How much does a Insurance Specialist make?

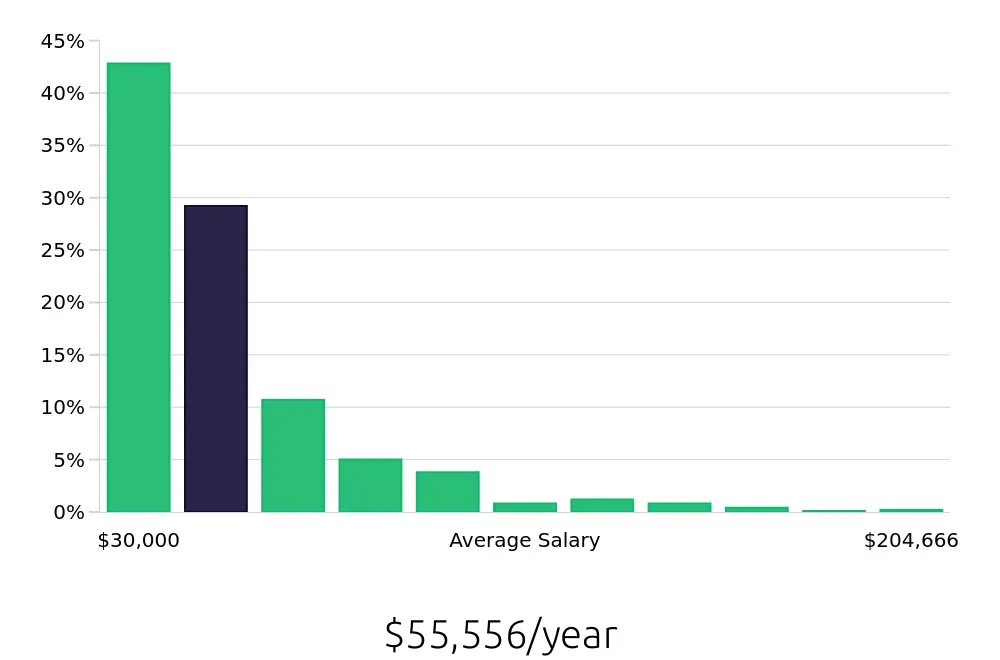

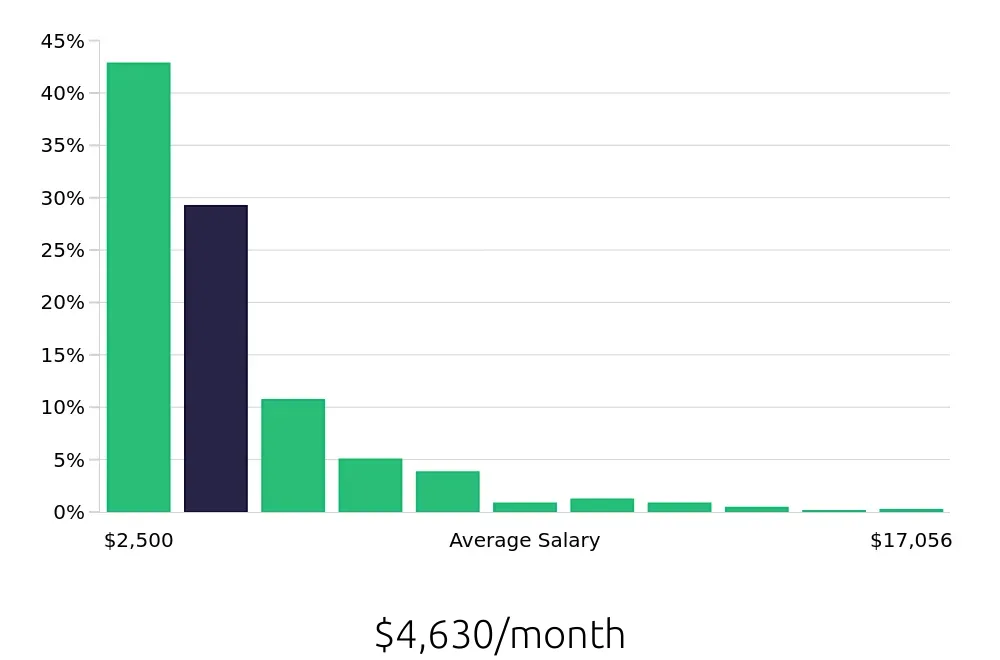

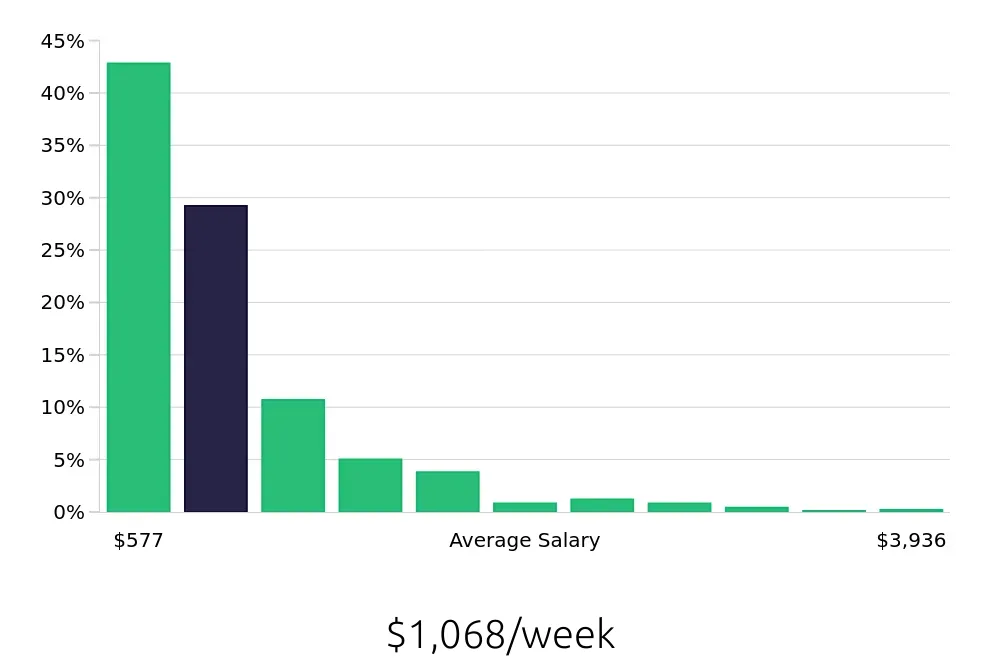

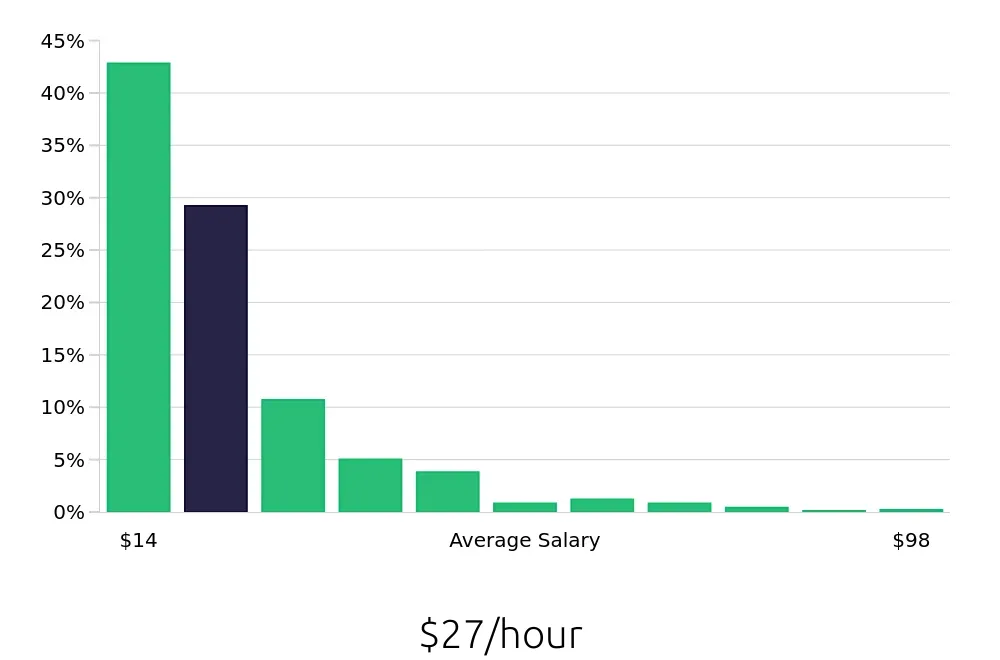

An Insurance Specialist plays a crucial role in helping clients find the right insurance policies. Their work can be both rewarding and financially beneficial. On average, Insurance Specialists earn about $55,556 each year. This varies depending on experience, education, and location.

Different levels of experience and specialization can lead to different salaries. For example, new specialists might start around $30,000, while experienced ones can make over $188,000 a year. Some factors that affect salary include company size, client base, and location. Major cities and areas with higher living costs usually offer higher salaries.

Here is a breakdown of salaries based on experience:

- Entry-level: $30,000

- Early career: $45,879

- Mid-career: $61,757

- Experienced: $77,636

- Senior-level: $93,515

- Top earners: $188,787

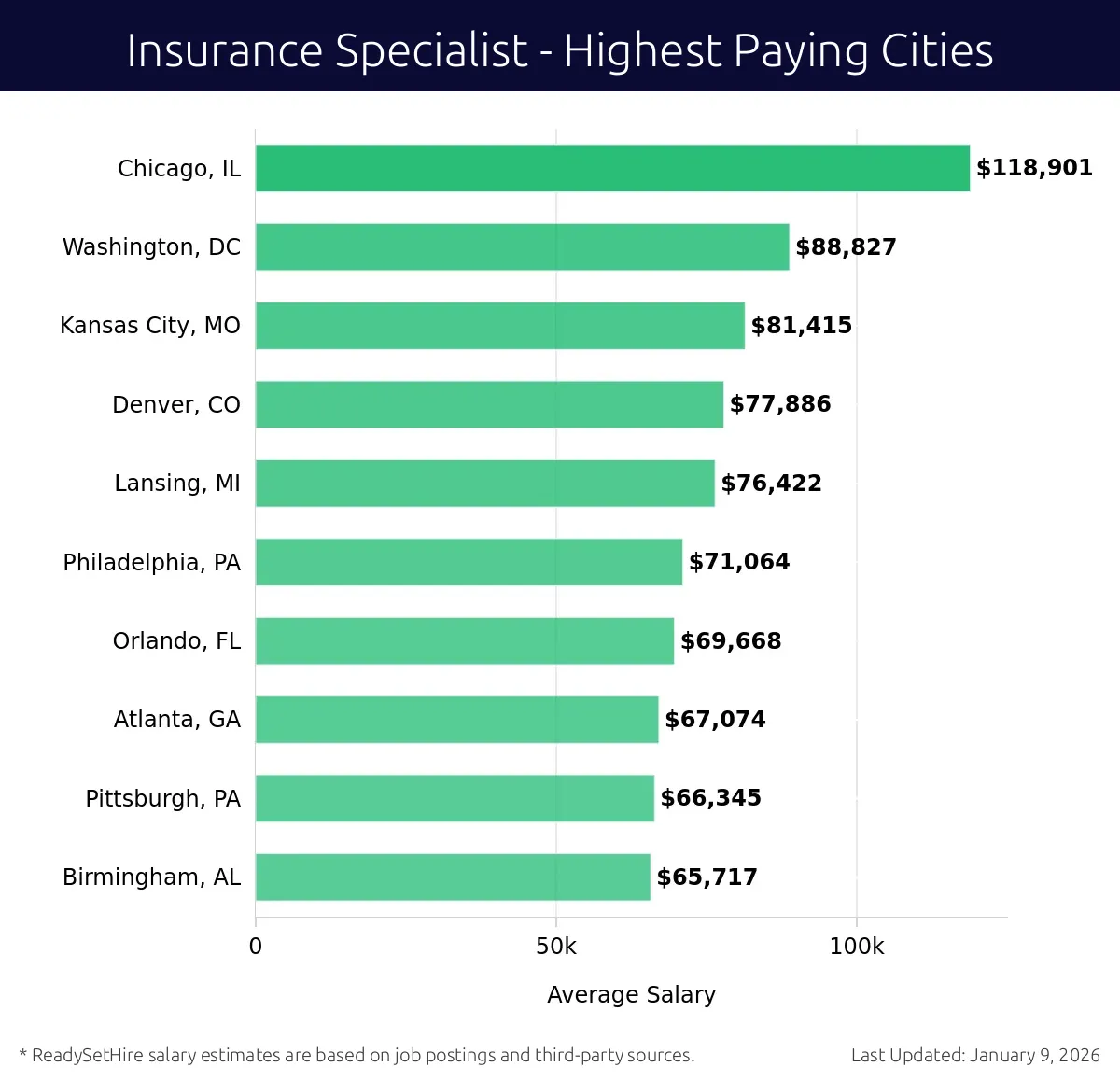

What are the highest paying cities for a Insurance Specialist?

-

Chicago, IL

Average Salary: $118,901

Working in Chicago as an insurance expert can be rewarding. The bustling city offers many opportunities with large firms like Allstate and CNA Financial. Enjoy a dynamic work environment and the chance to grow.

Find Insurance Specialist jobs in Chicago, IL

-

Washington, DC

Average Salary: $88,827

In Washington, DC, professionals can find stability and growth. Companies such as MetLife and UnitedHealth Group provide excellent opportunities. Working here means being part of a thriving industry in a vibrant city.

Find Insurance Specialist jobs in Washington, DC

-

Kansas City, MO

Average Salary: $81,415

Kansas City offers a balanced work life for insurance experts. With companies like American Century and The Kansas City Star, you can enjoy a stable job with a friendly community. It's a place where career and personal life blend well.

Find Insurance Specialist jobs in Kansas City, MO

-

Denver, CO

Average Salary: $77,886

Denver presents exciting opportunities in the insurance field. With employers like Denver Health and UnitedHealthcare, professionals can work in a dynamic environment. The city's growing economy means more chances to advance your career.

Find Insurance Specialist jobs in Denver, CO

-

Lansing, MI

Average Salary: $76,422

In Lansing, insurance experts can find a stable career. Companies such as Blue Cross Blue Shield of Michigan offer solid opportunities. The city's supportive community makes it a great place to build a lasting career.

Find Insurance Specialist jobs in Lansing, MI

-

Philadelphia, PA

Average Salary: $71,064

Philadelphia offers diverse opportunities for insurance professionals. Companies like Independence Blue Cross and Cigna provide excellent career paths. Working in Philly means being part of a rich history and vibrant culture.

Find Insurance Specialist jobs in Philadelphia, PA

-

Orlando, FL

Average Salary: $69,668

In Orlando, insurance experts thrive in a growing industry. Employers like Humana and Florida Blue offer many opportunities. The city's dynamic economy and tourism industry provide a lively work environment.

Find Insurance Specialist jobs in Orlando, FL

-

Atlanta, GA

Average Salary: $67,074

Atlanta is a hub for insurance careers. With giants like Aflac and Allstate, there are many opportunities for growth. The city's fast-paced environment offers a great mix of challenges and rewards.

Find Insurance Specialist jobs in Atlanta, GA

-

Pittsburgh, PA

Average Salary: $66,345

Pittsburgh offers a unique blend of career and lifestyle. Companies such as Highmark and UPMC provide solid opportunities. Working here means enjoying a vibrant city with a strong sense of community.

Find Insurance Specialist jobs in Pittsburgh, PA

-

Birmingham, AL

Average Salary: $65,717

In Birmingham, insurance professionals find a supportive work environment. Companies like HealthSouth and Blue Cross and Blue Shield of Alabama offer excellent opportunities. The city's friendly atmosphere makes it a great place to work.

Find Insurance Specialist jobs in Birmingham, AL

What are the best companies a Insurance Specialist can work for?

-

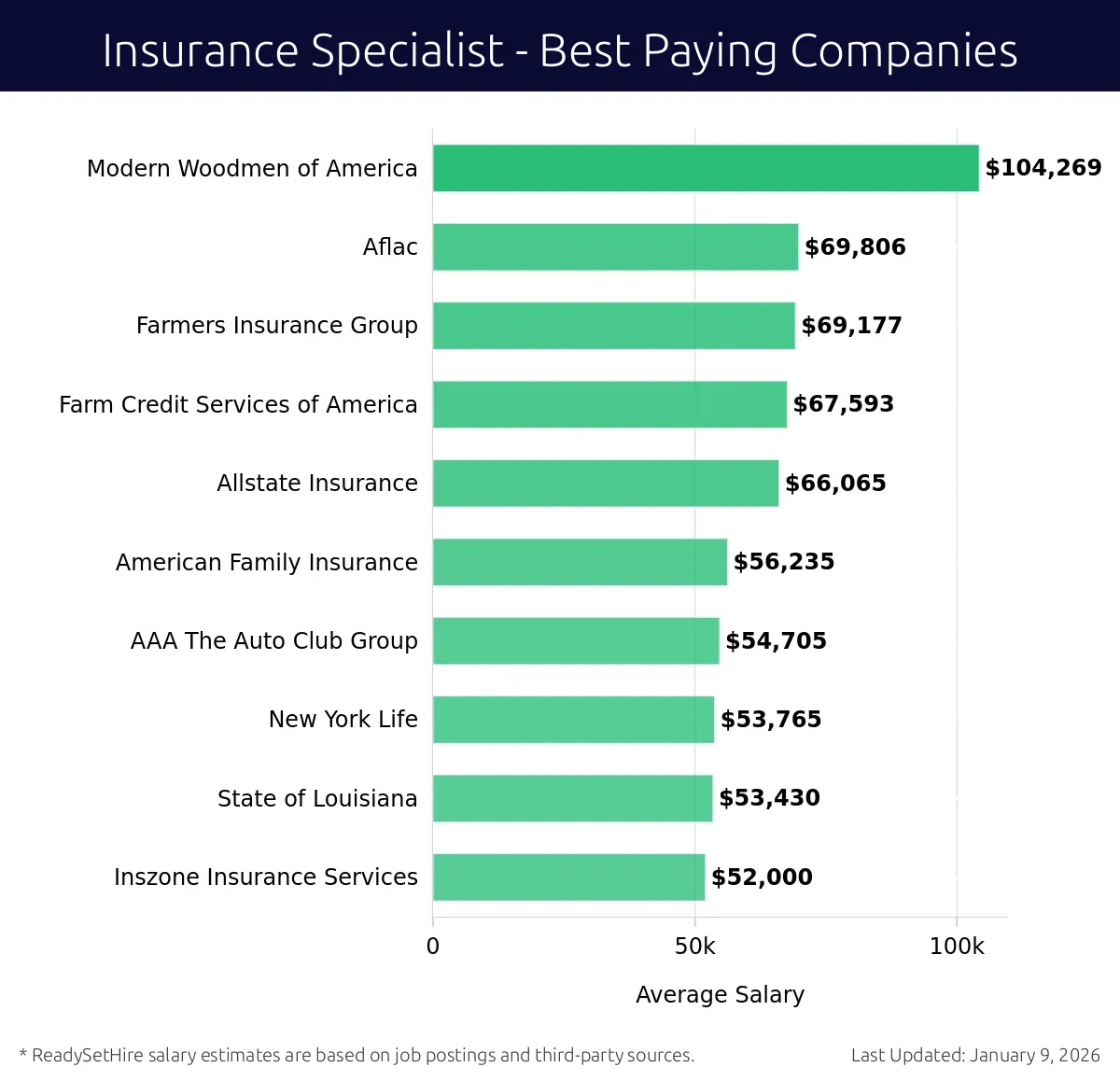

Modern Woodmen of America

Average Salary: $104,269

Modern Woodmen of America offers rewarding Insurance Specialist roles. They focus on life and health insurance. Their headquarters is in Davenport, Iowa, with offices across the U.S. They value benefits and job security.

-

Aflac

Average Salary: $69,806

Aflac is a leader in supplemental insurance. They offer jobs for Insurance Specialists in locations like Columbus, Georgia, and Tokyo, Japan. They provide a strong work culture and professional growth opportunities.

-

Farmers Insurance Group

Average Salary: $69,177

Farmers Insurance Group provides various insurance solutions. They have Insurance Specialist positions available in Los Angeles, California. They emphasize customer service and team collaboration.

-

Farm Credit Services of America

Average Salary: $67,593

Farm Credit Services of America offers Insurance Specialist jobs focusing on agricultural insurance. They have locations in Raleigh, North Carolina. They focus on strong client relationships and community support.

-

Allstate Insurance

Average Salary: $66,065

Allstate Insurance has Insurance Specialist roles in property and casualty insurance. They are based in Northbrook, Illinois, and have a nationwide presence. They value innovation and employee development.

-

American Family Insurance

Average Salary: $56,235

American Family Insurance offers Insurance Specialist positions in Madison, Wisconsin, and surrounding areas. They focus on personal and commercial insurance. They value a supportive work environment.

-

AAA The Auto Club Group

Average Salary: $54,705

AAA The Auto Club Group offers Insurance Specialist roles focusing on auto insurance. They have offices in Orlando, Florida, and across the U.S. They value customer service and community involvement.

-

New York Life

Average Salary: $53,765

New York Life offers Insurance Specialist roles in life insurance. They operate in New York City, New York. They value long-term career growth and client relationships.

-

State of Louisiana

Average Salary: $53,430

The State of Louisiana provides Insurance Specialist jobs focusing on public service. They have locations throughout Louisiana. They value public service and employee benefits.

-

Inszone Insurance Services

Average Salary: $52,000

Inszone Insurance Services offers Insurance Specialist roles focusing on personal and commercial insurance. They are based in Tampa, Florida. They emphasize a supportive and dynamic work environment.

How to earn more as a Insurance Specialist?

To increase earnings as an insurance specialist, focus on specific areas that enhance skills and value. Prioritize acquiring specialized certifications that align with specific insurance sectors. These credentials can differentiate an insurance specialist from others and justify higher pay.

Seeking opportunities for advancement within the company can also lead to higher salaries. Insurance specialists who take on leadership roles or move into management positions often see significant pay increases. Networking with industry professionals and attending workshops or seminars can uncover new career paths and salary-boosting opportunities. Working with a mentor who has experience in higher-level roles provides valuable insights and career guidance.

Insurance specialists who expand their expertise into multiple insurance types can increase their marketability. Specialization in areas such as health, life, property, or liability insurance can make an insurance specialist more valuable to employers. Continuous learning and keeping up with industry trends ensures insurance specialists remain competitive and attractive to potential employers willing to offer higher salaries.

Insurance specialists can also improve their earnings by negotiating their salaries effectively. Researching industry salary standards and understanding the value they bring to a company helps in making a strong case for higher pay. Demonstrating a track record of success and contributions to the company strengthens the negotiation position.

- Obtain specialized certifications.

- Advance within the company.

- Network with industry professionals.

- Expand expertise into multiple insurance types.

- Negotiate salaries effectively.