What does a Wealth Management Advisor do?

A Wealth Management Advisor plays a crucial role in helping clients achieve their financial goals. They work closely with individuals and families to create personalized financial plans. Advisors assess clients' current financial situations and future needs. They provide guidance on investments, retirement planning, and tax strategies. The goal is to help clients build and protect their wealth over time.

Wealth Management Advisors also stay updated on market trends and economic changes. They use this knowledge to adjust clients' financial plans as needed. Advisors often meet with clients regularly to review progress and make changes. They aim to ensure that clients' financial strategies remain aligned with their goals. This proactive approach helps clients navigate financial challenges and opportunities.

How to become a Wealth Management Advisor?

Becoming a Wealth Management Advisor involves a series of steps that require dedication and the right qualifications. This career path offers the opportunity to help clients manage their financial futures effectively. By following a structured process, one can achieve success in this rewarding field.

The journey to becoming a Wealth Management Advisor typically includes the following steps:

- Earn a bachelor's degree in a relevant field such as finance, economics, or business.

- Gain experience in the financial industry through internships or entry-level positions.

- Obtain necessary certifications, such as the Certified Financial Planner (CFP) designation.

- Apply for positions with financial institutions or wealth management firms.

- Continue professional development and stay updated on financial trends and regulations.

Each step plays a crucial role in building the skills and knowledge needed to excel as a Wealth Management Advisor. Starting with a solid educational foundation, gaining practical experience, and pursuing relevant certifications are key to advancing in this career. By following these steps, one can position themselves for success and make a significant impact in the lives of their clients.

How long does it take to become a Wealth Management Advisor?

The journey to becoming a Wealth Management Advisor involves several steps. First, a person needs a bachelor's degree in finance, business, or a related field. This usually takes four years. After college, gaining experience in finance or a related area is important. This can take a few years, depending on the job and the person's career goals.

Next, passing the necessary exams is crucial. The Certified Financial Planner (CFP) exam is a key step. Preparing for this exam can take several months. Passing the exam adds to the total time. Some people also choose to get additional certifications. These can take extra time, but they make the resume stronger. In total, it often takes five to seven years to become a Wealth Management Advisor. This includes education, experience, and exams.

Wealth Management Advisor Job Description Sample

A Wealth Management Advisor is responsible for developing and implementing personalized financial strategies for high-net-worth individuals and families. This role involves providing expert advice on investment, retirement planning, tax strategies, and estate planning to help clients achieve their financial goals.

Responsibilities:

- Develop and implement personalized financial plans for clients based on their financial goals and risk tolerance.

- Provide ongoing financial advice and support to clients, including investment management, retirement planning, and tax strategies.

- Conduct regular financial reviews and adjust plans as necessary to reflect changes in clients' circumstances.

- Stay informed about financial markets, investment products, and regulatory changes to provide accurate and up-to-date advice.

- Build and maintain strong relationships with clients, understanding their needs and providing exceptional service.

Qualifications

- Bachelor's degree in finance, business, economics, or a related field. A master's degree or professional certification (e.g., CFA, CFP) is preferred.

- Proven experience as a Wealth Management Advisor or in a similar role, with a strong track record of managing high-net-worth client portfolios.

- In-depth knowledge of investment products, financial markets, and regulatory requirements.

- Excellent communication and interpersonal skills, with the ability to build and maintain strong client relationships.

- Strong analytical and problem-solving skills, with the ability to develop and implement effective financial strategies.

Is becoming a Wealth Management Advisor a good career path?

A Wealth Management Advisor helps clients manage their finances. They create a plan to grow and protect wealth. This job involves working closely with clients to understand their financial goals. Advisors use their knowledge to suggest investments, retirement plans, and other strategies. They often need to stay updated on market trends and regulations.

Working as a Wealth Management Advisor has many benefits. Advisors can earn a good salary. They often get bonuses and commissions. The job can be very rewarding. Advisors see their clients achieve their financial goals. However, the job also has challenges. Advisors must handle a lot of paperwork. They need to stay updated on financial laws. The job can be stressful, especially during market downturns. Advisors must manage their clients' emotions and expectations.

Here are some pros and cons to consider:

- Pros:

- Good salary and bonuses

- Help clients achieve financial goals

- Opportunities for career growth

- Cons:

- Lots of paperwork

- Need to stay updated on laws

- Can be stressful during market downturns

What is the job outlook for a Wealth Management Advisor?

The job outlook for Wealth Management Advisors is promising. The Bureau of Labor Statistics (BLS) reports an average of 61,300 job positions available each year. This steady demand reflects a growing need for financial expertise. With the economy expanding, more individuals and businesses seek professional guidance to manage their wealth effectively.

Looking ahead, the BLS predicts an 8.2% growth in job openings for Wealth Management Advisors from 2022 to 2032. This increase highlights the importance of financial planning and investment management. As wealth management becomes more complex, the need for skilled advisors grows. This trend offers excellent opportunities for those entering the field.

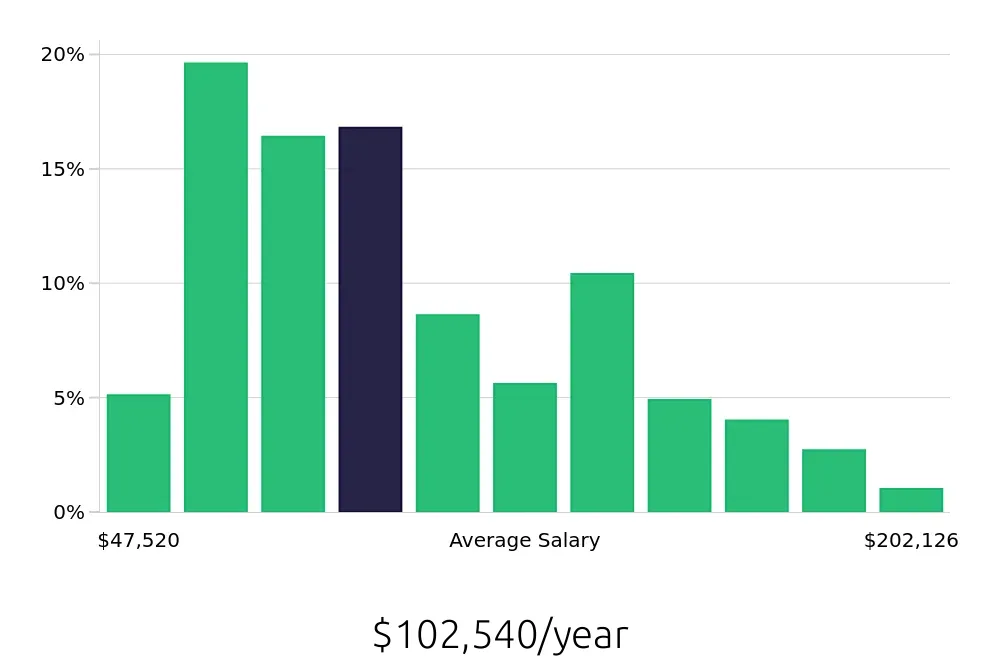

Wealth Management Advisors enjoy a competitive salary. The BLS reports an average national annual compensation of $123,330. This figure underscores the value placed on expertise in financial planning. Hourly compensation averages around $59.29, reflecting the specialized skills required. For job seekers, these figures indicate a rewarding career path with strong financial prospects.

Currently 447 Wealth Management Advisor job openings, nationwide.

Continue to Salaries for Wealth Management Advisor