What does a Underwriting Consultant do?

An Underwriting Consultant plays a vital role in the insurance industry. They evaluate risks associated with insuring individuals, businesses, or property. The consultant assesses the likelihood of a claim being made and determines the appropriate insurance coverage and premiums. This role involves analyzing data, financial records, and market trends to make informed decisions. The consultant works closely with clients, brokers, and underwriters to ensure accurate risk assessments. They must stay updated on industry changes and regulations to provide the best service.

The Underwriting Consultant communicates effectively with various stakeholders. They prepare detailed reports and presentations to support underwriting decisions. This role requires strong analytical skills and attention to detail. The consultant must also have excellent problem-solving abilities to address complex risk scenarios. By understanding the needs of clients and the potential risks, the Underwriting Consultant helps to create policies that protect against financial loss. This role is crucial in maintaining the balance between risk management and customer satisfaction.

How to become a Underwriting Consultant?

Becoming an Underwriting Consultant involves a clear path of education, experience, and professional development. This role requires a mix of skills in risk assessment, finance, and communication. By following a structured approach, individuals can position themselves for success in this competitive field.

Here are the key steps to embark on this career:

- Obtain a relevant degree. Start with a bachelor's degree in finance, business, or a related field.

- Gain experience. Work in the insurance industry to understand underwriting processes. Aim for roles in claims or underwriting.

- Get certified. Consider certifications like Associate in Risk Management (ARM) or Chartered Property Casualty Underwriter (CPCU). These add value to your resume.

- Network. Join professional organizations and attend industry events. Networking can lead to job opportunities and mentorship.

- Start consulting. Use your experience and knowledge to offer consulting services. Build a strong portfolio to showcase your expertise.

How long does it take to become a Underwriting Consultant?

Choosing a career in underwriting consulting can lead to a rewarding path in the insurance and finance industries. The journey to becoming a successful consultant often starts with a solid educational foundation. Many professionals begin with a bachelor’s degree in business, finance, or a related field, which typically takes four years to complete.

Following a bachelor’s degree, gaining experience in the insurance industry is crucial. Many individuals work in roles such as an insurance adjuster, claims processor, or risk manager. This hands-on experience can take two to five years, depending on the role and the industry. With sufficient experience and knowledge, candidates can then take on an underwriting consultant position. The transition to a consultant role may vary, with some professionals moving into this role after gaining experience, while others may choose to pursue further education or certifications to enhance their credentials. The total time from education to a full-time consultant role can range from five to ten years, making it a challenging but fulfilling career path.

Underwriting Consultant Job Description Sample

As an Underwriting Consultant, you will be responsible for evaluating and analyzing risk factors for various insurance policies. Your expertise will help in making informed decisions on policy issuance and premium determination, ensuring the company's financial stability and customer satisfaction.

Responsibilities:

- Conduct thorough assessments of clients' risk profiles.

- Analyze data to determine policy terms, conditions, and premium rates.

- Collaborate with sales teams to understand client needs and provide underwriting recommendations.

- Review and approve insurance applications and policy changes.

- Stay updated with industry trends, regulations, and best practices.

Qualifications

- Bachelor's degree in Business, Finance, Risk Management, or a related field.

- Minimum of 3-5 years of experience in underwriting or a related role.

- Strong analytical skills with the ability to interpret complex data.

- Knowledge of insurance policies, regulations, and industry standards.

- Excellent communication and interpersonal skills.

Is becoming a Underwriting Consultant a good career path?

An Underwriting Consultant plays a vital role in the insurance industry. This professional examines and evaluates risks to determine the terms of coverage. They work with clients and insurance companies to ensure the right policies are in place. This role requires a strong understanding of risk assessment and financial principles. It also involves analyzing data and making informed decisions.

Choosing a career as an Underwriting Consultant has many benefits. First, it offers a stable and often rewarding income. The demand for skilled underwriters is growing. Second, it provides opportunities for professional development and career advancement. Those who excel can move into higher roles within the insurance industry. Third, it involves working with a variety of clients, from individuals to large corporations. Each case presents new challenges and learning experiences. However, the job also has its challenges. The need for accuracy and attention to detail can be stressful. The role often requires long hours and the ability to meet tight deadlines. Additionally, the job can be repetitive and may involve extensive data analysis. These factors can lead to burnout if not managed properly.

Here are some pros and cons to consider:

- Pros:

- Stable and often rewarding income

- Opportunities for professional development

- Variety of clients and cases

- Cons:

- High stress due to need for accuracy

- Potential for long hours and tight deadlines

- Repetitive tasks and data analysis

What is the job outlook for a Underwriting Consultant?

The role of an Underwriting Consultant offers a promising career path for job seekers in the insurance industry. With an average of 61,300 job positions available each year, this field continues to grow and provide ample opportunities. The Bureau of Labor Statistics (BLS) reports a projected increase of 8.2% in job openings from 2022 to 2032, indicating strong growth potential for those entering this profession.

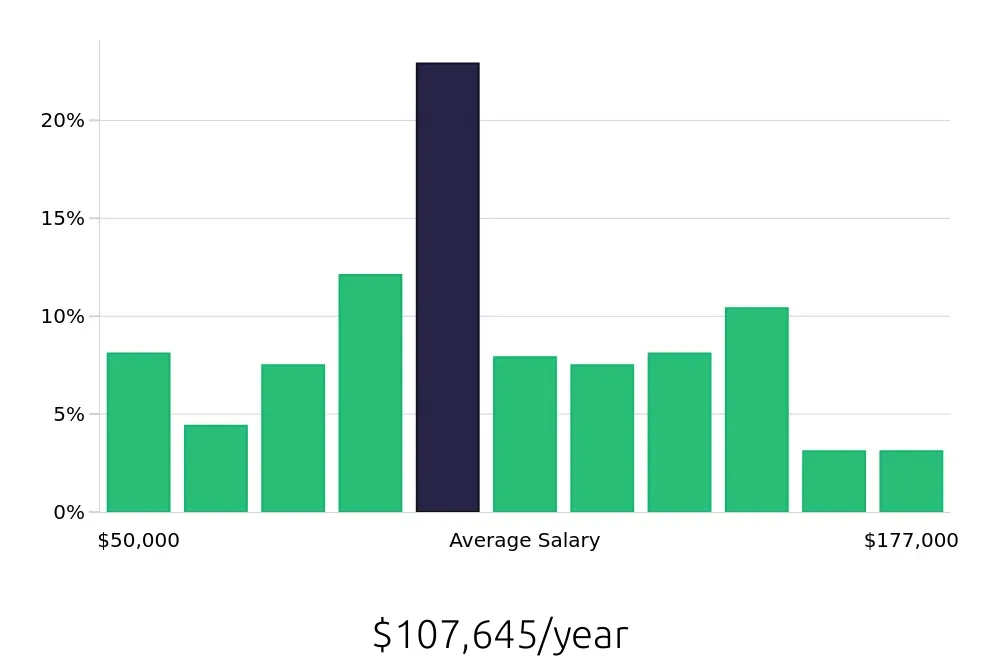

A key factor that makes Underwriting Consulting attractive is the competitive compensation. According to the BLS, the average national annual salary for Underwriting Consultants is $123,330. On an hourly basis, consultants earn an average of $59.29 per hour. This combination of a high average salary and steady job availability makes underwriting consultancy a lucrative field to consider. This financial stability can be a significant draw for job seekers looking for a rewarding career.

Job seekers interested in underwriting consultancy will find that this role not only offers financial benefits but also a dynamic work environment. With the industry's expected growth and the high demand for skilled professionals, those who enter this field can look forward to a promising future. Aspiring Underwriting Consultants should prepare to leverage these trends to their advantage as they seek employment in this growing sector.

Currently 33 Underwriting Consultant job openings, nationwide.

Continue to Salaries for Underwriting Consultant