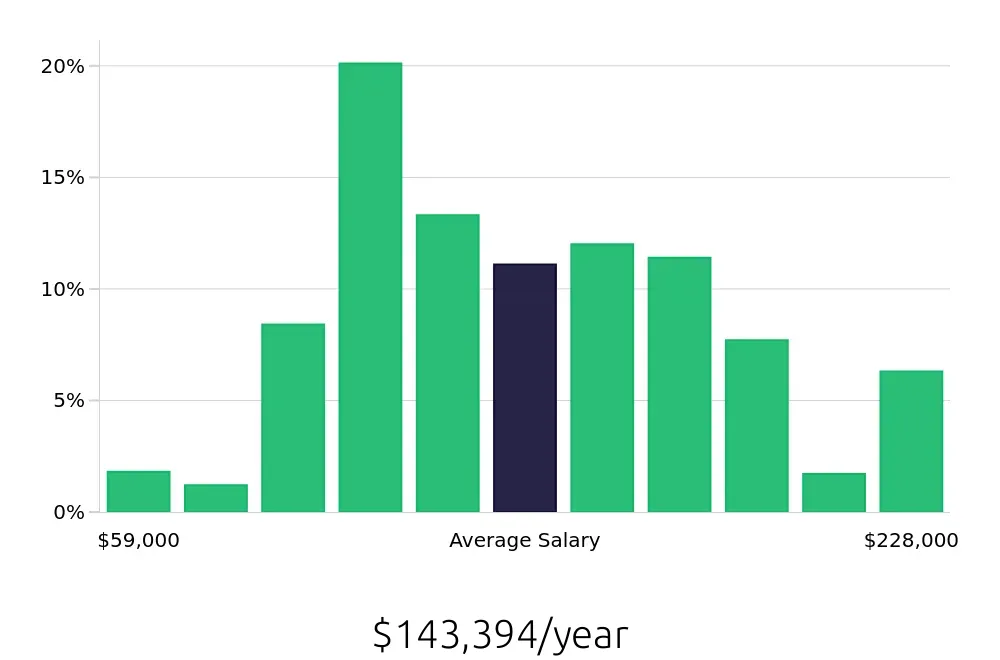

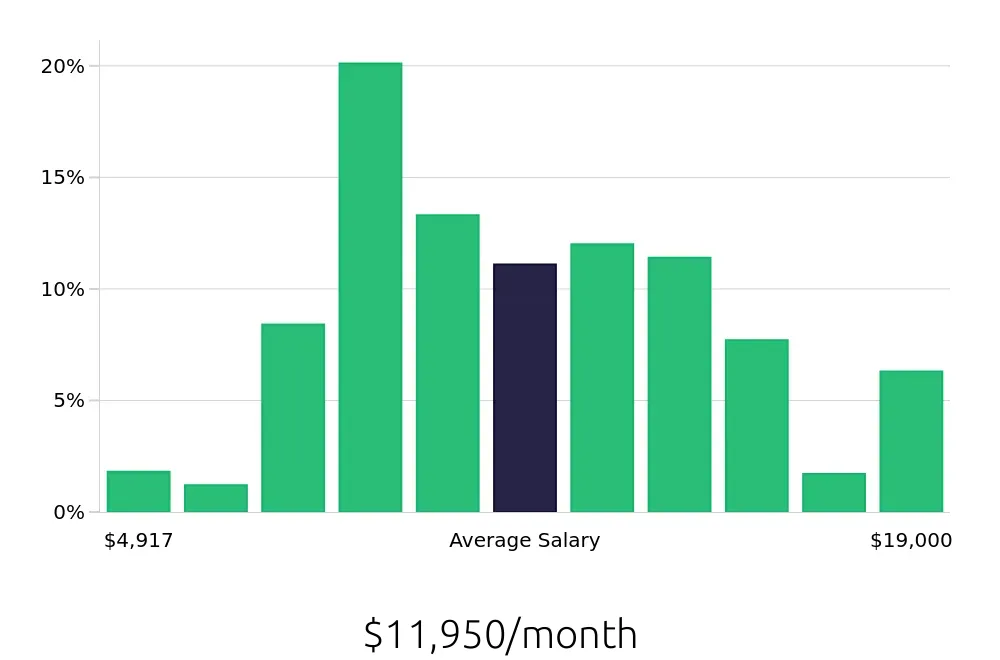

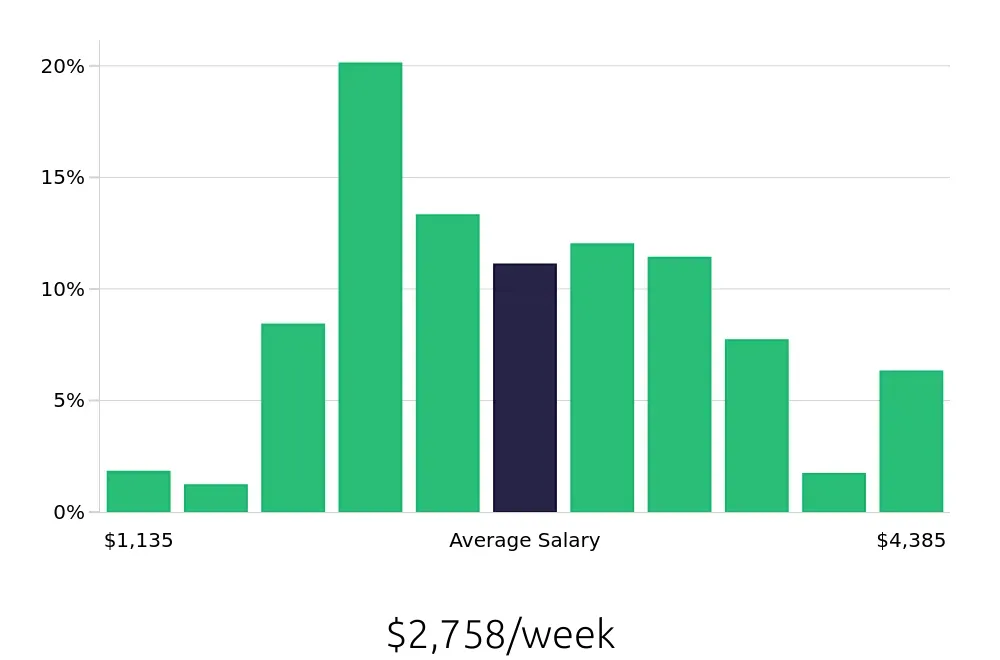

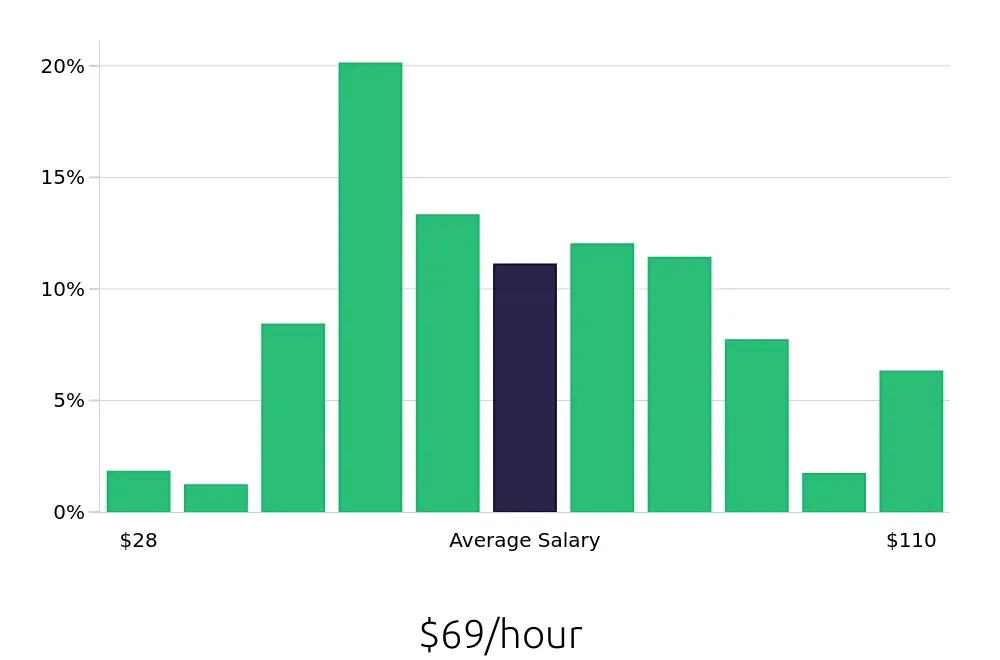

How much does a Underwriting Manager make?

An Underwriting Manager plays a key role in the financial sector. This position involves assessing and managing the risk of insurance policies and loans. The average yearly salary for this job is around $143,394. This means most Underwriting Managers earn between $59,000 and $228,000 per year. A large percentage of managers, about 20.13%, earn between $105,091 and $120,455 yearly.

Experience and location can affect the salary. Managers with more years of experience often earn more. Those in larger cities or regions with higher living costs may also see higher salaries. Many companies also offer benefits, such as bonuses or stock options, which can increase the overall compensation. Being skilled in analyzing risks and making decisions can lead to better pay. It also opens up opportunities for promotions and higher earnings over time.

What are the highest paying cities for a Underwriting Manager?

-

San Francisco, CA

Average Salary: $183,558

In San Francisco, managing underwriting offers a dynamic career. Professionals work with tech companies and startups. They ensure risk assessments are up-to-date with trends.

Find Underwriting Manager jobs in San Francisco, CA

-

Los Angeles, CA

Average Salary: $174,904

In Los Angeles, managing underwriting involves handling a variety of risks. Companies here focus on entertainment and real estate. Managers must stay informed on local market trends.

Find Underwriting Manager jobs in Los Angeles, CA

-

Chicago, IL

Average Salary: $171,171

Chicago's underwriting managers lead large teams. They work for financial institutions and insurance companies. They evaluate risks for different sectors like manufacturing and logistics.

Find Underwriting Manager jobs in Chicago, IL

-

Boston, MA

Average Salary: $170,532

In Boston, underwriting managers handle risks for tech and healthcare firms. They navigate complex regulations. Their work supports innovation and health services.

Find Underwriting Manager jobs in Boston, MA

-

Philadelphia, PA

Average Salary: $161,847

Philadelphia offers a mix of industries for underwriting managers. They work with local businesses and larger corporations. They must understand regional economic trends.

Find Underwriting Manager jobs in Philadelphia, PA

-

Denver, CO

Average Salary: $157,734

Denver's underwriting managers face unique risks. They work in energy and tourism sectors. They analyze data to manage risks effectively in a growing city.

Find Underwriting Manager jobs in Denver, CO

-

Atlanta, GA

Average Salary: $156,574

In Atlanta, underwriting managers support a diverse economy. They work in banking, insurance, and healthcare. They help businesses manage risks in a fast-growing market.

Find Underwriting Manager jobs in Atlanta, GA

-

Washington, DC

Average Salary: $151,310

Washington, DC, offers underwriting managers a chance to work with federal agencies. They also support large corporations. They ensure policies meet strict regulatory standards.

Find Underwriting Manager jobs in Washington, DC

-

Cincinnati, OH

Average Salary: $147,465

Cincinnati's underwriting managers work in insurance and finance. They focus on local and regional businesses. They assess risks to support economic growth.

Find Underwriting Manager jobs in Cincinnati, OH

-

Minneapolis, MN

Average Salary: $145,943

In Minneapolis, underwriting managers handle risks for financial and health services. They work with banks and insurance companies. They ensure the local economy stays stable.

Find Underwriting Manager jobs in Minneapolis, MN

What are the best companies a Underwriting Manager can work for?

-

Liberty Mutual Insurance

Average Salary: $196,793

Liberty Mutual Insurance offers dynamic roles for Underwriting Managers. They operate in several locations across the US. The role involves managing underwriting teams, making key decisions, and ensuring risk assessment and policy terms align with company policies.

-

AXA

Average Salary: $181,333

AXA provides comprehensive benefits for Underwriting Managers. The company has offices across major US cities. This role demands overseeing underwriting processes, working closely with sales and claims teams to manage risk effectively.

-

AXA XL

Average Salary: $178,679

AXA XL is a leading company for Underwriting Managers. They have a presence in key financial hubs. This role focuses on managing insurance risks and ensuring the right policies are in place to protect clients.

-

Wells Fargo

Average Salary: $175,096

Wells Fargo provides competitive salaries for Underwriting Managers. They have branches nationwide. Managers in this role work on assessing insurance applications and making decisions that align with company policies.

-

Zurich Insurance

Average Salary: $174,400

Zurich Insurance offers rewarding positions for Underwriting Managers. They operate in multiple locations across the country. This role involves evaluating risks, making underwriting decisions, and ensuring compliance with regulatory standards.

-

Great American Insurance Group

Average Salary: $167,318

Great American Insurance Group provides excellent opportunities for Underwriting Managers. They have offices in several key cities. Managers here are responsible for managing underwriting staff and ensuring policies meet company standards.

-

U.S. Bank

Average Salary: $143,767

U.S. Bank offers solid roles for Underwriting Managers. They have a wide presence in major cities. This role focuses on assessing insurance applications and managing risk to protect clients.

-

Nationwide Mutual Insurance Company

Average Salary: $134,545

Nationwide Mutual Insurance Company provides good opportunities for Underwriting Managers. They have branches across the US. This role involves managing underwriting staff and ensuring risk management strategies are in place.

-

CVS Health

Average Salary: $110,525

CVS Health offers decent positions for Underwriting Managers. They have locations in many US cities. Managers here work on assessing risks and ensuring policies are effective and compliant.

-

WCF Insurance

Average Salary: $61,298

WCF Insurance provides entry-level opportunities for Underwriting Managers. They operate in several locations. This role involves basic risk assessment and helping to develop underwriting policies.

How to earn more as a Underwriting Manager?

To earn more as an Underwriting Manager, consider focusing on key areas that demonstrate expertise and value. Gaining more experience in the field can lead to higher earning potential. This experience brings in-depth knowledge and a better understanding of risk assessments. As a result, this leads to more informed decision-making, which is critical in underwriting.

A strong educational background and relevant certifications also enhance an Underwriting Manager’s credentials. These qualifications can make a candidate more attractive to employers. This leads to opportunities for higher-paying positions. Networking within the industry opens doors to new opportunities and insights. Building relationships with peers and industry professionals can uncover hidden job prospects. Sharing knowledge and learning from others can lead to career advancement. Each of these factors plays a role in increasing earning potential. Here are some specific steps to consider:

- Gain More Experience: Work on diverse cases to understand different types of risks. This experience makes an Underwriting Manager more valuable.

- Get Relevant Certifications: Certifications such as the Associate in Risk Management (ARM) or Chartered Property Casualty Underwriter (CPCU) can boost credentials.

- Build Industry Connections: Attend industry events and join professional organizations. Networking can lead to new job opportunities.

- Pursue Advanced Degrees: Consider earning a master's degree in business administration (MBA) or a similar field. This education can lead to higher positions.

- Continuous Learning: Stay updated with industry trends and regulations. This ongoing education keeps skills sharp and relevant.