How much does a Underwriting Consultant make?

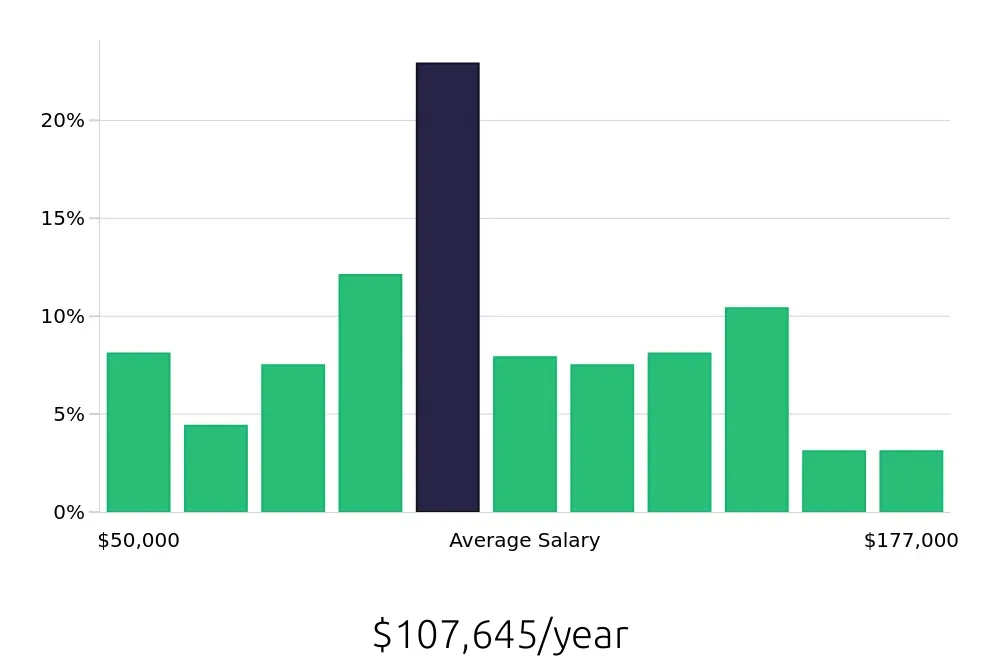

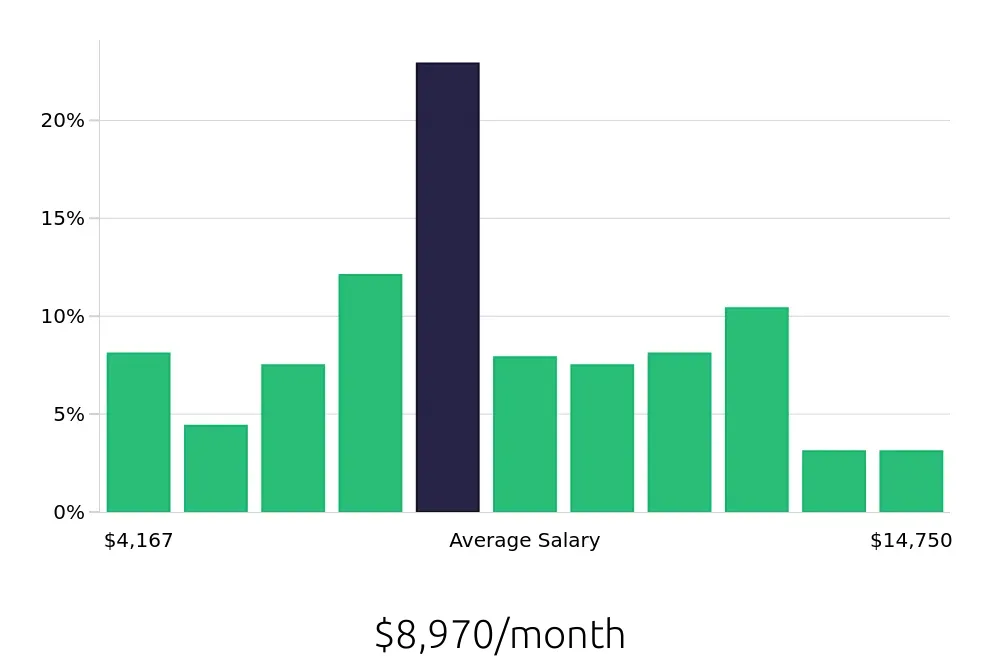

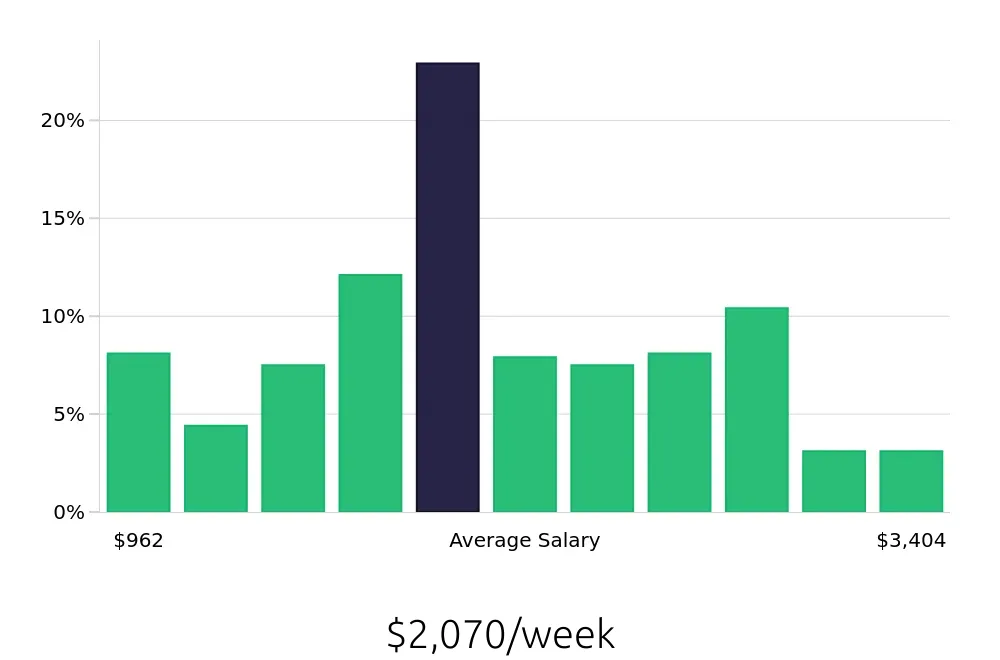

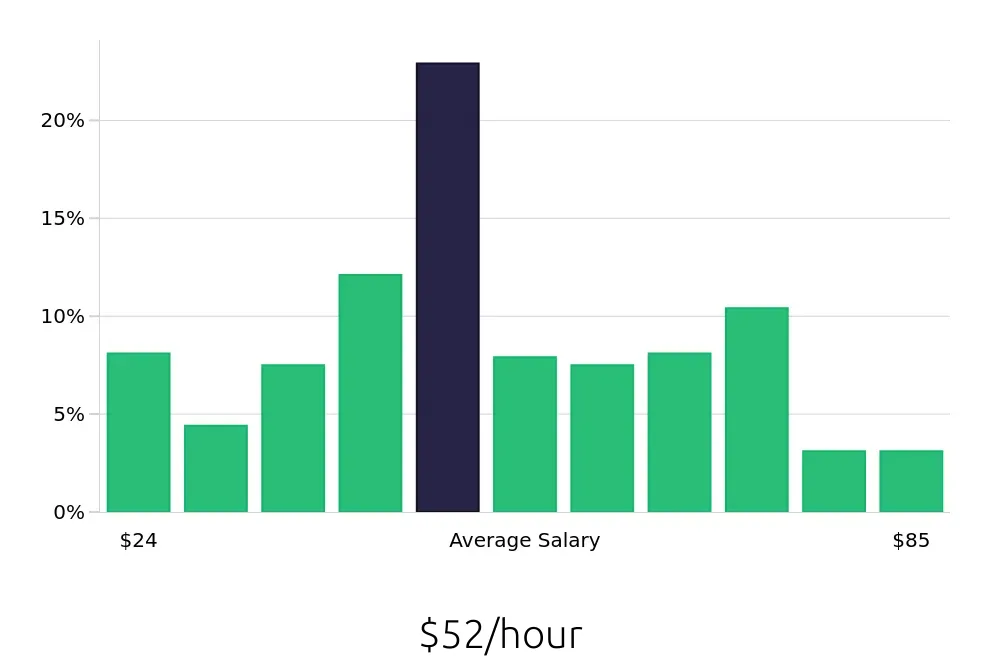

Underwriting Consultants play a key role in the insurance and finance industries. Their job is to assess the risk of insuring people, businesses, or properties. This important work earns them a good salary. On average, Underwriting Consultants make around $107,645 a year. This amount can vary based on experience and location.

Factors that can affect salary include:

- Years of experience

- Location of the job

- The industry they work in

- Education and certifications

Starting Underwriting Consultants can earn about $50,000 a year. Experienced professionals can make up to $177,000 annually. This range shows the potential for growth and the importance of gaining experience in the field.

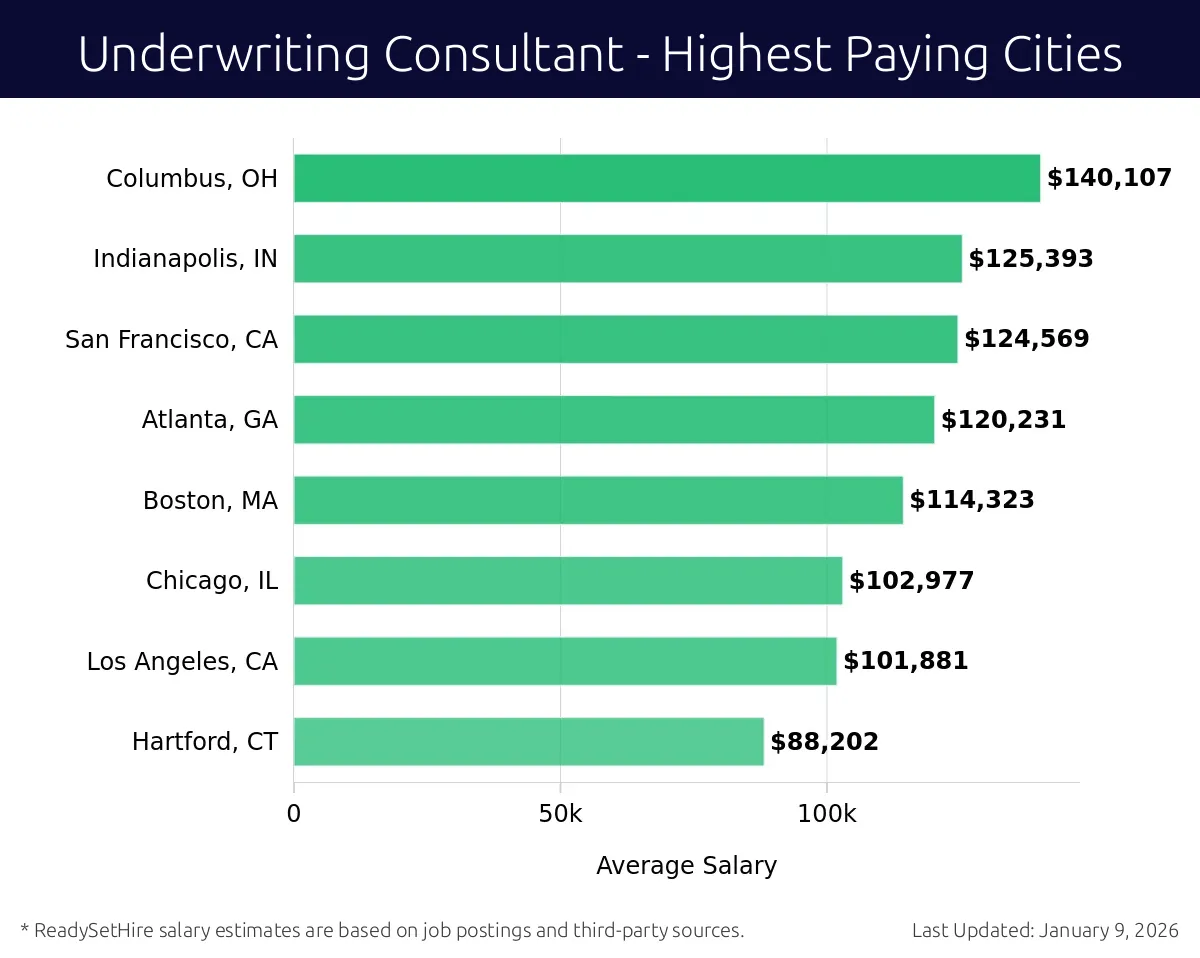

What are the highest paying cities for a Underwriting Consultant?

-

Columbus, OH

Average Salary: $140,107

Working in Columbus offers a stable environment for evaluating risk and making insurance decisions. Companies like Nationwide and Huntington National Bank provide opportunities to analyze policies and manage claims effectively.

Find Underwriting Consultant jobs in Columbus, OH

-

Indianapolis, IN

Average Salary: $125,393

In Indianapolis, consultants focus on assessing risks for businesses and individuals. Firms such as Indiana Farm Bureau and Conseco offer diverse roles in underwriting and client service.

Find Underwriting Consultant jobs in Indianapolis, IN

-

San Francisco, CA

Average Salary: $124,569

San Francisco presents a dynamic market for those in underwriting. Working with tech giants like Google and Salesforce, consultants evaluate risks for innovative products and services.

Find Underwriting Consultant jobs in San Francisco, CA

-

Atlanta, GA

Average Salary: $120,231

Atlanta's insurance sector is booming, providing ample opportunities for consultants to work with companies like Aflac and Allstate. The city's growth offers a vibrant environment for risk evaluation.

Find Underwriting Consultant jobs in Atlanta, GA

-

Boston, MA

Average Salary: $114,323

Boston's rich history in finance and insurance creates a robust setting for consultants. Employers such as MassMutual and John Hancock offer significant experience in the field.

Find Underwriting Consultant jobs in Boston, MA

-

Chicago, IL

Average Salary: $102,977

Chicago's insurance hub attracts many companies, making it a great place for consultants. Firms like Allstate and CNA Financial provide a competitive edge in the market.

Find Underwriting Consultant jobs in Chicago, IL

-

Los Angeles, CA

Average Salary: $101,881

Los Angeles offers diverse opportunities for consultants in the entertainment and tech industries. Companies like Farmers Insurance and State Farm present unique challenges in underwriting.

Find Underwriting Consultant jobs in Los Angeles, CA

-

Hartford, CT

Average Salary: $88,202

Hartford, known as the insurance capital, provides a strong foundation for consultants. Working with Aetna and Travelers, professionals can develop their risk assessment skills.

Find Underwriting Consultant jobs in Hartford, CT

What are the best companies a Underwriting Consultant can work for?

-

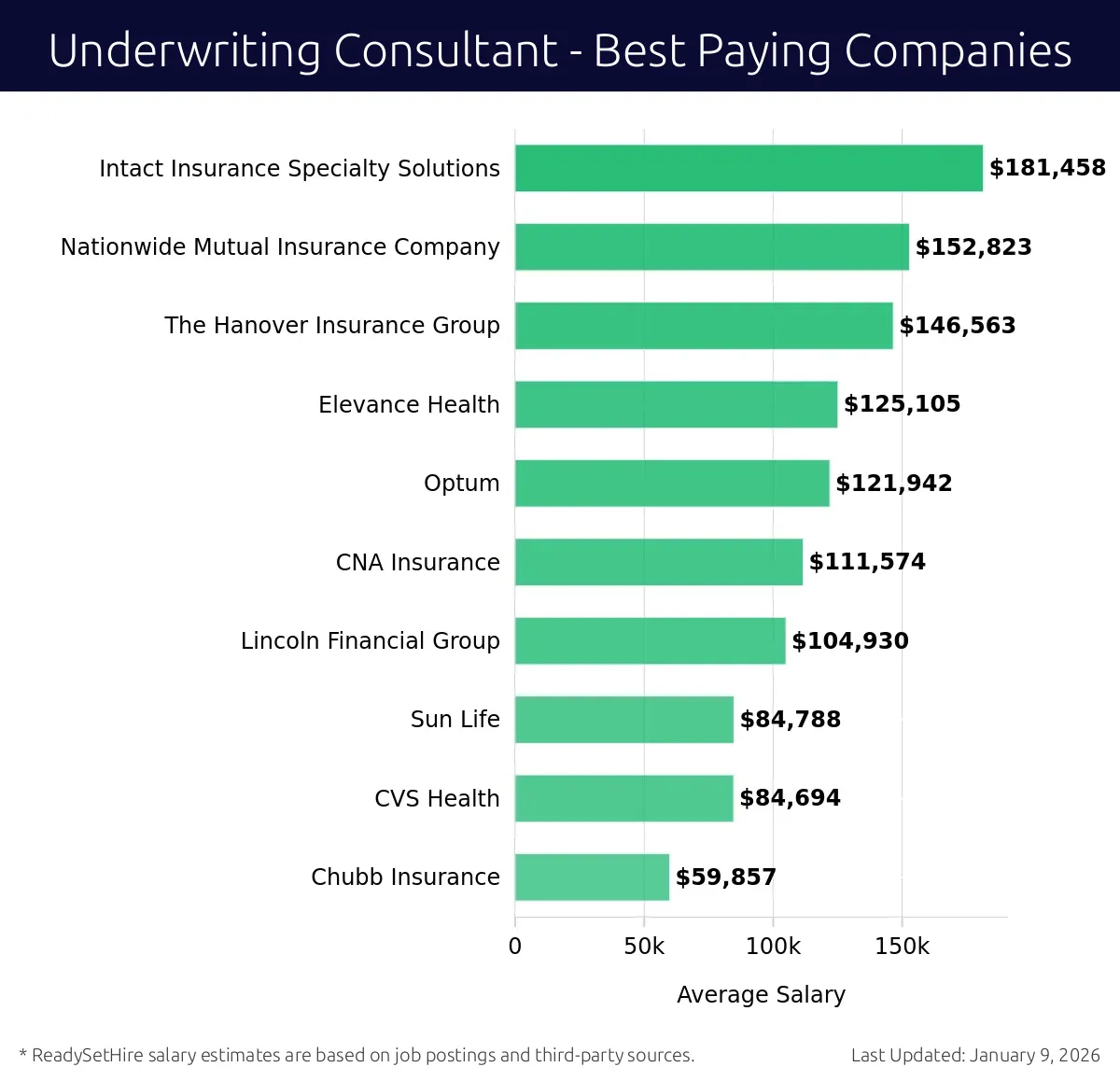

Intact Insurance Specialty Solutions

Average Salary: $181,458

Intact Insurance Specialty Solutions is known for its commitment to providing exceptional underwriting services. They offer rewarding career paths and competitive salaries. The company operates primarily in Canada, with offices in Toronto and Montreal.

-

Nationwide Mutual Insurance Company

Average Salary: $152,823

Nationwide Mutual Insurance Company is a leader in offering comprehensive insurance solutions. They provide excellent opportunities for Underwriting Consultants, especially in locations like Columbus, Ohio, and Phoenix, Arizona. The company values professional growth and offers robust compensation packages.

-

The Hanover Insurance Group

Average Salary: $146,563

The Hanover Insurance Group is recognized for its robust underwriting practices. They offer a supportive work environment and competitive salaries. Their locations include Boston, Massachusetts, and Richmond, Virginia, where they provide diverse career opportunities.

-

Elevance Health

Average Salary: $125,105

Elevance Health is an industry leader in health benefits. They provide rewarding roles for Underwriting Consultants in locations such as Indianapolis, Indiana, and Richmond, Virginia. The company focuses on innovation and career development.

-

Optum

Average Salary: $121,942

Optum is known for its comprehensive health services. They offer competitive salaries for Underwriting Consultants, with major offices in Minneapolis, Minnesota, and Eden Prairie, Minnesota. The company emphasizes growth and professional advancement.

-

CNA Insurance

Average Salary: $111,574

CNA Insurance provides excellent opportunities for Underwriting Consultants. They are headquartered in Chicago, Illinois, and also have offices in Los Angeles, California. The company values innovation and offers a positive work environment.

-

Lincoln Financial Group

Average Salary: $104,930

Lincoln Financial Group offers rewarding careers for Underwriting Consultants. They are based in Philadelphia, Pennsylvania, and also have offices in Charlotte, North Carolina. The company focuses on professional development and competitive compensation.

-

Sun Life

Average Salary: $84,788

Sun Life provides a supportive environment for Underwriting Consultants. They operate in Toronto, Ontario, and other parts of Canada. The company values financial security and offers a good work-life balance.

-

CVS Health

Average Salary: $84,694

CVS Health offers diverse roles for Underwriting Consultants. They have major offices in Woonsocket, Rhode Island, and also operate in other locations across the United States. The company emphasizes career growth and competitive benefits.

-

Chubb Insurance

Average Salary: $59,857

Chubb Insurance provides opportunities for Underwriting Consultants, especially in locations like Warren, New Jersey. The company values professional excellence and offers a supportive work environment.

How to earn more as a Underwriting Consultant?

Becoming a successful Underwriting Consultant means more than just having the right qualifications. It involves a combination of skills, experience, and smart career moves. One key strategy is to continually improve your knowledge and expertise in the field. Staying updated with the latest trends and regulations can set you apart from the competition.

Networking is another powerful tool. Building relationships with industry professionals can open doors to higher-paying opportunities. Joining professional organizations and attending industry events can provide valuable connections. Collaborating with other consultants can also lead to more significant and lucrative projects.

Here are some factors that can help increase earning potential:

- Certifications: Obtain relevant certifications to enhance your credentials.

- Experience: Gain experience by working on diverse and complex cases.

- Specialization: Focus on a niche area within underwriting to become an expert.

- Networking: Build and maintain professional relationships to discover new opportunities.

- Continuous Learning: Keep learning new skills and adapting to industry changes.