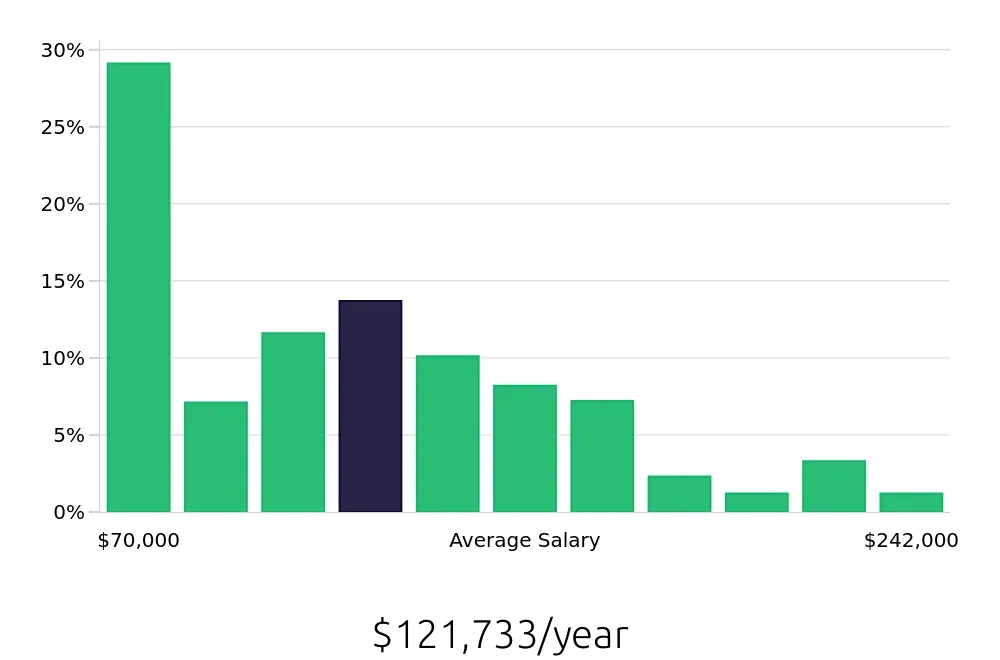

How much does a Quantitative Analyst make?

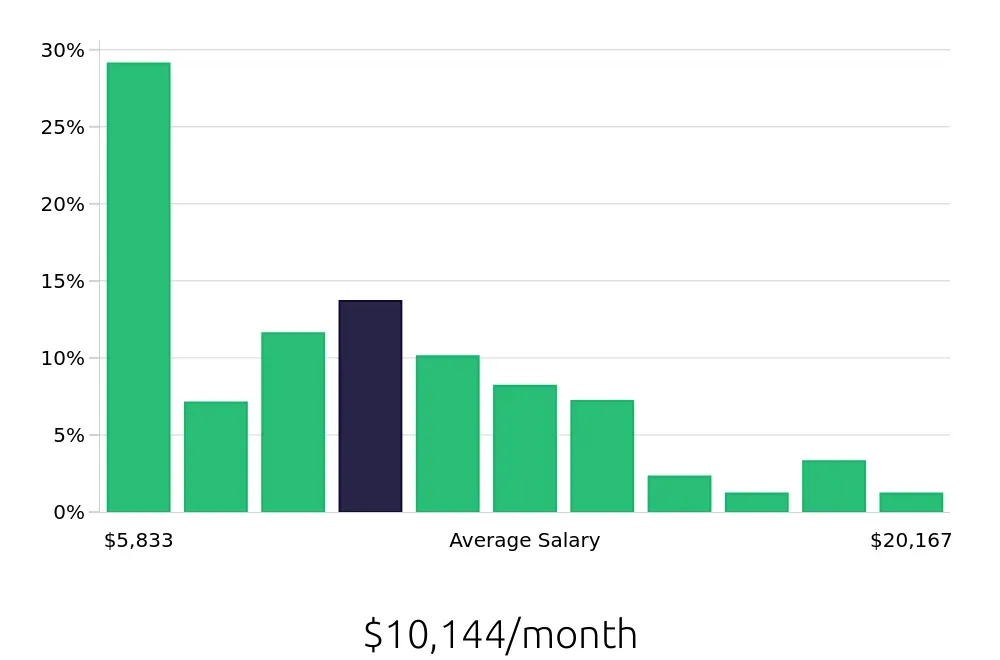

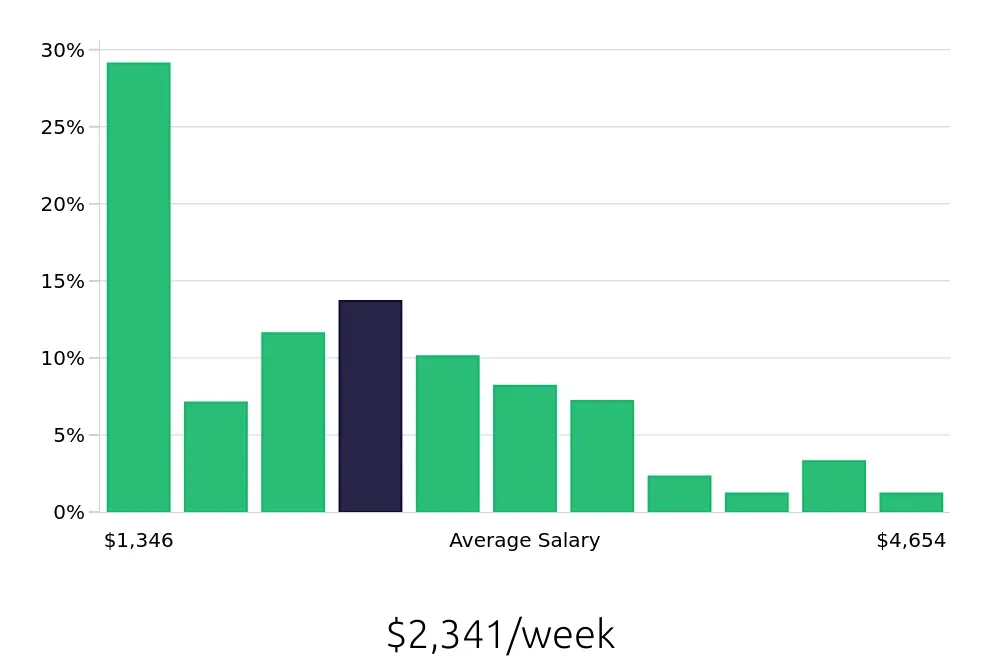

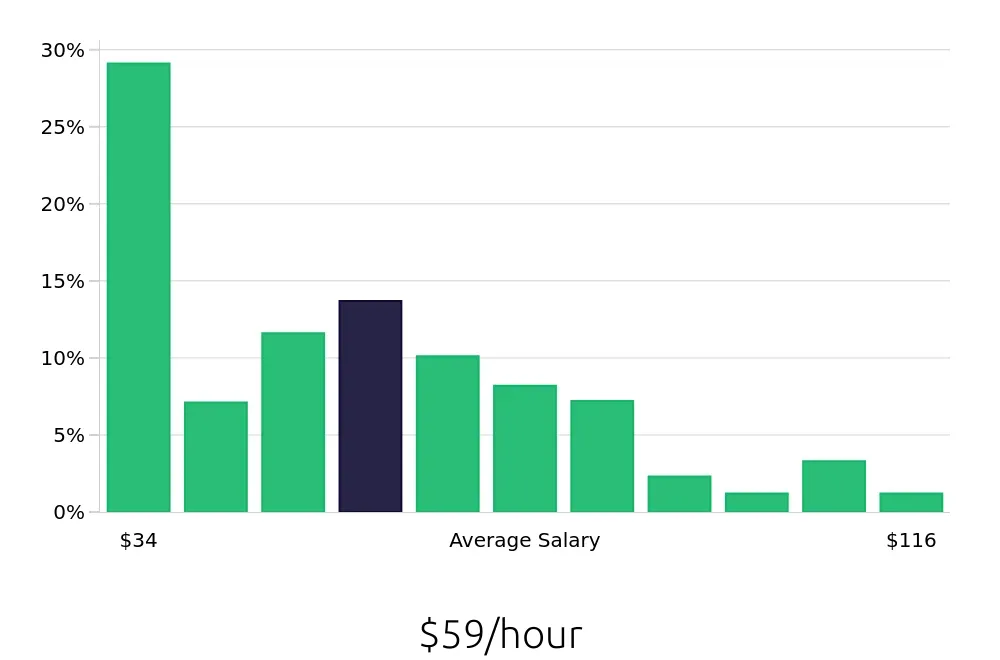

A Quantitative Analyst uses math, statistics, and computer skills to solve problems in business and finance. This person examines data and trends to help companies make better decisions. The field offers good pay. The average yearly salary for a Quantitative Analyst is about $121,733.

This salary can change based on experience and education. The lowest-paid analysts earn around $70,000 a year. Analysts with more experience can earn much more. The top 10% of earners make over $226,000 each year. Many companies offer extra pay for special skills or responsibilities. This can include bonuses or stock options. Other companies may offer benefits like health insurance and retirement plans.

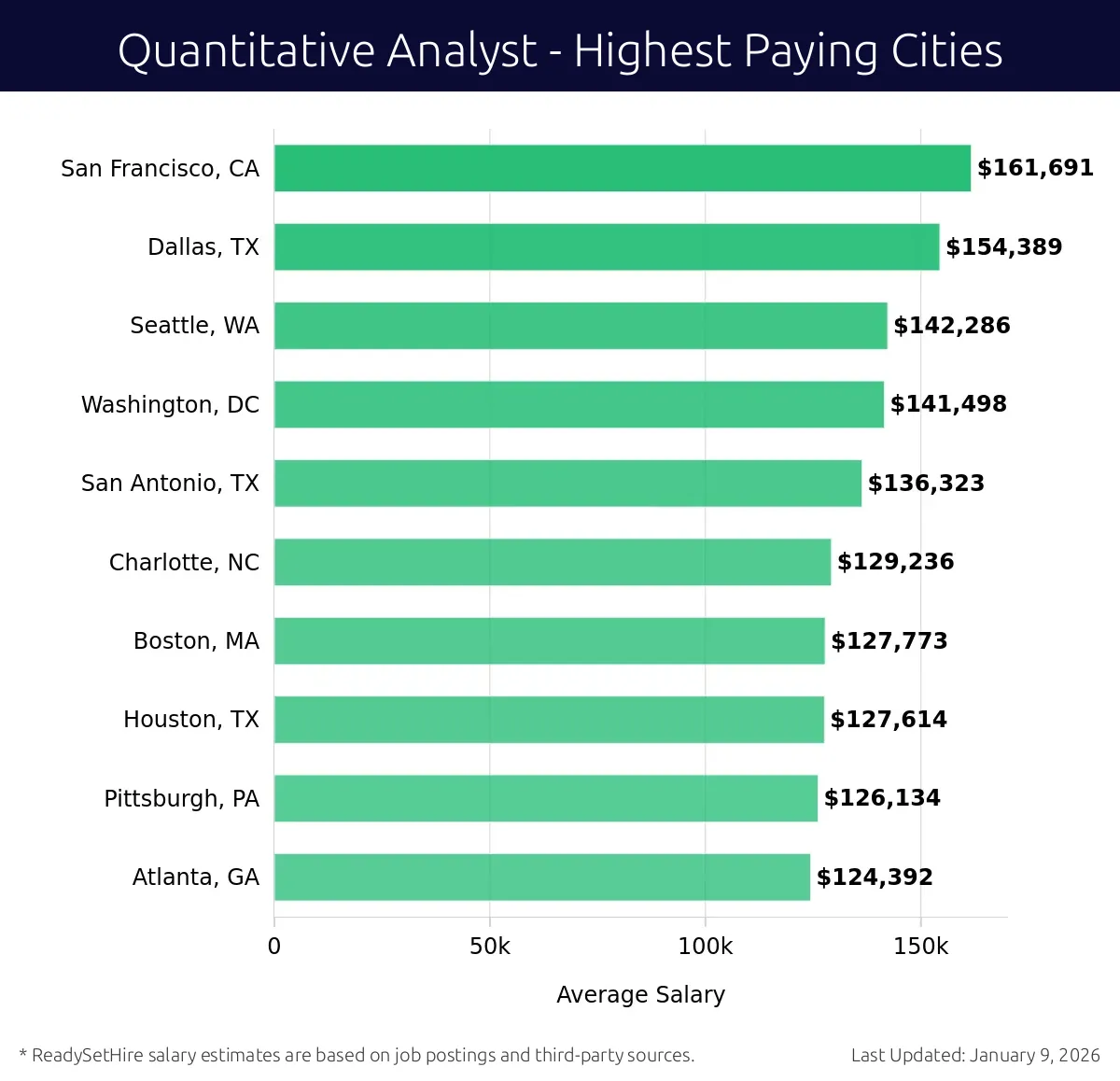

What are the highest paying cities for a Quantitative Analyst?

-

San Francisco, CA

Average Salary: $161,691

In San Francisco, analysts thrive in a tech-driven environment. They work with leading companies like Goldman Sachs and LinkedIn, focusing on data analysis and risk management. The city’s innovative spirit boosts career growth.

Find Quantitative Analyst jobs in San Francisco, CA

-

Dallas, TX

Average Salary: $154,389

Dallas offers a vibrant business atmosphere. Companies such as JPMorgan Chase and AT&T seek skilled analysts. Dallas analysts often work on financial modeling and investment strategies. The city provides a blend of professional opportunities and cultural experiences.

Find Quantitative Analyst jobs in Dallas, TX

-

Seattle, WA

Average Salary: $142,286

Seattle's tech industry creates a dynamic environment for analysts. Amazon and Microsoft are prominent employers. Analysts here focus on market trends and big data. The city’s laid-back vibe and outdoor activities make it an attractive place to live and work.

Find Quantitative Analyst jobs in Seattle, WA

-

Washington, DC

Average Salary: $141,498

In Washington, DC, analysts contribute to policy and finance. Major firms like Fannie Mae and BlackRock offer diverse projects. Analysts work on risk assessment and strategic planning. The city’s political scene adds depth to the work experience.

Find Quantitative Analyst jobs in Washington, DC

-

San Antonio, TX

Average Salary: $136,323

San Antonio provides a growing market for analysts. Companies such as Frost Bank and USAA need their expertise. Analysts in San Antonio work on financial forecasting and risk management. The city’s affordability and community feel enhance the quality of life.

Find Quantitative Analyst jobs in San Antonio, TX

-

Charlotte, NC

Average Salary: $129,236

Charlotte, known for banking, offers many opportunities for analysts. Banks like Bank of America and Wells Fargo provide a stable environment. Analysts here focus on financial modeling and data analysis. The city’s economic growth supports career advancement.

Find Quantitative Analyst jobs in Charlotte, NC

-

Boston, MA

Average Salary: $127,773

Boston’s rich history and academic environment attract top talent. Firms such as Fidelity Investments and State Street Corporation employ analysts. They work on quantitative strategies and risk assessment. The city’s educational institutions and cultural activities enrich the professional experience.

Find Quantitative Analyst jobs in Boston, MA

-

Houston, TX

Average Salary: $127,614

Houston offers a strong economy with opportunities in energy and finance. Firms like BP and ExxonMobil need analysts. They focus on data analysis and market trends. The city’s diverse culture and outdoor activities make it a lively place to work and live.

Find Quantitative Analyst jobs in Houston, TX

-

Pittsburgh, PA

Average Salary: $126,134

Pittsburgh provides a unique blend of industry and innovation. Companies like PNC and UPMC employ analysts. They work on financial analysis and risk management. The city’s smaller cost of living and community spirit add to the appeal.

Find Quantitative Analyst jobs in Pittsburgh, PA

-

Atlanta, GA

Average Salary: $124,392

Atlanta’s fast-growing tech scene offers many opportunities for analysts. Companies like Coca-Cola and Delta Air Lines need their skills. They focus on data analysis and financial modeling. The city’s warm climate and vibrant culture make it a desirable place to work.

Find Quantitative Analyst jobs in Atlanta, GA

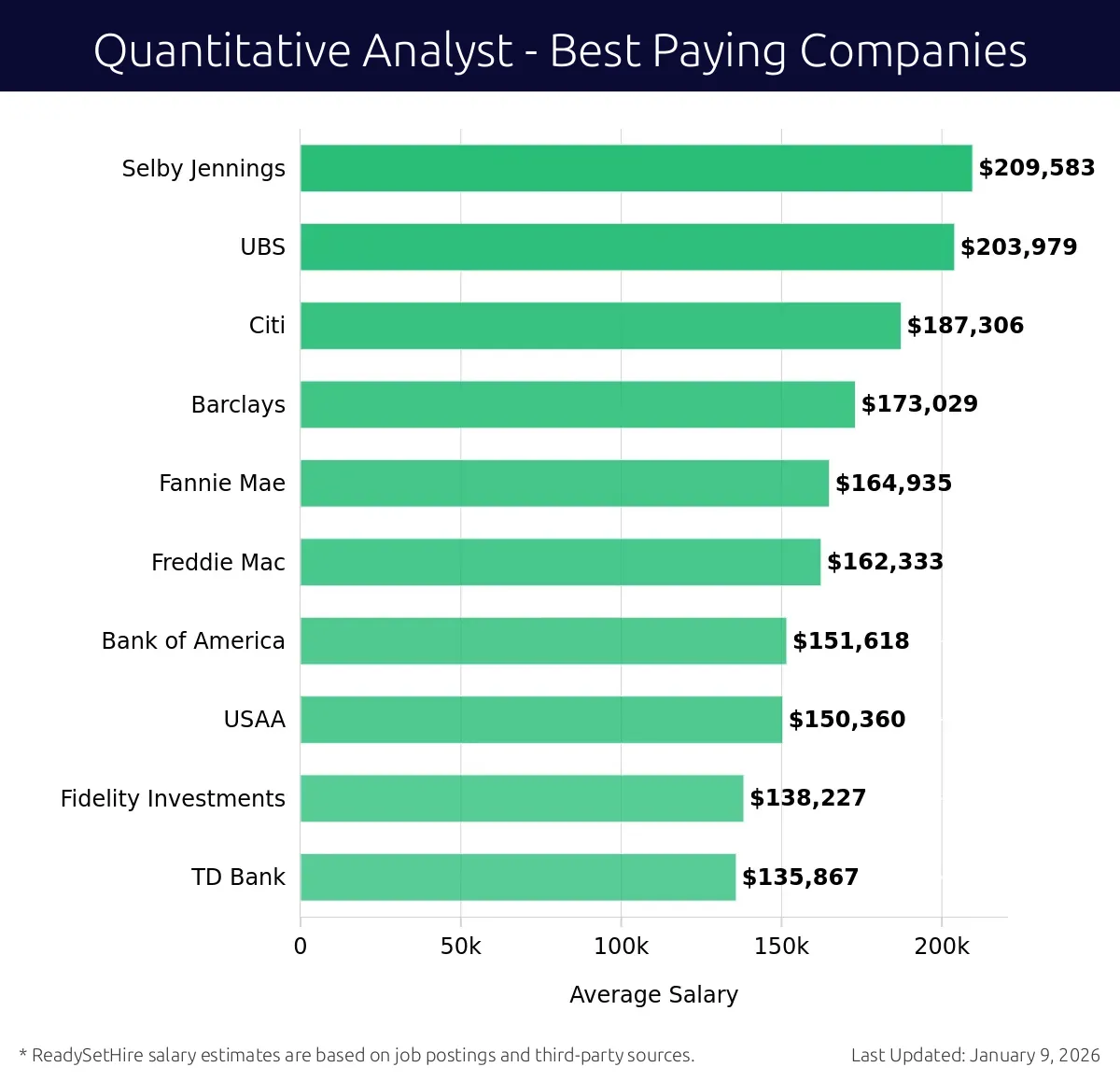

What are the best companies a Quantitative Analyst can work for?

-

Selby Jennings

Average Salary: $209,583

Selby Jennings is a top choice for Quantitative Analysts. They offer competitive salaries and a strong focus on analytics. They operate in major financial hubs such as New York, Chicago, and San Francisco.

-

UBS

Average Salary: $203,979

UBS offers excellent opportunities for Quantitative Analysts. They have a global presence with offices in New York, London, and Hong Kong. The role involves developing models and conducting in-depth analysis.

-

Citi

Average Salary: $187,306

Citi provides a dynamic environment for Quantitative Analysts. They operate worldwide, with key locations in New York, London, and Singapore. The role includes risk management and data analysis.

-

Barclays

Average Salary: $173,029

Barclays offers attractive compensation for Quantitative Analysts. They have a significant presence in New York, London, and Dubai. Analysts here work on complex financial models and risk assessments.

-

Fannie Mae

Average Salary: $164,935

Fannie Mae is known for its strong programs for Quantitative Analysts. They are headquartered in Washington, D.C., with offices in major cities across the U.S. Analysts here focus on mortgage-backed securities and financial strategies.

-

Freddie Mac

Average Salary: $162,333

Freddie Mac offers rewarding opportunities for Quantitative Analysts. They operate nationally, with a strong focus on mortgage analytics. The role involves risk modeling and data analysis.

-

Bank of America

Average Salary: $151,618

Bank of America provides a supportive environment for Quantitative Analysts. They have a global presence, with key locations in New York, Charlotte, and London. The role includes developing predictive models and performing financial analysis.

-

USAA

Average Salary: $150,360

USAA offers competitive salaries for Quantitative Analysts. They are headquartered in San Antonio, Texas, and have offices across the U.S. The role involves risk assessment and financial modeling.

-

Fidelity Investments

Average Salary: $138,227

Fidelity Investments provides a stable environment for Quantitative Analysts. They operate in Boston, Massachusetts, and various other locations. The role includes investment analysis and data modeling.

-

TD Bank

Average Salary: $135,867

TD Bank offers good opportunities for Quantitative Analysts. They have a significant presence in Toronto, Canada, and various U.S. cities. The role involves financial modeling and risk analysis.

How to earn more as a Quantitative Analyst?

A Quantitative Analyst can increase earnings by focusing on key areas that boost their market value. Mastery of advanced skills and tools can make a big difference. Experience in developing complex models for trading and risk management sets analysts apart. They should also stay updated with financial trends and technologies to remain competitive.

Networking with industry professionals opens doors to high-paying opportunities. Attending seminars, joining professional groups, and engaging on platforms like LinkedIn help build connections. Seeking mentorship from seasoned analysts provides valuable insights. Certifications from recognized bodies, such as the CFA Institute or FRM, add credibility and can lead to higher salaries. Lastly, transitioning to roles with greater responsibility, such as team lead or manager, often comes with a significant pay increase.

Consider these factors when aiming to earn more as a Quantitative Analyst:

- Learn advanced modeling skills

- Stay updated with financial trends

- Network with industry professionals

- Obtain relevant certifications

- Seek higher-responsibility roles