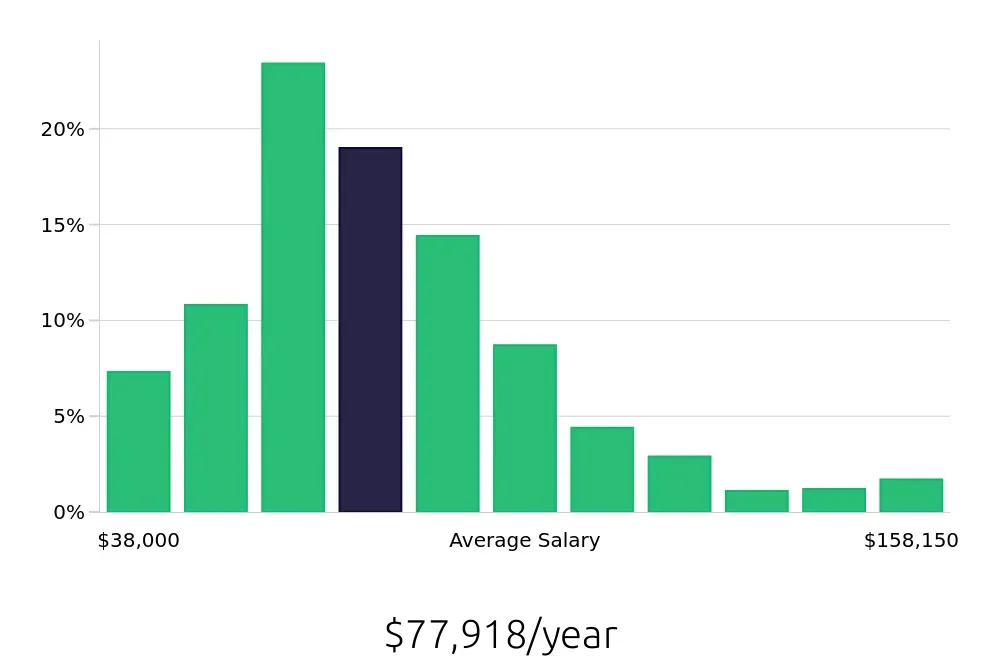

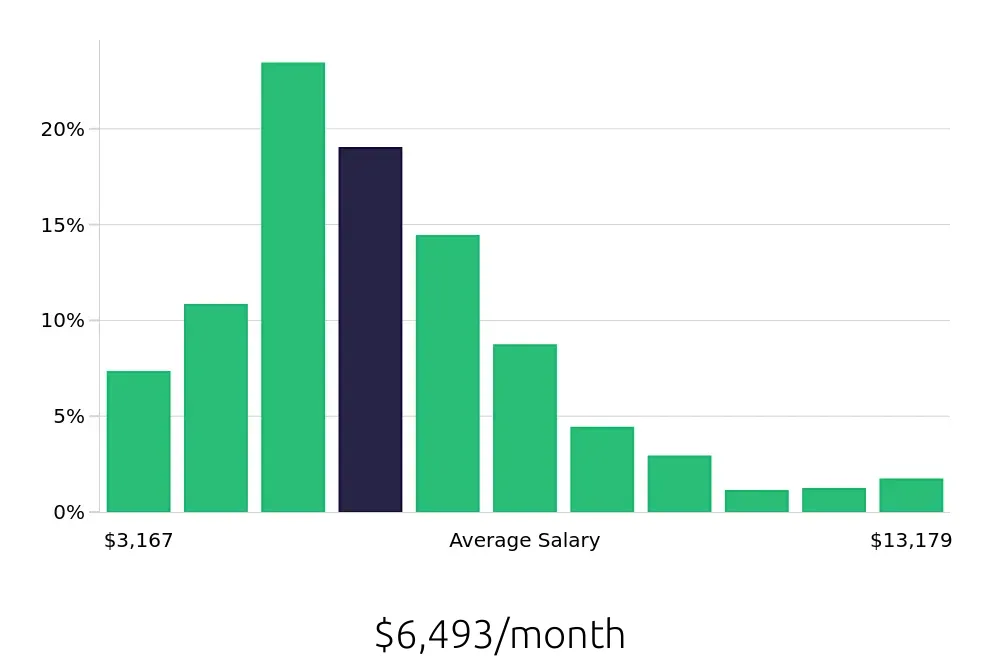

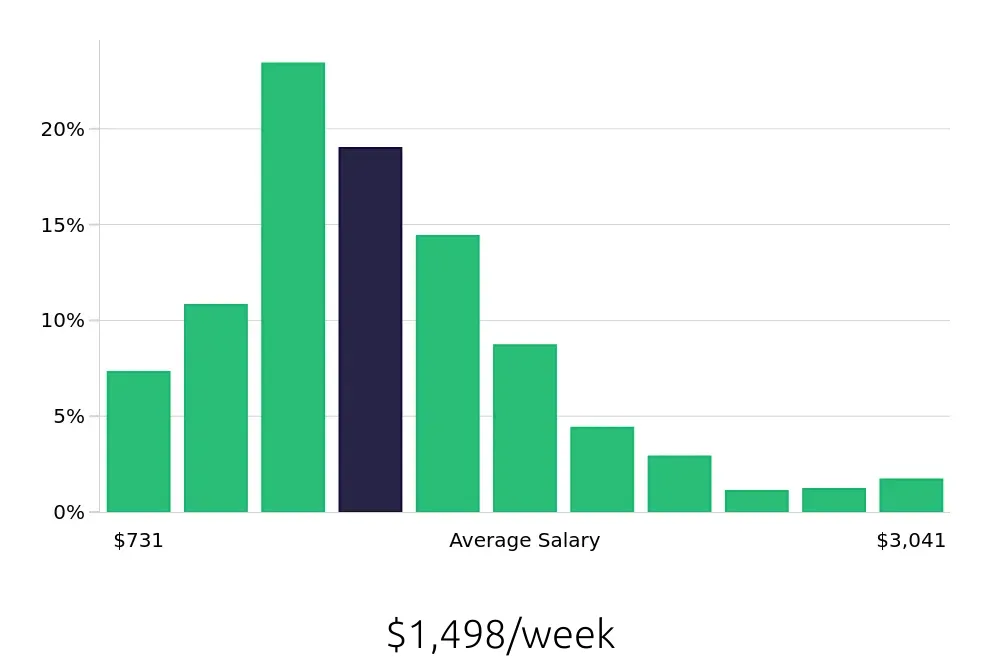

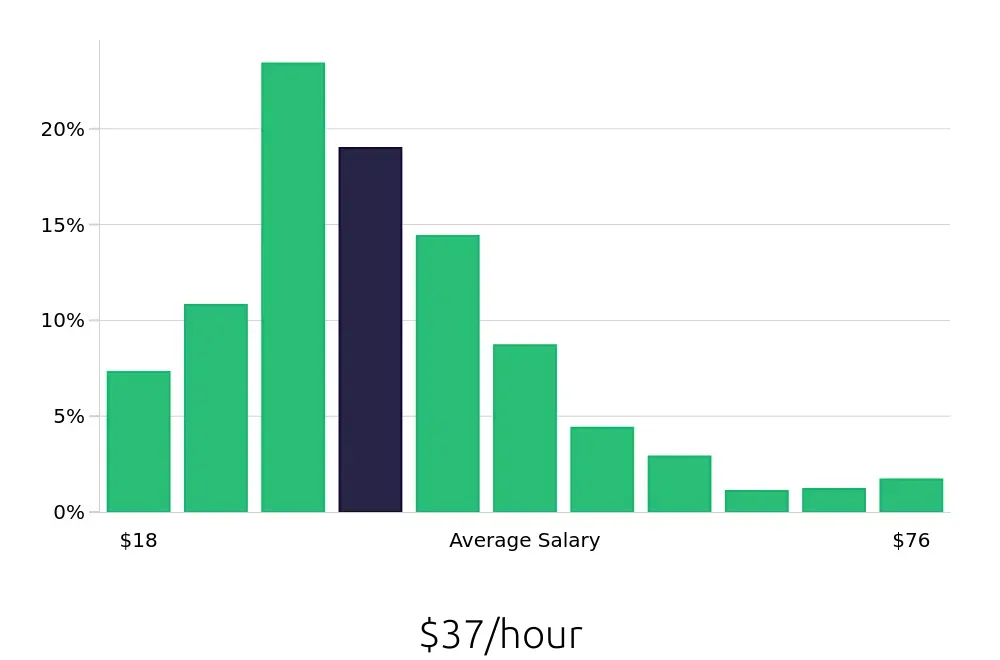

How much does a Tax Analyst make?

A Tax Analyst plays a key role in ensuring that individuals and organizations comply with tax laws. This role offers a variety of earning potentials depending on experience and location. On average, a Tax Analyst makes about $77,918 a year. Salaries can range from about $38,000 to over $150,000.

The lower end of the salary spectrum, starting around $38,000, is often for entry-level positions or those working in smaller firms. As analysts gain experience and advance in their careers, their salaries can grow significantly. For instance, experienced Tax Analysts might earn between $103,536 and $136,305 annually. Some senior positions, particularly those in larger firms or with extensive experience, can reach the upper end of the salary range, topping $150,000 a year. The highest earners in this field often work in busy tax seasons, major cities, or in specialized tax roles.

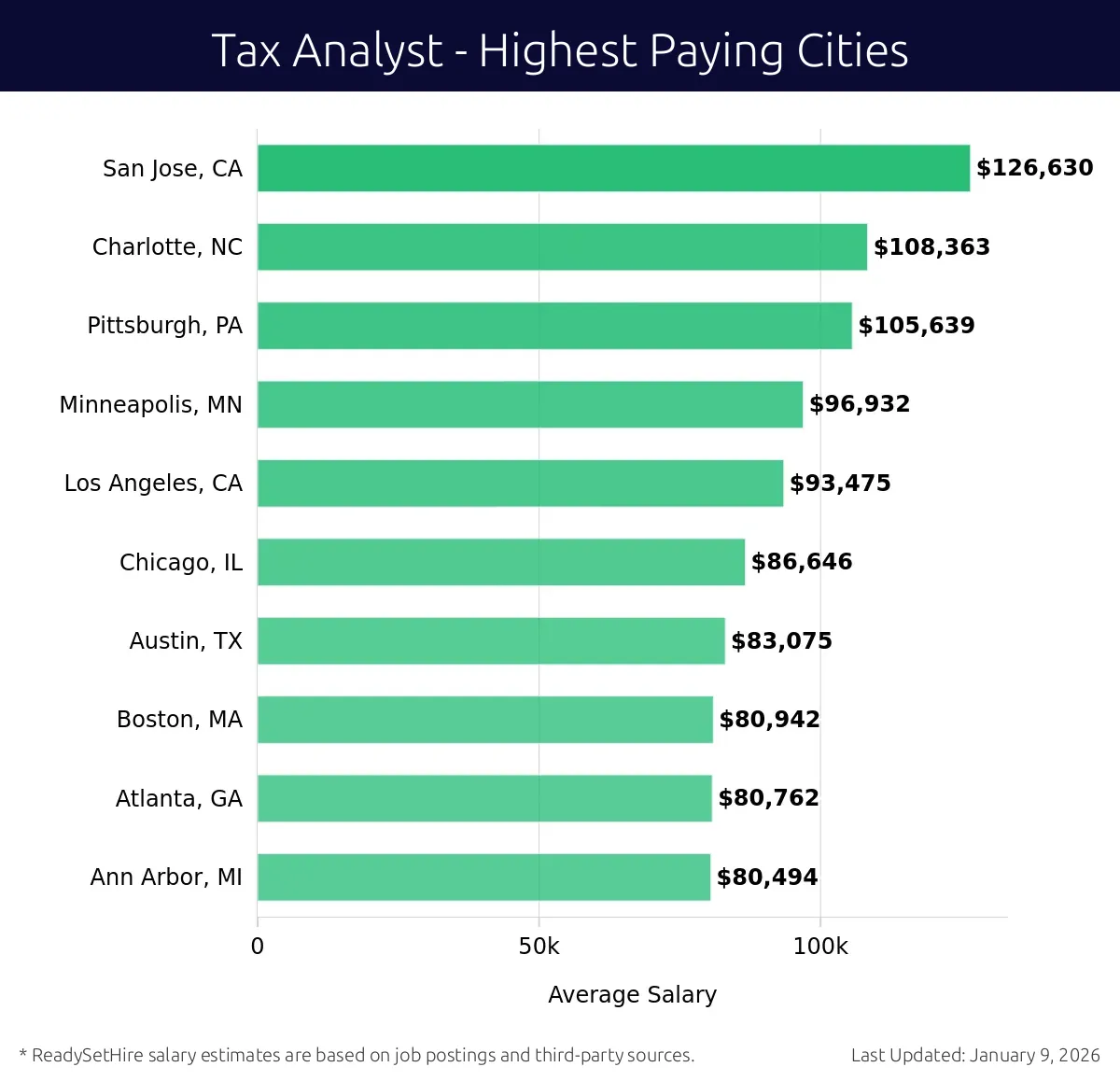

What are the highest paying cities for a Tax Analyst?

-

San Jose, CA

Average Salary: $126,630

San Jose offers a thriving tech industry, making it a prime spot for tax professionals. With many tech giants like Apple and Cisco based here, the demand for skilled tax analysts is high. Expect to work on innovative tax strategies in a fast-paced environment.

Find Tax Analyst jobs in San Jose, CA

-

Charlotte, NC

Average Salary: $108,363

Charlotte is a financial hub, home to big banks and financial firms. This city provides numerous opportunities for tax analysts to work with major corporations. Professionals here often engage with complex tax regulations and financial reporting.

Find Tax Analyst jobs in Charlotte, NC

-

Pittsburgh, PA

Average Salary: $105,639

Pittsburgh combines industrial heritage with modern advancements. It’s a good place for tax analysts to find jobs in both traditional and emerging industries. Companies like U.S. Steel and PNC Bank offer diverse tax-related roles.

Find Tax Analyst jobs in Pittsburgh, PA

-

Minneapolis, MN

Average Salary: $96,932

Minneapolis is known for its strong financial sector and corporate headquarters. Tax analysts in this city benefit from a robust job market. They often work with top firms like Target and 3M, dealing with state-of-the-art tax solutions.

Find Tax Analyst jobs in Minneapolis, MN

-

Los Angeles, CA

Average Salary: $93,475

Los Angeles offers a diverse economy, ranging from entertainment to tech. Tax analysts here work with companies like Amazon and NBCUniversal. The city's vibrant market provides a dynamic environment for tax professionals.

Find Tax Analyst jobs in Los Angeles, CA

-

Chicago, IL

Average Salary: $86,646

Chicago is a major financial center, home to many Fortune 500 companies. Tax analysts can find plenty of opportunities to work on significant tax projects. Working in this city means collaborating with top firms like Boeing and McDonald’s.

Find Tax Analyst jobs in Chicago, IL

-

Austin, TX

Average Salary: $83,075

Austin is a growing tech hub, attracting many tech companies. This city offers exciting opportunities for tax analysts. They often work with startups and established tech firms like Dell and Apple, focusing on innovative tax solutions.

Find Tax Analyst jobs in Austin, TX

-

Boston, MA

Average Salary: $80,942

Boston is rich in history and education. Tax analysts here often work with prestigious institutions and firms. Companies like Fidelity Investments and State Street provide challenging and rewarding tax positions.

Find Tax Analyst jobs in Boston, MA

-

Atlanta, GA

Average Salary: $80,762

Atlanta is a transportation and logistics powerhouse. Tax analysts can find jobs in major companies like Delta Air Lines. This city offers a blend of traditional and modern opportunities in the tax field.

Find Tax Analyst jobs in Atlanta, GA

-

Ann Arbor, MI

Average Salary: $80,494

Ann Arbor is known for its strong education sector, thanks to the University of Michigan. Tax analysts here work with a mix of educational institutions and tech companies. The environment is conducive to both learning and professional growth.

Find Tax Analyst jobs in Ann Arbor, MI

What are the best companies a Tax Analyst can work for?

-

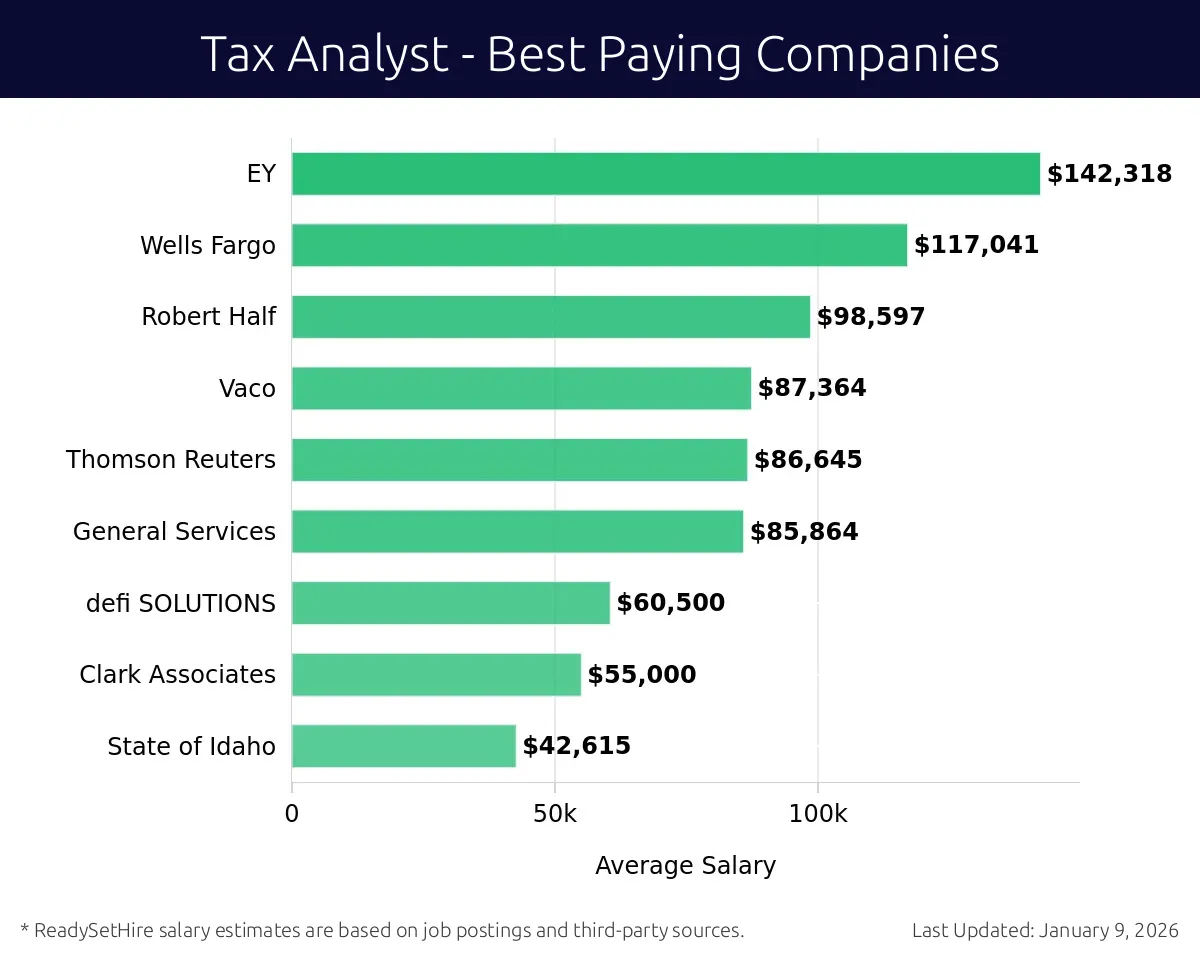

EY

Average Salary: $142,318

EY offers exciting Tax Analyst roles across the globe, with significant locations in the United States, Europe, and Asia. EY combines innovative technology with an inclusive environment, ensuring job security and growth. They work with a variety of industries, offering dynamic roles.

-

Wells Fargo

Average Salary: $117,041

Wells Fargo provides rewarding Tax Analyst positions in many U.S. cities, including New York, San Francisco, and Charlotte. They focus on customer satisfaction and innovation, making it a great place for career development. Their roles offer stability and a comprehensive benefits package.

-

Robert Half

Average Salary: $98,597

Robert Half offers Tax Analyst jobs in various locations, such as Los Angeles, Chicago, and Denver. They provide a flexible working environment and many opportunities for career advancement. Their diverse client base offers a wide range of experiences for Tax Analysts.

-

Vaco

Average Salary: $87,364

Vaco has Tax Analyst positions available in major cities like Houston, Atlanta, and Boston. They focus on matching candidates with companies that align with their career goals. Their role often involves working with top firms, offering a chance to learn from industry leaders.

-

Thomson Reuters

Average Salary: $86,645

Thomson Reuters provides Tax Analyst roles in key areas such as New York, London, and Toronto. They emphasize innovation and provide a collaborative work environment. Their positions often involve working on cutting-edge technology, making it ideal for tech-savvy analysts.

-

General Services

Average Salary: $85,864

General Services offers Tax Analyst jobs in cities like Seattle, Minneapolis, and Philadelphia. They focus on providing stable and secure employment, with opportunities for professional development. Their roles are varied and support multiple sectors.

-

defi SOLUTIONS

Average Salary: $60,500

defi SOLUTIONS provides Tax Analyst positions in growing markets such as Austin, San Diego, and Raleigh. They offer a dynamic work environment with the chance to work on diverse projects. Their company values innovation and teamwork, making it a great place to grow.

-

Clark Associates

Average Salary: $55,000

Clark Associates offers Tax Analyst roles in locations like Denver, Salt Lake City, and Portland. They focus on professional growth and offer a supportive work environment. Their positions often involve working with a diverse range of clients, offering valuable experience.

-

State of Idaho

Average Salary: $42,615

The State of Idaho provides Tax Analyst positions in various cities across the state, including Boise and Idaho Falls. They offer a stable job with good benefits. Their roles involve working closely with the state's tax policies and regulations, offering a unique and fulfilling experience.

How to earn more as a Tax Analyst?

Tax Analysts can find several ways to earn more in their careers. Gaining specialized knowledge and experience is a key factor. Analysts who specialize in high-demand areas, like international tax or estate planning, often earn higher salaries. Continuous education and certifications can also boost earning potential. Networking with industry professionals can lead to more job opportunities and higher salaries.

Professionals who take on more responsibilities often earn higher wages. Moving into senior roles, such as a Senior Tax Analyst or Tax Manager, can lead to significant pay increases. Experience with complex tax software and advanced analytical skills can set an Analyst apart. Employers value these skills, and they can lead to higher salaries. Seeking promotions and taking on challenging projects can help increase earnings.

Location also plays a big role in earnings. Tax Analysts in major cities or areas with a high cost of living often earn more. Analysts working for large corporations or prestigious firms may also see higher salaries. Staying informed about industry trends and market conditions can help Analysts make strategic career moves.

Here are the top five factors to consider:

- Specialized Knowledge and Experience

- Continuous Education and Certifications

- Taking on More Responsibilities

- Location and Industry Demand

- Staying Informed About Industry Trends