Management (ARM) or the Chartered Property Casualty Underwriter (CPCU). These certifications can enhance job prospects and open up more advanced positions.

Underwriter Job Description Sample

We are seeking a skilled Underwriter to join our team and assist in evaluating potential insurance risks and determining appropriate coverage terms. This role involves analyzing data, assessing risks, and collaborating with various departments to ensure accurate risk assessments and coverage recommendations.

Responsibilities:

- Analyze and evaluate insurance applications, assessing the risks associated with potential policyholders.

- Determine appropriate coverage terms, including policy limits, premiums, and endorsements based on risk assessments.

- Collaborate with sales and account management teams to provide underwriting recommendations and ensure accurate policy documentation.

- Review and interpret policy documents, ensuring compliance with company guidelines and regulatory requirements.

- Stay informed about industry trends, market conditions, and regulatory changes to adjust underwriting strategies accordingly.

Qualifications

- Bachelor’s degree in Finance, Business, Insurance, or a related field.

- Minimum of [X] years of experience in underwriting or a related role within the insurance industry.

- Strong analytical skills with the ability to assess and interpret complex data.

- Knowledge of insurance products, regulations, and industry best practices.

- Excellent communication and interpersonal skills, with the ability to collaborate effectively with internal teams and external stakeholders.

Is becoming a Underwriter a good career path?

Working as an underwriter involves assessing risks and making decisions about insurance policies. An underwriter examines risks to determine the terms of a policy and decides whether to approve coverage. This role requires a strong analytical mindset and attention to detail. Companies rely on underwriters to evaluate information and make informed decisions.

Underwriting can be a rewarding career. It offers the chance to work in different industries, including insurance, finance, and banking. Underwriters enjoy a stable job market and good earning potential. They can work in an office setting or remotely. Some underwriters can specialize in areas like property, liability, or health insurance. Working in this field can lead to career growth and opportunities for advancement.

However, the job has its challenges. Underwriters must make decisions based on limited information, which can be stressful. The role involves long hours and tight deadlines. Underwriters need to stay updated on laws and regulations, which can require extra study. The job can be repetitive, with similar tasks each day.

Here are some pros and cons to consider:

- Pros:

- Stable job market

- Good earning potential

- Opportunities for specialization

- Career growth and advancement

- Cons:

- High-stress decisions based on limited information

- Long hours and tight deadlines

- Need for continuous learning about laws and regulations

- Potential for repetitive tasks

What is the job outlook for a Underwriter?

Job seekers interested in the field of underwriting can look forward to a positive job outlook. The Bureau of Labor Statistics (BLS) reports an average of 61,300 job positions available each year for underwriters. This figure reflects a steady demand for professionals who can assess risks and determine insurance coverage.

Moreover, the BLS predicts a job openings percent change of 8.2% from 2022 to 2032, indicating a promising growth in the industry. This growth suggests a robust demand for skilled underwriters. Those entering or transitioning into this field can expect numerous opportunities.

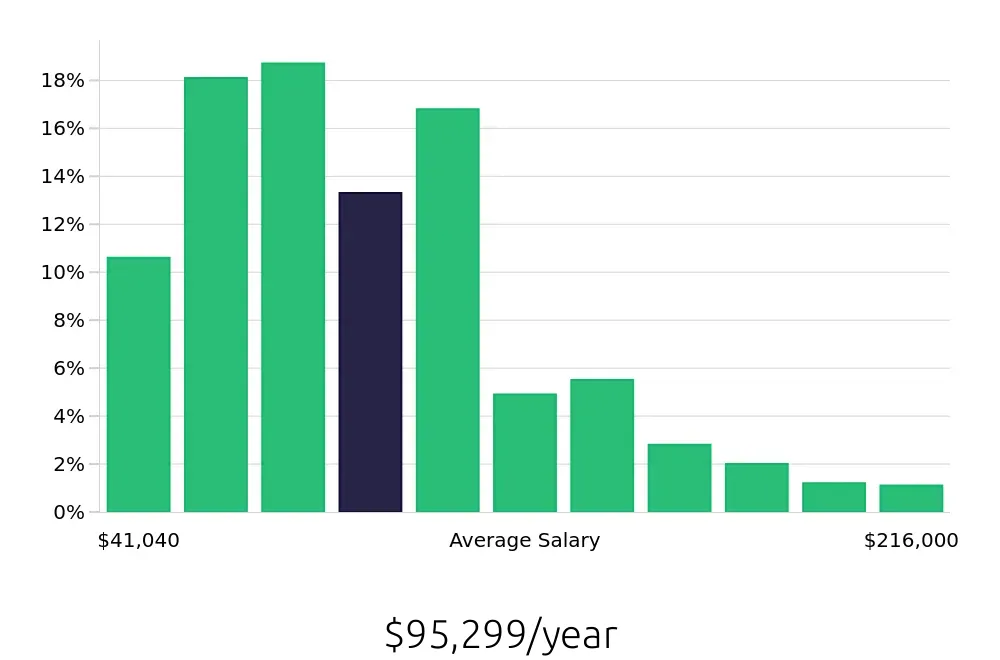

Underwriters also enjoy a competitive compensation package. The average national annual salary stands at $123,330, and the hourly rate is $59.29. These figures show that underwriting can be a lucrative career choice, offering both financial rewards and job security. For more detailed information, visit the BLS website.

Currently 622 Underwriter job openings, nationwide.

Continue to Salaries for Underwriter