How much does a Insurance Attorney make?

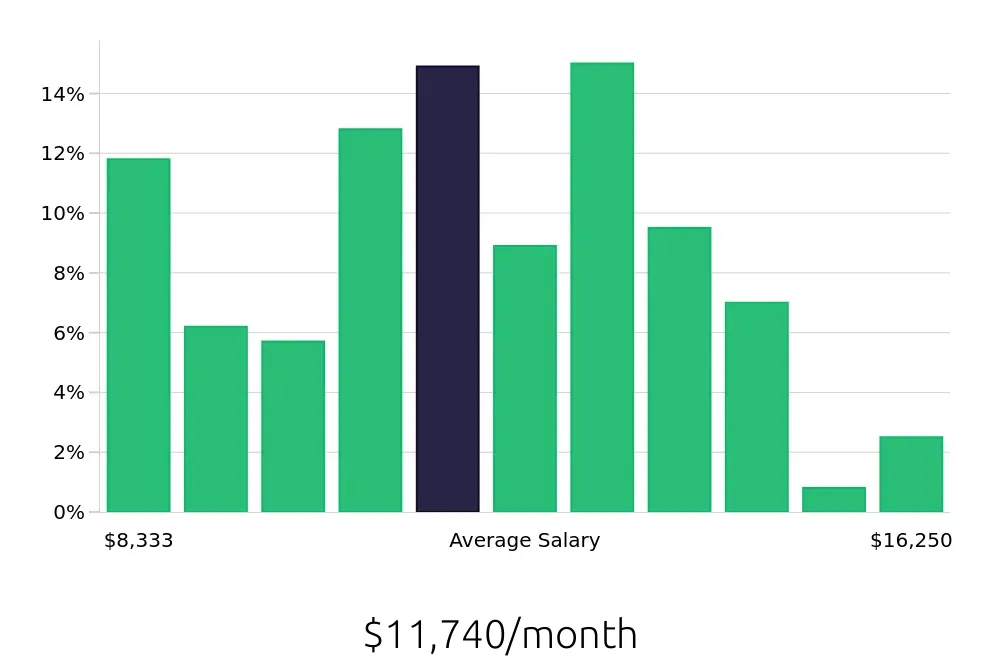

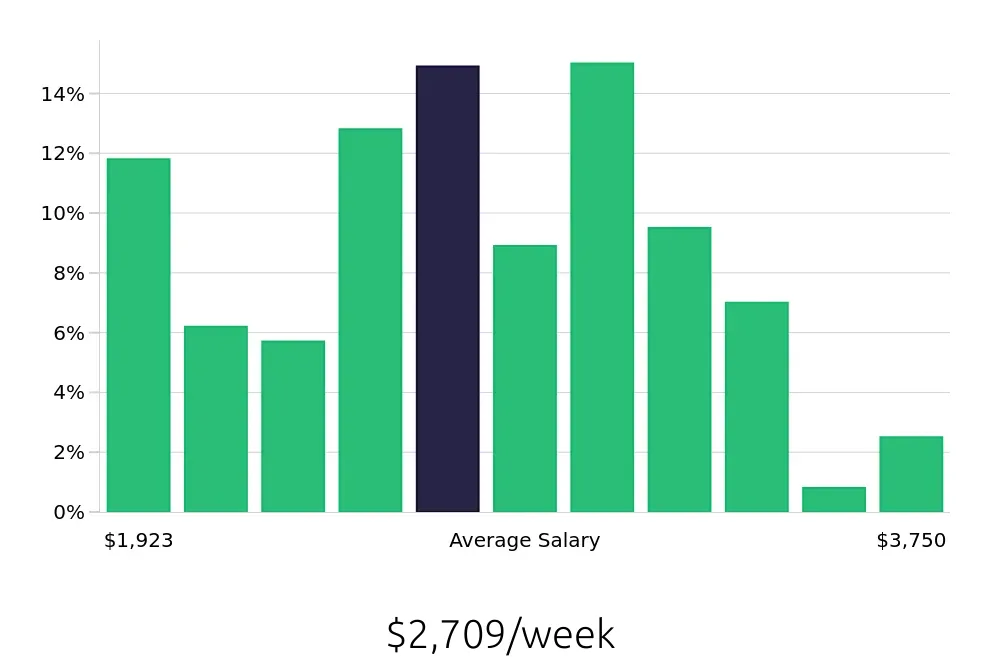

An Insurance Attorney focuses on legal issues related to insurance. This includes helping people file claims and dealing with legal disputes. The salary for an Insurance Attorney can vary, but on average, they make $140,876 per year. This number can change based on experience, location, and the size of the company they work for.

Looking at the salary data, Insurance Attorneys can earn between $100,000 and $195,000 a year. Some key points from the data include:

- The top 10% of Insurance Attorneys make more than $177,000 annually.

- The median salary is around $143,182.

- Most attorneys fall between $125,000 and $160,000 in yearly earnings.

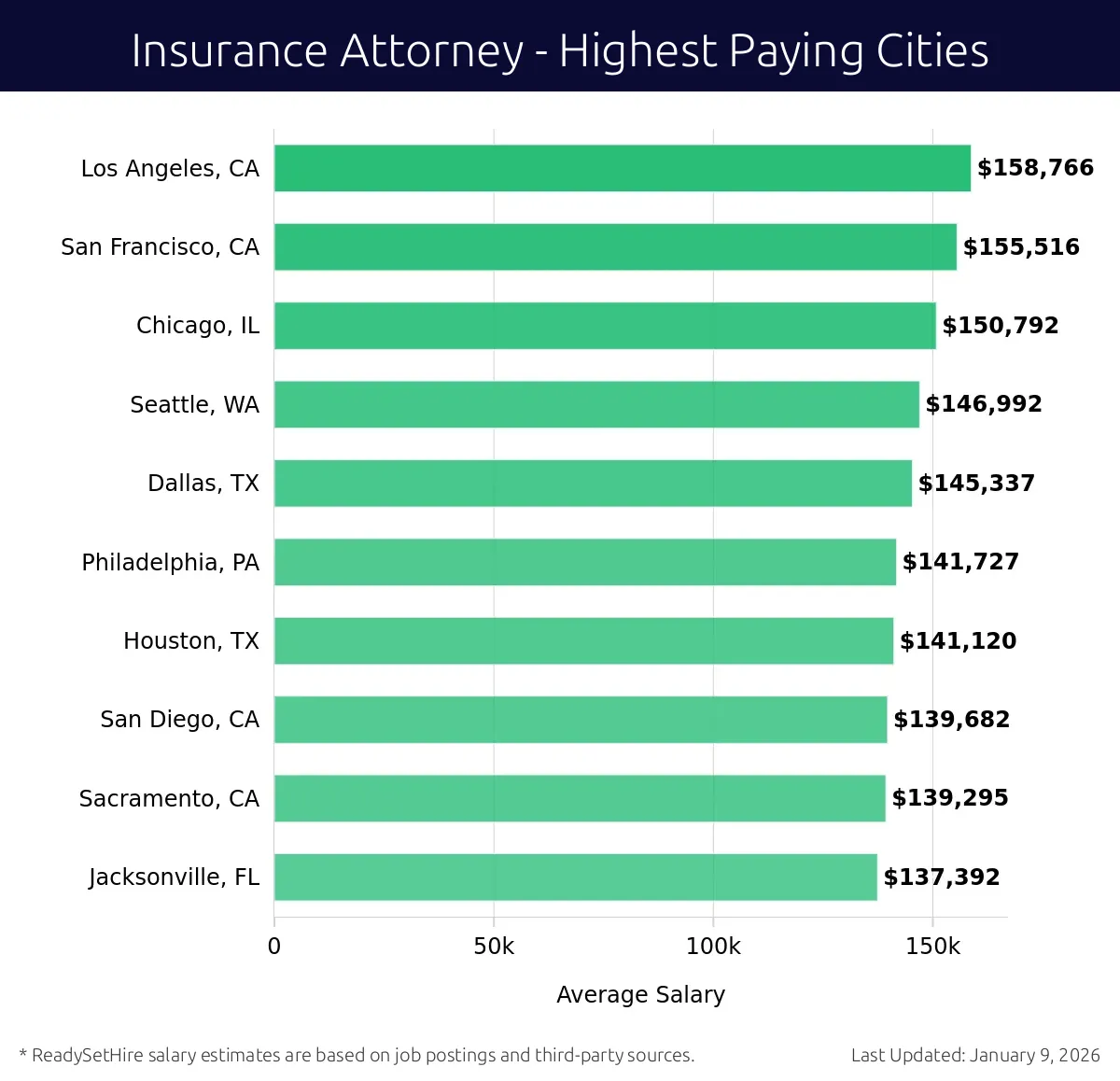

What are the highest paying cities for a Insurance Attorney?

-

Los Angeles, CA

Average Salary: $158,766

Working as an attorney in Los Angeles offers a dynamic environment with a mix of large firms and smaller practices. The city's diverse population and booming economy make it a prime location for those specializing in insurance law. High-profile firms like Aon Hewitt and Gallagher provide excellent opportunities.

Find Insurance Attorney jobs in Los Angeles, CA

-

San Francisco, CA

Average Salary: $155,516

San Francisco presents a vibrant market for insurance attorneys. With a high concentration of tech companies, there is a growing need for legal expertise in tech-related insurance issues. Firms like Orrick, Herrington & Sutcliffe LLP often seek skilled attorneys.

Find Insurance Attorney jobs in San Francisco, CA

-

Chicago, IL

Average Salary: $150,792

Chicago’s insurance industry is robust, offering a wealth of opportunities for attorneys. The city is home to major insurers like Allstate and Aon. Experienced professionals can find rewarding positions that involve complex cases and significant impact.

Find Insurance Attorney jobs in Chicago, IL

-

Seattle, WA

Average Salary: $146,992

Seattle is a prime location for those in the insurance field. The city’s thriving economy and presence of tech giants create a unique market for insurance attorneys. Legal professionals can find positions that cater to both traditional and cutting-edge insurance needs.

Find Insurance Attorney jobs in Seattle, WA

-

Dallas, TX

Average Salary: $145,337

Dallas offers a dynamic job market for insurance attorneys, with a focus on personal and commercial insurance. The city’s large population and business activity provide a steady stream of cases. Companies like Geico and Nationwide offer great opportunities.

Find Insurance Attorney jobs in Dallas, TX

-

Philadelphia, PA

Average Salary: $141,727

Philadelphia presents a mix of traditional and modern insurance challenges. The city’s established insurance companies, including Jefferson Health Plans, offer diverse opportunities. Professionals can work on a variety of cases that impact a broad range of clients.

Find Insurance Attorney jobs in Philadelphia, PA

-

Houston, TX

Average Salary: $141,120

Houston’s insurance market is driven by energy and petrochemical industries. The city provides a robust environment for those specializing in these sectors. Firms like Allstate and Liberty Mutual offer dynamic career paths for skilled attorneys.

Find Insurance Attorney jobs in Houston, TX

-

San Diego, CA

Average Salary: $139,682

San Diego offers a balanced market for insurance attorneys, with a mix of coastal charm and business opportunity. The city is home to several major insurers like Farmers Insurance. Professionals can find rewarding careers in both large firms and boutique practices.

Find Insurance Attorney jobs in San Diego, CA

-

Sacramento, CA

Average Salary: $139,295

Sacramento provides a stable and growing market for insurance attorneys. The state capital’s insurance needs, along with its government focus, offer unique challenges. Local firms and state-related insurance companies provide solid career opportunities.

Find Insurance Attorney jobs in Sacramento, CA

-

Jacksonville, FL

Average Salary: $137,392

Jacksonville’s insurance sector offers a mix of regional and national opportunities. The city’s diverse economy and growing population create a steady demand for legal services. Firms like Nationwide and State Farm provide excellent career paths.

Find Insurance Attorney jobs in Jacksonville, FL

What are the best companies a Insurance Attorney can work for?

-

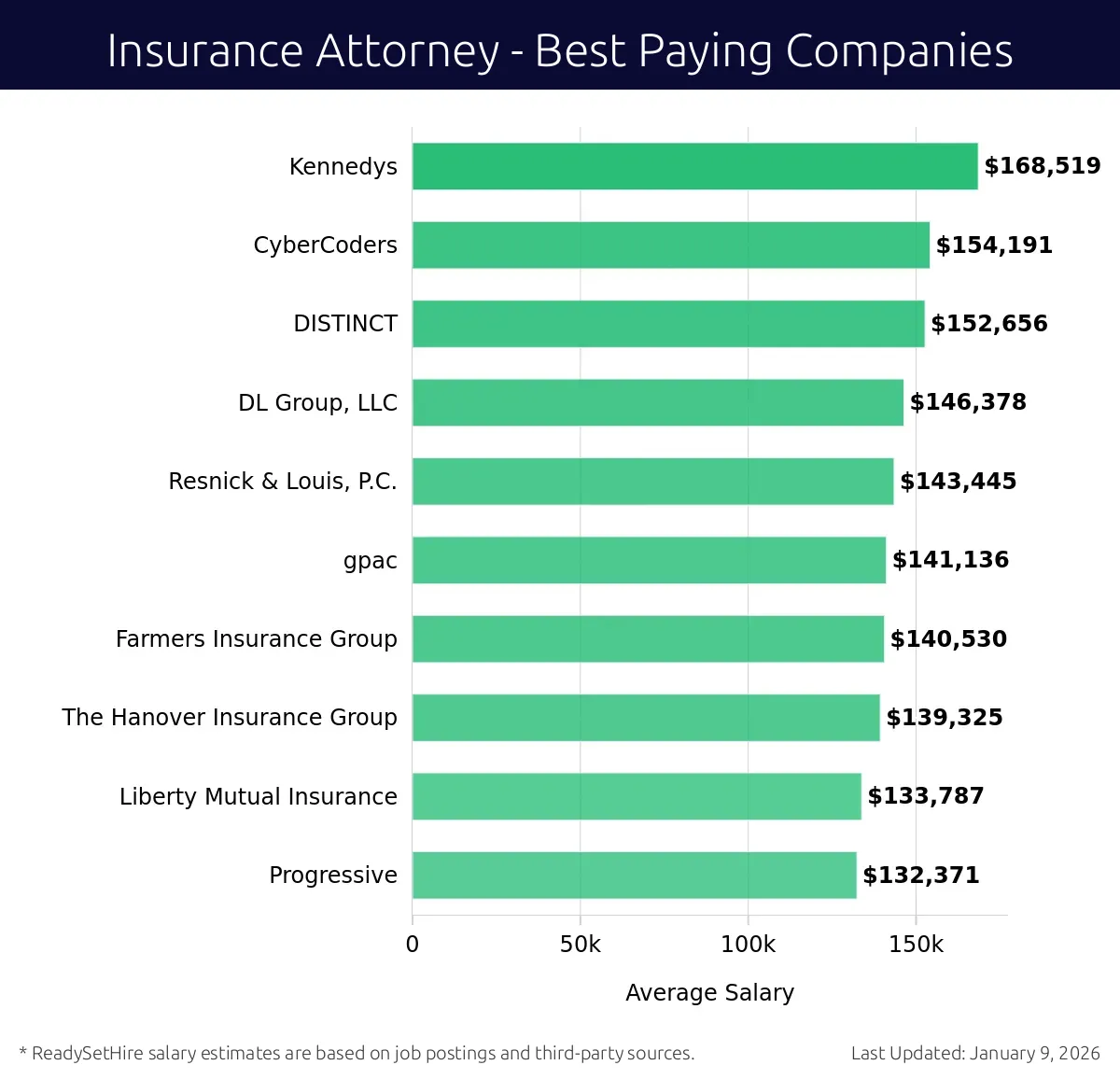

Kennedys

Average Salary: $168,519

Kennedys offers exciting opportunities for Insurance Attorneys. They have offices worldwide, including the USA, Europe, and the Middle East. They seek professionals ready to handle complex insurance cases.

-

CyberCoders

Average Salary: $154,191

CyberCoders provides top-tier positions for Insurance Attorneys. They focus on tech and cybersecurity jobs. They operate in major US cities and connect job seekers with high-paying roles.

-

DISTINCT

Average Salary: $152,656

DISTINCT offers rewarding Insurance Attorney jobs. They have locations in New York, Chicago, and Los Angeles. Their team works on significant insurance matters, making it a great place to grow.

-

DL Group, LLC

Average Salary: $146,378

DL Group, LLC, provides great opportunities for Insurance Attorneys. Their offices are in major US cities. They focus on personal and commercial insurance, offering a dynamic work environment.

-

Resnick & Louis, P.C.

Average Salary: $143,445

Resnick & Louis, P.C., offers high-paying Insurance Attorney jobs. They operate in the New York area. Their team handles a wide range of insurance cases, providing excellent career growth.

-

gpac

Average Salary: $141,136

Gpac offers competitive salaries for Insurance Attorneys. They have offices across the US. They focus on placing professionals in the right roles to match their skills and career goals.

-

Farmers Insurance Group

Average Salary: $140,530

Farmers Insurance Group offers opportunities for Insurance Attorneys. They operate nationwide. They focus on customer-centric insurance solutions, providing a supportive work environment.

-

The Hanover Insurance Group

Average Salary: $139,325

The Hanover Insurance Group provides good opportunities for Insurance Attorneys. They have offices in major US cities. They focus on various insurance needs, offering a stable career path.

-

Liberty Mutual Insurance

Average Salary: $133,787

Liberty Mutual Insurance offers competitive salaries for Insurance Attorneys. They have offices across the US. They focus on providing innovative insurance solutions, offering a dynamic work environment.

-

Progressive

Average Salary: $132,371

Progressive offers rewarding positions for Insurance Attorneys. They have offices in major US cities. They focus on auto and homeowners insurance, providing a stable and supportive work environment.

How to earn more as a Insurance Attorney?

An Insurance Attorney can enhance earning potential by focusing on several key areas. Specialization in a specific type of insurance, such as health, property, or liability, often leads to higher-paying opportunities. Experienced attorneys can also take on leadership roles, such as becoming a partner in a law firm or managing a legal department within a corporation. Networking and building strong relationships with clients and other legal professionals can open doors to lucrative cases. Continuous education and staying updated on changes in insurance laws and regulations can make an attorney more valuable. Finally, gaining experience in high-demand areas like litigation or regulatory compliance can significantly boost earnings.

Pursuing certifications and advanced degrees in insurance law can further increase an Insurance Attorney's salary. Engaging in public speaking and writing articles for legal publications can enhance credibility and attract high-profile clients. Providing excellent client service and maintaining a strong reputation can lead to referrals and repeat business. Working in urban areas with higher living costs can also result in better compensation. Balancing work and personal life to avoid burnout can lead to sustained high performance and better pay.

Here are some steps to consider for increasing earnings:

- Specialize in a niche area of insurance law.

- Take on leadership roles within a law firm or corporation.

- Network with clients and other professionals.

- Stay updated on insurance laws and regulations.

- Pursue certifications and advanced degrees.