What does a Underwriting Manager do?

An Underwriting Manager leads a team of underwriters to assess and accept insurance risks. They ensure policies meet company standards while balancing profit and risk. This role requires a blend of analytical skills and leadership abilities. The manager evaluates applications, makes decisions, and sets targets for the team.

Responsibilities include training staff, monitoring market trends, and developing underwriting guidelines. The manager also liaises with other departments, such as claims and finance. They aim to maximize profitability while maintaining a solid underwriting portfolio. Success in this role depends on strong decision-making and communication skills.

How to become a Underwriting Manager?

Becoming an Underwriting Manager is a rewarding career move. It requires specific steps to ensure success in the insurance industry. Achieving this role involves gaining relevant education, building experience, and developing key skills.

Start by earning a bachelor’s degree in a related field. Common choices include business administration, finance, or insurance. This foundation provides the necessary knowledge about risk assessment and financial principles. The next step is to gain experience in underwriting. Working in an entry-level position allows you to understand the daily tasks and challenges of the job. Aim to work in different areas of underwriting to broaden your expertise.

- Complete a bachelor’s degree in a relevant field.

- Gain experience in underwriting roles.

- Obtain relevant certifications to boost your credentials.

- Network with professionals in the industry.

- Advance to a management position through hard work and dedication.

Obtaining certifications, such as the Chartered Property Casualty Underwriter (CPCU), can enhance your resume. These credentials show your commitment to the field. Networking with other underwriting professionals helps to build connections that can lead to job opportunities. Finally, demonstrate leadership skills to move into a management role. This includes showing the ability to manage teams and make strategic decisions.

How long does it take to become a Underwriting Manager?

The journey to becoming an Underwriting Manager involves several steps and a commitment to professional growth. Typically, it starts with gaining a solid foundation in finance or business. Many professionals begin with a bachelor’s degree, focusing on relevant subjects. This foundational education can take about four years.

After earning a degree, aspiring underwriting managers often work in entry-level positions within the insurance or finance sectors. This experience helps them understand the industry and build necessary skills. Many professionals spend two to five years in these roles, learning the ins and outs of underwriting. Gaining experience and demonstrating expertise can lead to a promotion to a mid-level underwriting position. Continuing to gain experience and taking on more responsibility can further open the path to becoming a manager. This process usually takes an additional three to five years. Through dedication and hard work, individuals can aim to reach the role of Underwriting Manager within about seven to ten years from the start of their career.

Underwriting Manager Job Description Sample

We are seeking an experienced Underwriting Manager to lead our underwriting team. The ideal candidate will have a strong background in underwriting, excellent leadership skills, and the ability to make sound financial decisions.

Responsibilities:

- Lead and manage the underwriting team, ensuring the efficient and effective assessment of insurance applications.

- Develop and implement underwriting policies and procedures that align with company objectives and industry standards.

- Analyze and assess the risk of new and renewal insurance applications, providing recommendations to senior management.

- Collaborate with sales, claims, and actuarial teams to ensure a comprehensive understanding of risk and to develop strategies to minimize potential losses.

- Monitor and analyze underwriting trends, market conditions, and financial performance to make informed decisions.

Qualifications

- Bachelor’s degree in Finance, Business Administration, or a related field. A Master’s degree is preferred.

- Minimum of 7-10 years of experience in underwriting, with at least 3 years in a managerial or leadership role.

- Strong knowledge of underwriting principles, risk assessment, and insurance regulations.

- Excellent analytical, problem-solving, and decision-making skills.

- Proven leadership and team management experience.

Is becoming a Underwriting Manager a good career path?

The role of an Underwriting Manager is both challenging and rewarding. This position involves assessing risks for insurance companies and making important decisions on policies. An Underwriting Manager leads a team and ensures all underwriting activities align with company goals.

Being in this role offers many benefits. First, it provides a competitive salary and good benefits. Managers often enjoy flexible working hours and the chance to work remotely. They also have the opportunity to make a significant impact on company policies and strategies.

However, this career path has its challenges. Managing an underwriting team can be stressful. It requires long hours and attention to detail. The job demands constant learning and staying updated with industry changes. Managers must balance multiple tasks and meet tight deadlines.

Here are some pros and cons to consider:

- Pros:

- Competitive salary and benefits

- Flexible working hours

- Opportunity to work remotely

- Impact on company policies and strategies

- Cons:

- High stress levels

- Long working hours

- Need for constant learning

- Multiple tasks and tight deadlines

What is the job outlook for a Underwriting Manager?

The role of an Underwriting Manager is critical in the financial services sector, and the job outlook is quite promising. According to the Bureau of Labor Statistics (BLS), this position sees an average of 61,300 job openings per year. This steady demand reflects the essential nature of underwriting in risk management and financial stability. Job seekers will find numerous opportunities to grow their careers in this field.

Looking ahead, the job outlook for Underwriting Managers is positive. The BLS projects an 8.2% growth in job openings from 2022 to 2032. This growth indicates a continued need for skilled professionals who can manage and assess risks for financial institutions. For those seeking career advancement, the field of underwriting offers ample chances for professional development and financial rewards.

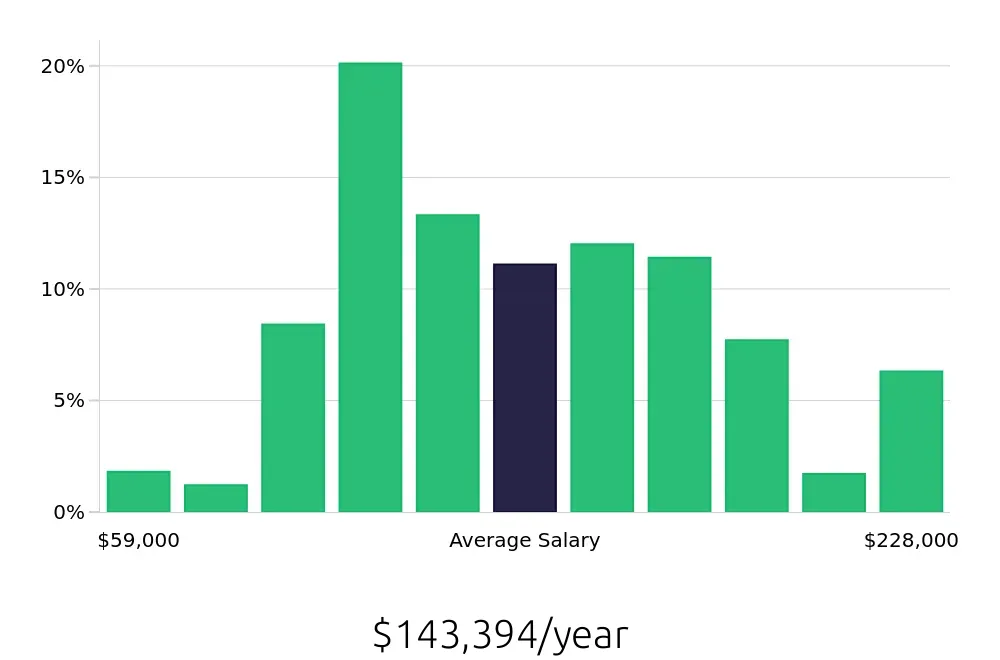

Underwriting Managers earn a competitive salary, which can make this career path very attractive. The average national annual compensation stands at $123,330, according to the BLS. With an hourly compensation of $59.29, professionals in this role can expect to receive a substantial income. These figures highlight the value placed on the expertise required for effective risk management and financial analysis.

Currently 77 Underwriting Manager job openings, nationwide.

Continue to Salaries for Underwriting Manager