How much does a Wealth Management Advisor make?

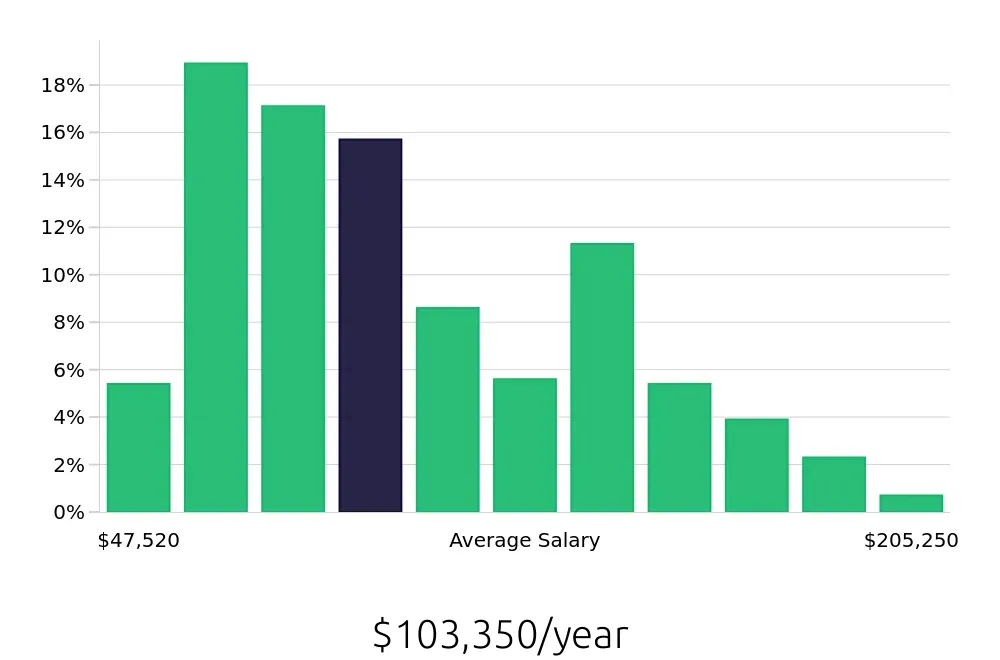

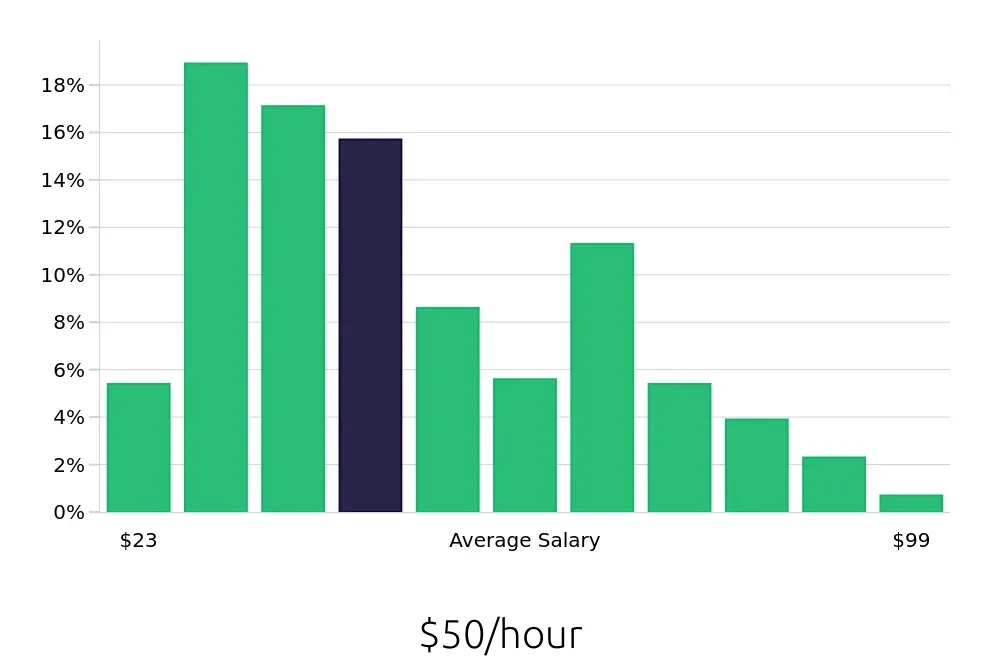

A Wealth Management Advisor helps people manage their money and investments. This job can be very rewarding. The salary for this role varies depending on experience and location. The average yearly salary for a Wealth Management Advisor is around $103,350. This number can go higher with more experience and better job performance.

Here is how the salary can change with more experience:

- First 10% earn about $47,520.

- Next 10% earn about $61,859.

- Next 15% earn about $76,198.

- Next 15% earn about $90,537.

- Next 10% earn about $104,876.

- Next 5% earn about $119,215.

- Next 5% earn about $133,555.

- Next 5% earn about $147,894.

- Next 4% earn about $162,233.

- Next 2% earn about $176,572.

- Top 1% earn about $190,911.

What are the highest paying cities for a Wealth Management Advisor?

-

Tampa, FL

Average Salary: $158,427

Working in Tampa offers a chance to engage with a thriving financial sector. Banks and investment firms provide a robust environment for those looking to grow in wealth management. Companies like Morgan Stanley and Raymond James are key players in the city.

Find Wealth Management Advisor jobs in Tampa, FL

-

Jacksonville, FL

Average Salary: $157,841

Jacksonville is a hub for financial services, with many firms offering opportunities in wealth management. The city's diverse economy supports a steady demand for financial advisors. Local leaders like Merrill Lynch and Wells Fargo attract professionals in this field.

Find Wealth Management Advisor jobs in Jacksonville, FL

-

Chattanooga, TN

Average Salary: $151,202

Chattanooga combines a small-town feel with a growing financial industry. Wealth management roles here benefit from the city's supportive business environment. Local banks and financial institutions offer a range of opportunities for career growth.

Find Wealth Management Advisor jobs in Chattanooga, TN

-

Wichita, KS

Average Salary: $148,000

In Wichita, wealth management advisors find a welcoming community with a solid financial base. The city supports a variety of financial services, with companies like Vanguard and Fidelity offering solid career paths.

Find Wealth Management Advisor jobs in Wichita, KS

-

Omaha, NE

Average Salary: $146,479

Omaha's financial sector is well-regarded for its stability and growth. Advisors here can leverage the city's strong economy, with notable firms like Berkshire Hathaway providing key opportunities.

Find Wealth Management Advisor jobs in Omaha, NE

-

Minneapolis, MN

Average Salary: $145,759

Minneapolis offers a vibrant financial landscape with many opportunities for wealth management professionals. The city is home to major firms such as U.S. Bank and Ameriprise Financial, offering a dynamic work environment.

Find Wealth Management Advisor jobs in Minneapolis, MN

-

Washington, DC

Average Salary: $143,197

Washington, DC, is a prime location for those in wealth management, with its proximity to many financial institutions and government bodies. Advisors can benefit from the city's political and financial influence, with firms like Capital One and JPMorgan Chase present.

Find Wealth Management Advisor jobs in Washington, DC

-

Charlotte, NC

Average Salary: $142,736

Charlotte is a key player in the financial industry, especially known for banking. Wealth management advisors here enjoy a competitive environment, with major firms like Bank of America and Wells Fargo offering strong career prospects.

Find Wealth Management Advisor jobs in Charlotte, NC

-

Boston, MA

Average Salary: $141,995

Boston's rich financial history provides a solid foundation for wealth management careers. The city's educational institutions and financial firms like Fidelity Investments and State Street Corporation create a rich professional landscape.

Find Wealth Management Advisor jobs in Boston, MA

-

Houston, TX

Average Salary: $141,819

Houston offers a diverse economic environment ideal for wealth management. The city's focus on energy and finance makes it a great place for advisors, with firms like Goldman Sachs and JPMorgan Chase providing key opportunities.

Find Wealth Management Advisor jobs in Houston, TX

What are the best companies a Wealth Management Advisor can work for?

-

Goodwin Recruiting

Average Salary: $265,333

Goodwin Recruiting specializes in placing professionals in top financial roles. Wealth Management Advisors at Goodwin enjoy competitive salaries and work in major financial hubs like New York and San Francisco.

-

Northern Trust Corp.

Average Salary: $192,895

Northern Trust Corp. offers a solid career path for Wealth Management Advisors. Their clients benefit from personalized financial strategies. The company operates globally with significant offices in Chicago, London, and Singapore.

-

M&T Bank

Average Salary: $184,544

M&T Bank values experienced Wealth Management Advisors. They provide tools and support for tailored financial planning. The bank has a strong presence across the Northeast U.S. with locations in Buffalo, Baltimore, and Pittsburgh.

-

Truist

Average Salary: $158,259

Truist offers dynamic roles for Wealth Management Advisors. They focus on long-term client relationships. The company operates widely with headquarters in Charlotte and additional offices across the Southeast U.S.

-

Charles Schwab

Average Salary: $139,849

Charles Schwab is known for its innovative approach to wealth management. Advisors here have access to extensive resources and training. The company has branches throughout the U.S., with major offices in San Francisco and Phoenix.

-

RBC

Average Salary: $134,500

RBC offers rewarding positions for Wealth Management Advisors. They focus on client satisfaction and professional growth. The company is strong in both the U.S. and Canada, with key offices in Toronto and New York.

-

Huntington Bank

Average Salary: $130,967

Huntington Bank seeks knowledgeable Wealth Management Advisors. They offer competitive pay and support for career advancement. The bank operates mainly in the Midwest with notable offices in Columbus and Cleveland.

-

REDW

Average Salary: $127,946

REDW provides specialized opportunities for Wealth Management Advisors. They focus on estate planning and tax strategies. The company operates nationwide, with major offices in Denver and Chicago.

-

Regions Financial

Average Salary: $123,819

Regions Financial offers solid roles for Wealth Management Advisors. They emphasize community involvement and client service. The bank is active throughout the Southeast U.S., with key locations in Birmingham and Atlanta.

-

KeyBank

Average Salary: $123,259

KeyBank provides excellent career options for Wealth Management Advisors. They offer a supportive environment for professional development. The bank has a strong presence in the Northeast and Midwest, with offices in Cleveland and Portland.

How to earn more as a Wealth Management Advisor?

A Wealth Management Advisor can find many ways to increase earnings. Starting with a solid client base and offering valuable services lead the way. Experienced advisors know how to grow and keep their business. They also focus on areas that boost their income.

Here are some key factors that can help increase a Wealth Management Advisor’s earnings:

- Expand Client Base: More clients mean more opportunities to earn. Advisors should focus on networking and building relationships.

- Enhance Skills: Continuous education and certifications improve knowledge. This makes the advisor more credible and attractive to clients.

- Diversify Services: Offering a range of services, like tax planning and estate planning, attracts more clients.

- Leverage Technology: Using the latest software helps manage client accounts and analyze market trends. This can lead to better decision-making and efficiency.

- Build a Personal Brand: Creating a strong online presence and sharing valuable insights can attract more clients.