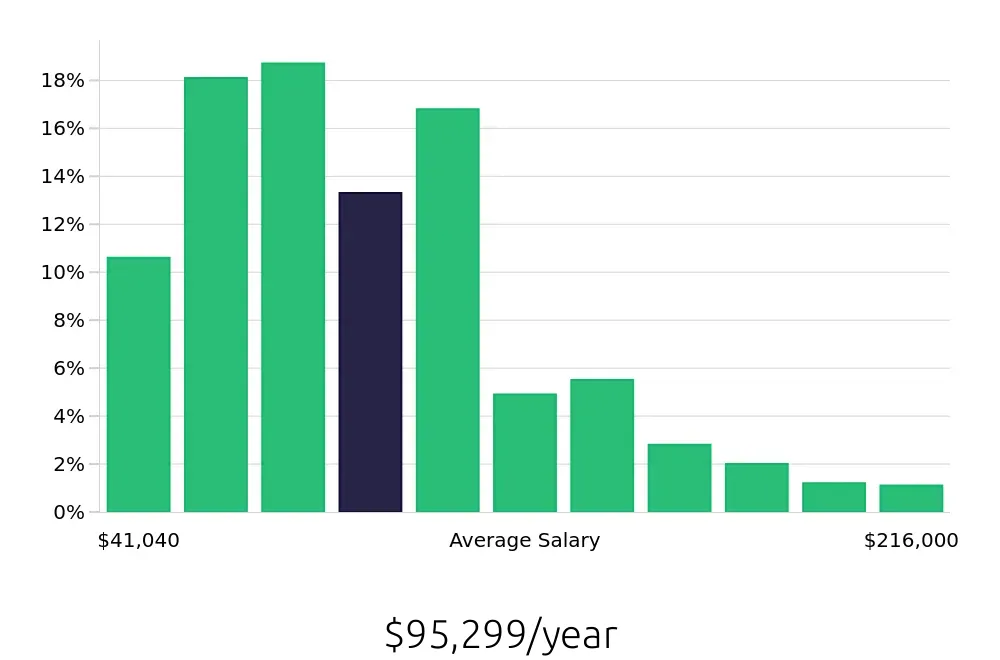

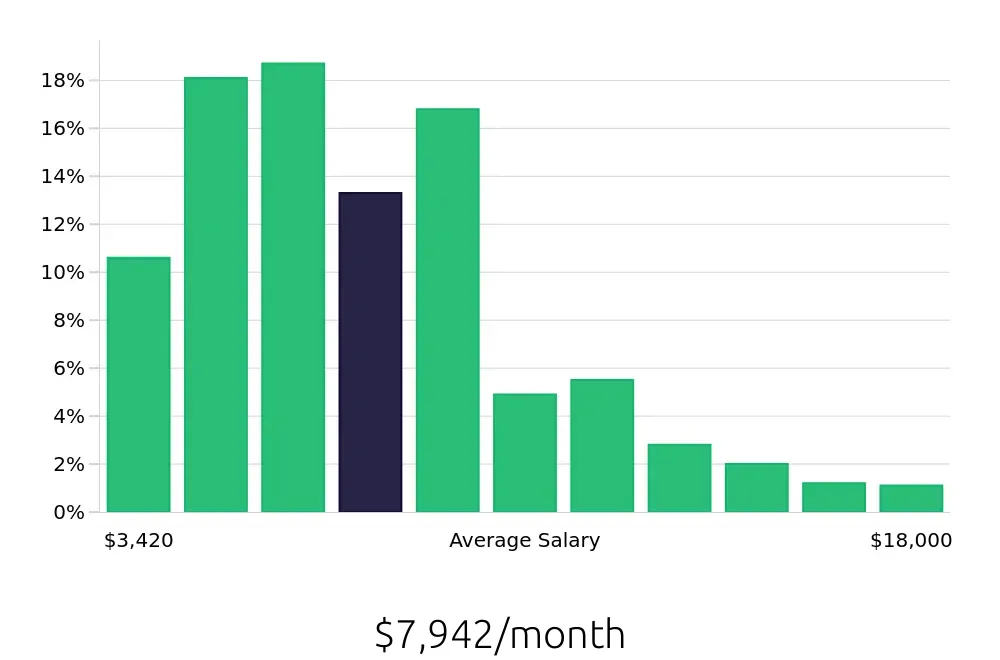

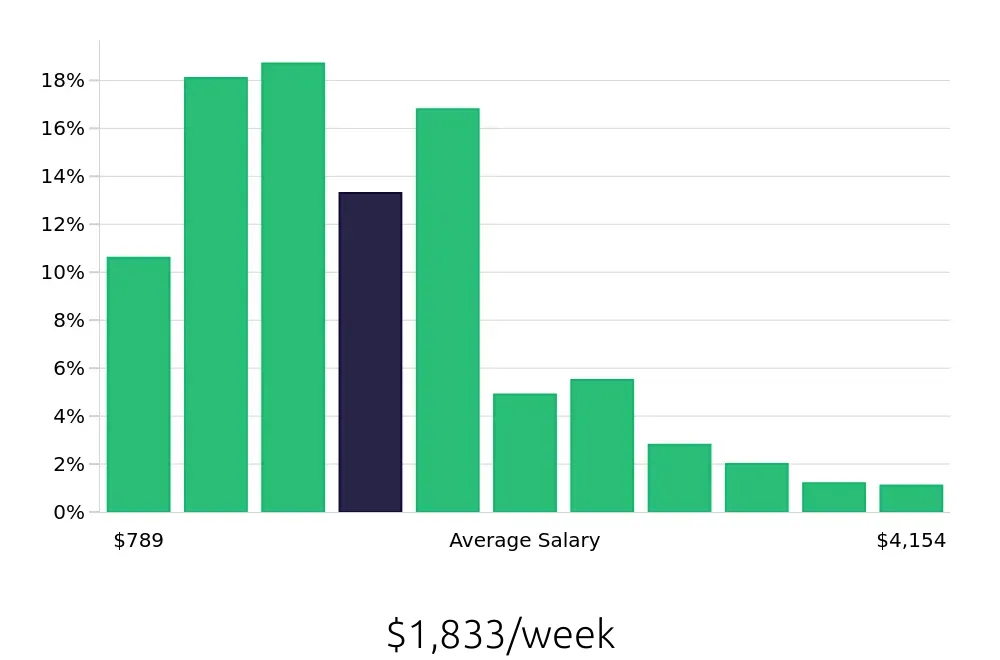

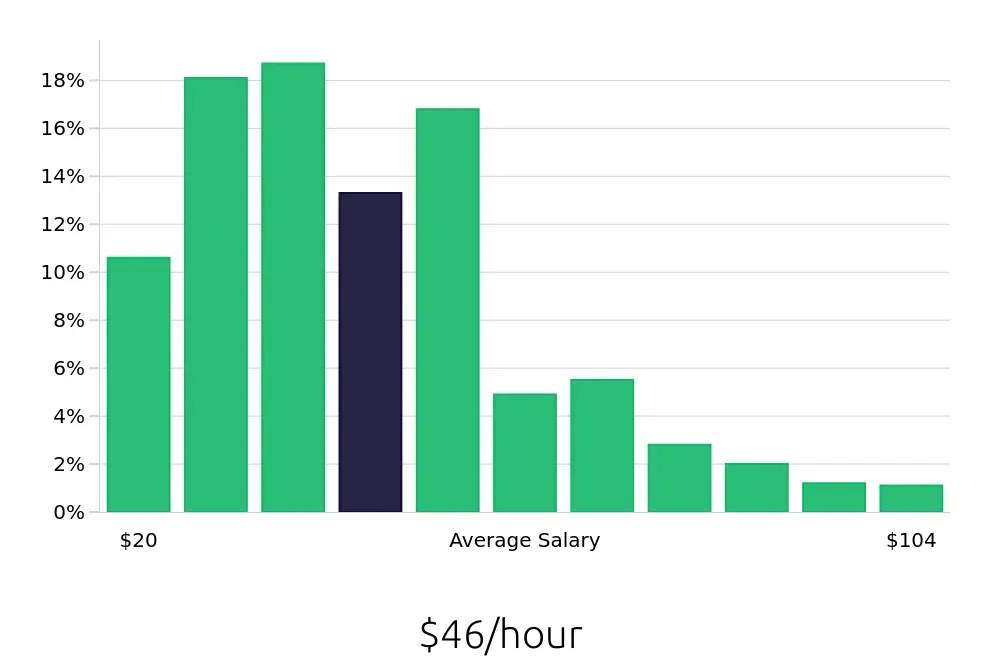

How much does a Underwriter make?

Underwriters look at risks and decide whether to provide insurance. Their work is important and interesting. They help people and businesses feel safe. The average yearly salary for an underwriter is around $95,299. But, this can change based on many things.

Some underwriters work for insurance companies. Others might work for banks or financial firms. Their pay can depend on their experience and where they work. New underwriters might start with a lower salary. Experienced underwriters can make more. There are many salary options, but the average is a good guide. It shows that being an underwriter can be a good career choice.

What are the highest paying cities for a Underwriter?

-

Stamford, CT

Average Salary: $142,768

In Stamford, job seekers will find a thriving insurance sector. Companies like The Hartford and Travelers thrive here, offering excellent opportunities for those entering the industry. The competitive salary makes it a desirable location for many.

Find Underwriter jobs in Stamford, CT

-

Boston, MA

Average Salary: $122,430

Boston stands out with its rich history in finance and insurance. Key players like State Street and Liberty Mutual provide diverse roles for professionals. The city's dynamic job market offers promising career growth.

Find Underwriter jobs in Boston, MA

-

Kansas City, MO

Average Salary: $116,149

Kansas City offers a robust insurance market with notable companies like American Century and Mutual of Omaha. Job seekers can expect a stable job environment with opportunities for career advancement.

Find Underwriter jobs in Kansas City, MO

-

San Francisco, CA

Average Salary: $114,230

San Francisco's tech-savvy environment offers unique opportunities in the insurance industry. Firms like MetLife and Safeco provide innovative roles. The city's competitive landscape encourages professional development.

Find Underwriter jobs in San Francisco, CA

-

Philadelphia, PA

Average Salary: $112,394

Philadelphia boasts a strong insurance industry, with giants like Lincoln Financial Group and Metlife leading the way. Job seekers can expect a mix of traditional and modern opportunities in a vibrant job market.

Find Underwriter jobs in Philadelphia, PA

-

Chicago, IL

Average Salary: $111,719

Chicago's insurance market is bustling with activity, featuring companies like Allstate and CNA Financial. The city's diverse economy offers a variety of roles, making it a great place to start or advance a career.

Find Underwriter jobs in Chicago, IL

-

Atlanta, GA

Average Salary: $110,202

Atlanta is a growing hub for insurance, with companies like SunTrust and State Farm driving the market. Job seekers benefit from a supportive job market that encourages professional growth.

Find Underwriter jobs in Atlanta, GA

-

Charlotte, NC

Average Salary: $106,363

Charlotte offers a dynamic insurance sector, with key firms like Bank of America and MetLife. Job seekers can look forward to a competitive salary and a variety of career opportunities.

Find Underwriter jobs in Charlotte, NC

-

Baltimore, MD

Average Salary: $106,289

Baltimore's insurance industry is supported by companies like Legg Mason and Fidelity National. Job seekers can find a range of roles with potential for advancement in a growing market.

Find Underwriter jobs in Baltimore, MD

-

Los Angeles, CA

Average Salary: $104,196

Los Angeles provides a vibrant job market with major insurance firms like Farmers Insurance and Travelers. Job seekers benefit from the city's diverse economy and numerous career opportunities.

Find Underwriter jobs in Los Angeles, CA

What are the best companies a Underwriter can work for?

-

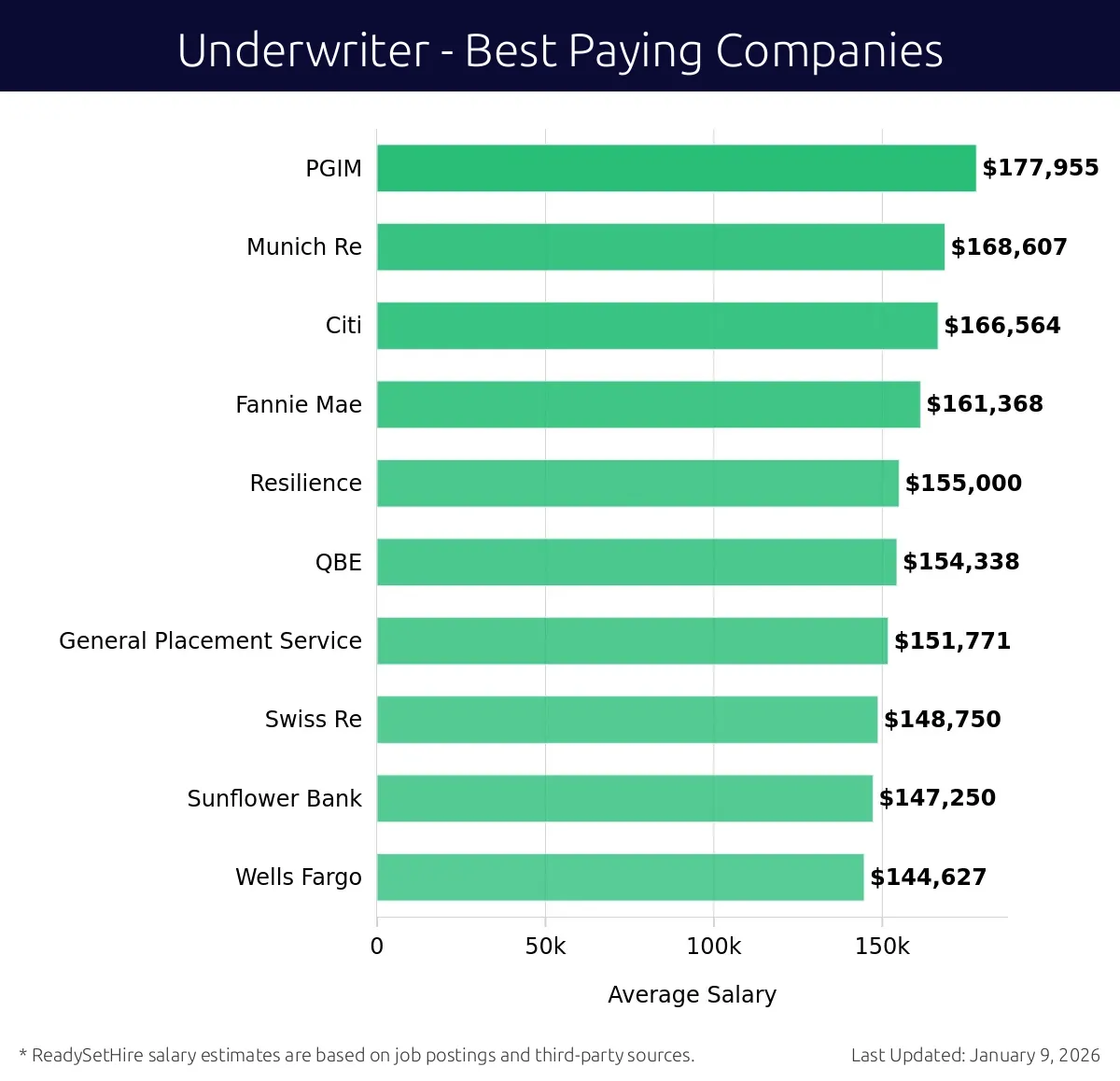

PGIM

Average Salary: $177,955

PGIM offers competitive salaries for Underwriters who assess risk and manage investments. This global investment management firm operates across many locations, including Newark, NJ, and Newark, DE.

-

Munich Re

Average Salary: $168,607

Munich Re provides top-tier salaries to Underwriters, who play a critical role in risk assessment and management. The company has a presence in major cities like New York, NY, and Washington, D.C.

-

Citi

Average Salary: $166,564

At Citi, Underwriters benefit from high salaries as they work on evaluating and managing financial risks. Citi's global influence is reflected in its offices in New York, NY, and London, UK.

-

Fannie Mae

Average Salary: $161,368

Fannie Mae offers attractive salaries for Underwriters, who assess mortgage risks. The company operates in key financial hubs such as Washington, D.C., and New York, NY.

-

Resilience

Average Salary: $155,000

Resilience provides substantial salaries to Underwriters who focus on risk management and assessment. The company has offices in New York, NY, and is expanding its reach.

-

QBE

Average Salary: $154,338

QBE offers competitive salaries for Underwriters who manage risk assessment. They operate in multiple locations, including Philadelphia, PA, and New York, NY.

-

General Placement Service

Average Salary: $151,771

General Placement Service provides good salaries for Underwriters who analyze and manage risks. The company is based in Boston, MA, and New York, NY.

-

Swiss Re

Average Salary: $148,750

Swiss Re offers solid salaries for Underwriters, who assess and manage risk. Their headquarters are in Zurich, Switzerland, and they have offices in New York, NY.

-

Sunflower Bank

Average Salary: $147,250

Sunflower Bank provides competitive salaries for Underwriters who handle risk assessment. They operate in major financial centers such as Kansas City, MO, and New York, NY.

-

Wells Fargo

Average Salary: $144,627

Wells Fargo offers good salaries for Underwriters who evaluate and manage financial risks. The company has a widespread presence with offices in San Francisco, CA, and New York, NY.

How to earn more as a Underwriter?

Becoming a top-earning Underwriter involves more than just a keen eye for detail. It requires dedication, skill, and a strategic approach to professional growth. An Underwriter assesses risks for companies, especially in the insurance and finance sectors. To earn more in this field, several factors play a key role. Understanding these can help boost your salary and job satisfaction.

First, gaining relevant experience is crucial. Companies often value Underwriters who have a solid track record of assessing and managing risk. Working in diverse industries can expand your skill set and make you more attractive to potential employers. Networking with other professionals can also open doors to higher-paying positions. Building a strong professional network helps you stay informed about job opportunities and industry trends.

Second, obtaining certifications can significantly enhance your earning potential. Certifications such as the Chartered Enterprise Valuer (CEV) or the Associate in Risk Management (ARM) are highly regarded. These credentials demonstrate your commitment to the profession and your expertise. Continuing education is vital in a rapidly changing industry. Keep your skills up to date to remain competitive.

Third, mastering data analysis and technology can set you apart. Proficiency with software and analytical tools can improve your efficiency and accuracy. This skill is in high demand as companies look for Underwriters who can quickly analyze complex data. Fourth, developing strong communication skills is essential. Clearly presenting your findings can lead to better decisions and higher job satisfaction. Lastly, seeking leadership opportunities can lead to higher pay. Taking on roles such as team leader or manager can open the door to more lucrative positions.

- Gain relevant experience

- Obtain certifications

- Master data analysis and technology

- Develop strong communication skills

- Seek leadership opportunities