How much does a Loan Processor make?

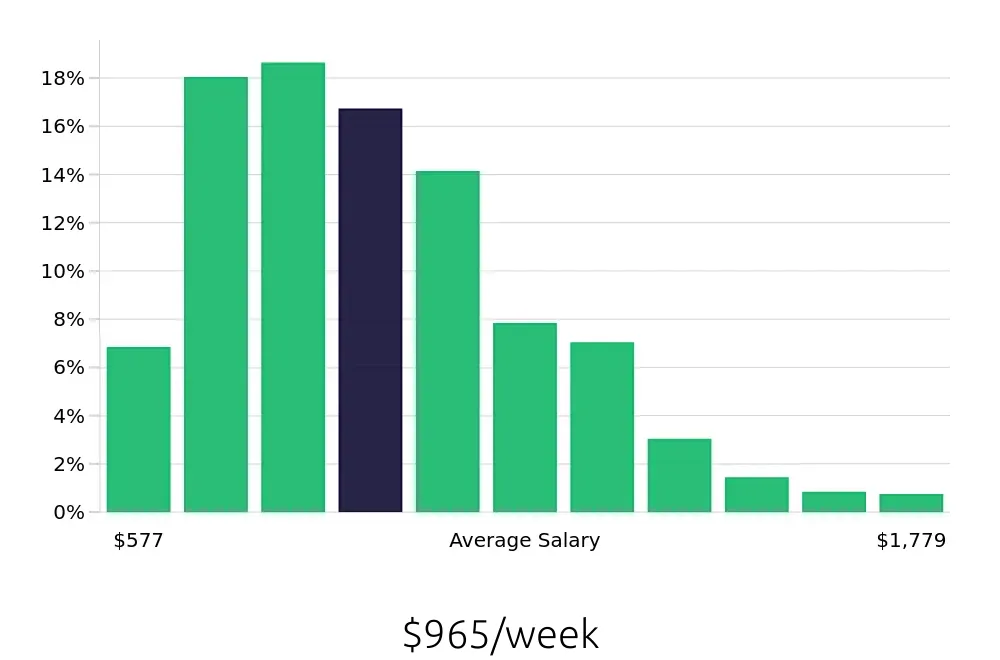

A Loan Processor plays a key role in managing and overseeing the loan process. This professional examines loan documents, assesses risks, and ensures compliance with regulations. The average yearly salary for a Loan Processor is $50,169. This figure varies based on experience and location, offering a solid income for those in the field.

The salary for Loan Processors can range significantly. At the lower end, about 10% of professionals earn around $30,000 annually. At the higher end, the top 10% earn over $86,818 per year. Most Loan Processors fall in the middle range, earning between $41,364 and $64,091. These numbers show a clear path for growth and rewards for those who gain experience and expertise.

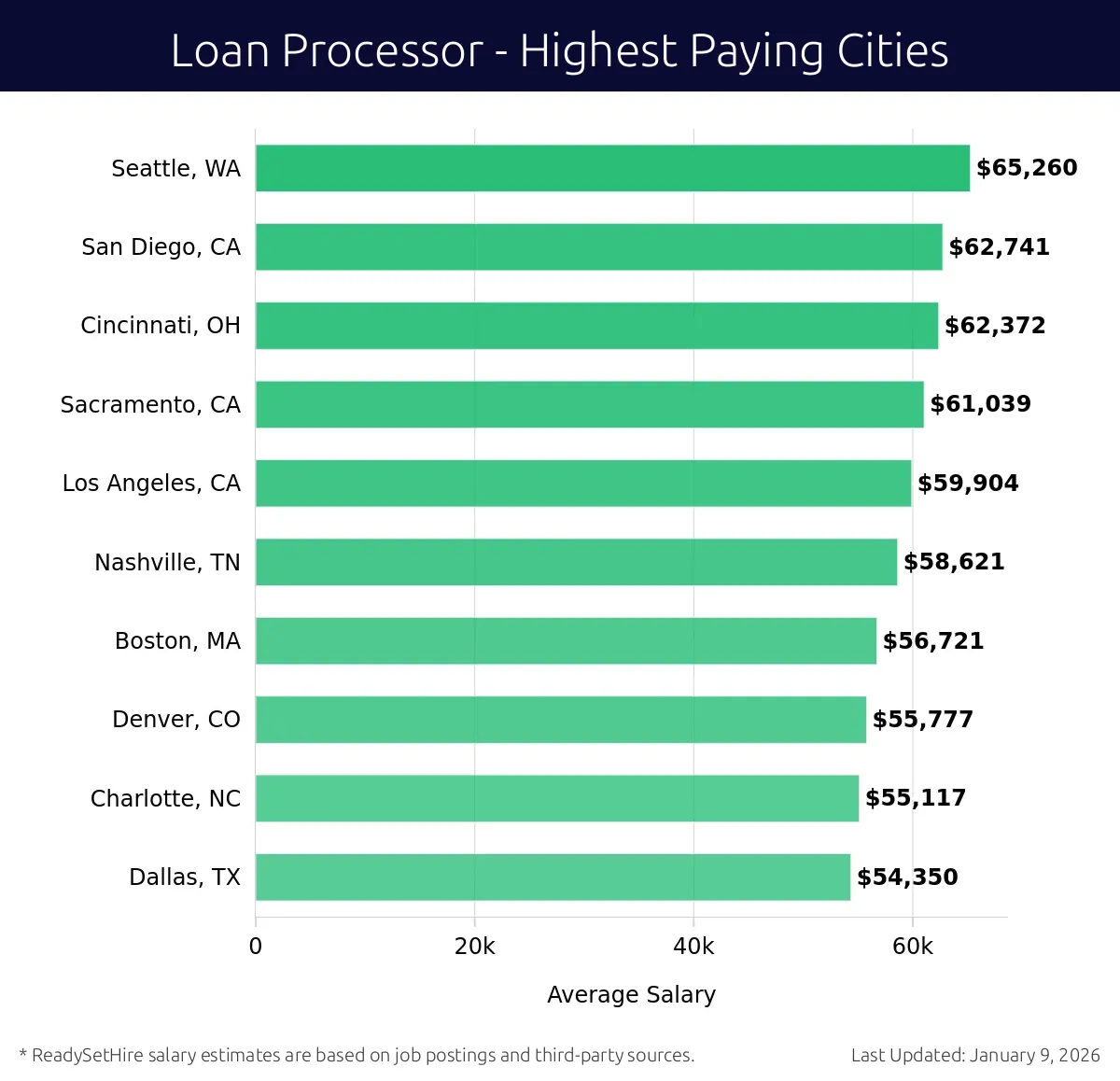

What are the highest paying cities for a Loan Processor?

-

Seattle, WA

Average Salary: $65,260

In Seattle, you can work for major banks like Wells Fargo or U.S. Bank. They hire for processing home and auto loans. The tech-savvy environment here makes tasks easier. Being in a city known for innovation, you'll find many tech tools to help with your job.

Find Loan Processor jobs in Seattle, WA

-

San Diego, CA

Average Salary: $62,741

San Diego offers job seekers a chance to work in the banking sector with companies like Chase and Bank of America. They often seek people to help with mortgage and personal loans. The pleasant weather makes the work environment even more enjoyable.

Find Loan Processor jobs in San Diego, CA

-

Cincinnati, OH

Average Salary: $62,372

Cincinnati is home to top financial institutions such as Fifth Third Bank and PNC Bank. They need skilled individuals for processing loans. The city offers a balance of work and leisure, with many parks and recreational activities.

Find Loan Processor jobs in Cincinnati, OH

-

Sacramento, CA

Average Salary: $61,039

In Sacramento, you can find opportunities with banks like Bank of the West and Wells Fargo. These companies require professionals to manage various types of loans. The state capital offers a vibrant community with plenty of outdoor activities.

Find Loan Processor jobs in Sacramento, CA

-

Los Angeles, CA

Average Salary: $59,904

Los Angeles offers many options for those in the loan processing field with big banks like Bank of America and U.S. Bank. They look for people to manage different loans. The city's dynamic culture provides a unique work experience.

Find Loan Processor jobs in Los Angeles, CA

-

Nashville, TN

Average Salary: $58,621

Nashville has job openings at institutions such as Regions Bank and BBVA USA. These companies need help processing loans. The city's lively music scene offers a fun and energetic atmosphere outside of work.

Find Loan Processor jobs in Nashville, TN

-

Boston, MA

Average Salary: $56,721

Boston provides job seekers with opportunities at major banks like TD Bank and Citizens Bank. They need individuals to handle various loans. Being in a historic city offers a unique work experience with plenty of cultural activities.

Find Loan Processor jobs in Boston, MA

-

Denver, CO

Average Salary: $55,777

In Denver, you can work for banks like U.S. Bank and Bank of the West. These companies look for people to process loans. The city's outdoor lifestyle makes for a balanced work environment.

Find Loan Processor jobs in Denver, CO

-

Charlotte, NC

Average Salary: $55,117

Charlotte offers jobs at big banks like Bank of America and Wells Fargo. They need skilled professionals to manage different types of loans. The city's growing economy provides many opportunities for career growth.

Find Loan Processor jobs in Charlotte, NC

-

Dallas, TX

Average Salary: $54,350

Dallas is home to institutions like Chase and Bank of America. They seek people to help with processing loans. The city's vibrant culture and business opportunities make it an exciting place to work.

Find Loan Processor jobs in Dallas, TX

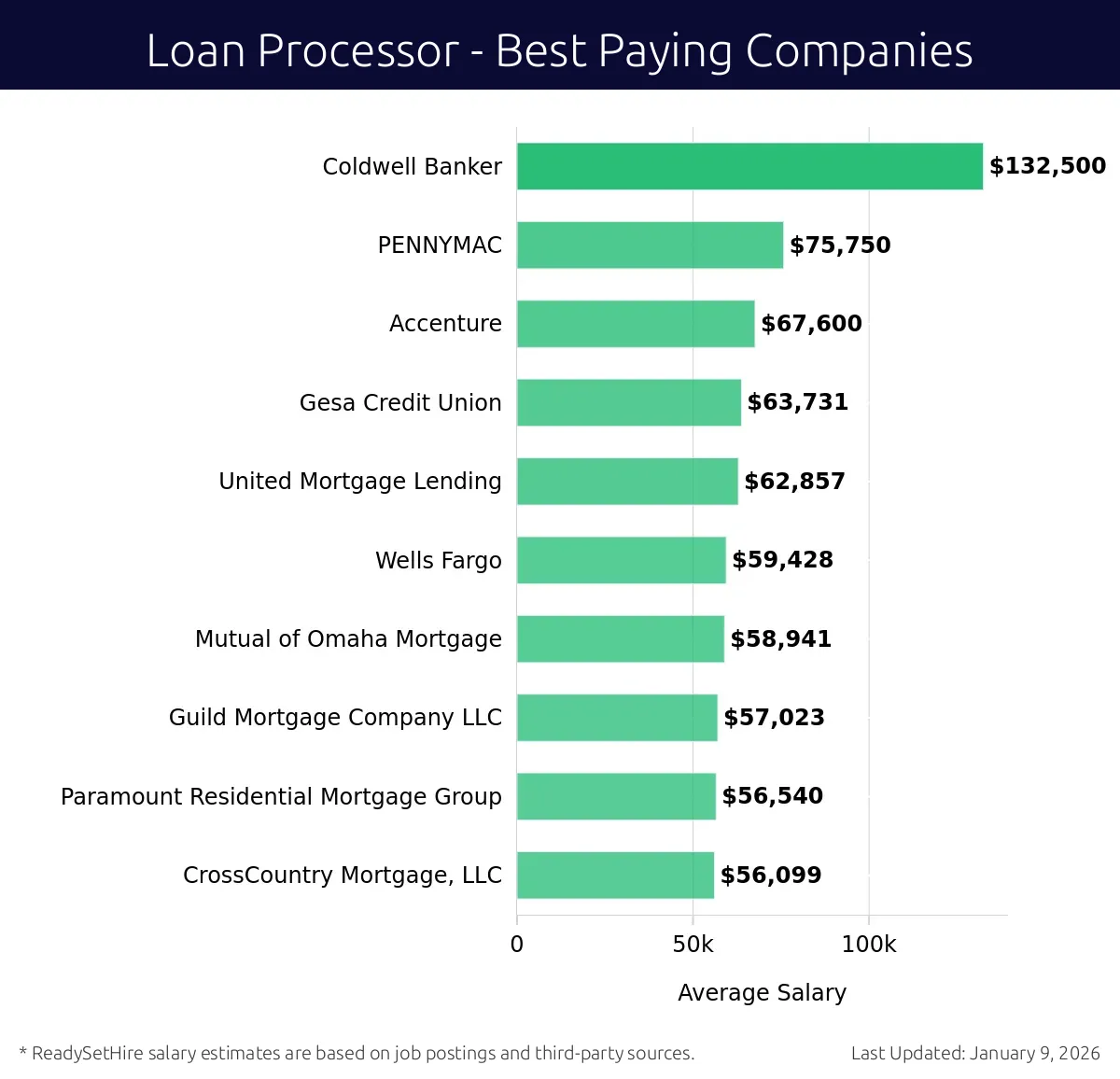

What are the best companies a Loan Processor can work for?

-

Coldwell Banker

Average Salary: $132,500

Coldwell Banker offers competitive salaries to Loan Processors. They have multiple locations across the U.S. where they offer various mortgage services.

-

PENNYMAC

Average Salary: $75,750

PENNYMAC provides strong compensation packages to Loan Processors. They operate nationwide, offering mortgage solutions to their clients.

-

Accenture

Average Salary: $67,600

Accenture hires Loan Processors with a solid pay package. They have offices worldwide, offering diverse opportunities for career growth.

-

Gesa Credit Union

Average Salary: $63,731

Gesa Credit Union values their Loan Processors with a good salary. They serve communities in Washington, Oregon, and Idaho.

-

United Mortgage Lending

Average Salary: $62,857

United Mortgage Lending offers a decent salary for Loan Processors. They are based in the U.S. and provide mortgage solutions across the country.

-

Wells Fargo

Average Salary: $59,428

Wells Fargo offers a competitive salary for Loan Processors. They have many locations across the U.S. and serve a large customer base.

-

Mutual of Omaha Mortgage

Average Salary: $58,941

Mutual of Omaha Mortgage pays its Loan Processors well. They operate in multiple states, providing mortgage services to clients.

-

Guild Mortgage Company LLC

Average Salary: $57,023

Guild Mortgage Company LLC offers a solid salary for Loan Processors. They serve clients in several states across the U.S.

-

Paramount Residential Mortgage Group

Average Salary: $56,540

Paramount Residential Mortgage Group provides a good salary for Loan Processors. They operate in multiple locations in the U.S.

-

CrossCountry Mortgage, LLC

Average Salary: $56,099

CrossCountry Mortgage, LLC offers a decent salary to Loan Processors. They have offices in several states, providing mortgage services.

How to earn more as a Loan Processor?

Loan processors handle many tasks to ensure loans are processed correctly. They can increase their earnings by gaining new skills and experience. This helps them become more valuable to their employers. Seeking opportunities to take on more responsibilities can lead to higher pay. Networking within the industry also opens doors to better-paying jobs.

By improving specific skills, loan processors can become more efficient. This efficiency can lead to higher salaries. Here are some key factors to consider:

- Advanced Certifications: Obtaining certifications like the Certified Loan Processor (CLP) can make a processor more attractive to employers.

- Technological Proficiency: Becoming skilled in loan processing software can improve job performance and open up more job opportunities.

- Customer Service Skills: Excellent communication skills help processors handle clients more effectively, potentially leading to higher earnings.

- Attention to Detail: Accuracy in processing loans reduces errors and increases job reliability, which can lead to promotions or raises.

- Experience: Gaining experience in different types of loans, such as mortgages and personal loans, makes a processor more versatile and valuable.